Should you would like to fill out kansas sales tax id number, it's not necessary to download any software - just make use of our PDF tool. In order to make our editor better and more convenient to use, we consistently develop new features, with our users' suggestions in mind. Getting underway is effortless! Everything you need to do is stick to the following basic steps below:

Step 1: Just click the "Get Form Button" above on this site to launch our form editor. Here you'll find all that is necessary to fill out your document.

Step 2: The editor will let you work with PDF files in a variety of ways. Change it with personalized text, correct existing content, and place in a signature - all manageable within minutes!

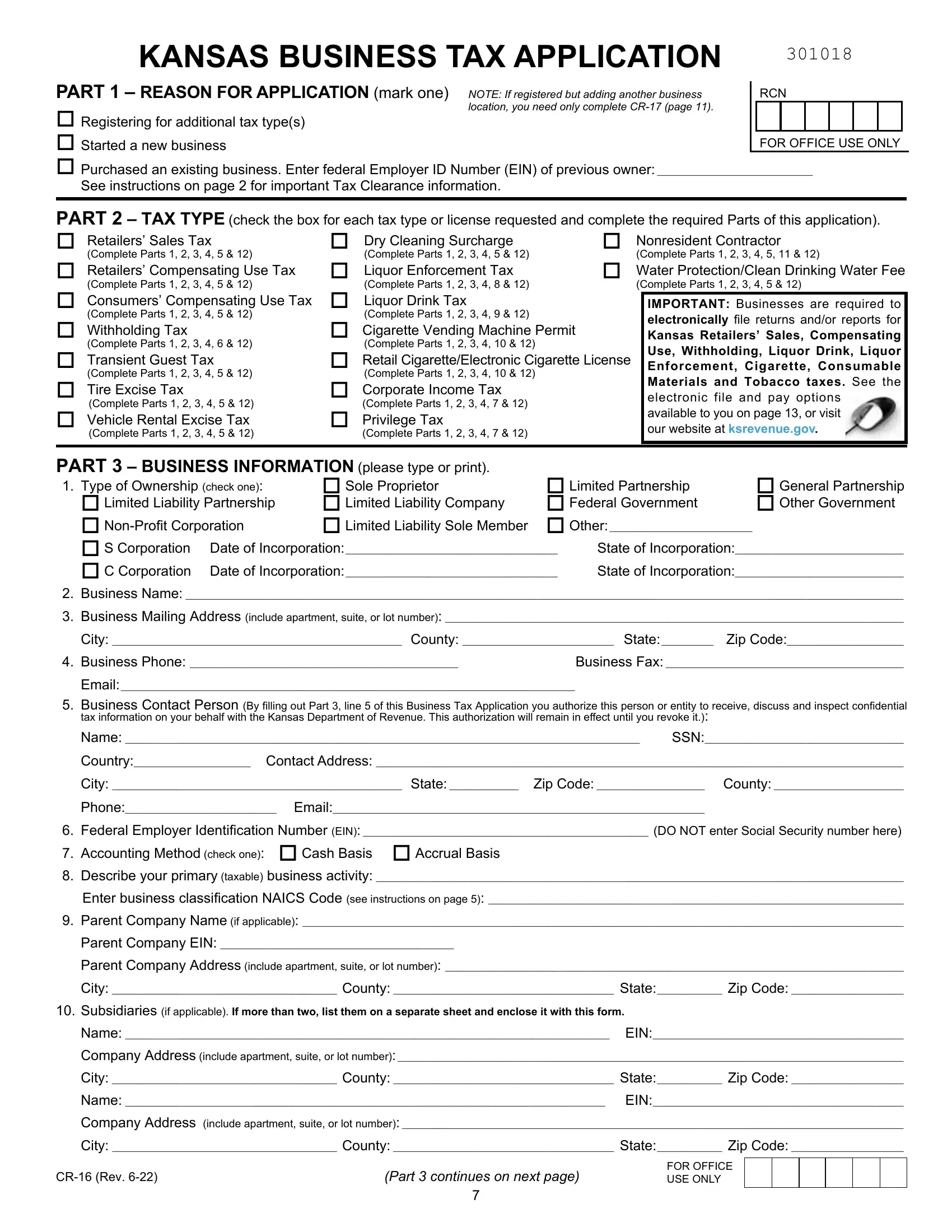

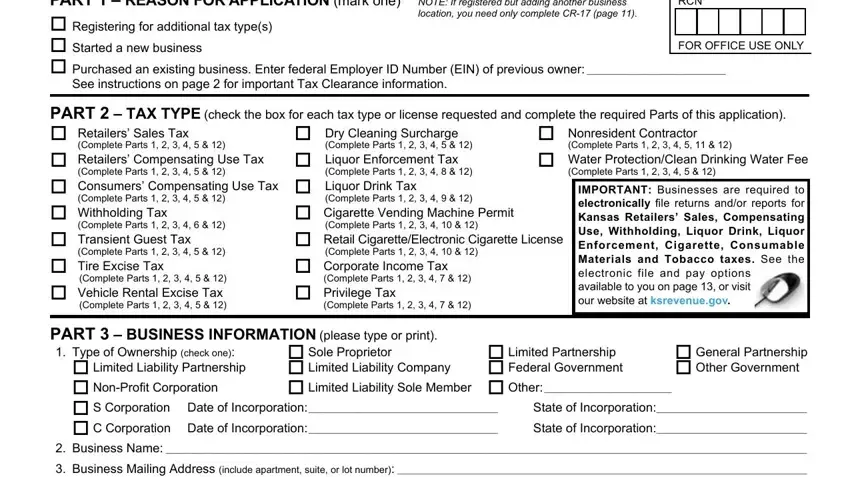

When it comes to fields of this precise document, here's what you should know:

1. First, while filling in the kansas sales tax id number, beging with the part containing next blank fields:

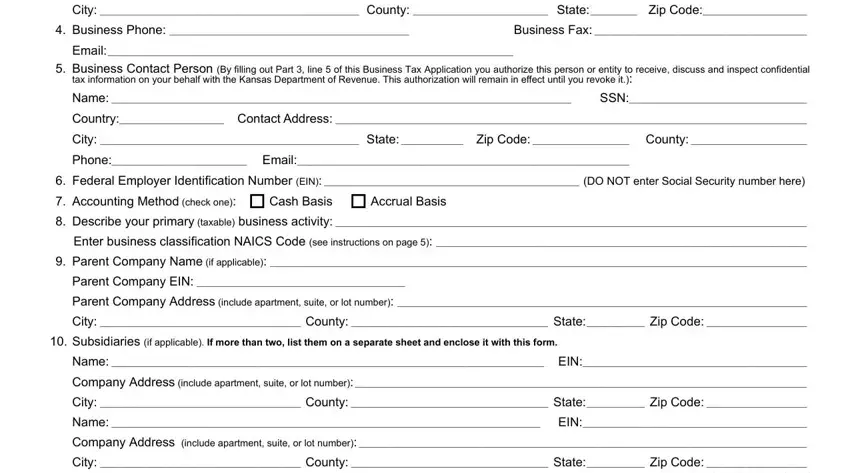

2. Given that the last part is completed, it is time to include the essential details in State of Incorporation State of, Business Phone, Email, Business Contact Person By, tax information on your behalf, Federal Employer Identification, Parent Company EIN Parent Company, Subsidiaries if applicable If, and Name EIN Company Address include allowing you to move forward further.

