In case you wish to fill out 2015 tax table for 740, there's no need to download and install any programs - just make use of our PDF editor. To maintain our editor on the cutting edge of efficiency, we work to put into practice user-driven capabilities and enhancements on a regular basis. We are always looking for feedback - play a pivotal role in remolding PDF editing. Starting is easy! All that you should do is stick to the following basic steps directly below:

Step 1: Just hit the "Get Form Button" in the top section of this page to open our pdf file editor. Here you'll find all that is necessary to work with your document.

Step 2: With the help of our state-of-the-art PDF tool, it is easy to do more than merely fill in forms. Try all the functions and make your docs seem sublime with customized text put in, or adjust the file's original input to perfection - all accompanied by an ability to insert almost any pictures and sign it off.

It's easy to fill out the form with our helpful tutorial! Here's what you need to do:

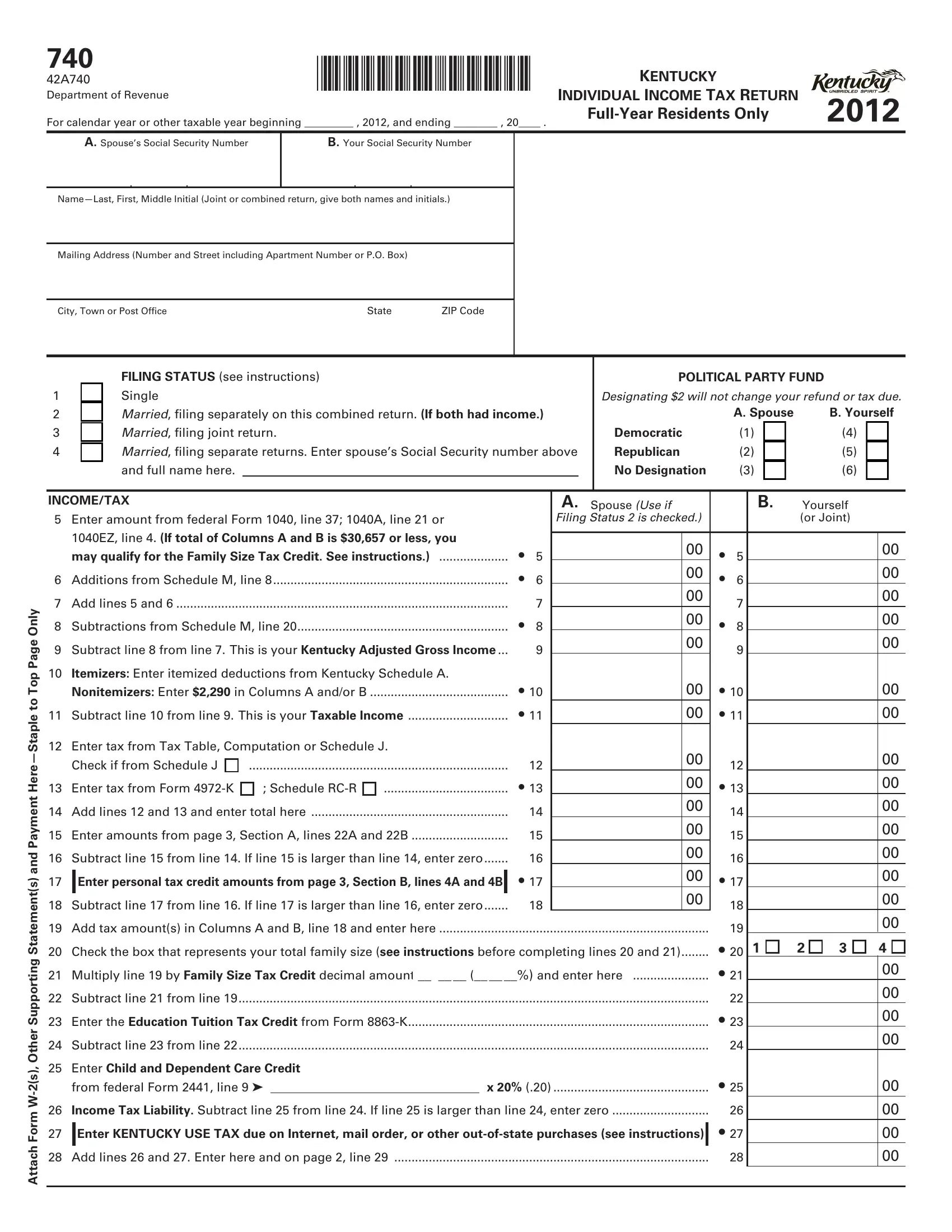

