In a world where understanding tax obligations is crucial for both businesses and individuals, the Kentucky 51A113 form serves as an essential document for those who need to report use tax in the Commonwealth of Kentucky. Specifically designed for use by those not registered as retailers or consumers, this form plays a pivotal role in ensuring that the correct tax is remitted for tangible personal property, digital property, and extended warranty services purchased without paying Kentucky sales or use tax. Each section of the form is meticulously designed to capture detailed information about such purchases, including the date of sale, the price, and the seller's details, which underscores the importance of thorough record-keeping. Moreover, the form calculates the tax due, taking into consideration any potential compensation, penalties, or interest, which highlights the financial implications of timely and accurate filings. The comprehensive instructions on the reverse side of the form guide taxpayers through the process, from determining the tax rate to understanding the penalties for late filings, making it a valuable resource for ensuring compliance with Kentucky's tax laws. With deadlines established for submission, and specific requirements for remittance, the Kentucky 51A113 form emphasizes the critical nature of fulfilling tax obligations promptly and accurately to avoid financial penalties.

| Question | Answer |

|---|---|

| Form Name | Kentucky Form 51A113 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ky 51a102, kentucky form ky 51a103, kentucky consumer use tax return fillable, kentucky sales taxd return 51a103 |

51A113(O) |

|

Read instructions on reverse |

Commonwealth of Kentucky |

CONSUMER’S USE TAX RETURN |

before completing return. |

DEPARTMENT OF REVENUE |

|

|

|

For Month of _____________________ , 20____ |

|

Type or Print |

|

|

Enter Applicable Number: |

SSN __ __ __ – __ __ – __ __ __ __ |

FEIN __ __ – __ __ __ __ __ __ __ |

|

|

|

|

|

Name and |

|

Name |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

P.O. Box or Number and Street |

|

|

|

|

|

|

|

|

City or Town |

County |

State |

ZIP Code |

|

|

|

|

|

Nature of |

Important: An accurate description of your business is necessary. |

|

|

|

Business |

|

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

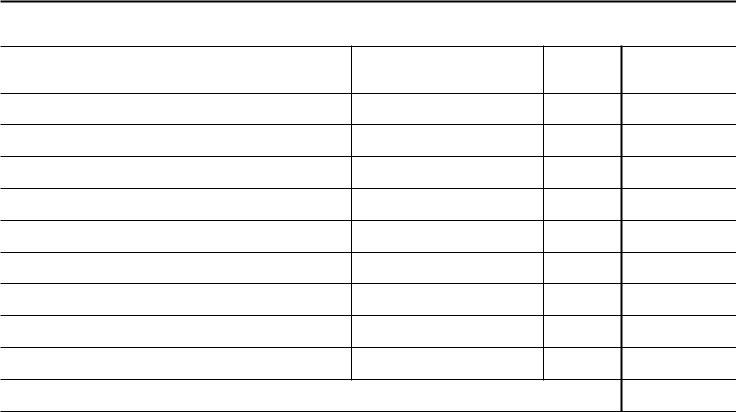

List All Purchases of Tangible Personal Property, Digital Property, and Extended Warranty Services Subject to Use Tax

|

|

|

|

|

Date of |

|

Sale Price of |

|

Name and Address of Seller |

|

Description of Property |

|

Purchase |

|

Property and Services |

|

|

|

|

|

|

|

Purchased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If additional space is needed, see reverse.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total sale price of tangible personal property, digital property, and extended warranty |

|

|

|

|||

|

services subject to use tax |

|

|

1 |

$ |

||

2. |

Use tax (6% of Line 1) |

|

|

2 |

|

||

|

|

|

|||||

3. |

Compensation (1 3/4% of first $1,000 of tax, 1.5% over $1,000) |

|

|

|

|||

|

|

|

|||||

|

(see instructions) (Compensation shall not exceed $50) |

............................................................. |

|

|

3 |

|

|

4. |

Tax due (Line 2 minus Line 3) |

|

|

4 |

|

||

5. |

Penalty (if any) (see instructions) |

|

|

5 |

|

||

6. |

Interest (if any) (see instructions) |

|

|

6 |

|

||

7. |

Total amount due and payable (total of Lines 4, 5 and 6) |

............................................................. |

|

|

7 |

$ |

|

|

|

|

|

|

|

|

|

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Date |

Taxpayer’s Signature |

Make check payable to Kentucky State Treasurer.

Mail return with check to: Department of Revenue

Frankfort, Kentucky 40619

NOTICE

This form is to be filed only by persons or firms liable for use tax who are not: (1) registered consumers or (2) registered retailers. Registered consumers and retailers must use returns mailed to them by the Department, or filed electronically.

INSTRUCTIONS

Time and Place for

Tax

Sale

Tangible Personal Property, Digital Property, and Extended Warranty

Completing the

Penalties and

The penalty for failure to pay the tax within the time prescribed is 2 percent of the tax not timely paid for each 30 days payment is

Additional Space for Listing Tangible Personal Property, Digital Property, and

Extended Warranty Services Subject to Use Tax

Name and Address of Seller

Description of Property

Date of

Purchase

Sale Price of

Property and Services

Purchased

$

Subtotal: Sale price of purchases (include in total on Line 1, front page) .............................................

$