maryland combined registration application form can be completed online without any problem. Just open FormsPal PDF editing tool to get the job done without delay. Our professional team is relentlessly endeavoring to expand the editor and make it even easier for people with its many features. Discover an constantly innovative experience today - explore and discover new possibilities along the way! In case you are looking to begin, here's what it requires:

Step 1: First, open the pdf tool by clicking the "Get Form Button" at the top of this site.

Step 2: After you open the online editor, you will see the form made ready to be filled out. In addition to filling in various fields, you could also do some other things with the Document, particularly writing any text, editing the initial text, inserting images, putting your signature on the PDF, and more.

Filling out this document calls for attention to detail. Make certain each field is done accurately.

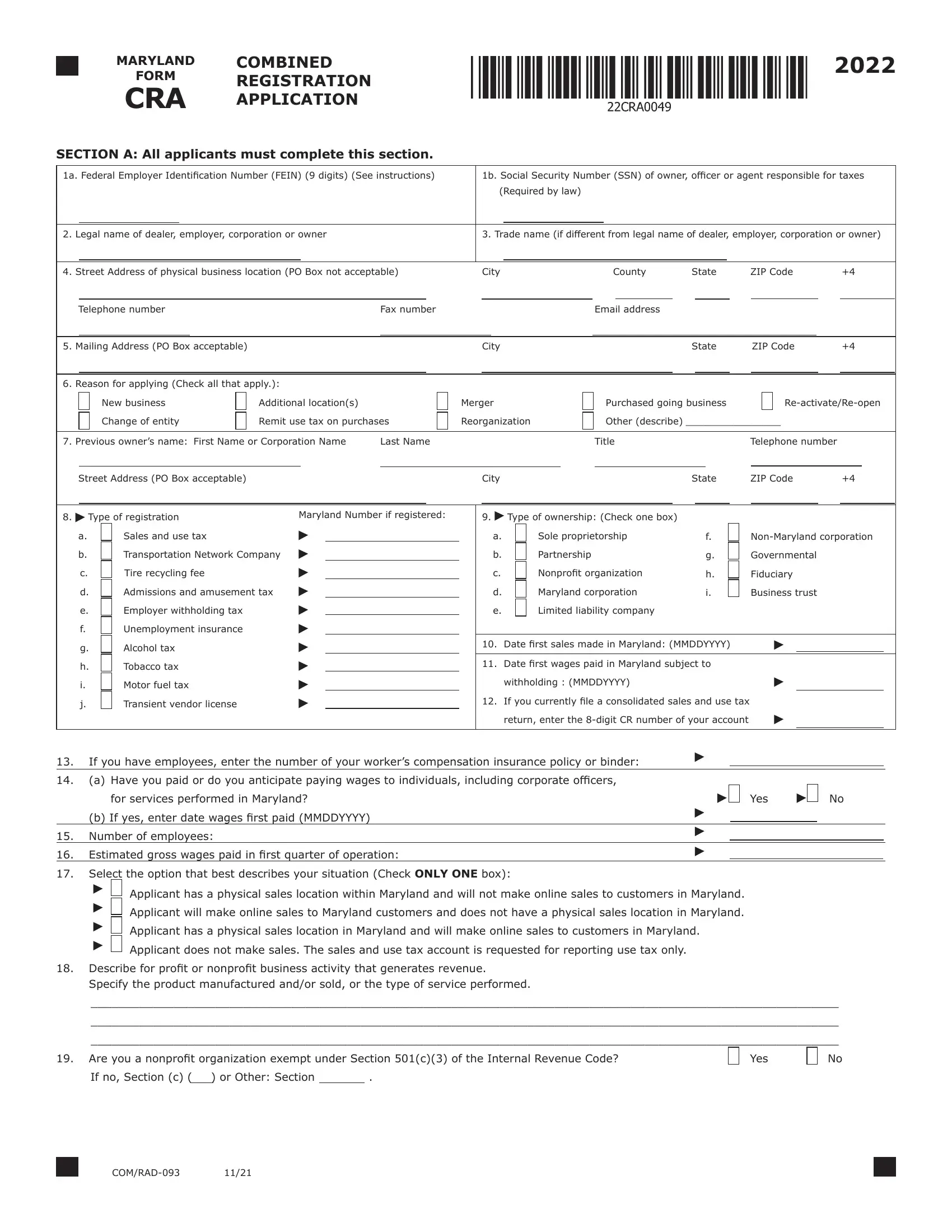

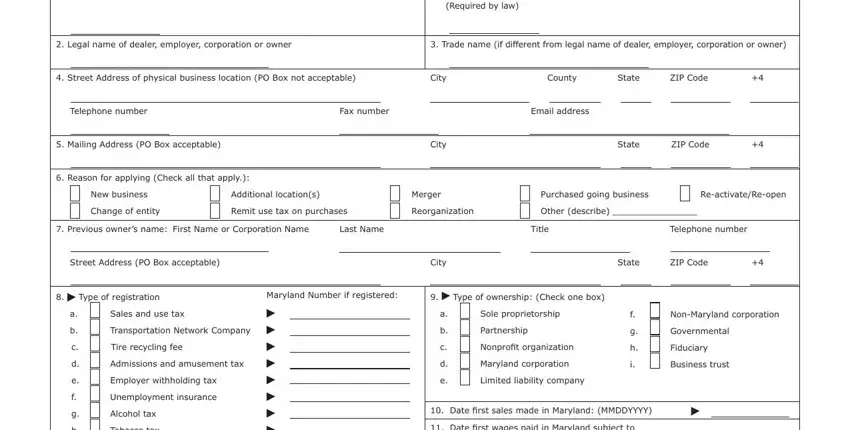

1. Whenever submitting the maryland combined registration application form, make sure to include all necessary blank fields within its corresponding section. This will help to facilitate the work, allowing for your details to be processed swiftly and correctly.

