15-DPT-AR MHTD 305-08/09

MANUFACTURED HOME TRANSFER DECLARATION

Purpose: The Manufactured Home Transfer Declaration (MHTD) provides essential information to the county assessor to help ensure fair and uniform assessment of titled manufactured homes, § 39-14-103, C.R.S.

Requirements: When ownership of a manufactured home changes or is conveyed, any application for a manufactured home title that is submitted to the authorized agent (county clerk and recorder) must be accompanied by an MHTD. The MHTD must be completed and signed by the purchaser (buyer) or transferee (seller) pursuant to § 39-14-103(1)(a), C.R.S.

Penalty for Noncompliance: In the event an MHTD does not accompany the manufactured home title application, the county clerk and recorder will notify the county assessor. The county assessor will notify the buyer or seller that the MHTD must be filed with the county assessor within 30 days.

If a completed MHTD is not returned to the county assessor within 30 days, the assessor may impose a penalty of $25.00 or

.025% of the sale price, whichever is greater. This penalty may be imposed annually until such time as the buyer or seller submits the MHTD or the titled manufactured home is sold, § 39-14-103(1)(b), C.R.S.

Confidentiality: The MHTD is available for inspection by any taxpayer who was specified in the manufactured home title application or who filed the MHTD, the person conducting any valuation for assessment study pursuant to § 39-1-104(16), C.R.S. and his or her employees, and the property tax administrator and his or her employees, § 39-14-103(1)(c), C.R.S.

-------------------------------------------------------------------------------------------------------------------------------------------------------

