Working with PDF documents online can be a breeze using our PDF editor. Anyone can fill in arizona loan status update form here with no trouble. To make our tool better and less complicated to utilize, we consistently come up with new features, bearing in mind feedback from our users. To begin your journey, take these simple steps:

Step 1: Click the "Get Form" button above on this page to get into our PDF editor.

Step 2: With our state-of-the-art PDF tool, you'll be able to do more than merely complete blanks. Edit away and make your docs appear sublime with customized text put in, or modify the original content to perfection - all accompanied by the capability to add your own pictures and sign the document off.

Be mindful when completing this form. Make sure each and every field is done properly.

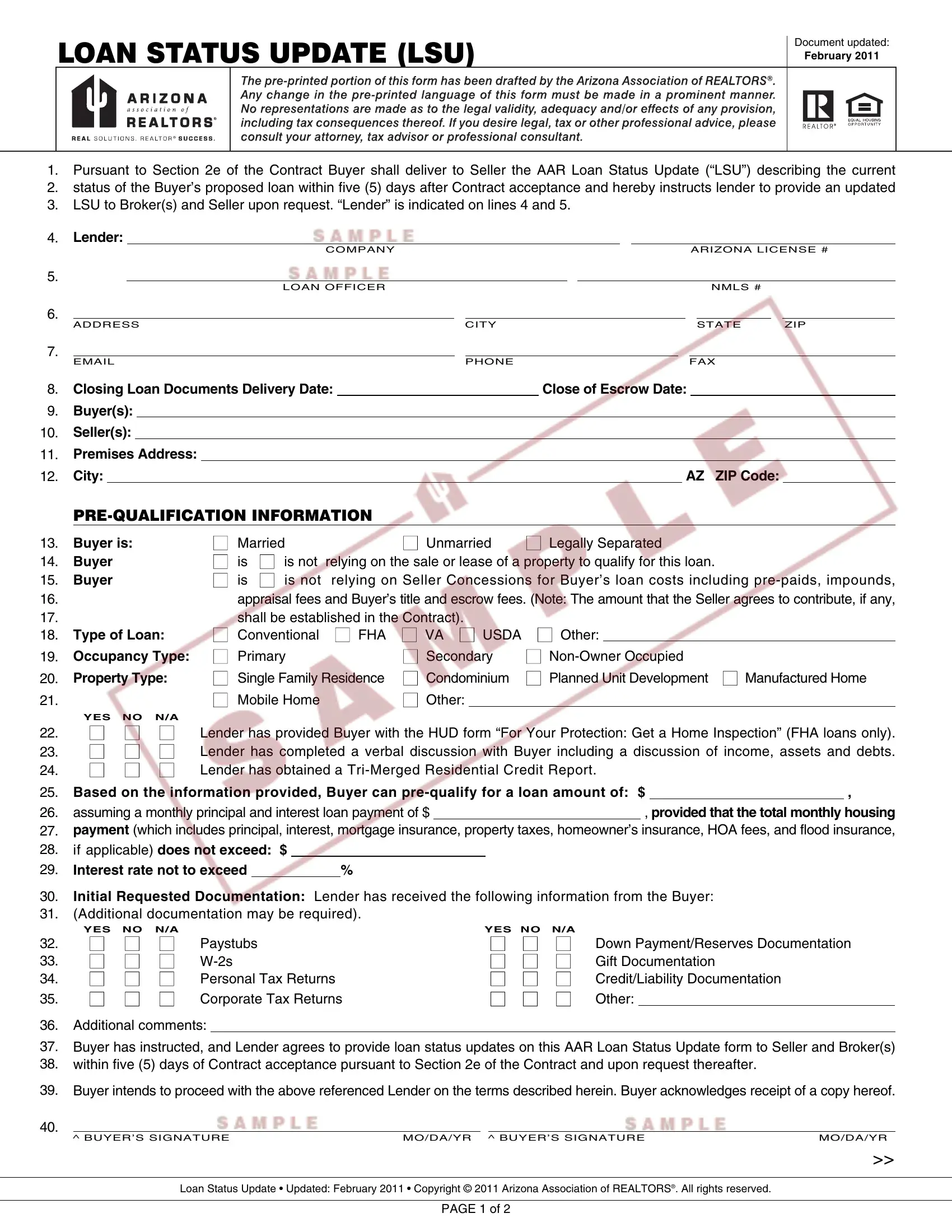

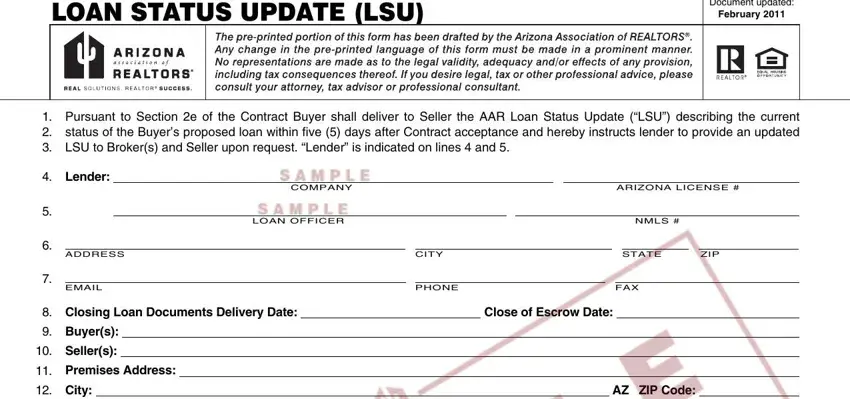

1. The arizona loan status update form will require certain details to be typed in. Make certain the next blanks are filled out:

