DRv

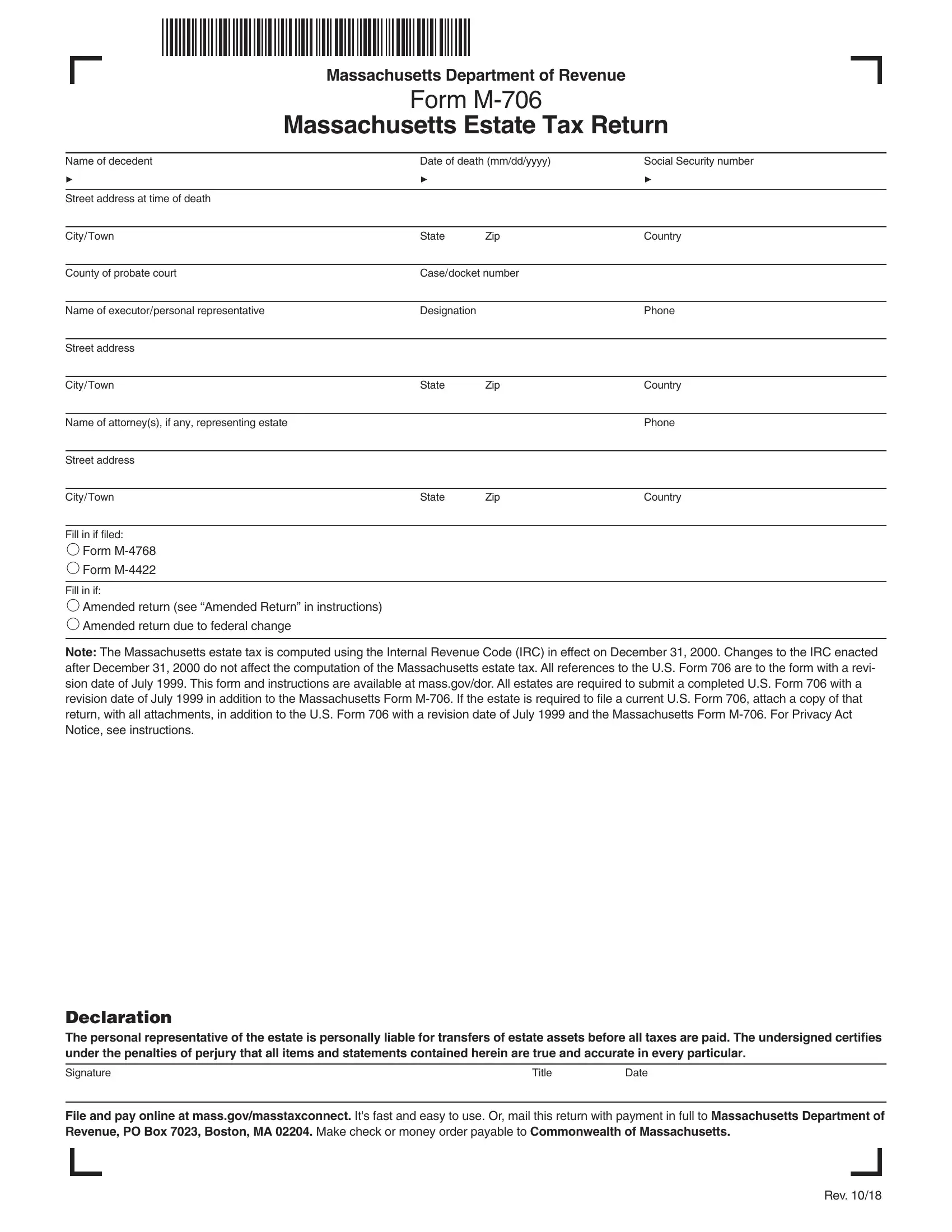

Form M-706

xR

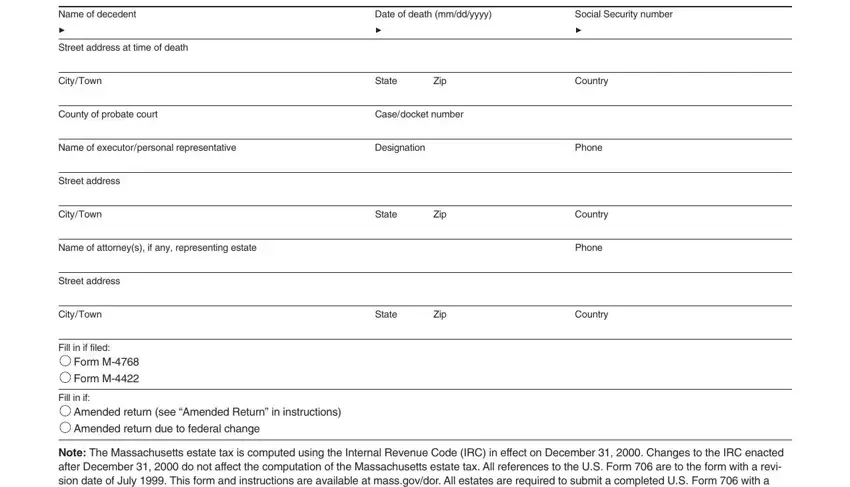

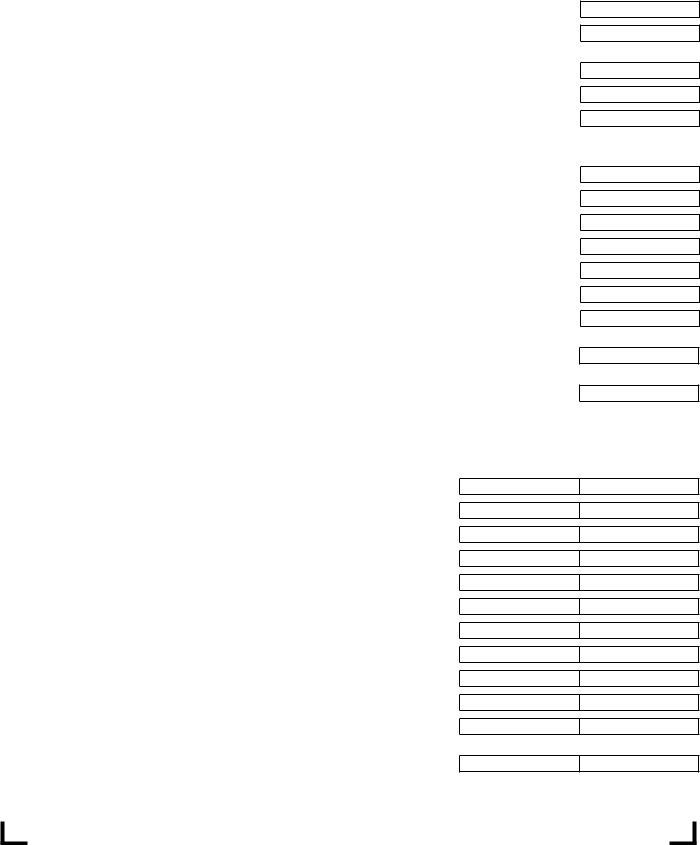

Name of decedentDate of death (mm/dd/yyyy)Social Security number

3 |

3 |

|

3 |

|

|

|

|

Street address at time of death |

|

|

|

|

|

|

|

City/Town |

State |

Zip |

Country |

|

|

|

County of probate court |

Case/docket number |

|

|

|

|

|

Name of executor/personal representative |

Designation |

|

Phone |

|

|

|

|

Street address |

|

|

|

|

|

|

|

City/Town |

State |

Zip |

Country |

|

|

|

|

Name of attorney(s), if any, representing estate |

|

|

Phone |

|

|

|

|

Street address |

|

|

|

|

|

|

|

City/Town |

State |

Zip |

Country |

|

|

|

|

Fill in if filed: |

|

|

|

Form M-4768

Form M-4422

Fill in if:

Amended return (see “Amended Return” in instructions)

