You may prepare Maryland Form 505X effortlessly with our PDFinity® editor. The tool is consistently maintained by our team, getting awesome functions and turning out to be greater. This is what you'd have to do to start:

Step 1: Open the PDF file inside our editor by hitting the "Get Form Button" in the top area of this webpage.

Step 2: This tool gives you the capability to work with your PDF in various ways. Improve it by writing personalized text, correct what is already in the document, and include a signature - all doable in minutes!

Completing this form will require attentiveness. Make certain all necessary blanks are completed accurately.

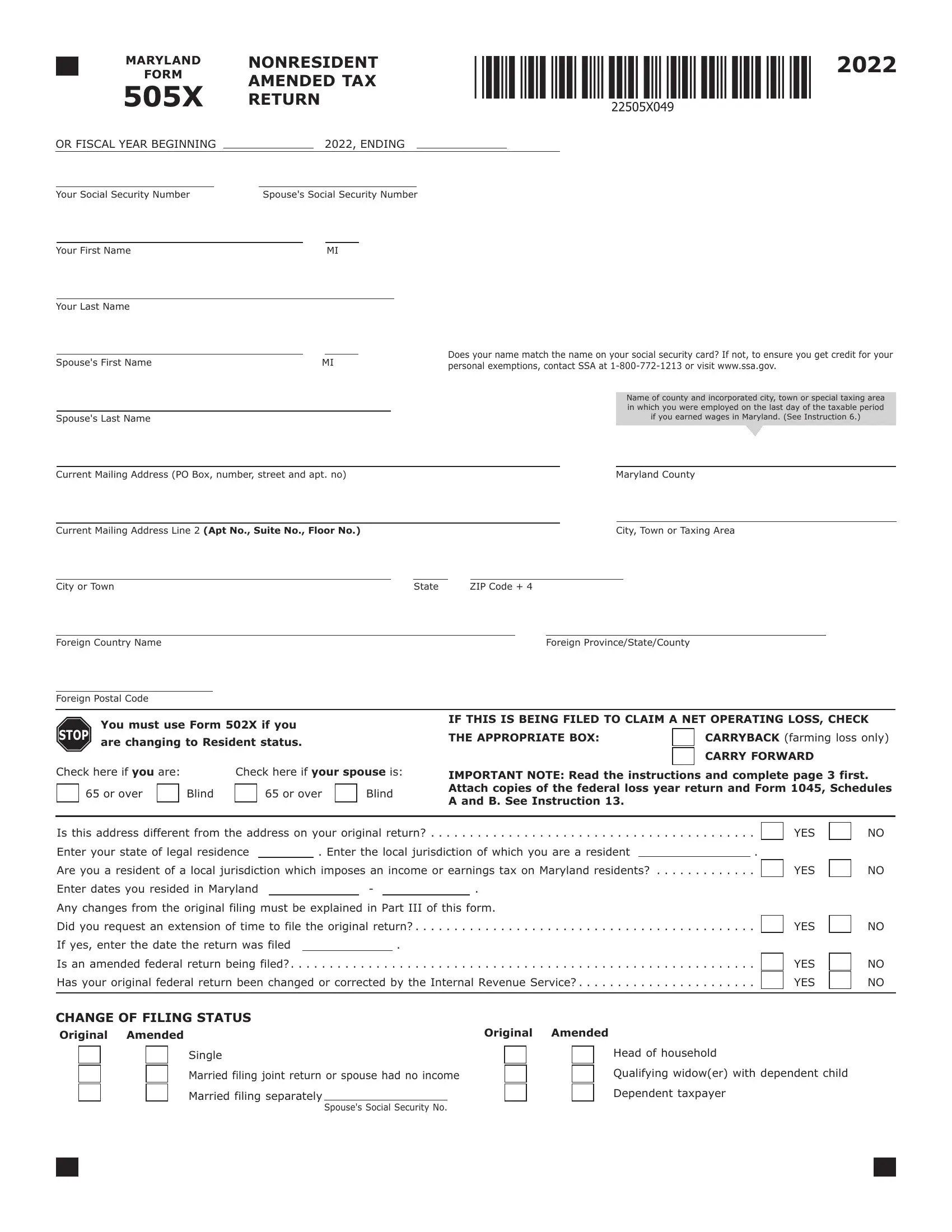

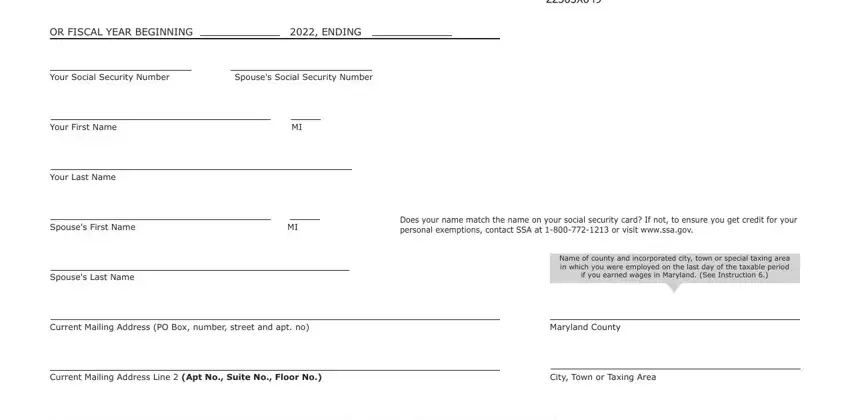

