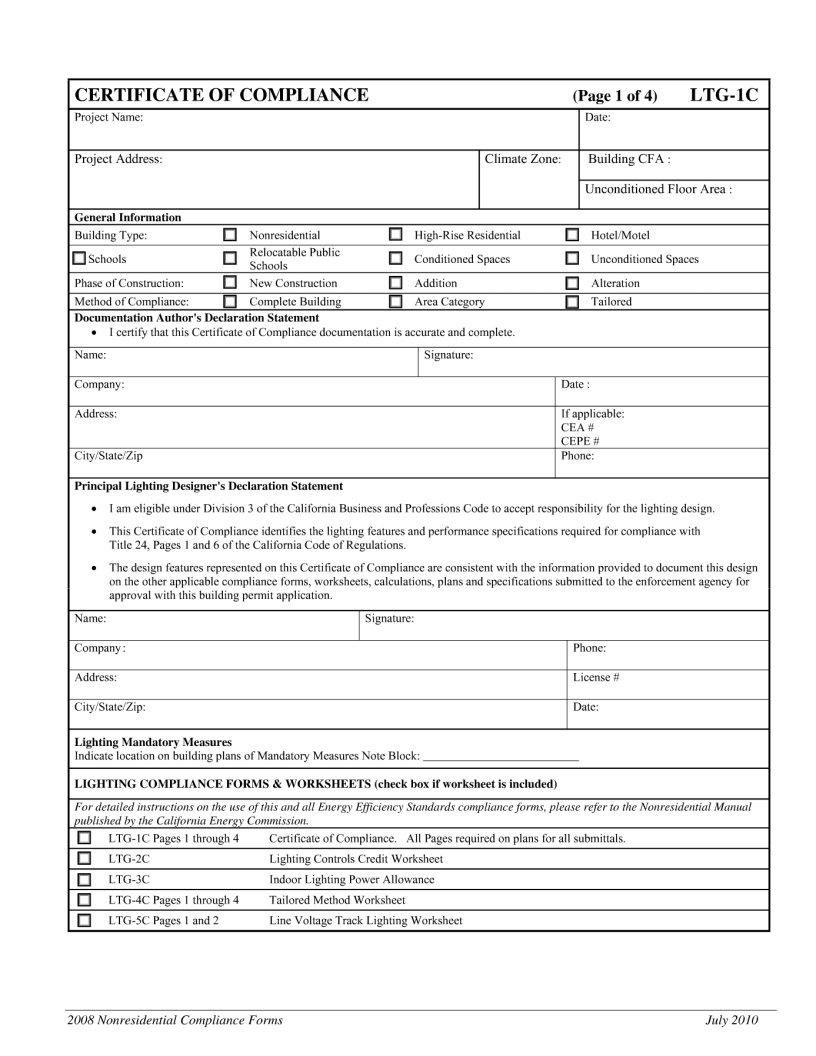

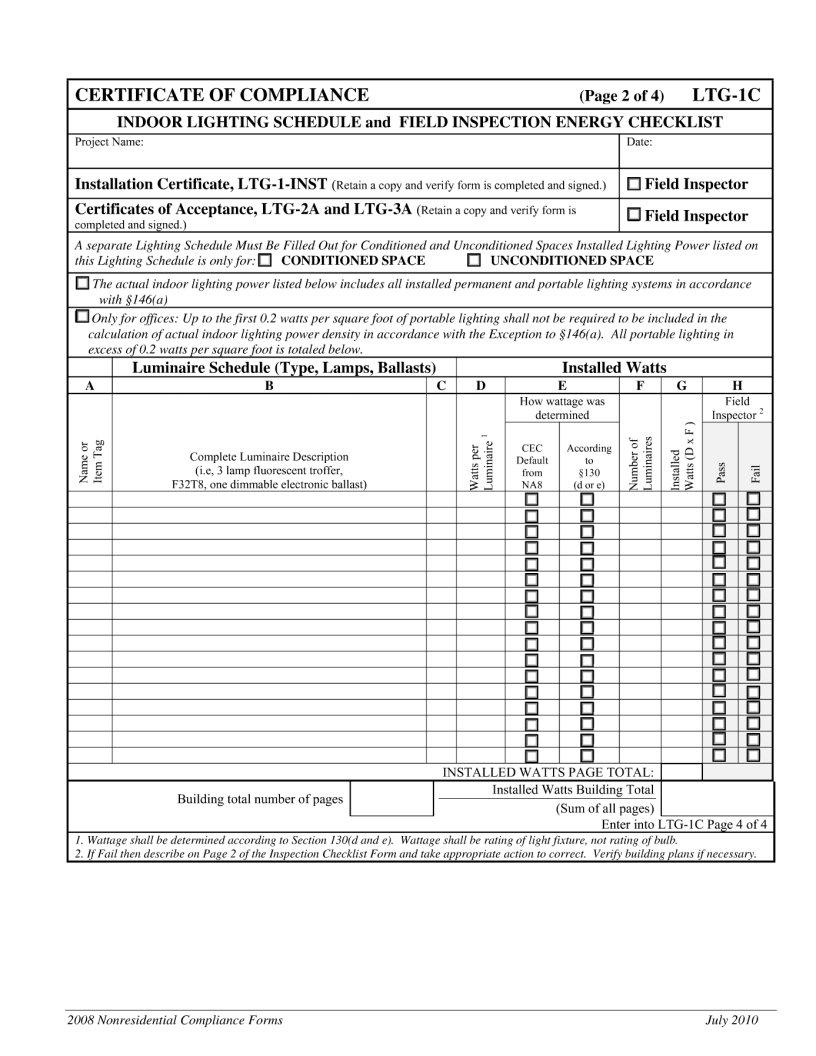

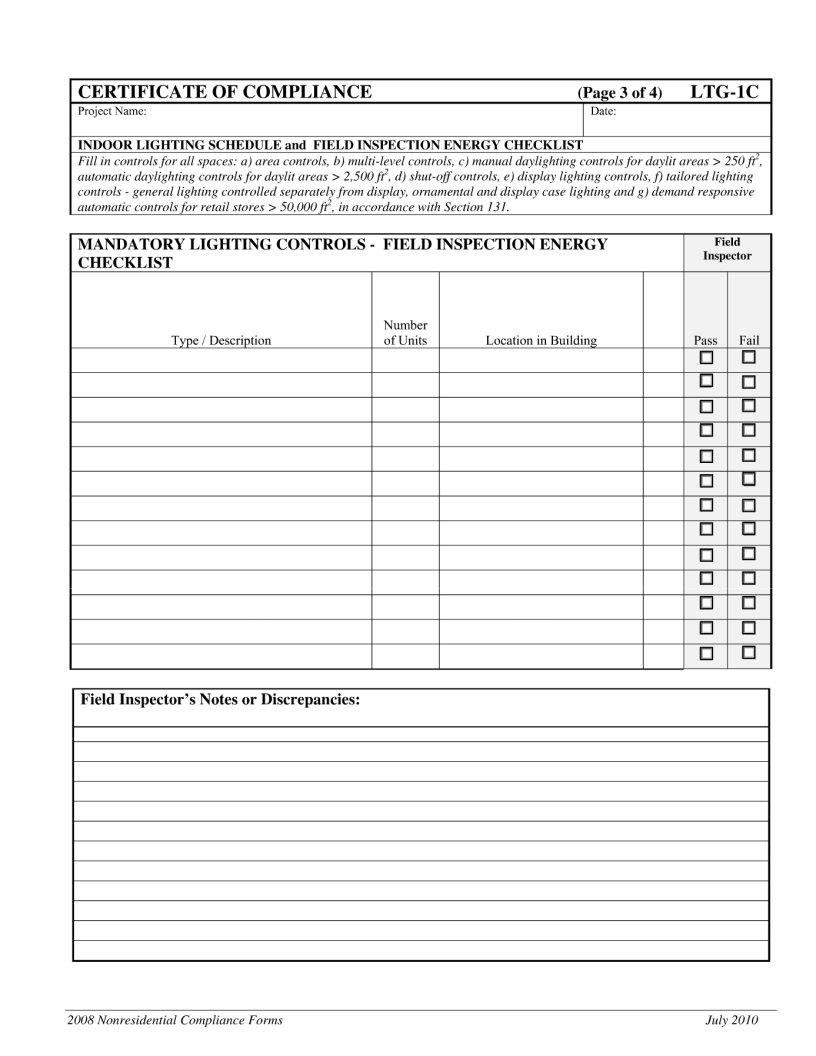

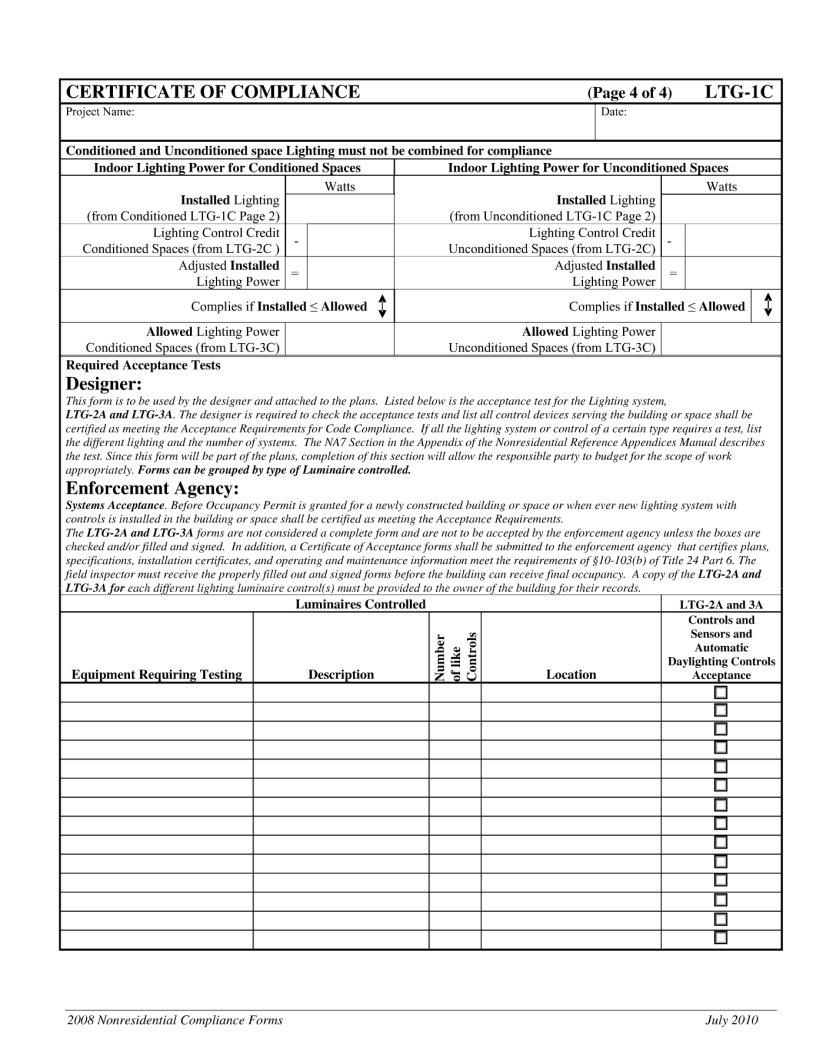

Understanding the intricacies of tax obligations can often feel like navigating a labyrinth, especially when it comes to forms like the Ltg 1C. This particular form plays a critical role for individuals and entities looking to document and report specific financial activities to the relevant tax authorities. Its significance stems from its use in ensuring compliance with the complexities of tax laws and regulations. The form serves as a vital tool, simplifying the process of declaring pertinent financial details, thereby helping to avoid potential legal pitfalls. While it may initially appear daunting, familiarity with the Ltg 1C form can significantly ease the burden of tax reporting. It is designed to provide clarity and structure to what could otherwise be an overwhelming task, making it indispensable for those aiming to maintain good standing with tax agencies. With its specific fields and requirements, the form guides users through the necessary steps to accurately report their financial circumstances, highlighting the importance of transparency and diligence in financial affairs.

| Question | Answer |

|---|---|

| Form Name | Ltg 1C Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | California, daylighting, Nonresidential, cec ltg 1c form |