Amended return due to federal change

NThe Massachusetts estate tax is computed using the Internal Revenue Code (IRC) in effect on December 31, 2000. Changes to the IRC enacted after December 31, 2000 do not affect the computation of the Massachusetts estate tax. All references to the U.S. Form 706 are to the form with a revi- sion date of July 1999. This form and instructions are available at mass.gov/dor. All estates are required to submit a completed U.S. Form 706 with a revision date of July 1999 in addition to the Massachusetts Form M-706. If the estate is required to file a current U.S. Form 706, attach a copy of that return, with all attachments, in addition to the U.S. Form 706 with a revision date of July 1999 and the Massachusetts Form M-706. For Privacy Act Notice, see instructions.

Declaration

viy |

ix |

|

ii |

yi |

|

iiivy |

|

|

|

|

|

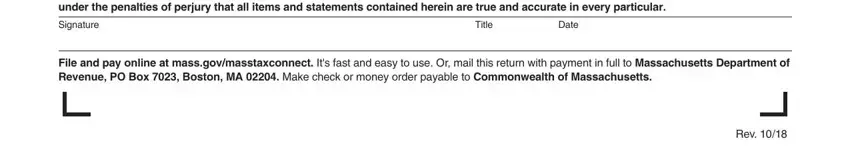

Signature |

|

Title |

Date |

File and pay online at mass.gov/masstaxconnect. It's fast and easy to use. Or, mail this return with payment in full to D

Rv, Bx,B, |

Make check or money order payable to C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

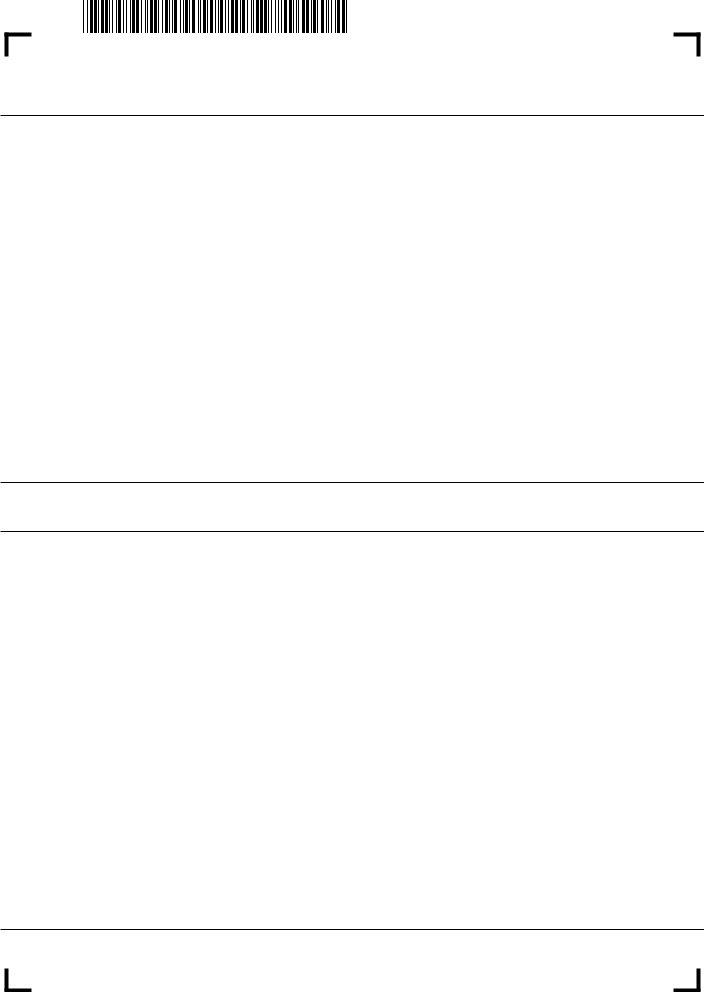

FORM M-706, PAGE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death (mm/dd/yyyy) |

