Any time you want to fill out ct financial affidavit long, you won't need to download any kind of programs - just try using our PDF editor. Our professional team is continuously endeavoring to improve the editor and insure that it is much faster for people with its handy features. Uncover an constantly progressive experience today - take a look at and find new possibilities as you go! This is what you will have to do to start:

Step 1: First of all, access the pdf tool by clicking the "Get Form Button" at the top of this site.

Step 2: Using this handy PDF tool, you are able to do more than merely fill out forms. Edit away and make your docs appear sublime with customized text put in, or fine-tune the original input to perfection - all comes with an ability to insert just about any graphics and sign it off.

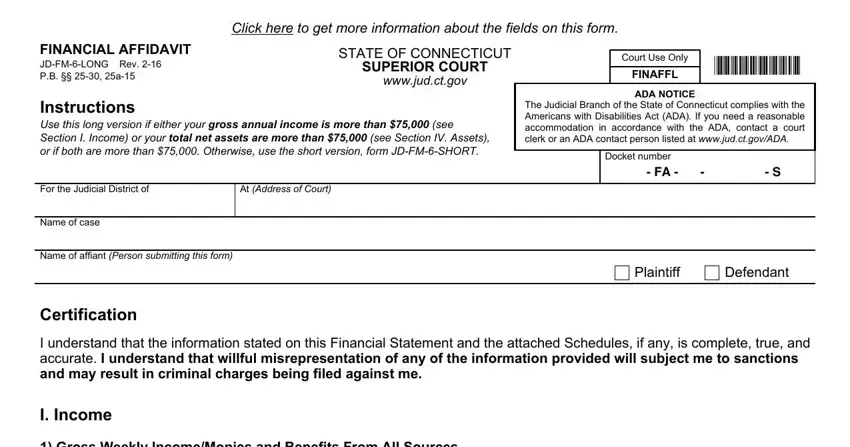

As for the fields of this specific form, this is what you should do:

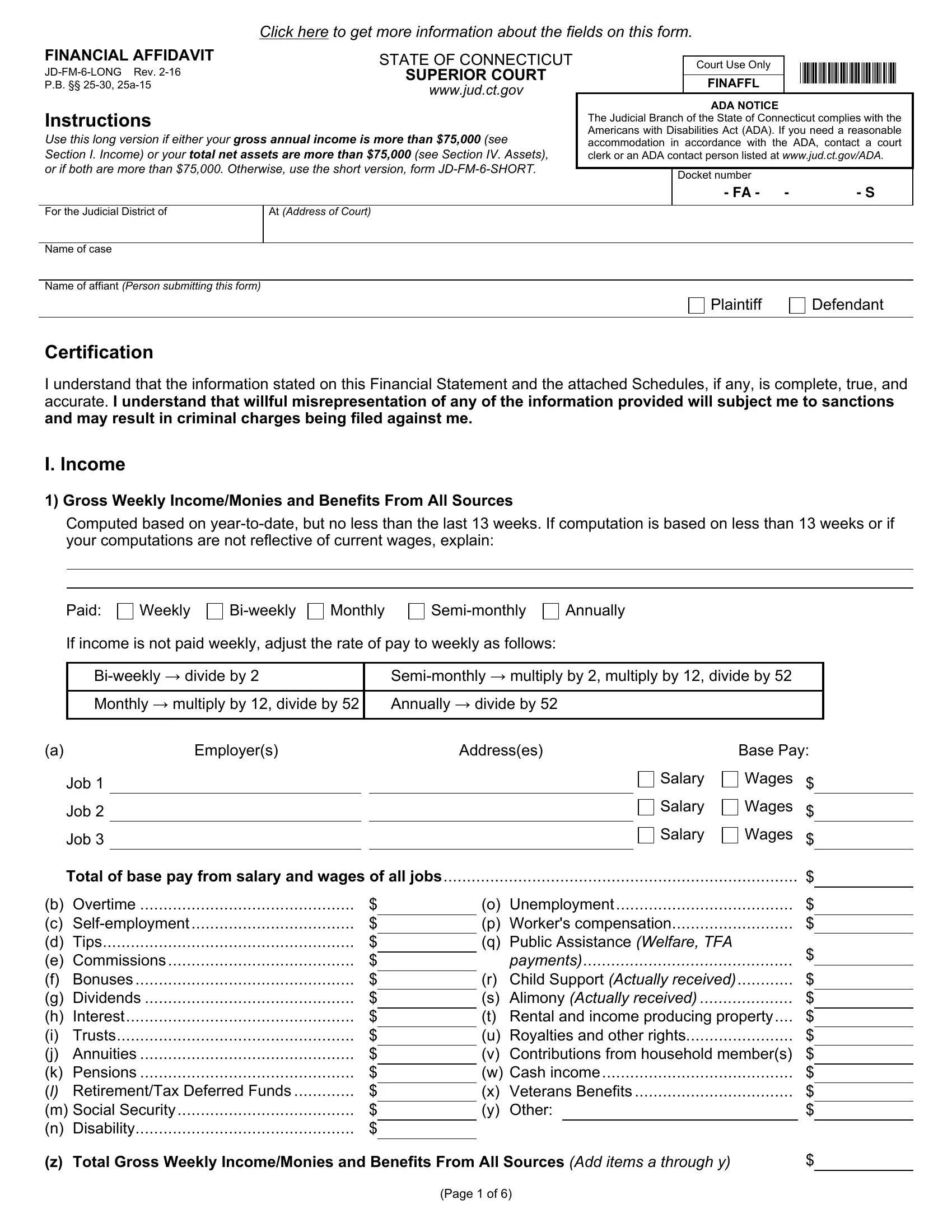

1. You will need to fill out the ct financial affidavit long properly, thus take care when filling out the segments including all these blanks:

2. The subsequent step is usually to submit these blanks: Computed based on yeartodate but, Paid, Weekly, Biweekly, Monthly, Semimonthly, Annually, If income is not paid weekly, Biweekly divide by Monthly, Semimonthly multiply by multiply, Employers, Addresses, Job, Job, and Job.

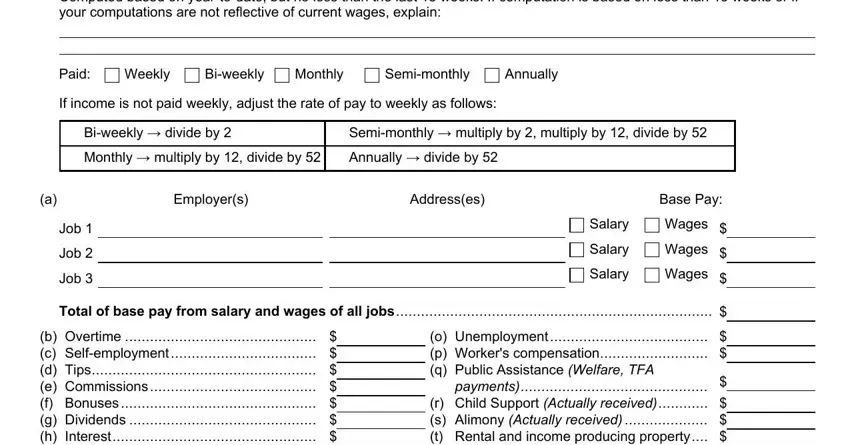

3. The next stage will be hassle-free - fill out all the form fields in b Overtime c Selfemployment d, o Unemployment p Workers, z Total Gross Weekly IncomeMonies, and Page of in order to complete this segment.

