With the help of the online editor for PDFs by FormsPal, it is easy to fill in or modify IRS here and now. The editor is continually maintained by us, acquiring powerful features and becoming much more versatile. If you are seeking to begin, this is what you will need to do:

Step 1: Just click the "Get Form Button" above on this page to get into our pdf form editing tool. This way, you will find everything that is necessary to fill out your document.

Step 2: As soon as you open the online editor, there'll be the form made ready to be filled out. In addition to filling in various fields, you may as well do many other things with the form, namely writing custom textual content, changing the original textual content, adding images, placing your signature to the PDF, and more.

It's straightforward to fill out the form with our detailed guide! Here is what you must do:

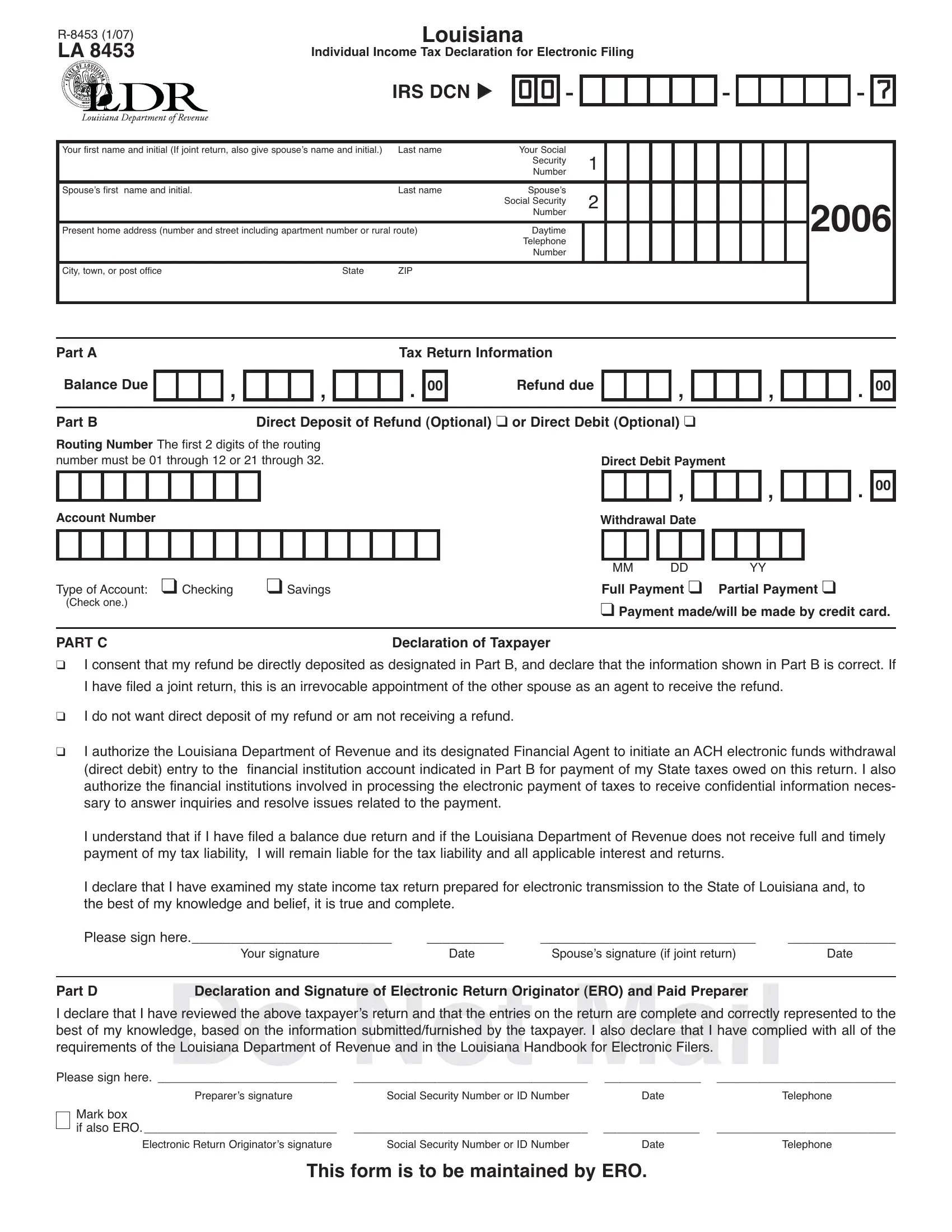

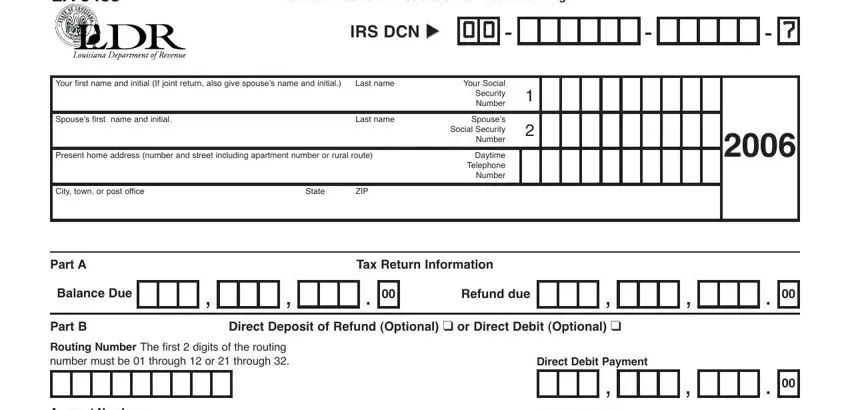

1. Whenever completing the IRS, make certain to incorporate all essential blanks in its corresponding section. This will help to hasten the process, making it possible for your information to be processed without delay and properly.

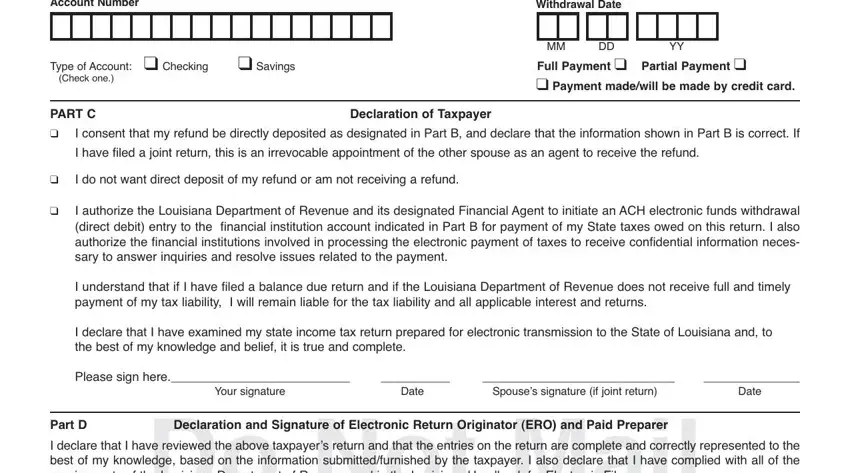