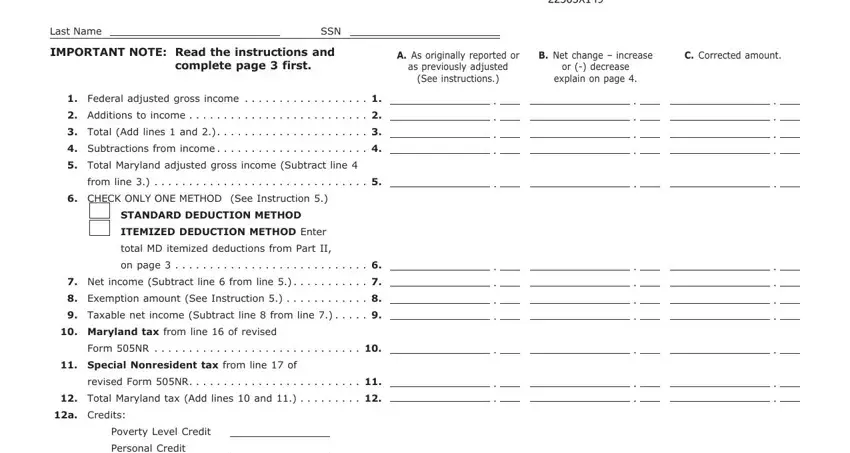

1. While completing the Maryland Form 505X, be sure to include all of the important blank fields in their associated section. It will help to facilitate the process, enabling your details to be processed quickly and correctly.

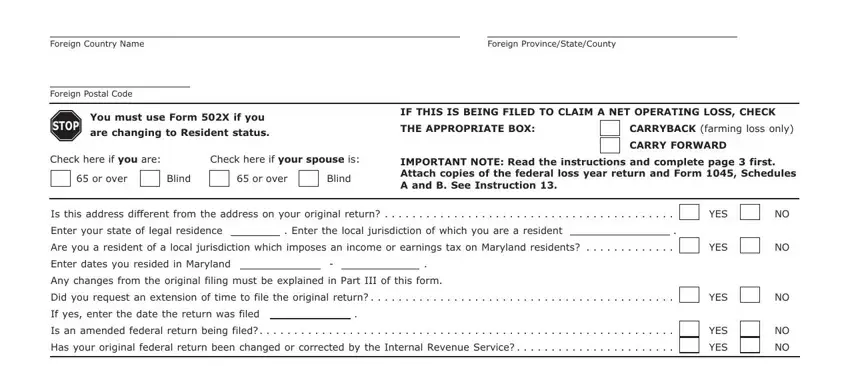

2. The subsequent stage would be to complete all of the following blanks: Foreign Country Name, Foreign ProvinceStateCounty, Foreign Postal Code, STOP, You must use Form X if you, are changing to Resident status, IF THIS IS BEING FILED TO CLAIM A, THE APPROPRIATE BOX, CARRYBACK farming loss only, CARRY FORWARD, Check here if you are, Check here if your spouse is, or over, Blind, and or over.