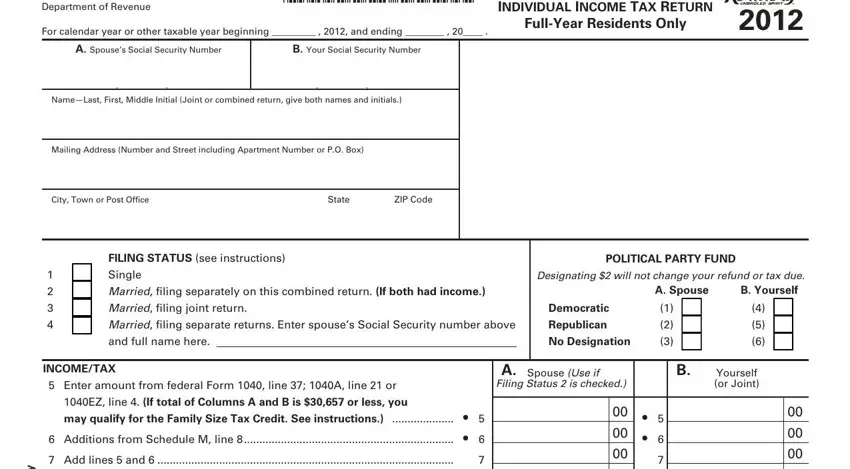

1. To start off, when filling in the 2015 tax table for 740, start in the section that has the subsequent fields:

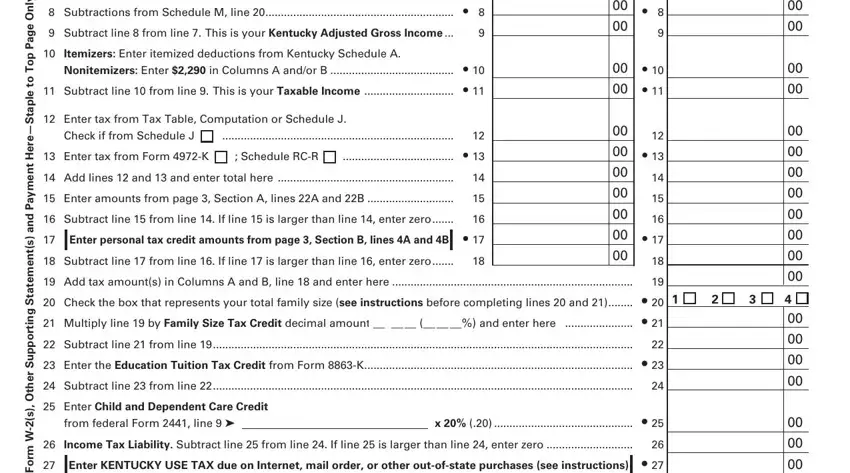

2. Once your current task is complete, take the next step – fill out all of these fields - Add lines and Subtractions, Subtract line from line This is, Itemizers Enter itemized, Nonitemizers Enter in Columns A, Enter tax from Tax Table, Check if from Schedule J, Enter tax from Form K, Schedule RCR, Add lines and and enter total, Enter amounts from page Section, Subtract line from line If line, Subtract line from line If line, Add tax amounts in Columns A and, Enter Child and Dependent Care, and from federal Form line with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

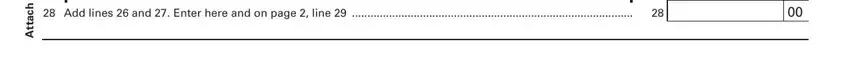

3. Completing x Income Tax Liability, and s W m r o F h c a t t A is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

People generally make mistakes while filling out x Income Tax Liability in this section. You should definitely revise whatever you enter right here.