Social Security number |

3 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

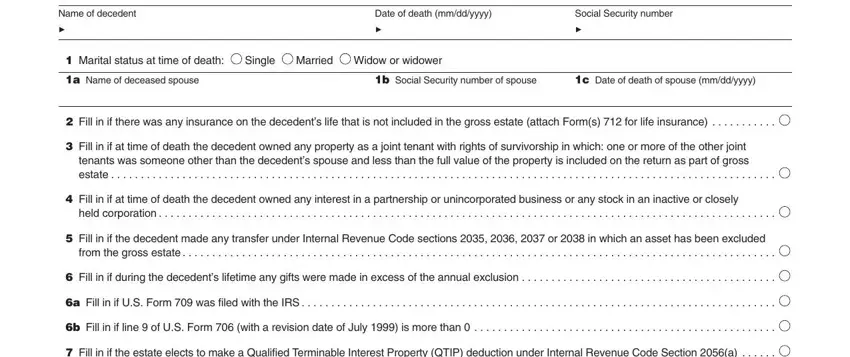

1Marital status at time of death: Single Married Widow or widower

1a Name of deceased spouse |

1b Social Security number of spouse |

1c Date of death of spouse (mm/dd/yyyy) |

2 Fill in if there was any insurance on the decedent’s life that is not included in the gross estate (attach Form(s) 712 for life insurance) . . . . . . . . . . .

3Fill in if at time of death the decedent owned any property as a joint tenant with rights of survivorship in which: one or more of the other joint tenants was someone other than the decedent’s spouse and less than the full value of the property is included on the return as part of gross

estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4Fill in if at time of death the decedent owned any interest in a partnership or unincorporated business or any stock in an inactive or closely

held corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5Fill in if the decedent made any transfer under Internal Revenue Code sections 2035, 2036, 2037 or 2038 in which an asset has been excluded

from the gross estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Fill in if during the decedent’s lifetime any gifts were made in excess of the annual exclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a Fill in if U.S. Form 709 was filed with the IRS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b Fill in if line 9 of U.S. Form 706 (with a revision date of July 1999) is more than 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Fill in if the estate elects to make a Qualified Terminable Interest Property (QTIP) deduction under Internal Revenue Code Section 2056(a) . . . . . .

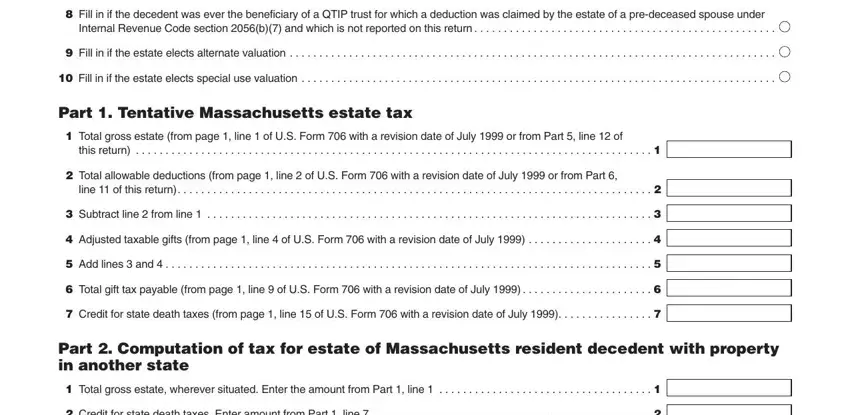

8Fill in if the decedent was ever the beneficiary of a QTIP trust for which a deduction was claimed by the estate of a pre-deceased spouse under

Internal Revenue Code section 2056(b)(7) and which is not reported on this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Fill in if the estate elects alternate valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Fill in if the estate elects special use valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part 1. Tentative Massachusetts estate tax

1Total gross estate (from page 1, line 1 of U.S. Form 706 with a revision date of July 1999 or from Part 5, line 12 of

this return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2Total allowable deductions (from page 1, line 2 of U.S. Form 706 with a revision date of July 1999 or from Part 6,

line 11 of this return). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Adjusted taxable gifts (from page 1, line 4 of U.S. Form 706 with a revision date of July 1999) . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total gift tax payable (from page 1, line 9 of U.S. Form 706 with a revision date of July 1999) . . . . . . . . . . . . . . . . . . . . . . 6