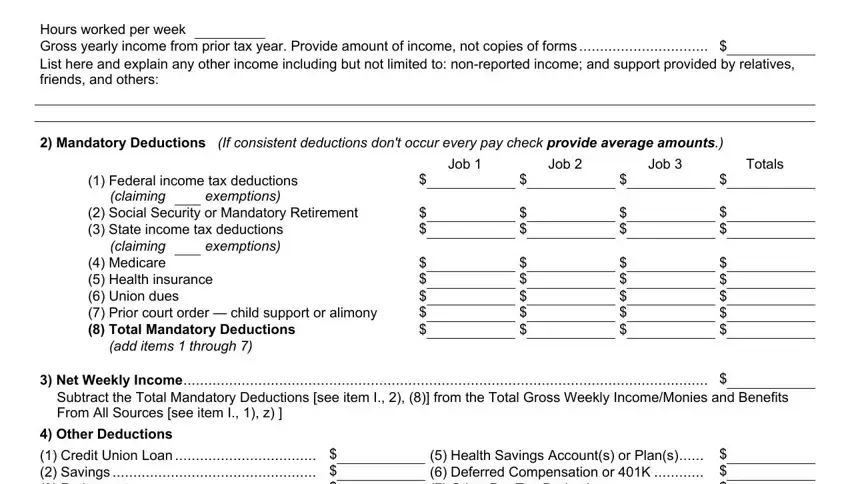

4. Now start working on this next form section! In this case you will get these Hours worked per week Gross yearly, Mandatory Deductions If, Job, Job, Job, Totals, Federal income tax deductions, claiming, exemptions, Social Security or Mandatory, claiming Medicare Health, add items through, Net Weekly Income, Subtract the Total Mandatory, and Other Deductions Credit Union fields to complete.

It's easy to make errors when filling in the Net Weekly Income, hence be sure you go through it again before you decide to submit it.

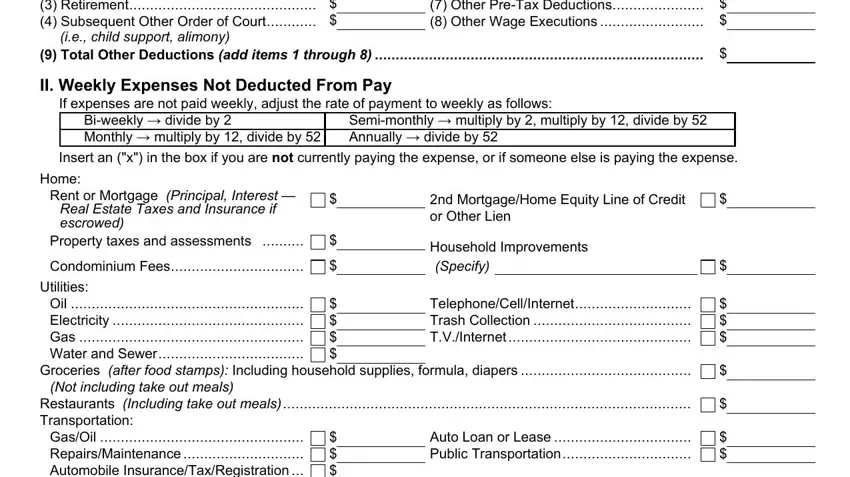

5. The very last stage to submit this PDF form is pivotal. Be sure to fill out the necessary blanks, which includes Other Deductions Credit Union, ie child support alimony, Health Savings Accounts or Plans, Total Other Deductions add items, II Weekly Expenses Not Deducted, If expenses are not paid weekly, Biweekly divide by Monthly, Semimonthly multiply by multiply, Insert an x in the box if you are, Home, Rent or Mortgage Principal, Real Estate Taxes and Insurance if, Property taxes and assessments, Condominium Fees, and Utilities, prior to finalizing. If you don't, it might produce an unfinished and potentially incorrect paper!

Step 3: Prior to addressing the next stage, ensure that all blank fields were filled out as intended. When you believe it is all fine, press “Done." Right after setting up a7-day free trial account with us, you'll be able to download ct financial affidavit long or send it via email at once. The document will also be readily available in your personal account menu with all your modifications. FormsPal guarantees safe form completion without personal information record-keeping or distributing. Rest assured that your data is secure here!