When you intend to fill out lII, you won't need to install any kind of programs - just give a try to our PDF tool. FormsPal development team is relentlessly endeavoring to improve the tool and enable it to be even faster for clients with its extensive features. Take full advantage of present-day revolutionary prospects, and discover a heap of new experiences! For anyone who is looking to begin, here's what it requires:

Step 1: Click the "Get Form" button above. It is going to open up our tool so you could begin filling in your form.

Step 2: The tool will let you work with your PDF file in a range of ways. Enhance it with any text, correct original content, and place in a signature - all within a few mouse clicks!

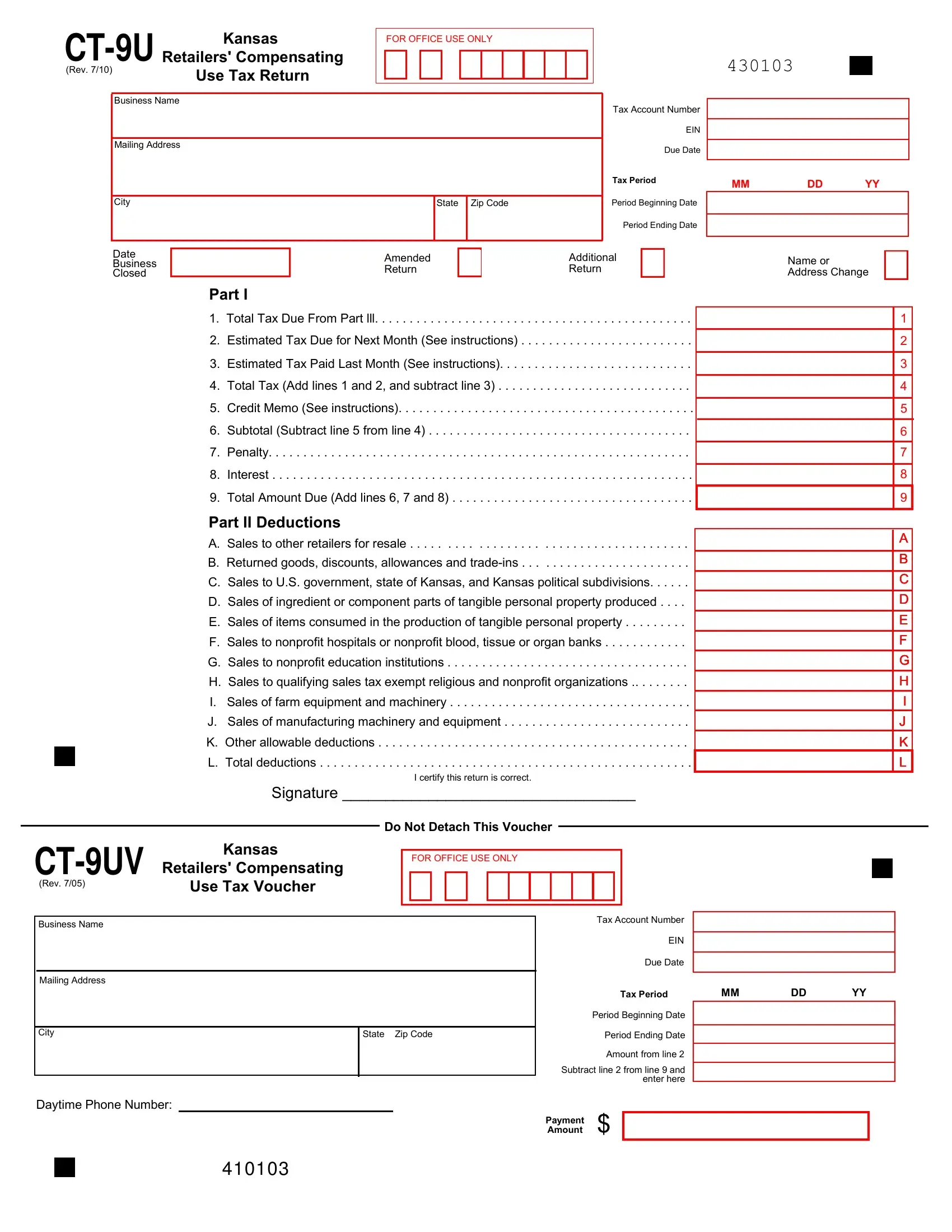

This PDF form will need particular data to be filled in, therefore you should definitely take the time to type in what is asked:

