The Jamaica 4D form serves as a critical component in the administration of the General Consumption Tax (GCT), specifically tailored for businesses involved in tourism activities under the General Consumption Tax Act and the Tourism Act. This comprehensive form, which must be diligently filled out by registered taxpayers, encompasses various vital sections ranging from general information about the business, detailed accounts of supplies, calculation of output and input tax, to the declaration of GCT payable or creditable. The form is meticulously designed to ensure accurate tax reporting and incorporates fields for taxable supplies, exempt, export, and zero-rated supplies, alongside provisions for adjustments and credits relating to GCT paid on local purchases, imported goods, and services. Moreover, it outlines the necessity of e-filing, especially to claim credits for GCT withheld by tax withholding entities, highlighting the movement towards digital compliance. The form's layout intends to streamline the tax return process for taxpayers in the tourism sector, encouraging precise and timely submissions. It emphasizes the importance of using black or blue ink pens and not pencils, rounding dollar values to the nearest whole number, and the requirement to complete all applicable sections, essentially guiding taxpayers through the process with explicit instructions to avoid common errors and ensure compliance with Jamaica's tax regulations.

| Question | Answer |

|---|---|

| Form Name | Jamaica Form 4D |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tax office forms, stamp office requisition form, jamaica tax forms online, tax administration jamaica forms |

|

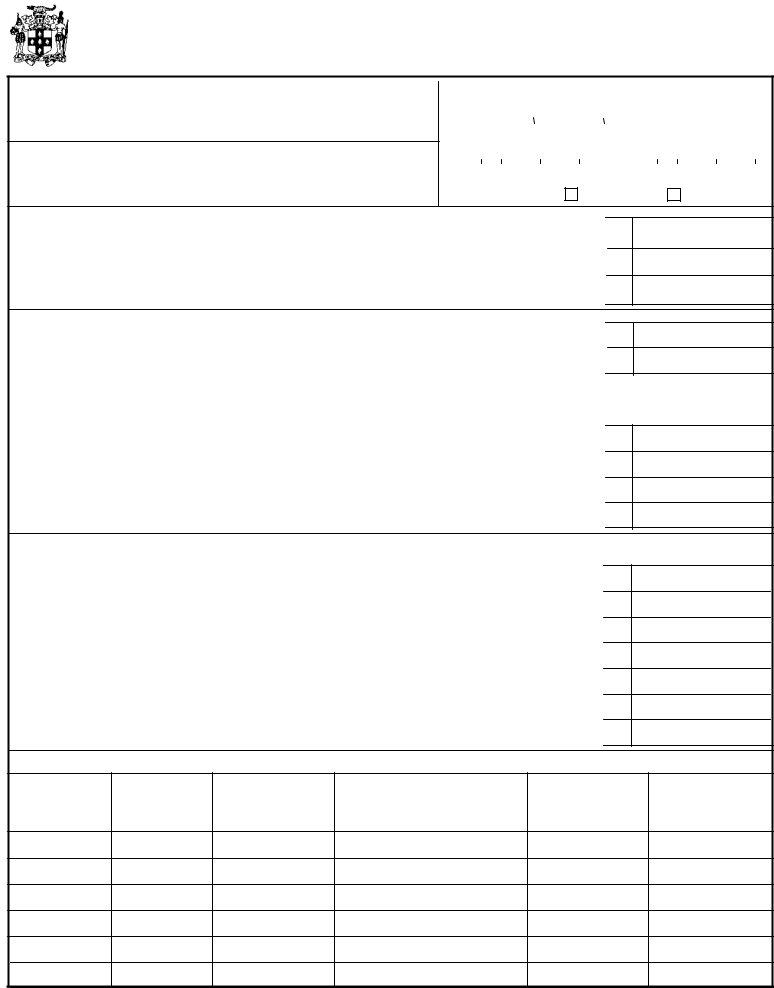

THEGENERALCONSUMPTION TAXACT |

|

GENERAL CONSUMPTION TAX RETURN |

|

( TOURISM ACTIVITIES) |

Jamaica |

Please Read Instructions Overleaf before Completing this Return |

FORM 4D

Section A: GENERALINFORMATION

1.Name of Business

4.Address of Business

2. Taxpayer Registration Number (TRN)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

3. Return Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mont h Day |

||||||||||||||

|

|

|

|

|

|

|

|

Mont h |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2 0 |

|

|

|

|

|

|

0 1 |

|

|

|

2 0 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Tick if applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

New Address |

|

|

Revised Return |

||||||||||||||||||

Section B: SUPPLIES |

(Goods & Services) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Total Supplies made duringthe Period . . . |