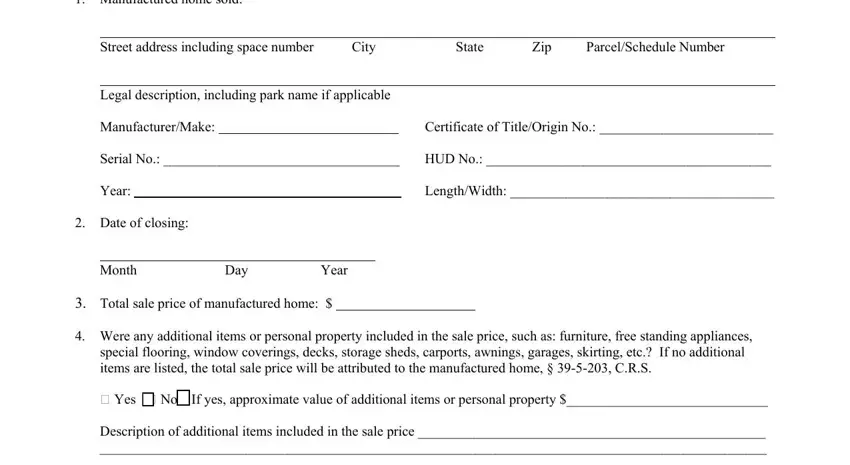

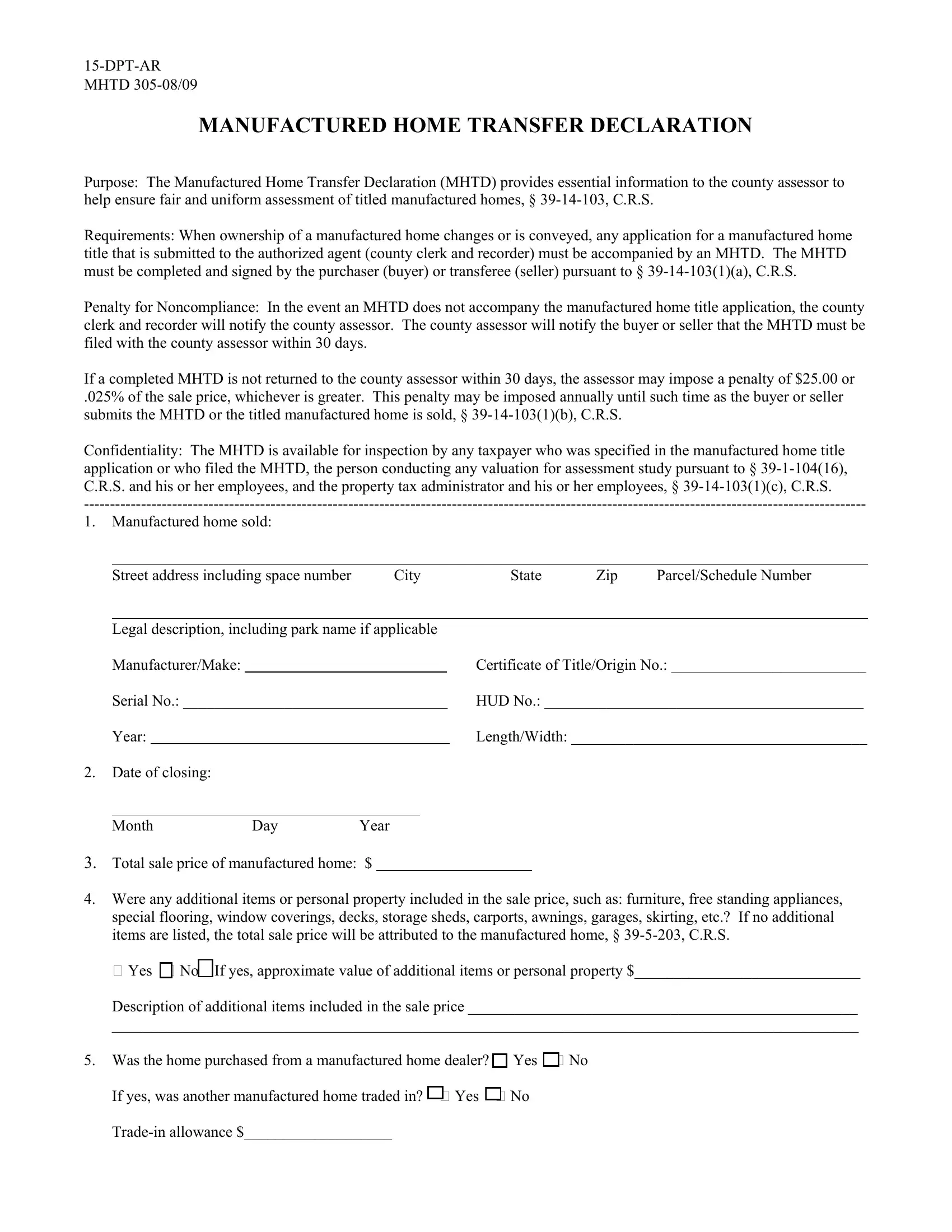

1. |

Manufactured home sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address including space number |

City |

State |

Zip |

Parcel/Schedule Number |

|

|

|

|

|

|

|

|

|

|

|

Legal description, including park name if applicable |

|

|

|

|

|

Manufacturer/Make: |

|

|

|

Certificate of Title/Origin No.: _________________________ |

|

|

Serial No.: __________________________________ |

HUD No.: _________________________________________ |

|

|

Year: |

|

|

|

Length/Width: ______________________________________ |

2. |

|

Date of closing: |

|

|

|

|

|

Month Day Year

3.Total sale price of manufactured home: $

4.Were any additional items or personal property included in the sale price, such as: furniture, free standing appliances, special flooring, window coverings, decks, storage sheds, carports, awnings, garages, skirting, etc.? If no additional items are listed, the total sale price will be attributed to the manufactured home, § 39-5-203, C.R.S.

If yes, approximate value of additional items or personal property $_____________________________

Description of additional items included in the sale price __________________________________________________

________________________________________________________________________________________________

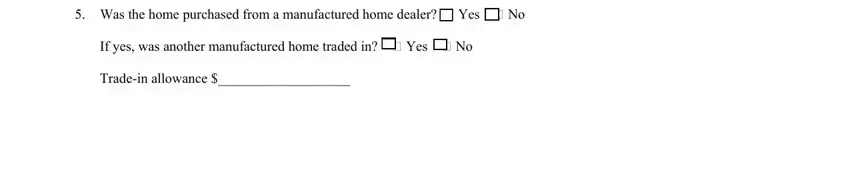

5.Was the home purchased from a manufactured home dealer? Yes

If yes, was another manufactured home traded in?