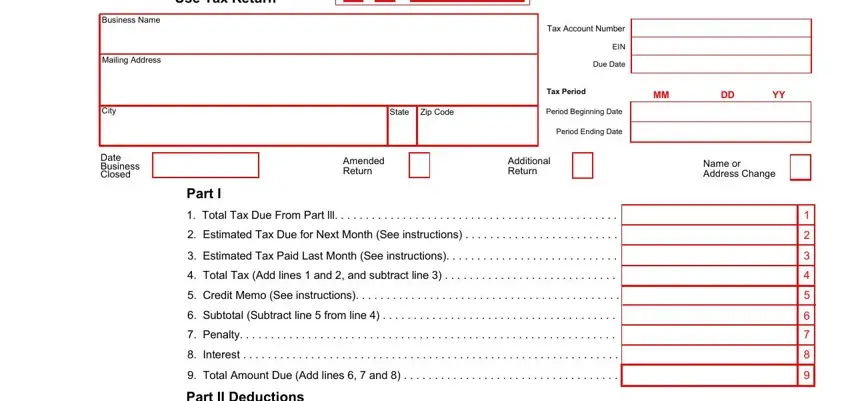

1. You need to complete the lII accurately, hence pay close attention while filling in the parts that contain all of these blanks:

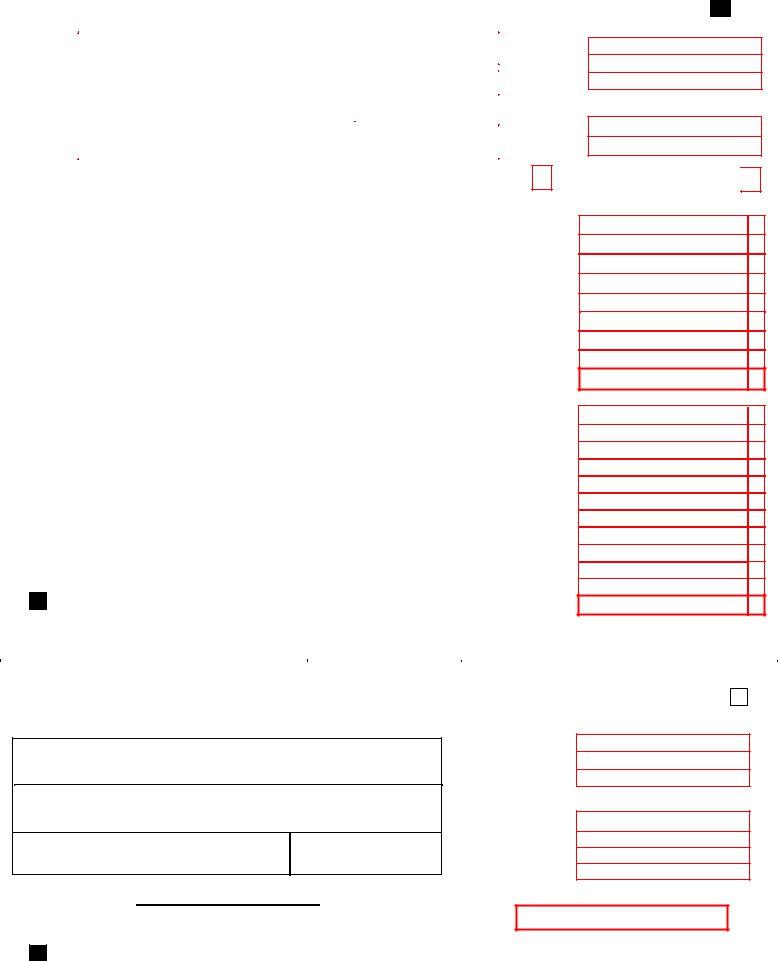

2. Once your current task is complete, take the next step – fill out all of these fields - Total Amount Due Add lines and, Signature, I certify this return is correct, AAA BBB CCC DDD EEE FFF GGG HHH, Kansas, Retailers Compensating, Use Tax Voucher, CTUV, Rev, Business Name, Do Not Detach This Voucher, FOR OFFICE USE ONLY, Tax Account Number, and EIN with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

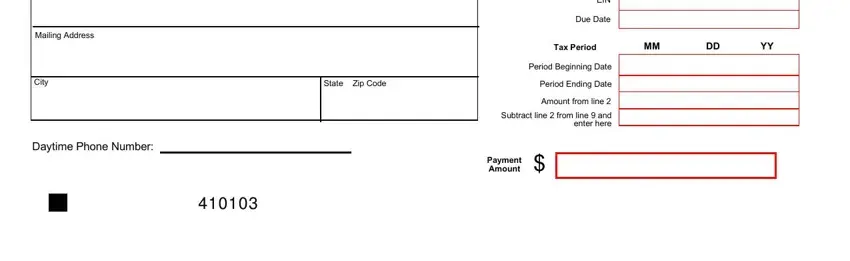

3. Completing Mailing Address, City, Daytime Phone Number, EIN, Due Date, Tax Period, State Zip Code, Period Beginning Date, Period Ending Date, Amount from line Subtract line, Payment, and Amount is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