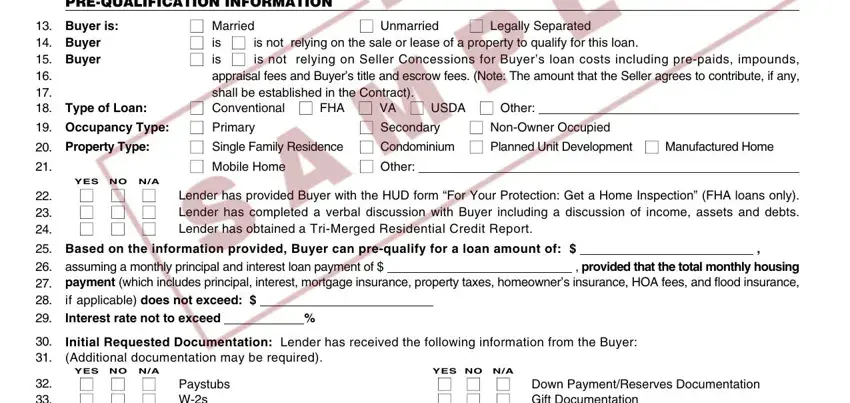

2. Once your current task is complete, take the next step – fill out all of these fields - PREQUALIFICATION INFORMATION, Buyer is Buyer Buyer, n Unmarried, n Married n is n is not relying on, n Legally Separated, n Conventional n FHA n VA n USDA n, Type of Loan Occupancy Type n, n Secondary, n NonOwner Occupied, Property Type, n Single Family Residence n, n Other, YES NO NA n n n Lender has, Based on the information provided, and Initial Requested Documentation with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

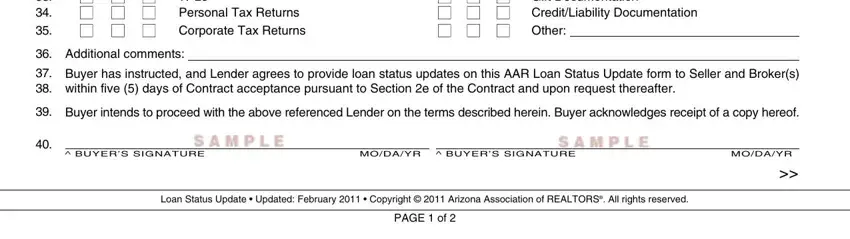

3. In this specific step, have a look at YES NO NA n n n Paystubs n n n Ws, YES NO NA n n n Down, Additional comments, Buyer has instructed and Lender, Buyer intends to proceed with the, BUYERS SIGNATURE, MODAYR BUYERS SIGNATURE, MODAYR, Loan Status Update Updated, and PAGE of. These are required to be filled in with greatest accuracy.

