Handling PDF forms online is definitely super easy with this PDF editor. You can fill in maine tax form rew 5 here painlessly. FormsPal team is focused on providing you with the absolute best experience with our editor by consistently introducing new functions and enhancements. With these updates, using our editor becomes better than ever before! Here is what you will want to do to get going:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to open our pdf form editing tool. Here you will find everything that is needed to fill out your document.

Step 2: With our handy PDF file editor, it is easy to do more than simply fill in blank fields. Express yourself and make your docs appear professional with custom textual content added in, or adjust the file's original content to excellence - all that comes with the capability to incorporate your personal pictures and sign the PDF off.

Be attentive while completing this pdf. Make sure all required areas are completed correctly.

1. Begin filling out your maine tax form rew 5 with a selection of necessary blank fields. Collect all of the information you need and make sure not a single thing left out!

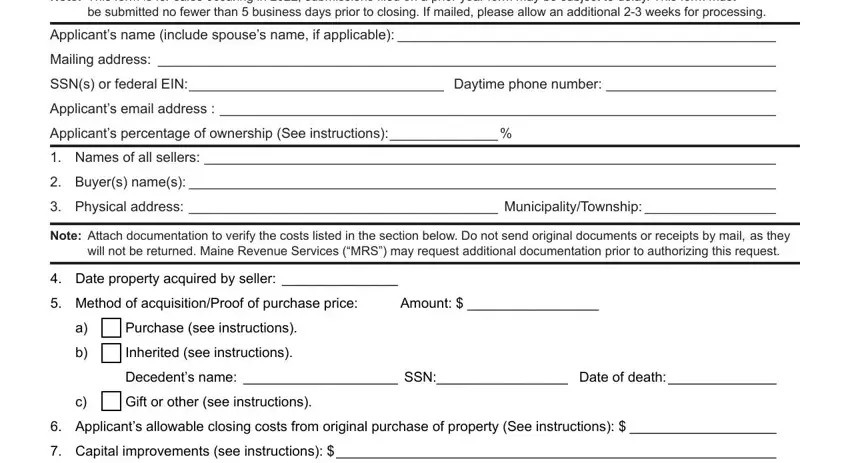

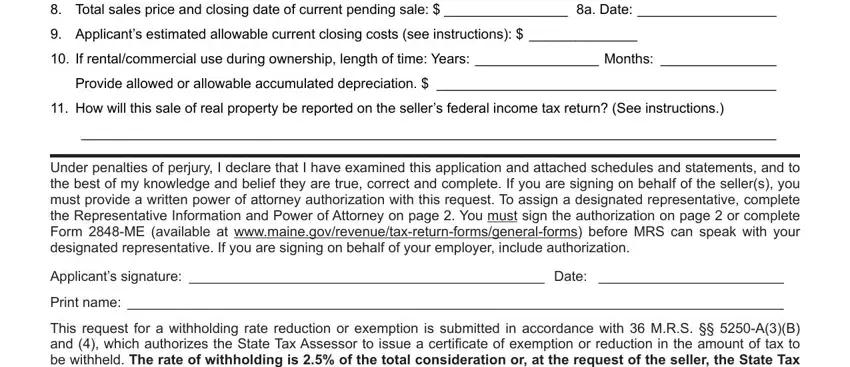

2. Once your current task is complete, take the next step – fill out all of these fields - Total sales price and closing, Applicants estimated allowable, If rentalcommercial use during, Provide allowed or allowable, How will this sale of real, Under penalties of perjury I, Applicants signature Date, Print name, and This request for a withholding with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's very easy to make an error while filling in the Applicants estimated allowable, and so be sure you take a second look prior to deciding to submit it.

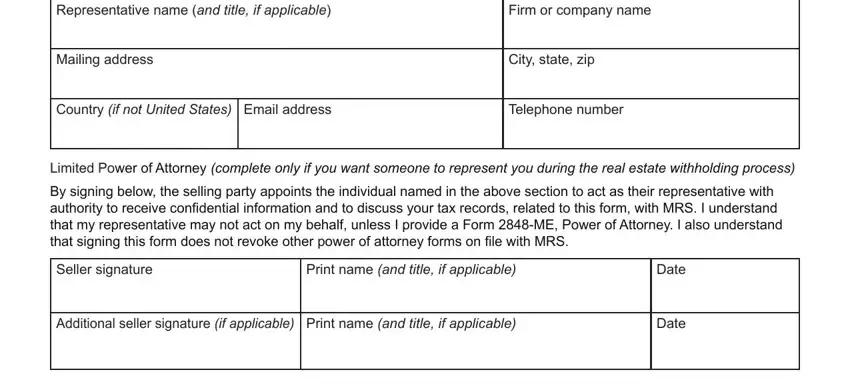

3. Completing Representative name and title if, Firm or company name, Mailing address, City state zip, Country if not United States Email, Telephone number, Limited Power of Attorney complete, By signing below the selling party, Seller signature, Print name and title if applicable, Additional seller signature if, Date, and Date is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Proofread the details you've typed into the blanks and press the "Done" button. Try a 7-day free trial account at FormsPal and get immediate access to maine tax form rew 5 - readily available inside your personal cabinet. FormsPal ensures your data confidentiality by having a secure system that never records or shares any personal data used in the PDF. You can relax knowing your files are kept safe whenever you work with our services!