Any time you need to fill out ks form taxpayer, you won't need to install any kind of software - just make use of our PDF tool. To make our editor better and less complicated to utilize, we consistently implement new features, with our users' suggestions in mind. All it requires is a few simple steps:

Step 1: Open the PDF file in our editor by clicking on the "Get Form Button" in the top section of this webpage.

Step 2: This editor offers you the capability to change your PDF in many different ways. Transform it by writing customized text, adjust what's already in the file, and add a signature - all readily available!

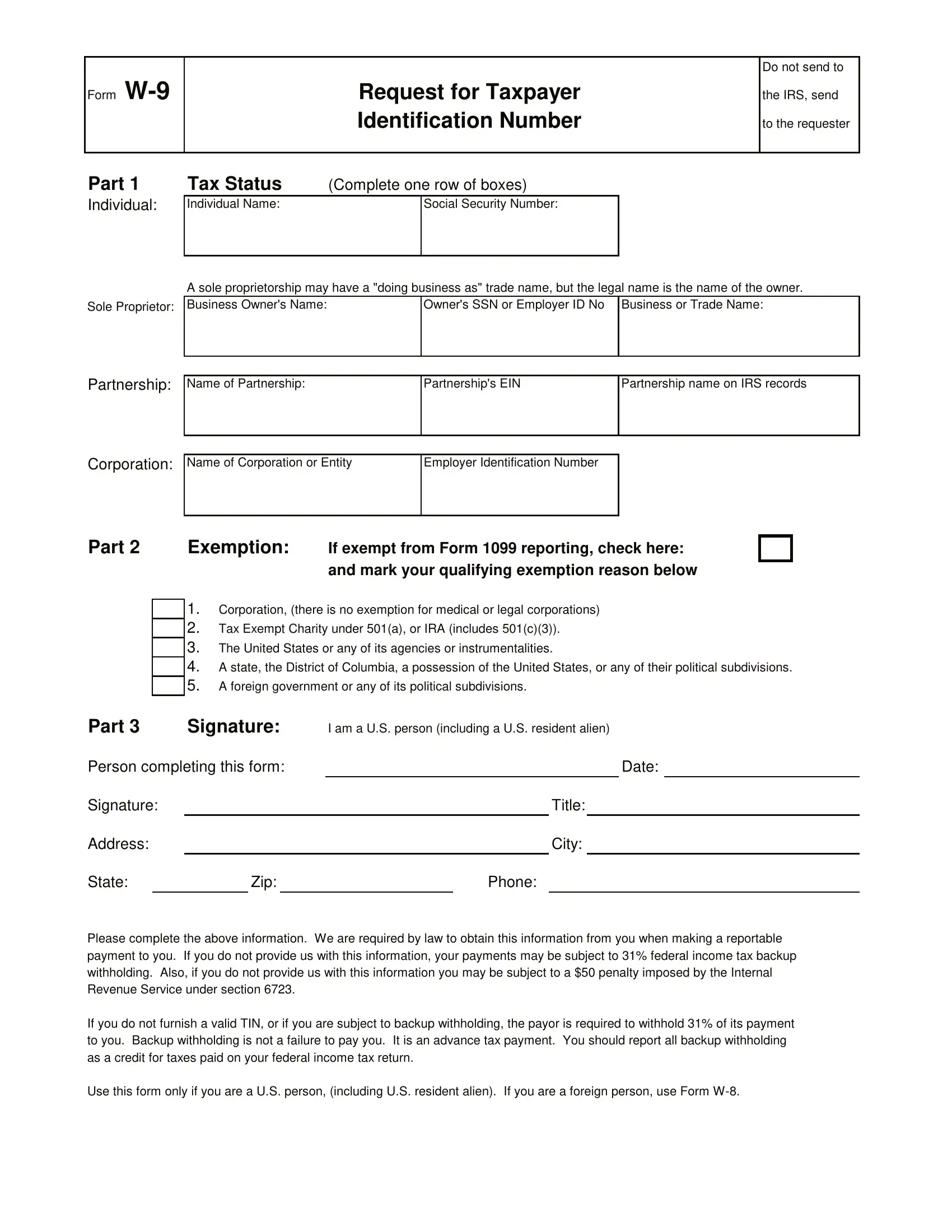

Completing this PDF demands focus on details. Make certain each and every field is completed correctly.

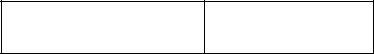

1. It is very important complete the ks form taxpayer accurately, hence pay close attention while filling in the segments including these blanks:

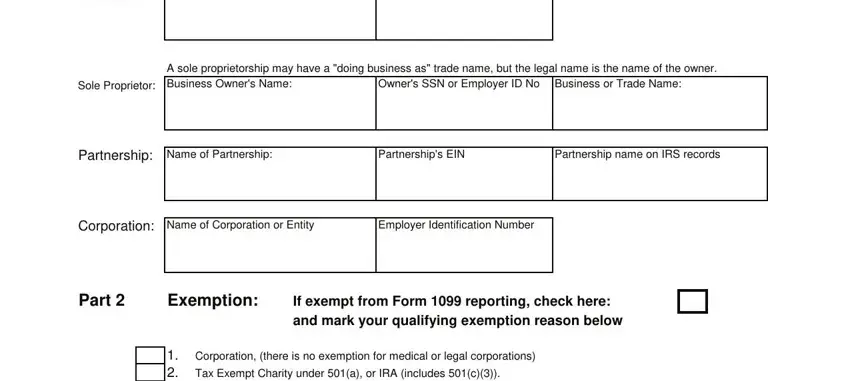

2. Right after filling out this section, head on to the subsequent step and complete the essential particulars in all these blank fields - The United States or any of its, A state the District of Columbia a, A foreign government or any of its, Part, Signature, I am a US person including a US, Person completing this form, Date, Signature, Address, State, Title, City, Zip, and Phone.

As to City and Title, be certain you take another look in this section. The two of these are considered the most significant ones in this page.

Step 3: Ensure your information is accurate and then click on "Done" to complete the process. Find your ks form taxpayer when you subscribe to a 7-day free trial. Easily use the pdf inside your FormsPal account, together with any modifications and changes being all saved! Here at FormsPal, we aim to make sure that all of your details are maintained protected.