|

|

|

Statement of Claim for Death Benefit |

|

Mailing Address: |

Courier Address: |

Telephone Inquiries |

|

John Hancock |

John Hancock |

Customers before 1/1/2005 |

|

Attn: Life Claims Services R-03 |

Life Claims Services R-03 |

1-800-732-5543 |

|

1 John Hancock Way Suite 1105 |

27 Drydock Ave Suite 3 |

|

Originally a Manulife Customer or Customer after 12/31/2004 |

|

Boston MA 02217-1105 |

Boston MA 02210-2382 |

|

1-800-387-2747 |

|

|

|

A message to our John Hancock beneficiaries

On behalf of John Hancock, please accept our condolences for your loss. We realize that this is a difficult time for you and your family and we will make every effort to process your claim promptly. We take pride in assisting our beneficiaries.

To expedite the processing of your claim, it is important that it contain all of the necessary information as requested in the Claimant's Statement attached.

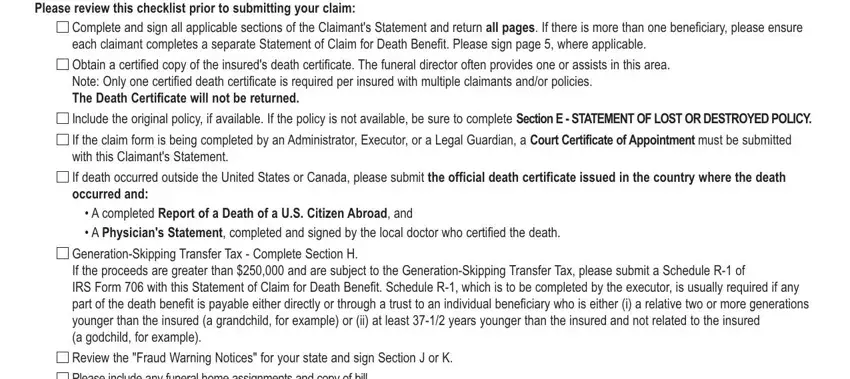

Please review this checklist prior to submitting your claim:

Complete and sign all applicable sections of the Claimant's Statement and return all pages. If there is more than one beneficiary, please ensure each claimant completes a separate Statement of Claim for Death Benefit. Please sign page 5, where applicable.

Obtain a certified copy of the insured's death certificate. The funeral director often provides one or assists in this area. Note: Only one certified death certificate is required per insured with multiple claimants and/or policies.

The Death Certificate will not be returned.

Include the original policy, if available. If the policy is not available, be sure to complete Section E - STATEMENT OF LOST OR DESTROYED POLICY.

If the claim form is being completed by an Administrator, Executor, or a Legal Guardian, a Court Certificate of Appointment must be submitted with this Claimant's Statement.

If death occurred outside the United States or Canada, please submit the official death certificate issued in the country where the death

occurred and:

•A completed Report of a Death of a U.S. Citizen Abroad, and

•A Physician's Statement, completed and signed by the local doctor who certified the death.

Generation-Skipping Transfer Tax - Complete Section H.

If the proceeds are greater than $250,000 and are subject to the Generation-Skipping Transfer Tax, please submit a Schedule R-1 of

IRS Form 706 with this Statement of Claim for Death Benefit. Schedule R-1, which is to be completed by the executor, is usually required if any part of the death benefit is payable either directly or through a trust to an individual beneficiary who is either (i) a relative two or more generations younger than the insured (a grandchild, for example) or (ii) at least 37-1/2 years younger than the insured and not related to the insured

(a godchild, for example).

Review the "Fraud Warning Notices" for your state and sign Section J or K.

Please include any funeral home assignments and copy of bill.