Be extremely careful while completing CARRY FORWARD and THE APPROPRIATE BOX, as this is the section where a lot of people make errors.

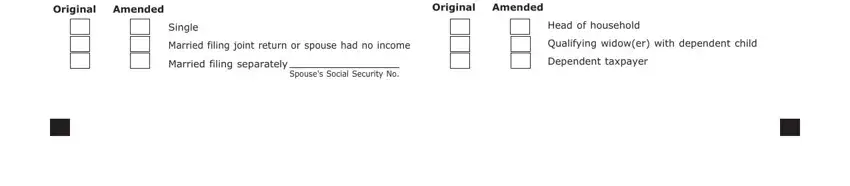

3. Completing CHANGE OF FILING STATUS, Original Amended, Single, Married filing joint return or, Married filing separately, Spouses Social Security No, Original Amended, Head of household, Qualifying widower with dependent, and Dependent taxpayer is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

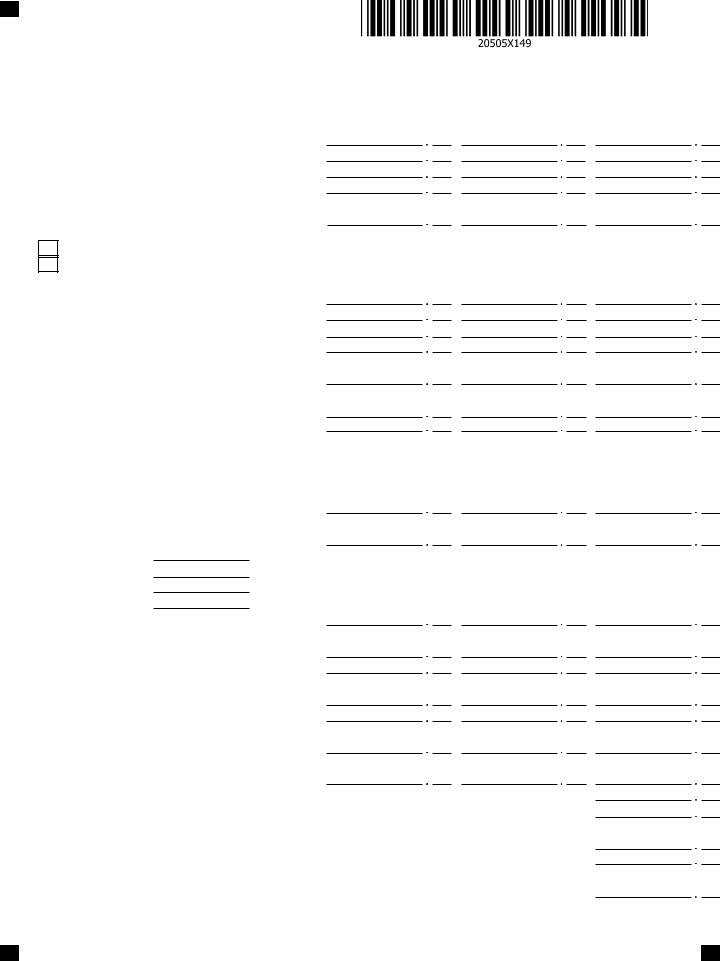

4. This next section requires some additional information. Ensure you complete all the necessary fields - A As originally reported or, B Net change increase, C Corrected amount, as previously adjusted, See instructions, or decrease explain on page, NONRESIDENT AMENDED TAX RETURN, Last Name, SSN, IMPORTANT NOTE Read the, complete page first, Federal adjusted gross income, Additions to income, Total Add lines and, and Subtractions from income - to proceed further in your process!