7 Credit for state death taxes (from page 1, line 15 of U.S. Form 706 with a revision date of July 1999). . . . . . . . . . . . . . . . 7

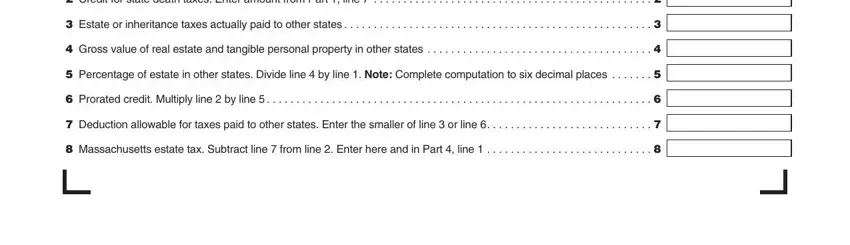

Part 2. Computation of tax for estate of Massachusetts resident decedent with property in another state

1 Total gross estate, wherever situated. Enter the amount from Part 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Credit for state death taxes. Enter amount from Part 1, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Estate or inheritance taxes actually paid to other states . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Gross value of real estate and tangible personal property in other states . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Percentage of estate in other states. Divide line 4 by line 1. N |

Complete computation to six decimal places |

5 |

6 Prorated credit. Multiply line 2 by line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Deduction allowable for taxes paid to other states. Enter the smaller of line 3 or line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Massachusetts estate tax. Subtract line 7 from line 2. Enter here and in Part 4, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

