M1Pr Form can be filled in online without difficulty. Simply open FormsPal PDF editor to finish the job promptly. We are focused on giving you the best possible experience with our tool by constantly presenting new capabilities and improvements. Our editor has become even more useful with the newest updates! So now, editing PDF forms is a lot easier and faster than ever before. To get started on your journey, take these easy steps:

Step 1: Hit the orange "Get Form" button above. It'll open our tool so you could begin filling in your form.

Step 2: This tool offers the ability to change PDF documents in a range of ways. Transform it by writing any text, correct what is already in the document, and add a signature - all readily available!

It is actually an easy task to finish the document with this helpful tutorial! Here's what you have to do:

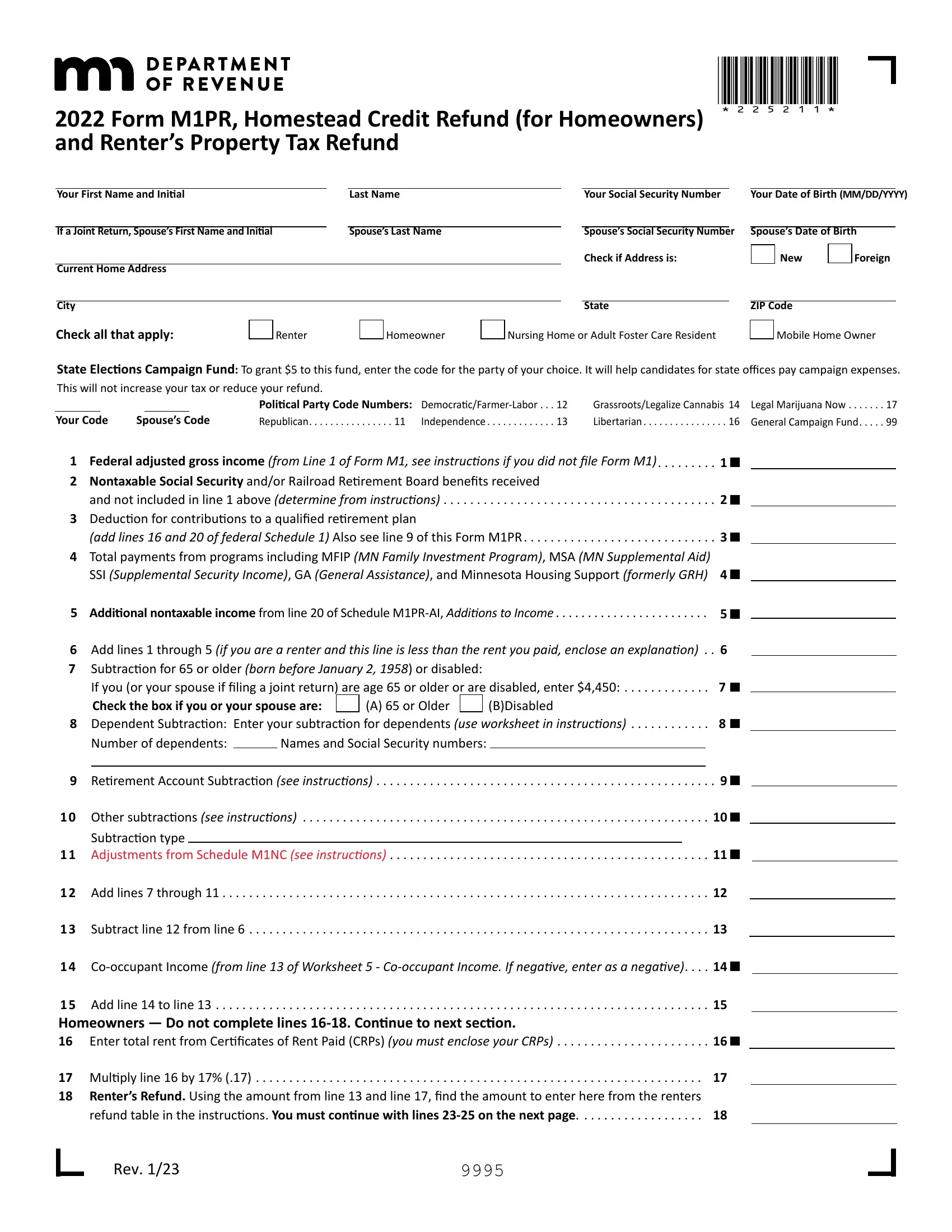

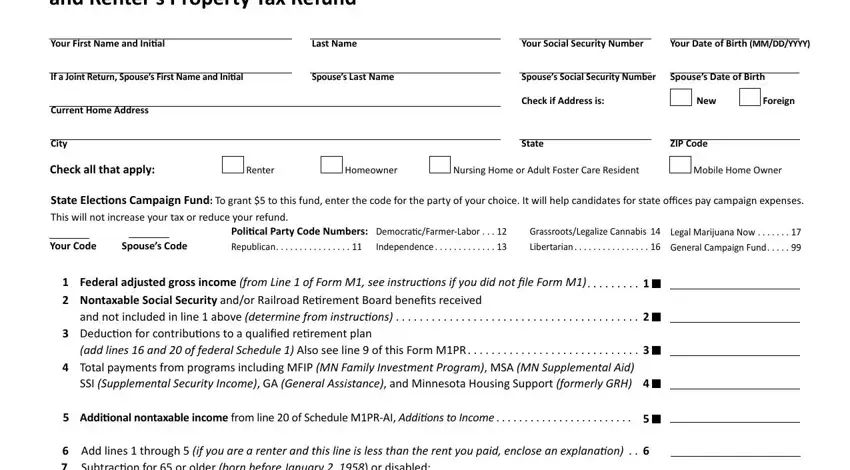

1. When completing the M1Pr Form, be sure to complete all of the essential blank fields within its relevant part. It will help expedite the process, making it possible for your details to be handled quickly and accurately.

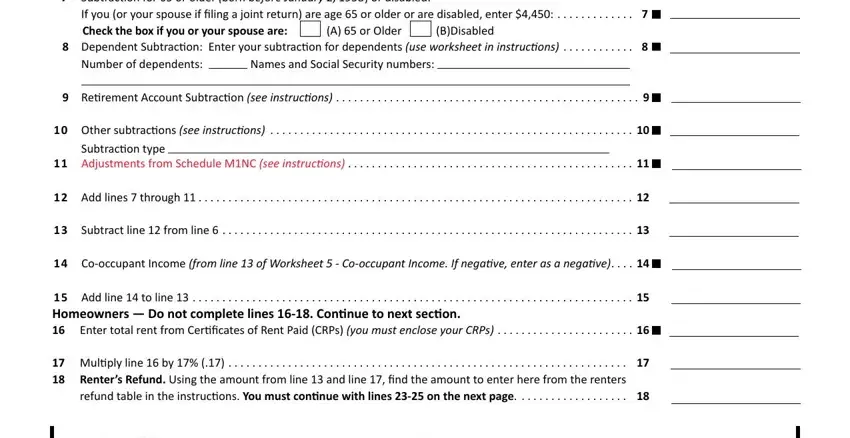

2. Right after filling in this step, head on to the subsequent part and complete the necessary particulars in these blank fields - Add lines through if you are a, If you or your spouse if filing a, A or Older, BDisabled, Dependent Subtraction Enter your, Number of dependents, Names and Social Security numbers, Retirement Account Subtraction, Other subtractions see, Subtraction type, Adjustments from Schedule MNC, Add lines through, Subtract line from line, Cooccupant Income from line of, and Add line to line.