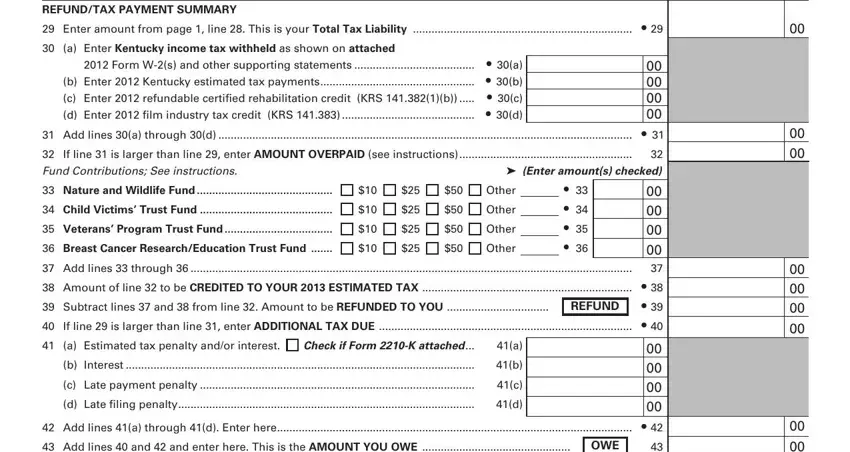

4. Now complete the next portion! Here you will have all of these REFUNDTAX PAYMENT SUMMARY Enter, Form Ws and other supporting, Add lines a through d If, Other, Other, Other, Other, Veterans Program Trust Fund, Child Victims Trust Fund, Nature and Wildlife Fund, Breast Cancer ResearchEducation, Add lines through Amount, Add lines a through d Enter, Check if Form K attached b, and c Late payment penalty empty form fields to do.

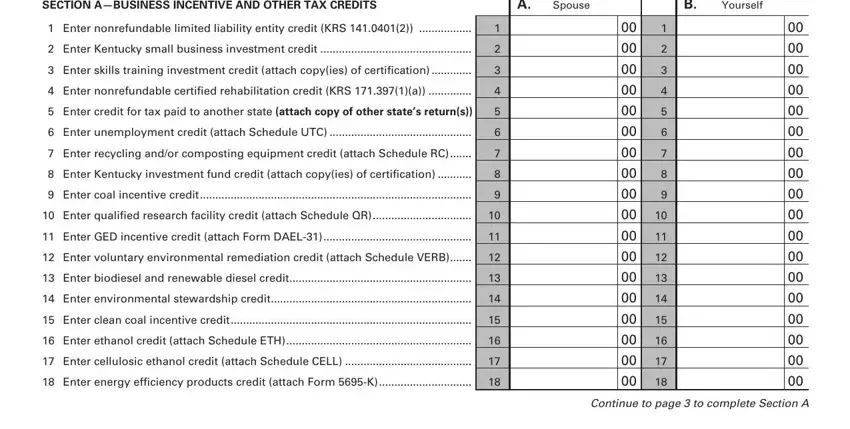

5. To wrap up your document, the final section includes a number of extra blanks. Entering SECTION ABUSINESS INCENTIVE AND, Spouse, Yourself, Enter nonrefundable limited, Enter Kentucky small business, Enter skills training investment, Enter nonrefundable certified, Enter credit for tax paid to, Enter unemployment credit attach, Enter recycling andor composting, Enter Kentucky investment fund, Enter coal incentive credit, Enter qualified research facility, Enter GED incentive credit attach, and Enter voluntary environmental should wrap up everything and you're going to be done in no time at all!

Step 3: Right after looking through the form fields you have filled out, hit "Done" and you are all set! Sign up with us today and immediately get access to 2015 tax table for 740, available for download. Every edit made is handily saved , enabling you to change the form at a later stage when required. If you use FormsPal, you're able to complete forms without being concerned about personal information incidents or records being distributed. Our protected software ensures that your personal data is maintained safely.