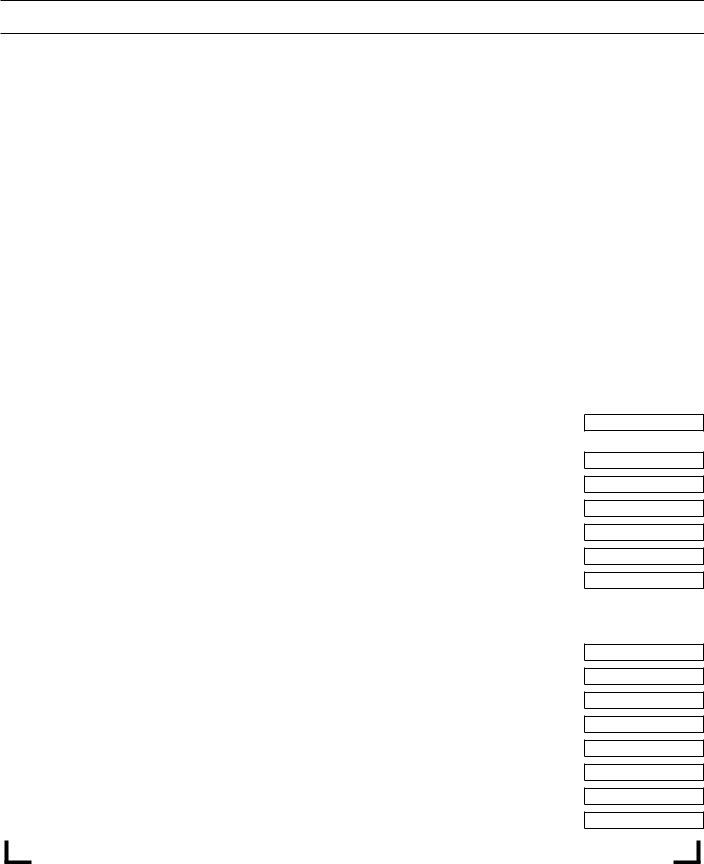

FORM M-706, PAGE 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

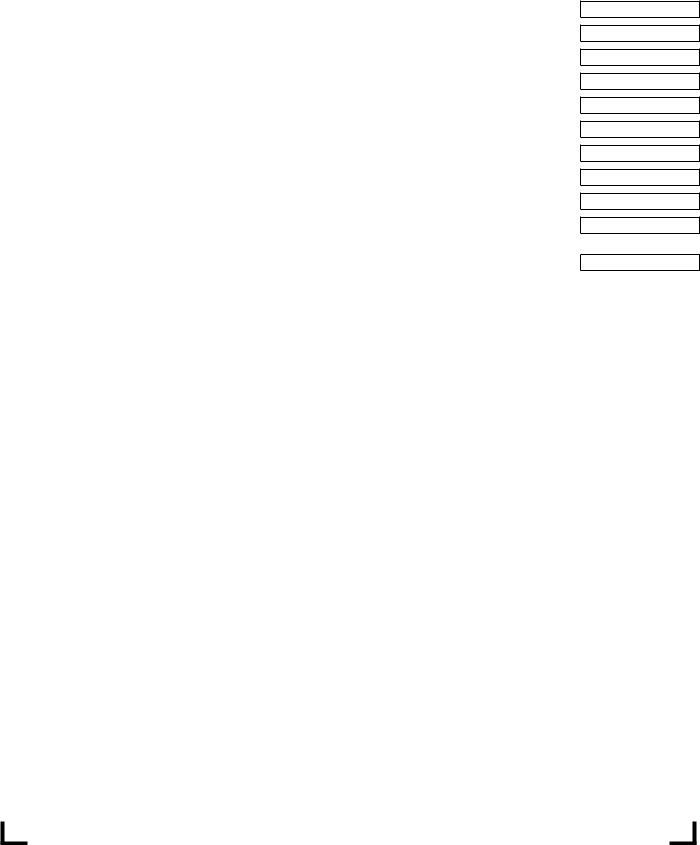

Name of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death (mm/dd/yyyy) |

Social Security number |

3 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3. Computation of tax for estate of nonresident decedent with Massachusetts property

1 Total gross estate, wherever situated. Enter the amount from Part 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Credit for state death taxes. Enter the amount from Part 1, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Gross value of real estate and tangible personal property in Massachusetts. Enter the total reported on Form M-NRA,

line 26. Do not deduct the value of any mortgage or lien . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Percentage of estate in Massachusetts. Divide line 3 by line 1. N |

Complete computation to six decimal places |

4 |

5 Massachusetts nonresident estate tax. Multiply line 2 by line 4. Enter result here and in Part 4, line 1 . . . . . . . . . . . . . . . 5

Part 4. Massachusetts estate tax due

1 Massachusetts estate tax. Enter the amount from Part 1, line 7; Part 2, line 8; or Part 3, line 5, whichever applies. . . . . . 1

2 Late file and/or late pay penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total amount due. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Payments made with extension. Attach a copy of Form M-4768 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Other amounts previously paid. Attach copies of any prior filings with payment dates and amounts . . . . . . . . . . . . . . . . . 6

7 Total payments. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8Overpayment. If line 4 is smaller than line 7, subtract line 4 from line 7. This is the amount of your refund. If line 4 is

larger than line 7, omit line 8 and complete line 9. If lines 4 and 7 are equal, enter “0” in line 8 and omit line 9 . . . . . . . . . 8

9Balance due. If line 4 is larger than line 7, subtract line 7 from line 4. This is the amount of the payment due at time

of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Part 5. Total gross estate. Schedule references are to the schedules of the U.S. Form 706 with a revision date of July 1999 which must be completed and submitted with this return whether or not a current federal estate tax return, U.S. Form 706, is required to be filed.

Av

1 Schedule A: Real estate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Schedule B: Stocks and bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Schedule C: Mortgages, notes, and cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Schedule D: Insurance on decedent’s life (attach Form(s) 712) . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Schedule E: Jointly owned property (attach Form(s) 712 for life insurance) . . . . . . . . . . . . . . . 5

6 Schedule F: Other miscellaneous property (attach Form(s) 712 for life insurance) . . . . . . . . . . 6

7 Schedule G: Transfers during decedent’s life (attach Form(s) 712 for life insurance) . . . . . . . . 7

8 Schedule H: Powers of appointment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Schedule I: Annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total gross estate (add lines 1 through 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Schedule U: Qualified conservation easement exclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12Total gross estate less exclusion (subtract line 11 from line 10). Enter here and on line 1

of Part 1, Tentative Massachusetts estate tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM M-706, PAGE 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death (mm/dd/yyyy) |

Social Security number |

3 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 6. Total allowable deductions. Schedule references are to the schedules of the U.S. Form 706 with a revision date of July 1999 which must be completed and submitted with this return whether or not a current federal estate tax return, U.S. Form 706, is required to be filed.