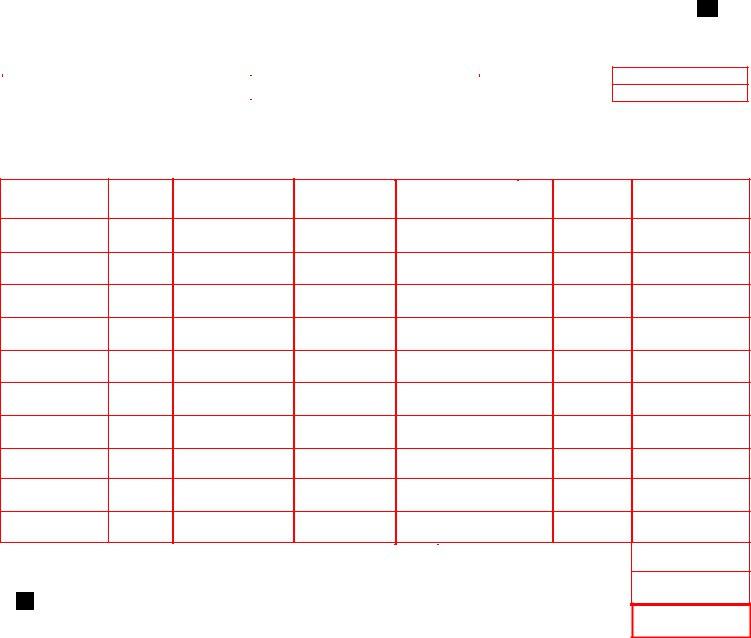

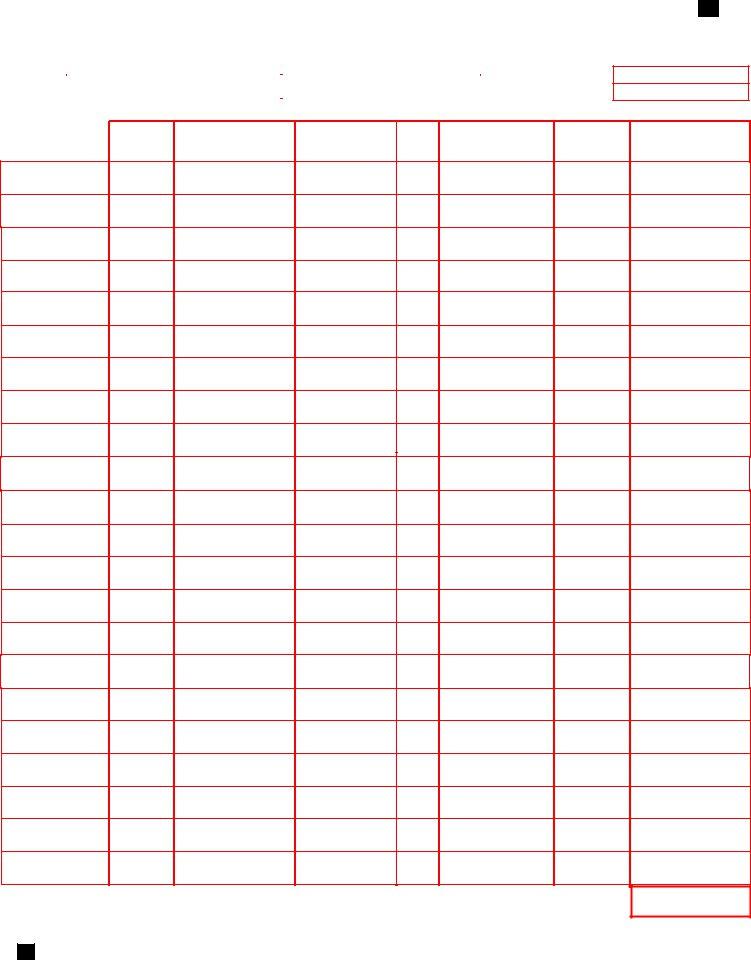

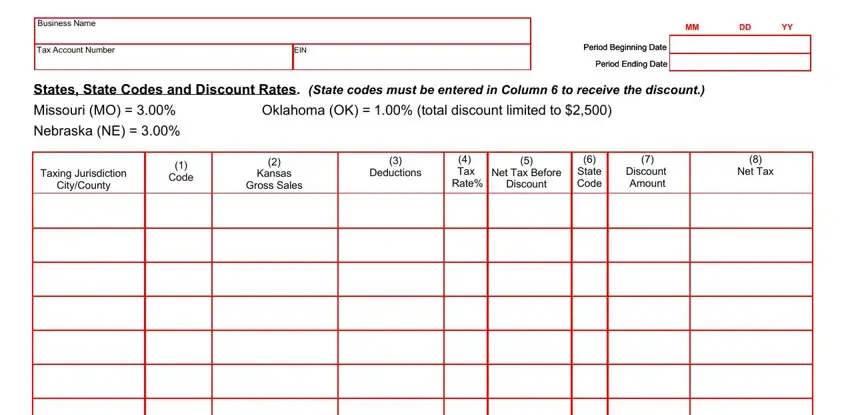

4. Your next part needs your attention in the subsequent areas: Business Name, Tax Account Number, EIN, PPeeririoodd BBegieginnnniinngg, PPeeririodod EEnndidingng DDaatete, States State Codes and Discount, Oklahoma OK total discount, Taxing Jurisdiction, CityCounty, Code, Kansas, Gross Sales, Deductions, Tax Rate, and Net Tax Before. Be sure that you fill in all of the required information to move onward.

People often make some errors when completing Net Tax Before in this part. Be certain to revise everything you type in here.