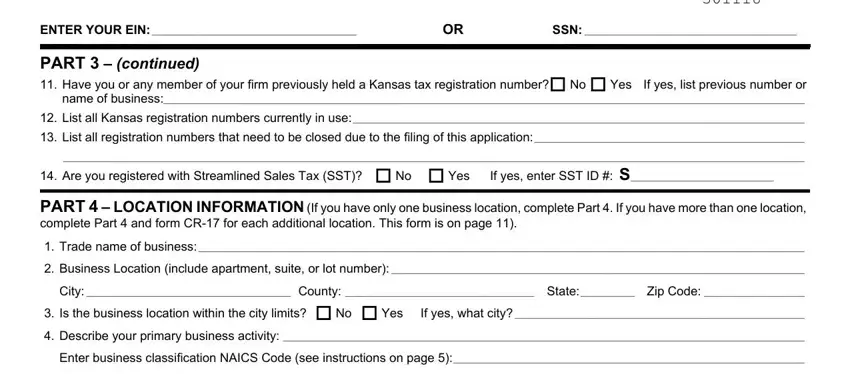

3. This next part is rather straightforward, ENTER YOUR EIN, SSN, PART continued Have you or any, If yes list previous number or, Are you registered with, If yes enter SST ID S, PART LOCATION INFORMATION If you, and Business phone number Is your - these fields needs to be filled in here.

When it comes to ENTER YOUR EIN and If yes enter SST ID S, be certain you review things in this current part. Those two are the key fields in this page.

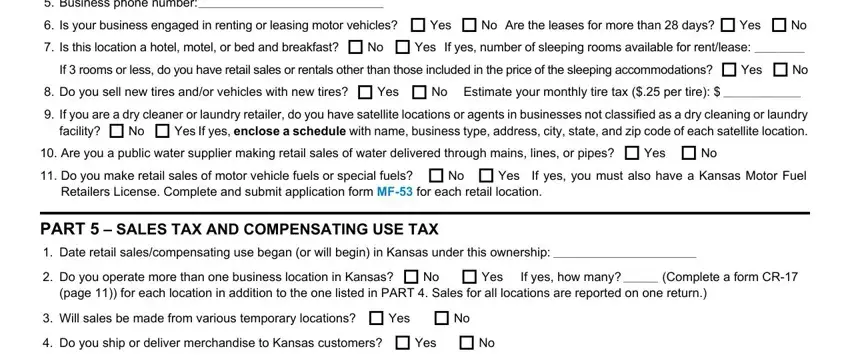

4. This particular paragraph comes with all of the following blank fields to consider: Business phone number Is your, Are you a public water supplier, If yes you must also have a Kansas, Retailers License Complete and, PART SALES TAX AND COMPENSATING, page for each location in, If yes how many Complete a form CR, and Will sales be made from various.

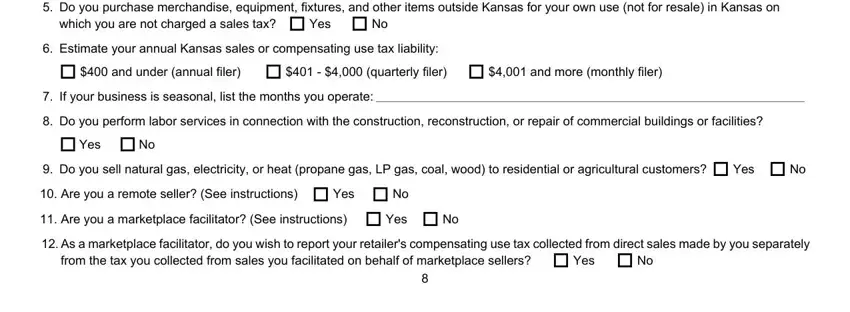

5. This final point to complete this form is pivotal. Be sure to fill in the required blank fields, particularly Will sales be made from various, which you are not charged a sales, Estimate your annual Kansas sales, and under annual filer, If your business is seasonal list, Yes No, Do you sell natural gas, and from the tax you collected from, prior to submitting. Failing to do this could give you an unfinished and potentially unacceptable document!

Step 3: Proofread all the details you have entered into the blanks and press the "Done" button. Create a 7-day free trial option at FormsPal and get instant access to kansas sales tax id number - accessible in your personal account page. We do not share the information that you type in whenever completing forms at our website.