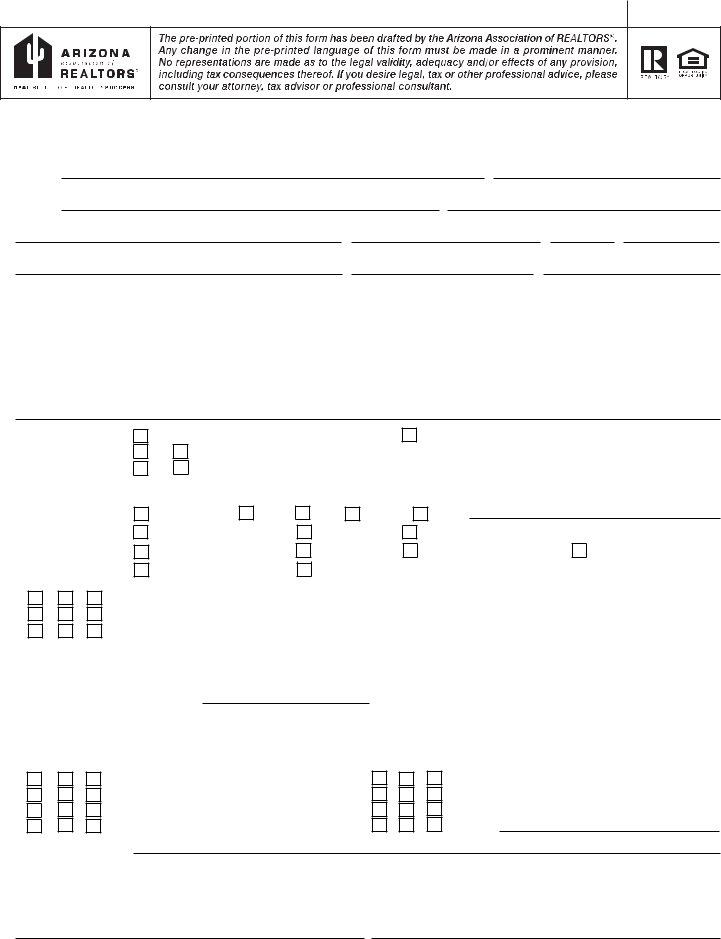

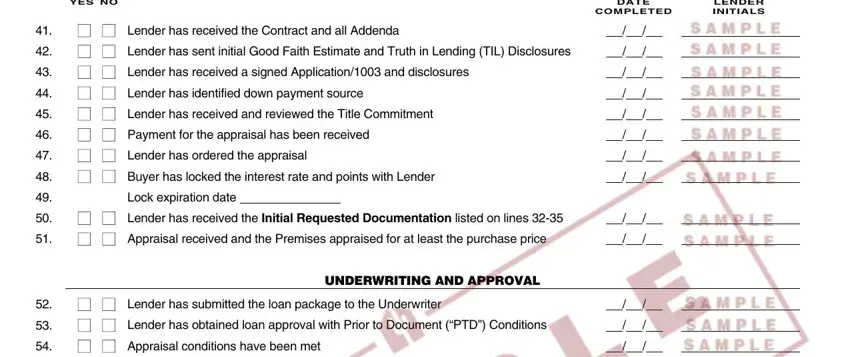

4. To move forward, this next form section involves completing a couple of form blanks. These include YES NO, n n Lender has received the, DATE, COMPLETED, LENDER INITIALS, n n Lender has sent initial Good, n n Lender has received a signed, n n Lender has identified down, n n Lender has received and, n n Payment for the appraisal has, n n Lender has ordered the, n n Buyer has locked the interest, Lock expiration date, n n Lender has received the, and n n Appraisal received and the, which are vital to moving forward with this process.

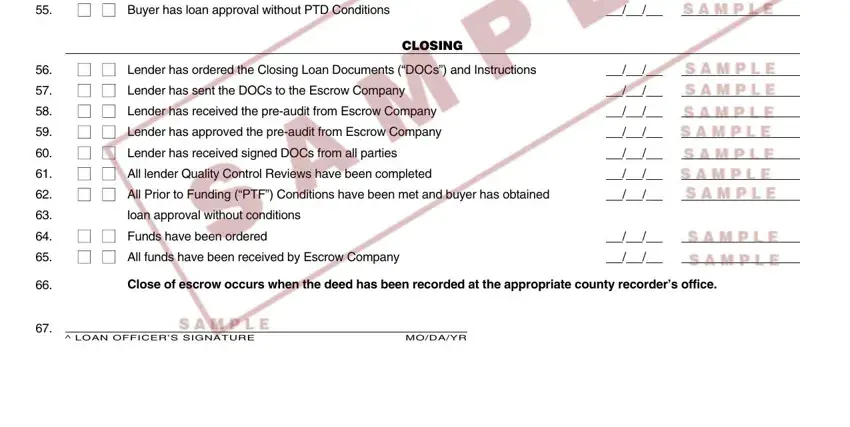

5. This document needs to be finalized by dealing with this part. Further there is a detailed listing of form fields that require appropriate information to allow your form usage to be complete: n n Buyer has loan approval, n n Lender has ordered the Closing, CLOSING, n n Lender has sent the DOCs to, n n Lender has received the, n n Lender has approved the, n n Lender has received signed, n n All lender Quality Control, n n All Prior to Funding PTF, loan approval without conditions, n n Funds have been ordered, n n All funds have been received, Close of escrow occurs when the, LOAN OFFICERS SIGNATURE, and MODAYR.

Regarding n n All Prior to Funding PTF and n n Buyer has loan approval, ensure you get them right in this current part. Both these are considered the most significant fields in this file.

Step 3: Proofread everything you've typed into the blank fields and then click on the "Done" button. Go for a free trial account at FormsPal and obtain immediate access to arizona loan status update form - download, email, or edit inside your FormsPal account. FormsPal guarantees your data privacy via a secure system that never records or distributes any sort of private data involved in the process. Feel safe knowing your files are kept protected every time you use our tools!