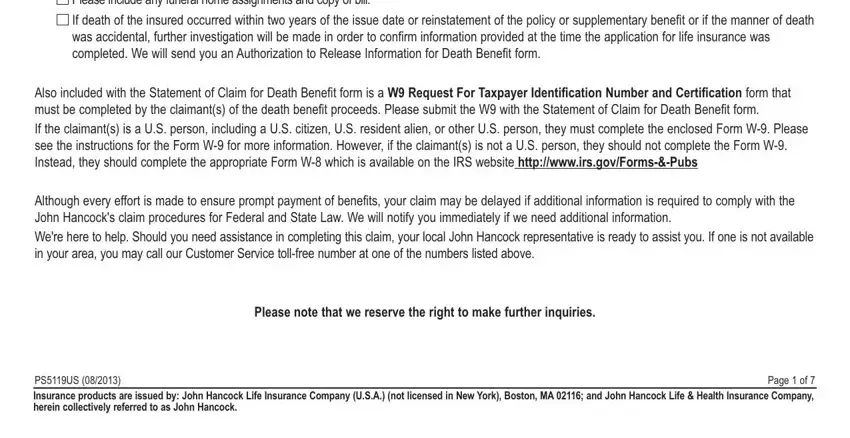

If death of the insured occurred within two years of the issue date or reinstatement of the policy or supplementary benefit or if the manner of death was accidental, further investigation will be made in order to confirm information provided at the time the application for life insurance was completed. We will send you an Authorization to Release Information for Death Benefit form.

Also included with the Statement of Claim for Death Benefit form is a W9 Request For Taxpayer Identification Number and Certification form that must be completed by the claimant(s) of the death benefit proceeds. Please submit the W9 with the Statement of Claim for Death Benefit form.

If the claimant(s) is a U.S. person, including a U.S. citizen, U.S. resident alien, or other U.S. person, they must complete the enclosed Form W-9. Please see the instructions for the Form W-9 for more information. However, if the claimant(s) is not a U.S. person, they should not complete the Form W-9. Instead, they should complete the appropriate Form W-8 which is available on the IRS website http://www.irs.gov/Forms-&-Pubs

Although every effort is made to ensure prompt payment of benefits, your claim may be delayed if additional information is required to comply with the John Hancock's claim procedures for Federal and State Law. We will notify you immediately if we need additional information.

We're here to help. Should you need assistance in completing this claim, your local John Hancock representative is ready to assist you. If one is not available in your area, you may call our Customer Service toll-free number at one of the numbers listed above.

Please note that we reserve the right to make further inquiries.

PS5119US (08/2013) |

Page 1 of 7 |

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.) (not licensed in New York), Boston, MA 02116; and John Hancock Life & Health Insurance Company, herein collectively referred to as John Hancock.

|

|

|

Statement of Claim for Death Benefit |

|

Mailing Address: |

Courier Address: |

Telephone Inquiries |

|

John Hancock |

John Hancock |

Customers before 1/1/2005 |

|

Attn: Life Claims Services R-03 |

Life Claims Services R-03 |

1-800-732-5543 |

|

1 John Hancock Way Suite 1105 |

27 Drydock Ave Suite 3 |

|

Originally a Manulife Customer or Customer after 12/31/2004 |

|

Boston MA 02217-1105 |

Boston MA 02210-2382 |

|

1-800-387-2747 |

|

|

|

|

|

|

|

Settlement Options and Payment of Proceeds

If the policyowner previously elected a settlement option

•John Hancock is required to carry out the policyowner's instructions. We will provide the beneficiary with complete details when the claim is processed.

Payment Options for Lump-Sum Payments

•Total proceeds from one or more policies or contracts of less than $7,500 will be paid directly to the beneficiary(ies) by check or electronic funds transfer. Available on policies issued after December 31, 2004 - please complete the Electronic Funds Transfer Information on page 7.

•Total proceeds of $7,500 or more from one or more policies or contracts will be placed in a John Hancock Safe Access Account in the beneficiary’s name. The John Hancock Safe Access Account also assures our beneficiary(ies) of immediate access to the claim proceeds. Please read the section below entitled “Safe Access Account” for more information.

•If the claim is payable to a corporation, partnership, multiple trustees or estate, the total proceeds will be paid by check or electronic funds transfer. Available on policies issued after December 31, 2004 - please complete the Electronic Funds Transfer Information on page 7.

Safe Access Account

•The total claim proceeds will be deposited in a John Hancock Safe Access Account in the beneficiary's name.

The Safe Access Account gives beneficiaries added peace of mind in knowing that while they take the time to make well planned financial decisions, they are immediately earning interest on the claim proceeds.

