It is possible to complete Ldr Form R 19023 easily in our online tool for PDF editing. The editor is consistently maintained by our staff, receiving additional features and becoming a lot more versatile. Starting is effortless! What you need to do is adhere to the following basic steps directly below:

Step 1: First of all, access the tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: With the help of this advanced PDF editor, you may accomplish more than simply complete forms. Express yourself and make your forms look great with customized text added, or optimize the original input to excellence - all that comes along with an ability to incorporate stunning images and sign it off.

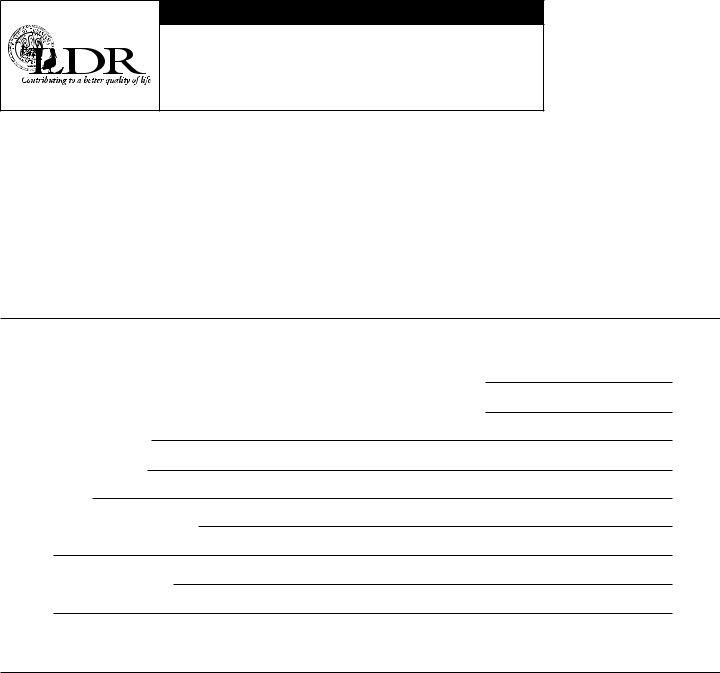

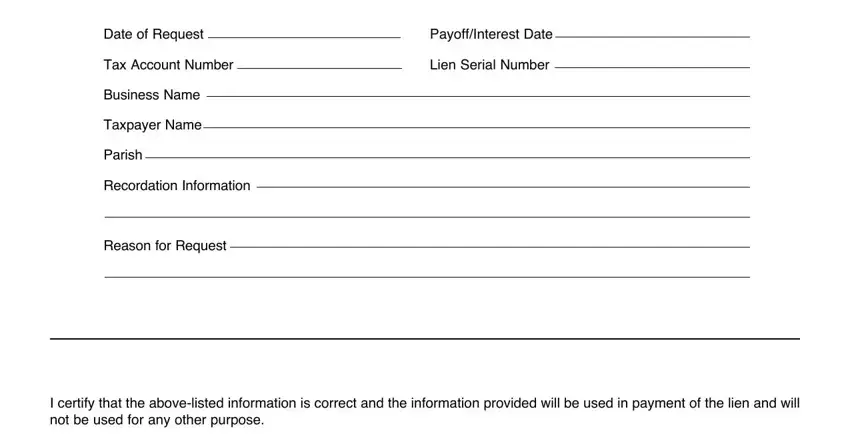

This PDF doc needs some specific information; to ensure accuracy and reliability, take the time to bear in mind the recommendations directly below:

1. It's very important to complete the Ldr Form R 19023 properly, thus be careful when filling out the areas that contain all of these blanks:

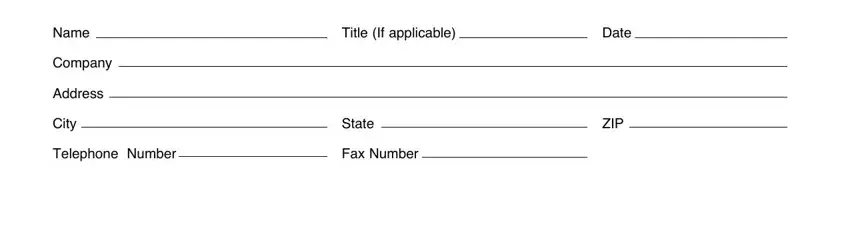

2. Right after the previous array of blanks is done, go to type in the suitable information in all these - Name, Company, Address, City, Telephone Number, Title If applicable, Date, State, Fax Number, and ZIP.

As to Company and Telephone Number, make sure that you review things in this section. These could be the most important fields in this form.

Step 3: Before moving forward, check that form fields were filled in the proper way. The moment you believe it is all fine, press “Done." Sign up with FormsPal today and easily use Ldr Form R 19023, available for downloading. All alterations you make are preserved , so that you can edit the form at a later point when necessary. Whenever you work with FormsPal, you can complete forms without having to worry about information leaks or records being distributed. Our protected software makes sure that your private details are maintained safe.