Trade-in allowance $___________________

15-DPT-AR MHTD 305-08/09

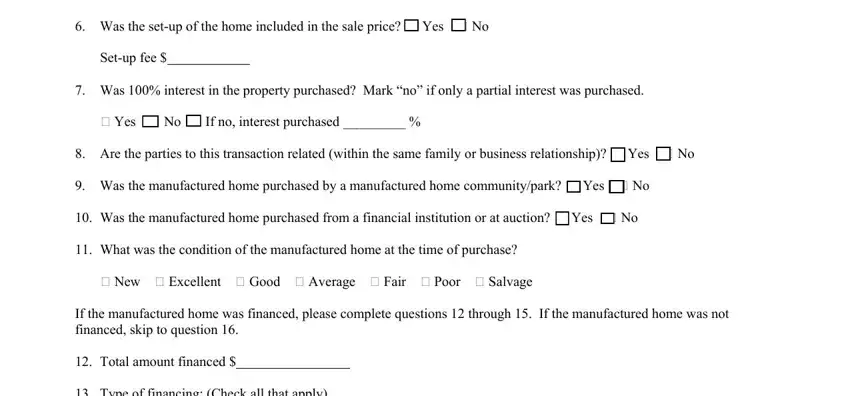

6. Was the set-up of the home included in the sale price? Yes No

Set-up fee $

7.Was 100% interest in the property purchased? Mark “no” if only a partial interest was purchased.

|

Yes |

No |

If no, interest purchased _________ % |

|

8. |

Are the parties to this transaction related (within the same family or business relationship)? |

Yes No |

9. |

Was the manufactured home purchased by a manufactured home community/park? Yes |

No |

10. |

Was the manufactured home purchased from a financial institution or at auction? Yes |

No |

11. |

What was the condition of the manufactured home at the time of purchase? |

|

|

New |

Excellent Good Average Fair Poor Salvage |

|

If the manufactured home was financed, please complete questions 12 through 15. If the manufactured home was not financed, skip to question 16.

12.Total amount financed $

13.Type of financing: (Check all that apply)

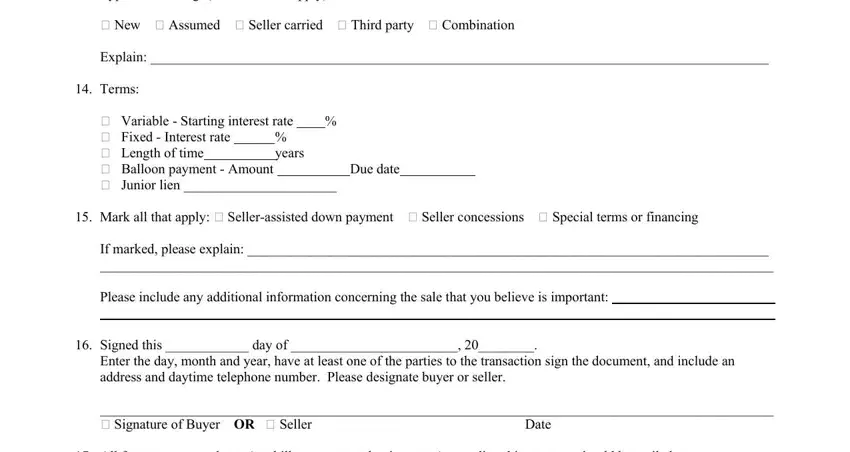

|

New Assumed |

Seller carried |

Third party Combination |

|

Explain: _________________________________________________________________________________________ |

14. |

Terms: |

|

|

|

|

|

|

|

|

|

|

Variable - Starting interest rate |

% |

|

|

|

|

|

Fixed - Interest rate |

% |

|

|

|

|

|

|

|

Length of time |

|

|

years |

|

|

|

|

|

|

Balloon payment - Amount |

|

Due date |

|

|

|

|

|

|

|

|

|

Junior lien ______________________ |

15. |

Mark all that apply: Seller-assisted down payment Seller concessions Special terms or financing |

|

If marked, please explain: ___________________________________________________________________________ |

|

_________________________________________________________________________________________________ |

Please include any additional information concerning the sale that you believe is important:

16.Signed this ____________ day of ________________________, 20________.

Enter the day, month and year, have at least one of the parties to the transaction sign the document, and include an address and daytime telephone number. Please designate buyer or seller.

