r 1310 tax can be filled in online easily. Simply use FormsPal PDF tool to finish the job without delay. To maintain our editor on the forefront of efficiency, we aim to put into action user-oriented capabilities and improvements regularly. We're at all times looking for feedback - join us in reshaping the way you work with PDF docs. Starting is easy! All that you should do is stick to these simple steps below:

Step 1: Click the "Get Form" button above. It's going to open up our pdf tool so you could begin filling in your form.

Step 2: With the help of this advanced PDF editing tool, you can actually do more than just fill in blank form fields. Edit away and make your documents look professional with customized textual content incorporated, or modify the original input to excellence - all comes with an ability to add any kind of photos and sign the PDF off.

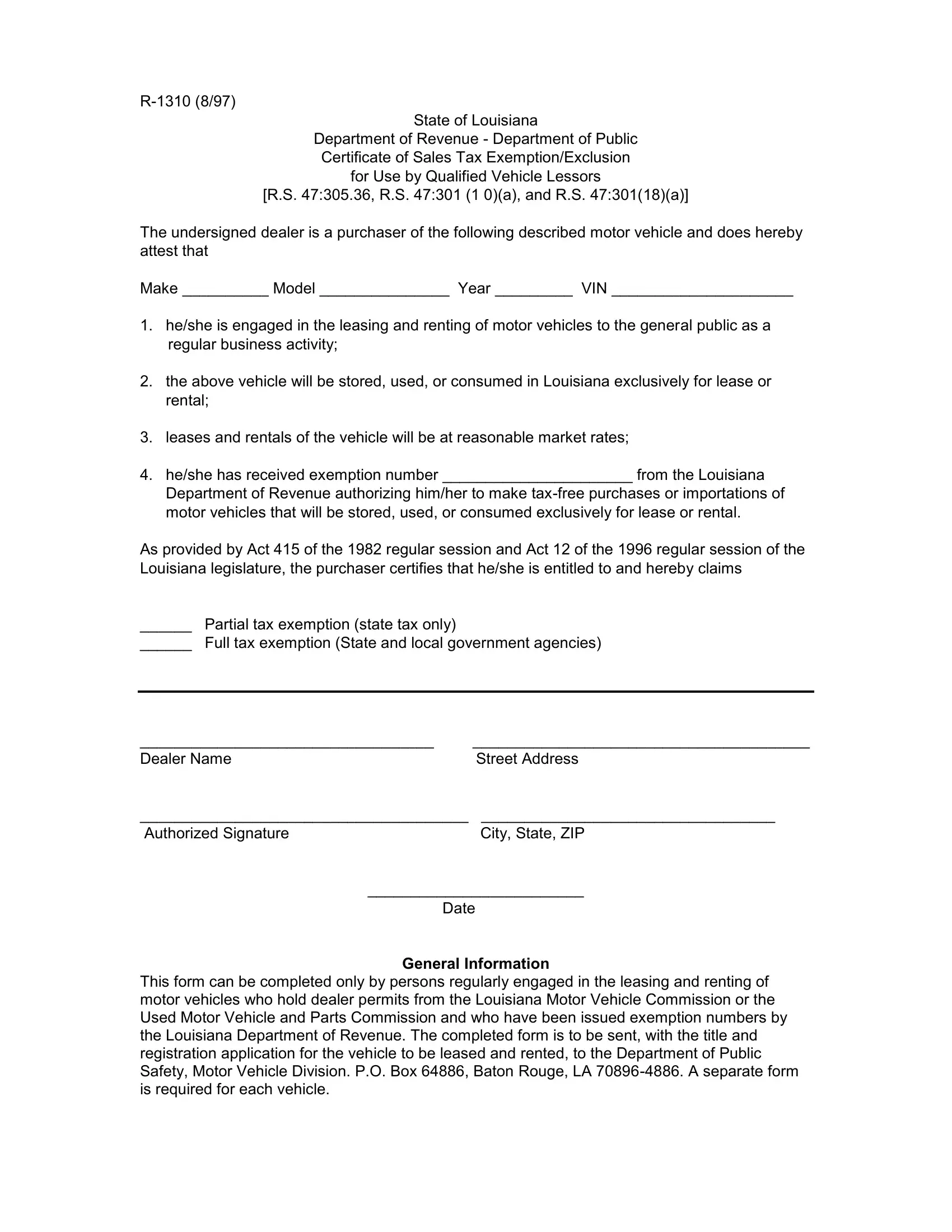

So as to finalize this PDF form, ensure that you enter the right information in every single blank field:

1. Fill out the r 1310 tax with a number of necessary fields. Note all the important information and make sure not a single thing neglected!

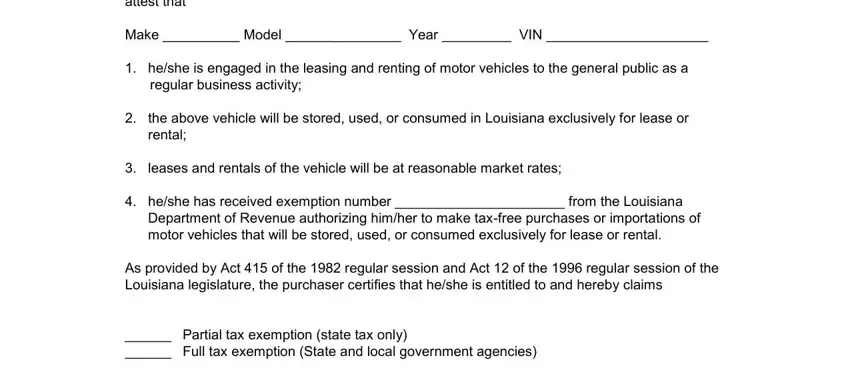

2. After the last array of fields is complete, you should insert the required details in Dealer Name Authorized, City State ZIP, Street Address, Date, General Information, and This form can be completed only by in order to progress to the 3rd step.

When it comes to Dealer Name Authorized and Date, make sure you double-check them here. These are the most important ones in the PDF.

Step 3: Right after rereading your completed blanks, hit "Done" and you are all set! Try a 7-day free trial subscription with us and acquire immediate access to r 1310 tax - readily available inside your personal account page. When you work with FormsPal, you can certainly fill out documents without stressing about personal information breaches or data entries being shared. Our secure software ensures that your private data is stored safely.