It is possible to fill in the 2020 ss benefits worksheet document with this PDF editor. The next actions can help you immediately create your document.

Step 1: This web page has an orange button stating "Get Form Now". Press it.

Step 2: Now you are on the file editing page. You may change and add content to the file, highlight specified content, cross or check selected words, insert images, put a signature on it, get rid of unwanted fields, or take them out entirely.

For every single part, complete the data required by the software.

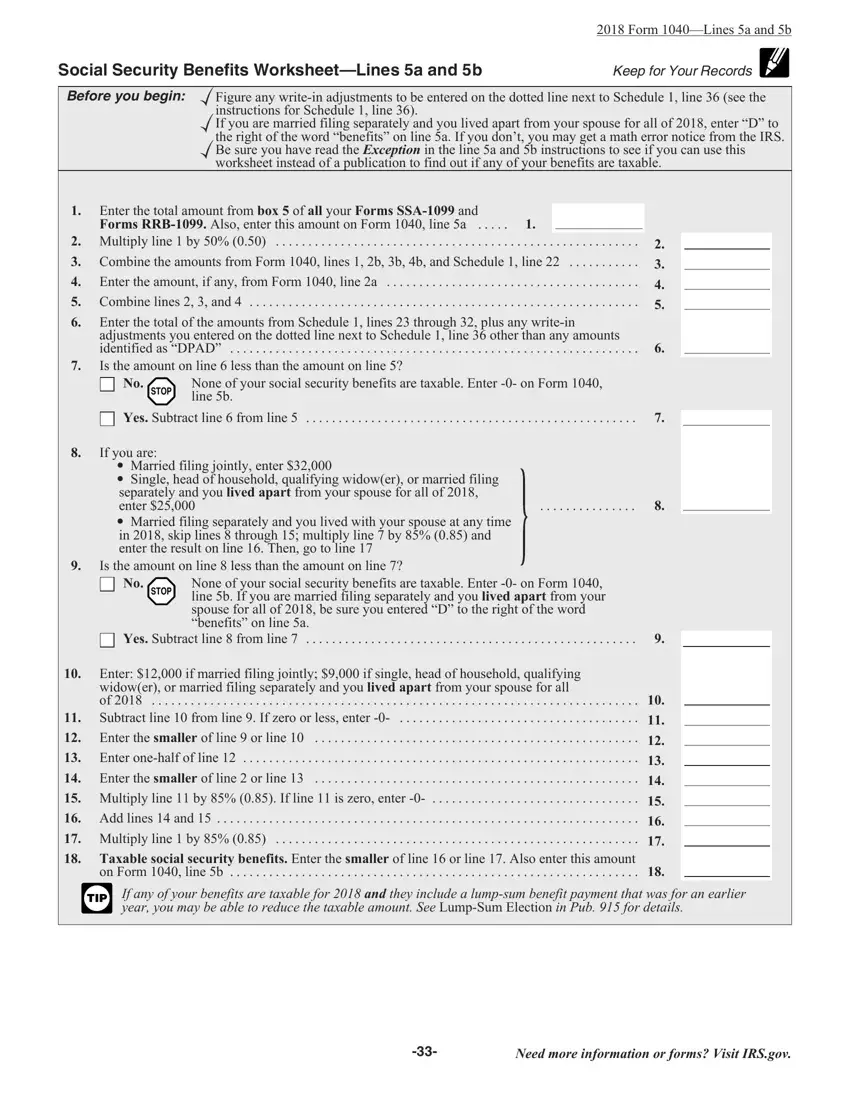

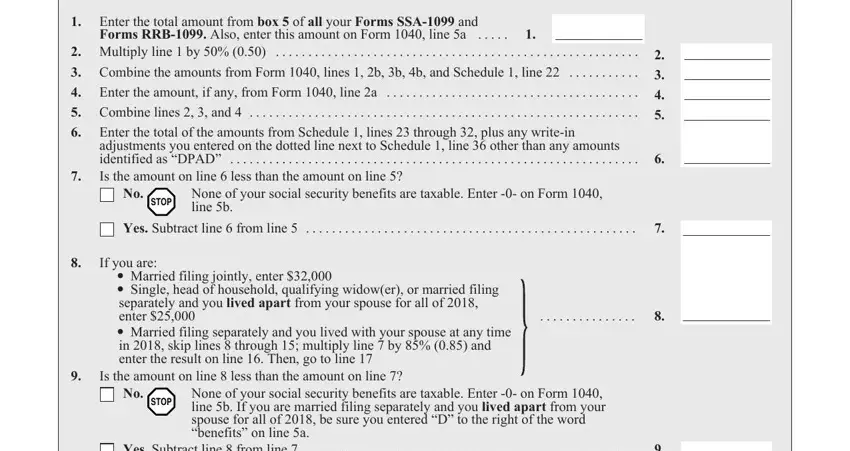

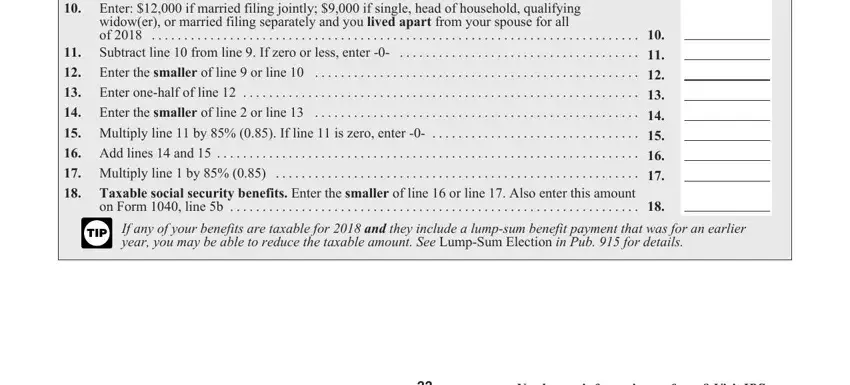

Type in the appropriate data in the section Enter if married filing jointly, on Form line b, If any of your benefits are, and Need more information or forms.

Step 3: Click the button "Done". The PDF form is available to be exported. It is possible to upload it to your pc or email it.

Step 4: Try to generate as many duplicates of the form as possible to remain away from future misunderstandings.