_________________________________________________________________________________________________

Signature of Buyer OR Seller |

Date |

17. All future correspondence (tax bills, property valuations, etc.) regarding this property should be mailed to:

_________________________________________________________________________________________________

Address (mailing)Daytime Telephone

_________________________________________________________________________________________________

City, State and Zip Code

INSTRUCTIONS FOR COMPLETING

MANUFACTURED HOME TRANSFER DECLARATION

Every two years, Colorado assessors must appraise all real property in the state. For property tax purposes, titled manufactured homes are considered real property per § 39-5-202, C.R.S. Sale prices of properties are used extensively in the appraisal process. Due to certain circumstances surrounding a sale (for example, a sale between family members) some sale prices are not truly indicative of a property's value. Appraisers typically adjust sale prices when unusual circumstances exist or disqualify (ignore) these sales altogether. The Manufactured Home Transfer Declaration (MHTD) alerts the assessor's office to sales which may not provide a true indication of a property's value. When untitled manufactured homes that are permanently affixed to the land sell, a Real Property Transfer Declaration is filed.

The following is a brief explanation of the purpose of each question and the information required on the MHTD:

1.Street address, parcel or schedule number, legal description of the real property and manufactured home information:

This information links the sale to the assessor's records, identifies the location of the manufactured home, and the parcel or schedule number assigned by the county assessor. Include the legal description of the land or the name and location of the manufactured home park. The description of the titled manufactured home; serial number, manufacturer/make, and year are all required information. Certificate of Title/Origin number, HUD number, and length and width are optional.

2.Date of closing:

The date the property is transferred from the seller to the buyer. This allows the assessor to establish the exact date of the “meeting of the minds” concerning the date the sales price was agreed upon.

3.Total sale price of manufactured home:

The total sale price is the most essential item of information concerning the sale. The total sale price may include set-up fees. (See number six below for additional information regarding set-up fees.) Adjustments to the sale price are often necessary before a sale can be used and adjustments are more accurate when the true price of only the titled manufactured home has been identified.

4.Were any additional items or personal property included in the transaction?

Items include, but are not limited to: furniture, free standing appliances, special flooring, window coverings, decks, storage sheds, carports, awnings, garages, skirting, etc. If any additional items or personal property are included in the sale price, the value of those items must be subtracted from the sale price to determine the true sale price of the manufactured home.

5.Was the home purchased from a manufactured home dealer?

In some cases a dealer’s sale price may be different from a private party’s sale price. It is important for the assessor to qualify those particular sales to see what is included in the sale price. If a manufactured home is traded for another manufactured home, additional adjustments may be made to the sale price.

6.Was the set-up of the home included in the sale price?

Manufactured home dealers or manufacturers may charge a fee for the set-up of the manufactured home. This fee is typically included in the total sale price of the home. The set- up fee may include: rough set, utility hook-ups, seam and stitch, and full finish.

7.Was 100% interest in the property purchased?

This is crucial to identify whether the sale included the full 100% interest. If less than 100% interest in the manufactured home was purchased, the sale price cannot be considered representative of the total market value of the property.

8.Is this transaction among related parties?

It is important to know whether the buyer and seller are related individuals, as such sales often do not reflect market value.

9.Was the manufactured home purchased by a manufactured home community?

It is important to know whether a manufactured home community was involved in the transaction, as manufactured home communities typically purchase homes for less than market value in order to fill spaces in the manufactured home community/park.

10. Was the manufactured home purchased from a financial institution or at auction?

It is important to know whether a financial institution was involved or if the purchase was made at an auction, as sales under these conditions typically result in below market value purchase prices. For example; was the sale from a bank, auction house, or a property foreclosure/repossession?

11. What was the condition of the manufactured home at the time of purchase?

When determining market value, the condition of the property at the time of the sale is very important. If one or more of the items are checked, further analysis is necessary to establish the condition at the time of sale.

12. - 15. Finance questions:

When financing reflects current market practices and interest rates, which is ordinarily the case with third-party financing, sale prices do not require adjustments. However, adjustments or disqualifications may be considered if the type of financing is unusual of the market.

16. Signature and date signed:

Verification by either the buyer of the manufactured home or the seller of the manufactured home that the information contained on the Manufactured Home Transfer Declaration is true and complete.

17. Address and daytime telephone number:

This information is helpful if the address of the sold property differs from the address of the owner of record. It also verifies the mailing address for future correspondence.