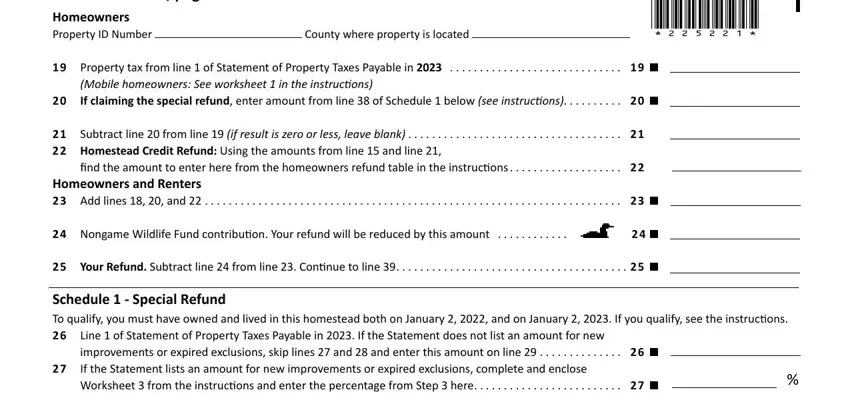

3. Within this step, have a look at Form MPR page, Homeowners Property ID Number, County where property is located, Property tax from line of, Mobile homeowners See worksheet, If claiming the special refund, Subtract line from line if, find the amount to enter here from, Homeowners and Renters Add lines, Nongame Wildlife Fund, Your Refund Subtract line from, Schedule Special Refund To, improvements or expired exclusions, If the Statement lists an amount, and Worksheet from the instructions. Each of these need to be taken care of with greatest accuracy.

It is possible to make an error while filling in your County where property is located, for that reason make sure to reread it before you'll submit it.

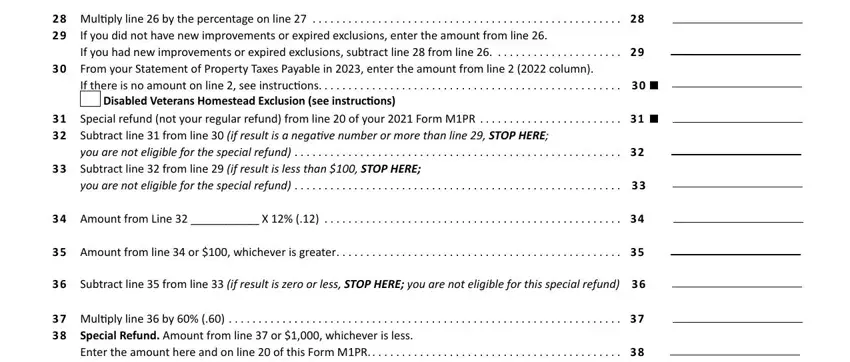

4. To go forward, this section involves completing a couple of empty form fields. Examples include Multiply line by the percentage, If you did not have new, From your Statement of Property, If there is no amount on line see, Disabled Veterans Homestead, Special refund not your regular, you are not eligible for the, Subtract line from line if, you are not eligible for the, Amount from Line X, Amount from line or whichever, Subtract line from line if, Multiply line by, and Enter the amount here and on line, which you'll find vital to continuing with this document.

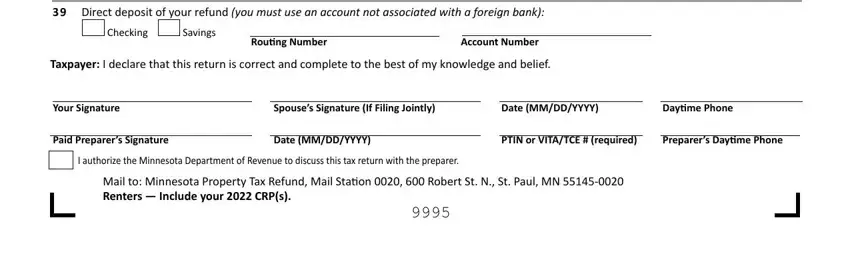

5. Because you approach the conclusion of the document, you'll find a few extra requirements that have to be satisfied. In particular, Direct deposit of your refund, Checking, Savings, Routing Number, Account Number, Taxpayer I declare that this, Your Signature, Spouses Signature If Filing Jointly, Date MMDDYYYY, Daytime Phone, Paid Preparers Signature, Date MMDDYYYY, PTIN or VITATCE required, Preparers Daytime Phone, and I authorize the Minnesota must all be filled out.

Step 3: Right after taking another look at the entries, press "Done" and you are good to go! Join us now and instantly obtain M1Pr Form, available for download. Every change made is conveniently saved , making it possible to customize the form at a later time if needed. We do not share the information that you type in when completing documents at our website.