•For more information about John Hancock’s Safe Access Account, please see the terms and conditions set forth in the Supplemental Contract.

Safe Access Account offers you

Safety John Hancock guarantees the entire account balance*.

Convenience You can access the funds in your account at any time simply by writing a check.

Value There are no monthly service charges or check fees.

Growth Your account earns an attractive interest rate.

Time Take the time you need to make well planned financial decisions.

Additional payment options

•You have the right to receive a lump sum payment by check. Certain life insurance policies may provide for other methods of payment.

A description of available options can be found in the policy. To receive a lump sum payment by check or to inquire whether other settlement options are available, please contact your local John Hancock Representative or call our Customer Service toll-free number listed on page 1.

*A John Hancock Safe Access Account is not a bank account and is not insured by the FDIC; however, protection is afforded by the State Guaranty Associations. For information about coverage limitations in your state, you may contact the National Organization of Life and Health Insurance Guaranty Associations at www.nohlga.com. Guarantees are dependent upon the claims-paying ability of the issuing company. Safe Access Account balances remain in John Hancock's general account and are subject to the claims of our creditors.

PS5119US (08/2013) |

Page 2 of 7 |

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.) (not licensed in New York), Boston, MA 02116; and John Hancock Life & Health Insurance Company, herein collectively referred to as John Hancock.

|

|

|

Statement of Claim for Death Benefit |

|

|

|

John Hancock Life Insurance Company (U.S.A.) |

|

|

|

(hereinafter referred to as The Company) |

|

Mailing Address: |

Courier Address: |

Telephone Inquiries |

|

John Hancock |

John Hancock |

Customers before 1/1/2005 |

|

Attn: Life Claims Services R-03 |

Life Claims Services R-03 |

1-800-732-5543 |

|

1 John Hancock Way Suite 1105 |

27 Drydock Ave Suite 3 |

Originally a Manulife Customer or Customer after 12/31/2004 |

|

Boston MA 02217-1105 |

Boston MA 02210-2382 |

|

1-800-387-2747 |

|

|

|

Complete, sign and return the form together with the insurance policy and a certified death certificate, which indicates the cause and manner of death of the insured person. Additional requirements may also be requested depending on the circumstances.

You, your and yourself refer to the person(s), Trustee(s) or Entity claiming the death benefit, whichever is applicable to the policy(ies).

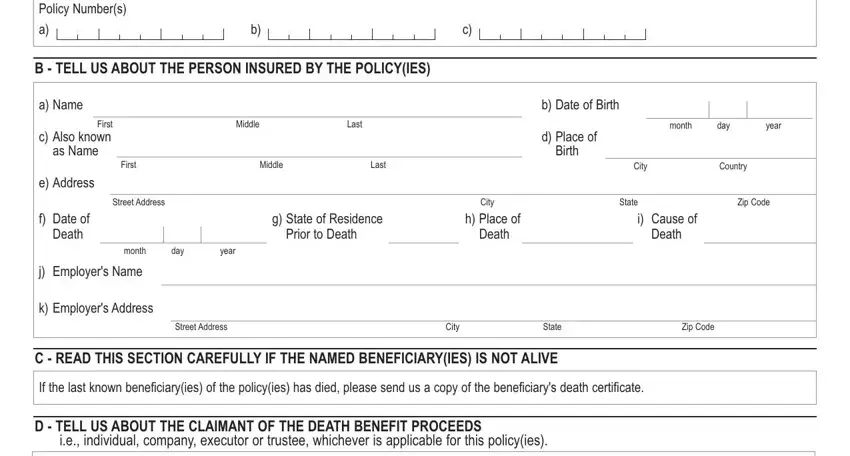

A - LIST ALL POLICY NUMBERS IF YOU ARE CLAIMING THE DEATH BENEFIT FOR MORE THAN ONE POLICY

B - TELL US ABOUT THE PERSON INSURED BY THE POLICY(IES)