. . . . . . . |

|

. . . . |

. . . . . . |

. . |

. . . |

. . . . . |

. |

. |

|

. |

. . . . . . . . |

|

|

|

|

|

|

||||||||

|

|

Exempt Supplies |

Export Supplies |

|

|

|

|

|

|

|

|

|

10 |

|||||||||||||

|

7 |

|

|

|

+ |

8 |

|

|

|

|

+ |

9 |

|

|

|

|

|

|

|

= |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Taxable Supplies (Subtract Line10 from Line6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

. . . |

. . . . . . |

. . |

. . . . |

. . . . . |

|

. . |

|

. . . . . . . |

. . |

. |

|

|

. . |

|

|

. |

||||||||||

Section C: OUTPUT TAX |

|

|

|

|

|

|

|

|

|

|

|

Rate |

|

|

|

|

|

|

|

|

||||||

|

|

12 |

|

|

|

|

|

x |

|

|

% |

|

= |

|

13 |

|||||||||||

. . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

14 |

|

|

|

|

|

x |

|

% |

|

= |

|

15 |

||||||||||||

. . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Tourism Revenue |

|

|

|

|

|

|

01 |

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

. . . . . . . . . |

. . . |

. . . |

. . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Gratuities |

|

|

|

|

|

|

02 |

|

|

|

|

|

|

|

|

Rate |

|

|

|

|

|

|

|

|

||

. . . . . . . . . |

. . . |

. . . |

. . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Tourism Revenue (Subtract Line02 from Line01) |

03 |

|

0.00 |

|

x |

|

% |

= |

|

04 |

||||||||||||||||

Imported Services (Excludefrom Line6 above) |

15a |

|

|

|

|

|

x |

|

% |

= |

|

|

15b |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

GCT Due on Goods Used for Exempt Activities, Personal Use and other Adjustments |

|

|

|

|

|

|

||||||||||||||||||||

|

. |

|

. . |

|

|

. |

||||||||||||||||||||

Total Output Tax (Add Lines 13, 15, 04, 15b &16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|||||||||

. . . . |

. . . . . . |

. . |

. . . |

. . . . . |

|

. |

|

|

. . . . . . . . . . |

|

|

. . |

. |

|

|

|||||||||||

Section D: INPUT TAX/ TAX CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Total Local Purchases & Expenses that Qualify for Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|||||||||||||

GCT on Local Purchases & Expenses that Qualify for Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

. . . |

. . . . . |

. |

. |

|

. |

. . . . . . . |

. |

|

|

|

|

|

|

|

||||||||||||

GCT Paid on Imports |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|||||||

. . . . |

. . . . . . |

. . |

. . . |

. . . . . . |

|

. |

. |

|

. . . . . |

|

|

|

|

|

|

|

|

|||||||||

GCT on Capital Goods that Qualify for Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|||||||||

. . . . |

. . . . . . |

. . |

. . . |

. . . . . . |

|

. |

. |

|

. . . . |

|

|

|

|

|

|

|

|

|||||||||

GCT withheld by Tax WithholdingEntities |

(To claim, return must be |

|

|

23a |

||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

GCT on Imported Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23b |

||||||

. . . . . . . . |

. . . |

. . . . . . |

. . . |

. . . |

. . . . . |

|

. . |

|

. . . . . . . . |

|

|

|

|

|

|

|

||||||||||

Adjustments - Specify: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|||||||

Total Input Tax |

(Add Lines 19, 22, 23, 23a, 23b and 24) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

. . . |

. . . . . |

|

. . |

|

|

. . . . . . . . . . |

|

|

. . |

|

|

|

||||||||||||||

TABLE1 - DETAILSOF WITHHOLDING TAX CREDIT (CERTIFICATESCLAIMED)

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Tax Withholding Certificate Number

Tax Withholding Certificate Date

TRNof Tax Withholding

Entity

Name of Tax Withholding Entity

Value of Supply

($)

GCT Withheld

($)