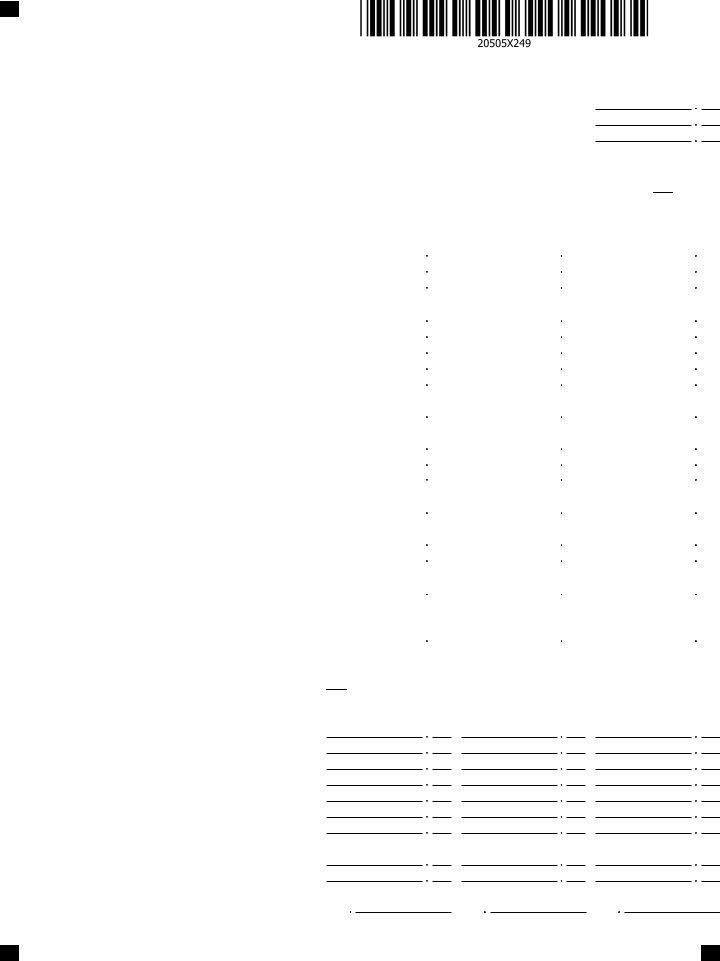

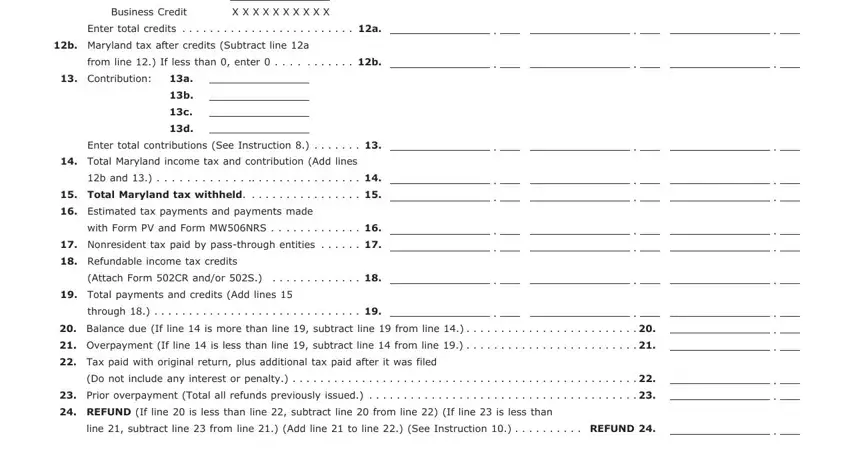

5. While you reach the end of the form, there are actually just a few more requirements that must be satisfied. Notably, Personal Credit, Business Credit X X X X X X X X X X, Enter total credits, b Maryland tax after credits, from line If less than enter, Contribution, Enter total contributions See, Total Maryland income tax and, b and, Total Maryland tax withheld, Estimated tax payments and, with Form PV and Form MWNRS, Nonresident tax paid by, Refundable income tax credits, and Attach Form CR andor S should all be filled in.

Step 3: Check all the information you have typed into the blank fields and then click on the "Done" button. After creating a7-day free trial account with us, you'll be able to download Maryland Form 505X or send it through email promptly. The PDF document will also be available via your personal account page with your every edit. We do not share the details you type in while filling out forms at our website.