a) Name |

|

|

|

b) Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

Middle |

Last |

|

|

|

|

|

|

|

|

|

|

|

|

month |

day |

|

year |

|

c) Also known |

|

|

|

d) Place of |

|

|

|

|

as Name |

|

|

|

Birth |

|

|

|

|

|

|

|

First |

Middle |

Last |

|

|

|

|

|

|

|

|

|

|

City |

Country |

|

e) Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

City |

|

State |

|

Zip Code |

|

f)Date of Death

month day

g) State of Residence |

|

h) Place of |

|

i) Cause of |

Prior to Death |

|

Death |

|

Death |

year

j)Employer's Name

k)Employer's Address

Street Address |

City |

State |

Zip Code |

C - READ THIS SECTION CAREFULLY IF THE NAMED BENEFICIARY(IES) IS NOT ALIVE

If the last known beneficiary(ies) of the policy(ies) has died, please send us a copy of the beneficiary's death certificate.

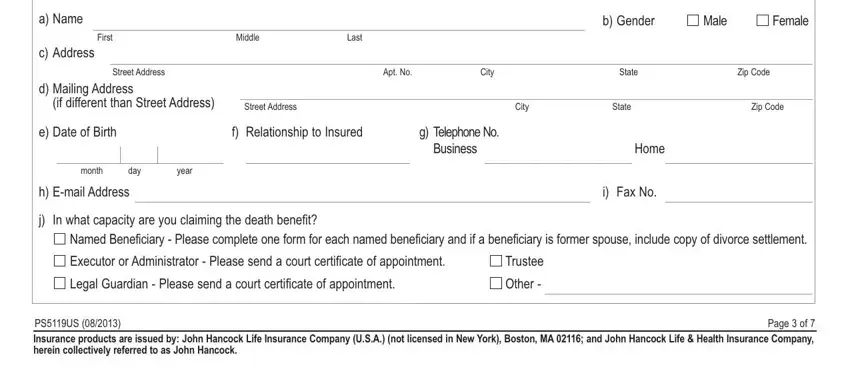

D - TELL US ABOUT THE CLAIMANT OF THE DEATH BENEFIT PROCEEDS

i.e., individual, company, executor or trustee, whichever is applicable for this policy(ies).

a) Name |

|

|

|

|

b) Gender |

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

Middle |

Last |

|

|

|

|

|

|

c) Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

Apt. No. |

City |

State |

|

Zip Code |

d) Mailing Address |

|

|

|

|

|

|

|

|

|

(if different than Street Address) |

|

|

|

|

|

|

|

|

Street Address |

|

City |

State |

|

Zip Code |

e) Date of Birth |

|

|

|

f) Relationship to Insured |

g) Telephone No. |

|

|

|

|

|

|

|

|

|

Business |

|

Home |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

month |

day |

year |

|

|

|

|

|

h) E-mail Address |

|

|

|

|

|

|

i) |

Fax No. |

j)In what capacity are you claiming the death benefit?

Named Beneficiary - Please complete one form for each named beneficiary and if a beneficiary is former spouse, include copy of divorce settlement.

|

Executor or Administrator - Please send a court certificate of appointment. |

Trustee |

|

|

Legal Guardian - Please send a court certificate of appointment. |

Other - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PS5119US (08/2013) |

|

Page 3 of 7 |

|

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.) (not licensed in New York), Boston, MA 02116; and John Hancock Life & Health Insurance Company, herein collectively referred to as John Hancock.

E - STATEMENT OF LOST OR DESTROYED POLICY

Check this box if the policy is lost or destroyed:

The undersigned hereby represents that the above numbered policy was lost or destroyed. This policy is not now assigned, nor has it been otherwise transferred or encumbered in any manner. No person, firm or corporation has or claims the right to possession of this policy.

F - FORM 712 (LIFE INSURANCE STATEMENT)

If you require an IRS Form 712 (Life Insurance Statement) for estate tax purposes, please check this box.

G - READ THIS SECTION CAREFULLY AND COMPLETE IT ONLY IF YOU ARE A TRUSTEE OF THE TRUST THAT IS CLAIMING THE PROCEEDS OF THIS POLICY(IES).

a) Name |

|

b) Date |

of Trust |

|

of Trust |

c) Name of Trustees

If more than one trustee, all trustees must complete and sign this form

Certification

If you have completed this section, you are making the following commitments when you sign this form:

•You certify that you are the trustee(s) of the trust named above.