2. Right after filling out the previous step, go to the next stage and fill out all required particulars in these blank fields - Account Number, Withdrawal Date, Type of Account Checking Savings, Check one, PART C, Declaration of Taxpayer, Full Payment Partial Payment, I consent that my refund be, I have filed a joint return this, I do not want direct deposit of, I authorize the Louisiana, I understand that if I have filed, I declare that I have examined my, Please sign here, and Your signature.

It's easy to make an error while filling out your PART C, and so be sure to reread it prior to when you finalize the form.

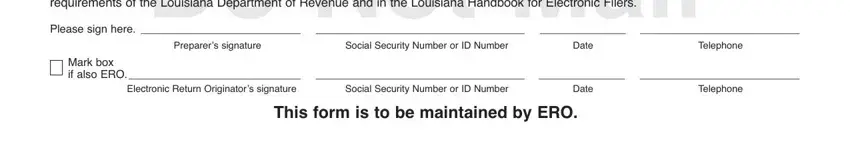

3. This subsequent section is considered pretty easy, I declare that I have reviewed the, Do Not Mail, Please sign here, Preparers signature, Social Security Number or ID Number, Date, Telephone, Mark box if also ERO Electronic, Social Security Number or ID Number, Date, Telephone, and This form is to be maintained by - all these form fields is required to be completed here.

Step 3: Immediately after going through the fields, hit "Done" and you're done and dusted! Sign up with FormsPal right now and instantly get IRS, available for download. Every last change you make is handily kept , enabling you to change the form at a later time when necessary. Here at FormsPal.com, we endeavor to make sure that all of your information is stored private.