Form No. 4E (Issued 2002/ 04) |

PLEASESEEOVERLEAF FORCONTINUATION OF FORM |

Tax Administration Jamaica |

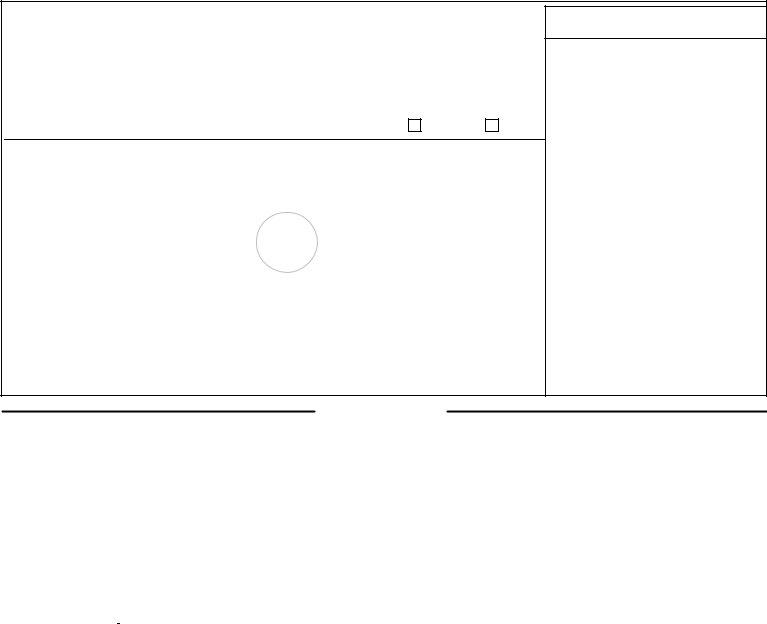

Section E: GCT PAYABLE/ CREDITABLE

GCT Payable/Creditable . . . . . . . . . . . . . . . . . . . . . . . . .

Balance Brought Forward: Payable/Creditable . . . . . . . . . . . . .

Tot al (Add Lines 26 and 27) . . . . . . . . . . . . . . . . . . . . . .

GCT BeingPaid this Period . . . . . . . . . . . . . . . . . . . . . .

If amount at Line 26 is negative, tick appropriate box at Line 30

26 |

|

0.00 |

|

|

|

27 |

|

|

|

|

|

28 |

|

0.00 |

29 |

|

|

|

|

|

30 |

Refund |

Credit |

|

|

|

OFFICIAL USE

Section F: DECLARATION: (To be signed by Taxpayer only)

Ideclare that to the best of my knowledge and belief this is a true and correct statement of the information and particulars given on this form.

|

|

Name of Responsible Officer |

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

Official |

|

|

|

|||

|

|

|

|

|

|

St amp |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Representative's Details - |

(To be completed if prepared by person other than Taxpayer) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

Preparer's Name (Individual/Firm) |

|

Address |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

TRN |

|

Contact Number |

|

Signature |

Date |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICE CODE:

INSTRUCTIONS

This form is to be completed ONLYby Registered taxpayers carryingout Tourism Activities prescribed in Part II of the Second Schedule of the General Consumption Tax Regulations, Item 12(1). Please type or print the required information. Do not use a pencil. Use blue or black ink pen only. All dollar value amounts should be rounded to the nearest whole number. Complete all applicable Sections in Ato F.

Section A: GENERAL INFORMATION

Box 1 : Name of Business - Enter information as stated on the GCT Certificate of Registration.

Box 2 : Taxpayer Registration Number (TRN) - Enter number (TRN) commencingwith the first box on the left .

Box 3 : Return Period - Monthly Returns e.g. October 2000 enter:

Box 4: Address of Business - Enter the address from which the business operates.

Box 5: Please tick appropriate box to indicate new address or revised return.

Section B: SUPPLIES (Goods & Services)

Include all activities relatingto supplies (sales) duringthe Return Period. For business enterprises in the service sector the value of sales must include the amount charged for Fees.

Section C: OUTPUT TAX

Calculate tax on supplies (sales) duringthe Return Period.

Section D: INPUT TAX/ TAXCREDIT

NOTE: Line 20 "GCT for Imports that Qualify for Credit" and Line 21 "GCT Deferred on Imports" are no longer applicable and have been removed from the form.

Report tax paid on goods and services incurred in carryingon the taxable activity duringthe period.

Line 23a: GCT withheld by Tax WithholdingEntities - Enter the total value of GCT withheld by Tax WithholdingEntities (i.e. currently Government Entities) for the period. To claim this tax credit you must:

●Possess a "Certificate for GCT Withheld" (Form 5)issued by a Tax WithholdingEnity.

●File your return online!

Section E: GCT PAYABLE/ CREDITABLE

Line 27 should include penalty, interest and surcharge.

Where output tax exceeds input tax, the difference should be remitted to the Collector of Taxes plus any penalties, interest and/or surcharge balances from pervious periods. Where input tax exceeds output tax, you are required to indicate how the credit should be treated by placinga tick in the appropriate box at Line 30.

NOTE: If arefund isrequested and hasnot been received bythe time the next Return isfiled, do not take acredit against the taxdue.