•You certify that you have the right under the trust to act as the claimant for the policies named in this form.

•You agree that John Hancock doesn't have to determine the original terms of the trust or any revisions to them. You also agree that John Hancock shall not be charged with the knowledge of the trust's provisions. You confirm that neither John Hancock nor its representatives are responsible for inquiring into or shall be charged with the knowledge of the terms of the trust.

•You agree that John Hancock may discharge its obligations under the policies named in this form by relying solely on the signature of the trustee(s) or successor trustee(s) on this form.

•You agree that proof of payment to the trustee(s) of the death claim proceeds will be final and conclusive evidence that payment was made and that all claims and demands of the trustee(s) against John Hancock will have been satisfied.

H - GENERATION-SKIPPING TRANSFER TAX

Are the death benefit proceeds subject to the Generation-Skipping Transfer Tax? |

Yes |

No |

If you answered ‘Yes’ above, and the proceeds are greater than $250,000, please submit a Schedule R-1 of IRS Form 706.

I - ADDITIONAL INFORMATION

Complete if any family members are covered under the insurance being claimed.

Please list the names and birth dates of all children born of the marriage of the insured and the insured's Spouse, or of children acquired by the insured as stepchildren or legally adopted children. Please list only living children who have not reached their 25th birthday.

Full Name of Child/Spouse

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is there any possibility of a posthumous child (a child born after the death of the father)? |

|

Yes |

|

No |

|

|

|

|

|

|

|

PS5119US (08/2013) |

Page 4 of 7 |

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.) (not licensed in New York), Boston, MA 02116; and John Hancock Life & Health Insurance Company, herein collectively referred to as John Hancock.

J - ALL INDIVIDUAL CLAIMANTS OR TRUSTEES OR EXECUTORS MUST SIGN HERE AND HAVE THEIR SIGNATURE WITNESSED BY A DISINTERESTED THIRD PARTY.

Any person who knowingly and with intent to defraud any insurance company or other persons, files a statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, is subject to criminal prosecution and/or civil penalties. By signing below, you agree under penalties of perjury that the information in this statement is complete and true to the best of your knowledge (please sign as you would sign a check). Refer to "Fraud Warning Notices" insert for your state.

To the extent proceeds are settled by lump sum into a John Hancock Safe Access Account, you further agree to the terms and conditions set forth in the

John Hancock Safe Access Account Supplemental Contract, which together with this Statement of Claim forms the entire agreement between you and John Hancock.

Signed at |

City |

State |

This |

Day of |

Year |

Signature of Claimant, Trustee(s), Executor or Signing Officer

X

Signature of Witness

X

K - SIGNATURES - ALL CORPORATE CLAIMANTS MUST SIGN HERE AND HAVE THEIR SIGNATURE WITNESSED BY A DISINTERESTED THIRD PARTY

Any person who knowingly and with intent to defraud any insurance company or other persons, files a statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, is subject to criminal prosecution and/or civil penalties. By signing below, you agree under penalties of perjury that the information in this statement is complete and true to the best of your knowledge (please sign as you would sign a check). Refer to "Fraud Warning Notices" insert for your state.

Corporations making a claim must provide either:

•The title and signature of one signing officer along with the corporate seal, or

•Signatures of two signing officers with their titles and the Corporation Name.

Signed at |

City |

State |

This |

Day of |

Year |

|

|

|

|

|

|

|

|

Signature of the First Signing Officer |

|

|

|

|

Name and Title of the First Signing Officer and the Name of Corporation |

X

Signature of Witness

X

Signed at |

City |

State |

This |

Day of |

Year |

|

|

|

|

|

|

|

|

Signature of the Second Signing Officer |

|

|

|

|

|

|

|

X

Signature of Witness

X

By providing this form or other claim forms for the convenience of the claimant, John Hancock does not admit any liability or waive any of its rights.

PS5119US (08/2013) |

Page 5 of 7 |

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.) (not licensed in New York), Boston, MA 02116; and John Hancock Life & Health Insurance Company, herein collectively referred to as John Hancock.