1 Schedule J: Funeral expenses and expenses incurred in administering property subject to claims . . . . . . . . . . . . . . . . . . 1

2 Schedule K: Debts of the decedent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Schedule K: Mortgages and liens . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Amount of allowable deduction from line 4 (see IRC Section 2053(c)). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Schedule L: Net losses during administration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Schedule L: Expenses incurred in administering property not subject to claims . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Schedule M: Bequests, etc. to surviving spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Schedule O: Charitable, public and similar gifts and bequests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Schedule T: Qualified family-owned business interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Total allowable deductions (add lines 5 through 10). Enter here and on line 2 of Part 1, Tentative Massachusetts

estate tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

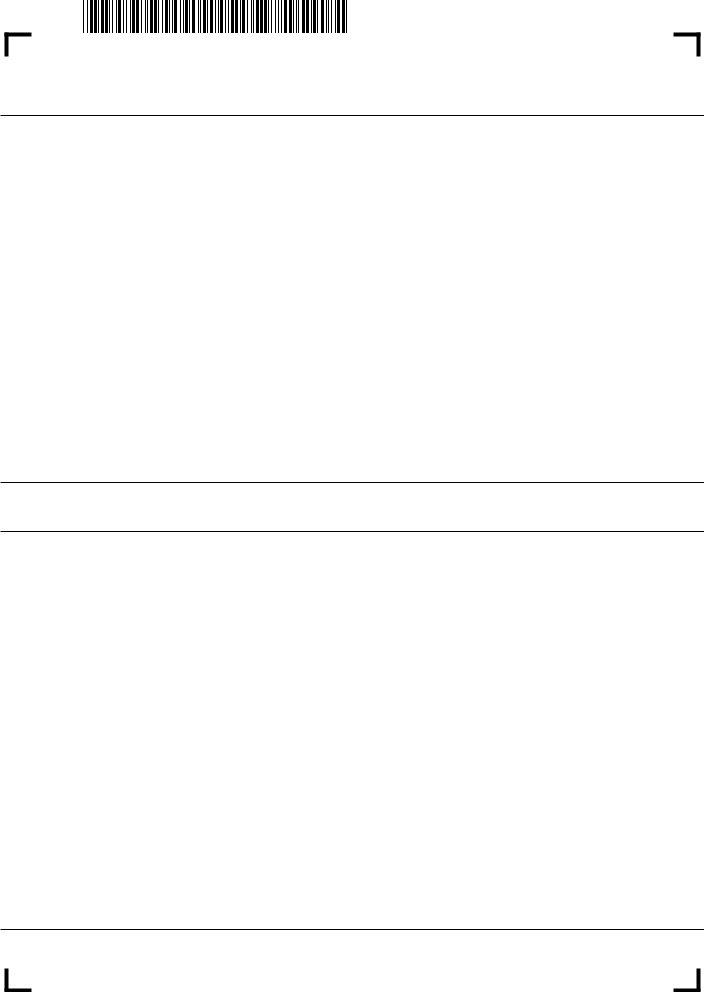

FORM M-706, PAGE 5

Name of decedent |

Date of death (mm/dd/yyyy) |

Social Security number |

|

3 |

3 |

|

|

|

Part 7. Real estate subject to Massachusetts estate tax lien. Complete the table below for each property in which the decedent had an interest.

1. |

|

|

|

|

Ci |

i |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

B |

|

|

|

(mm/dd/yyyy) |

Riyii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

Ci |

i |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

B |

|

|

|

(mm/dd/yyyy) |

Riyii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

Ci |

i |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

B |

|

|

|

(mm/dd/yyyy) |

Riyii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

Ci |

i |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

B |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

Riyii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|