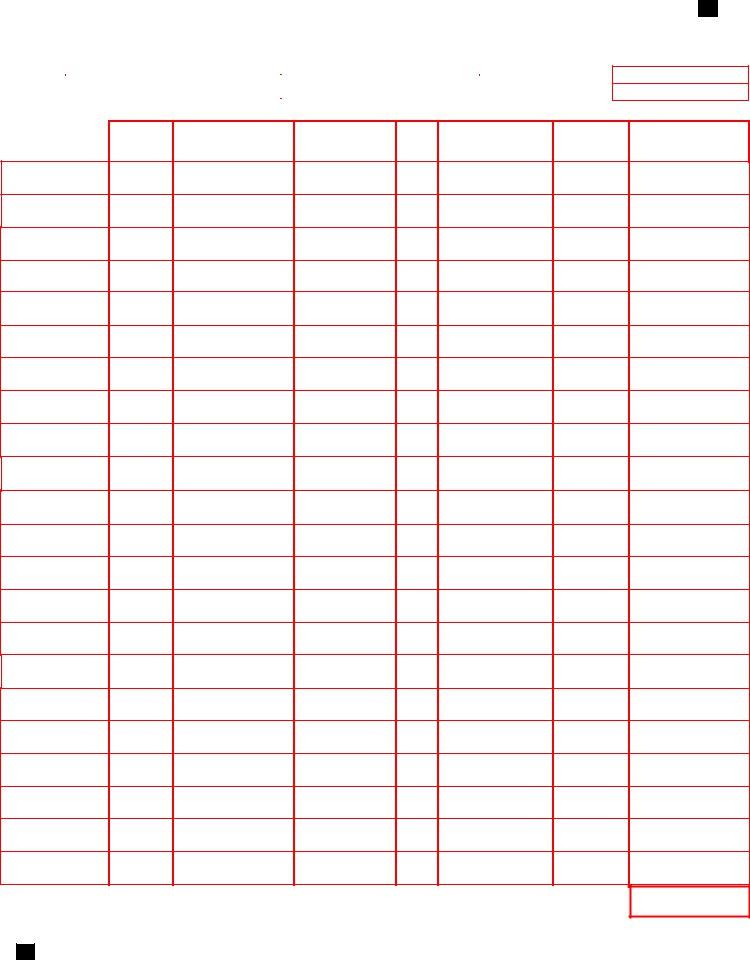

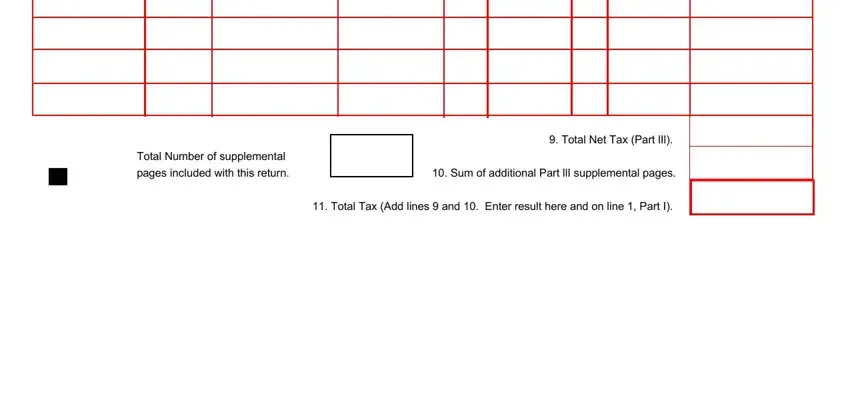

5. To conclude your document, the last segment incorporates several additional fields. Typing in Total Number of supplemental pages, Total Net Tax Part lIl, Sum of additional Part llI, and Total Tax Add lines and Enter will certainly finalize the process and you'll be done in a tick!

Step 3: Check what you have inserted in the blank fields and then click the "Done" button. After registering afree trial account here, you'll be able to download lII or email it directly. The file will also be available from your personal account with all of your adjustments. Whenever you work with FormsPal, you can fill out documents without the need to worry about personal data incidents or records getting distributed. Our secure software ensures that your personal details are stored safe.