Using PDF forms online can be very simple with our PDF editor. Anyone can fill in Ldr Form R 620Ins here effortlessly. In order to make our tool better and easier to use, we continuously design new features, with our users' suggestions in mind. With just a couple of simple steps, you may begin your PDF editing:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" above on this site.

Step 2: The tool enables you to customize nearly all PDF forms in many different ways. Transform it with personalized text, correct what's already in the PDF, and place in a signature - all when you need it!

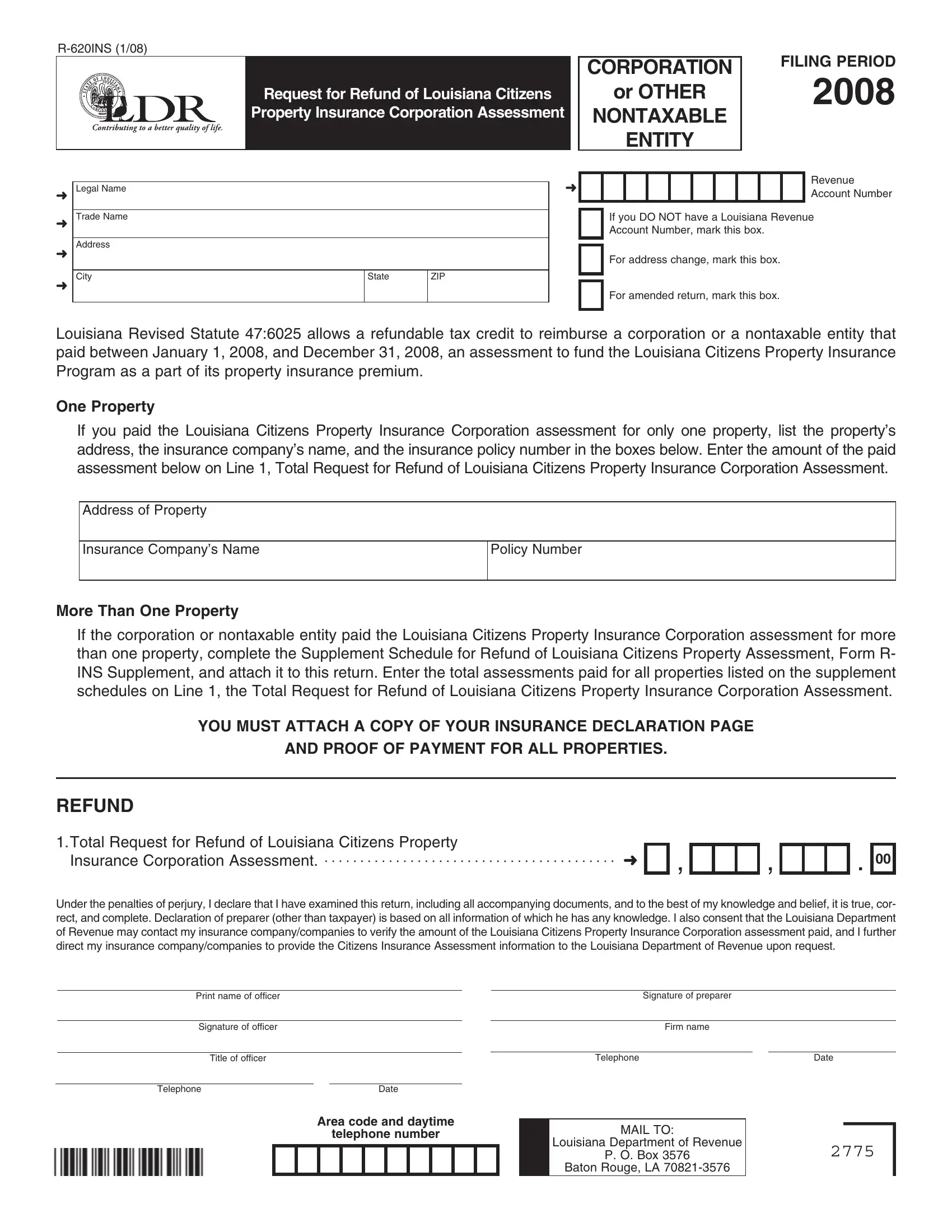

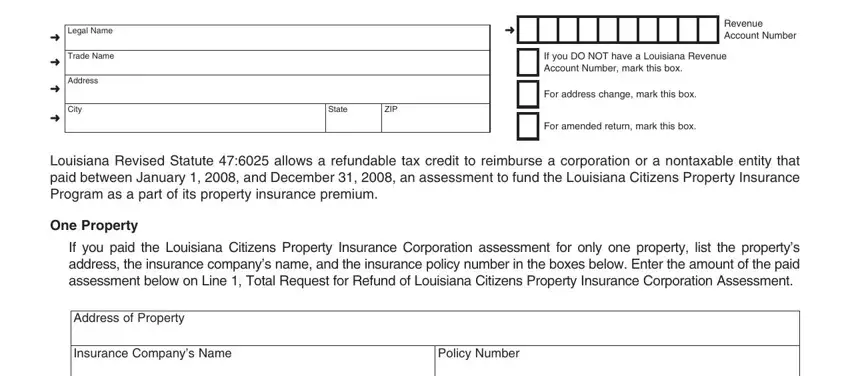

This PDF doc will require specific information; to guarantee correctness, you should consider the recommendations further on:

1. The Ldr Form R 620Ins involves specific information to be inserted. Ensure the following blank fields are complete:

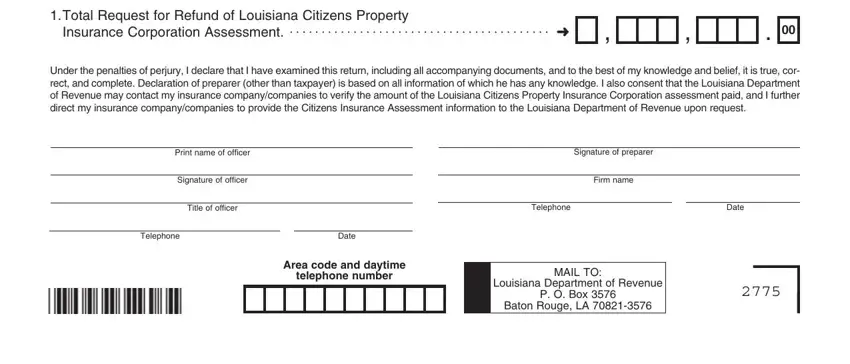

2. Once your current task is complete, take the next step – fill out all of these fields - Total Request for Refund of, Insurance Corporation Assessment, Under the penalties of perjury I, Print name of officer, Signature of oficer, Title of oficer, Signature of preparer, Firm name, Telephone, Date, Telephone, Date, Area code and daytime, telephone number, and MAIL TO with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people frequently make some errors when filling out telephone number in this part. Ensure that you double-check what you enter right here.

Step 3: After looking through the fields you've filled out, click "Done" and you're all set! Create a free trial account at FormsPal and get direct access to Ldr Form R 620Ins - download, email, or change inside your personal account page. FormsPal is devoted to the confidentiality of our users; we ensure that all personal data put into our tool continues to be confidential.