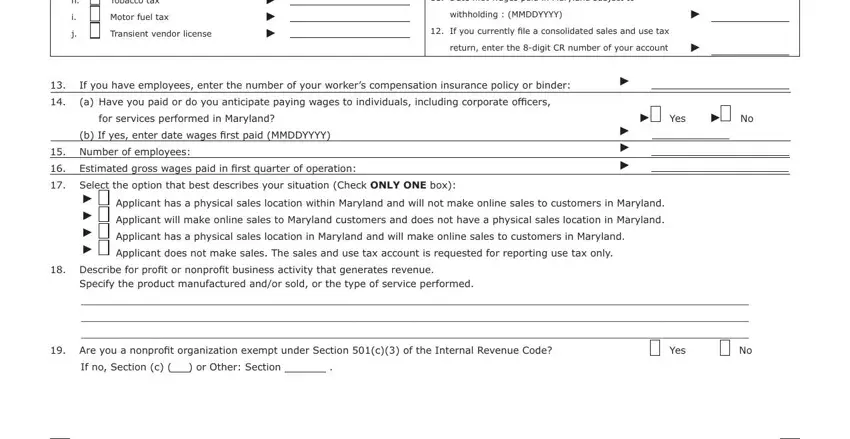

2. After finishing the last part, go on to the next step and complete the essential particulars in all these blank fields - a b c d e f g h i j, Sales and use tax Transportation, Date first wages paid in Maryland, withholding MMDDYYYY, If you currently file a, If you have employees enter the, for services performed in Maryland, b If yes enter date wages first, Number of employees Select the, Estimated gross wages paid in, Yes, Applicant has a physical sales, Describe for profit or nonprofit, Specify the product manufactured, and Are you a nonprofit organization.

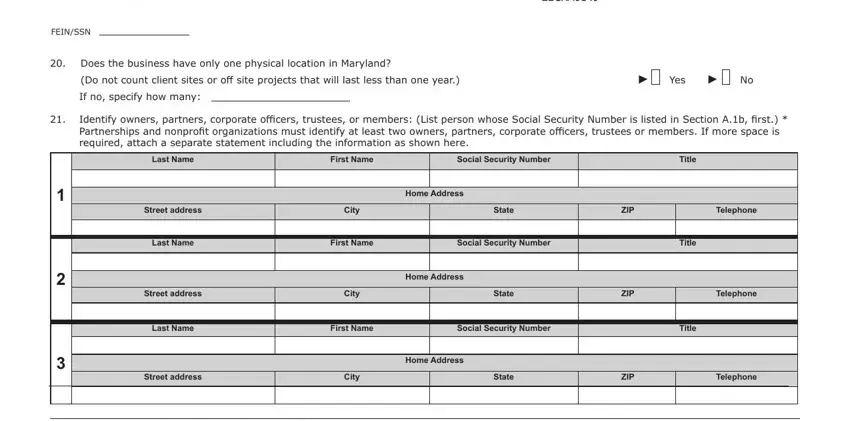

3. This stage will be simple - complete all of the fields in CRA, FEINSSN, Does the business have only one, Yes, Identify owners partners corporate, Last Name, First Name, Social Security Number, Title, Street address, City, State, ZIP, Telephone, and Home Address in order to complete this segment.

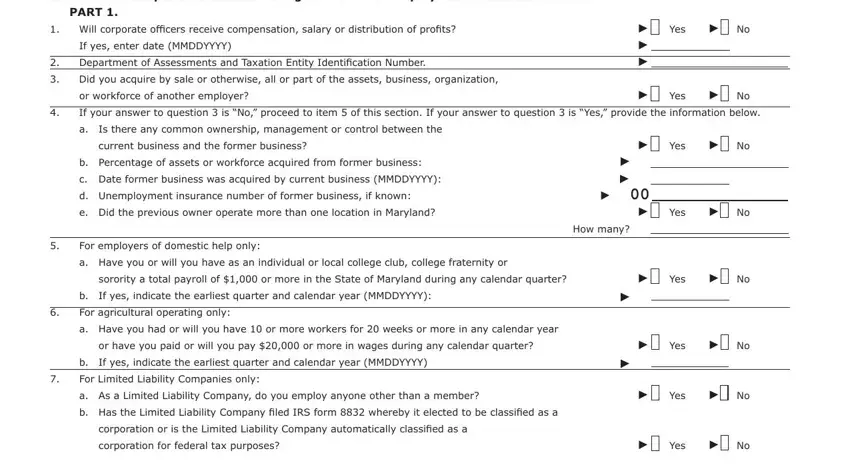

4. Filling in SECTION B Complete this section to, PART Will corporate officers, If yes enter date MMDDYYYY, Yes, Yes, Yes, current business and the former, or workforce of another employer, corporation or is the Limited, sorority a total payroll of or, or have you paid or will you pay, How many, Yes, Yes, and Yes is vital in the next form section - ensure that you don't rush and fill out each and every field!

Always be extremely mindful while filling out SECTION B Complete this section to and sorority a total payroll of or, since this is where most people make some mistakes.

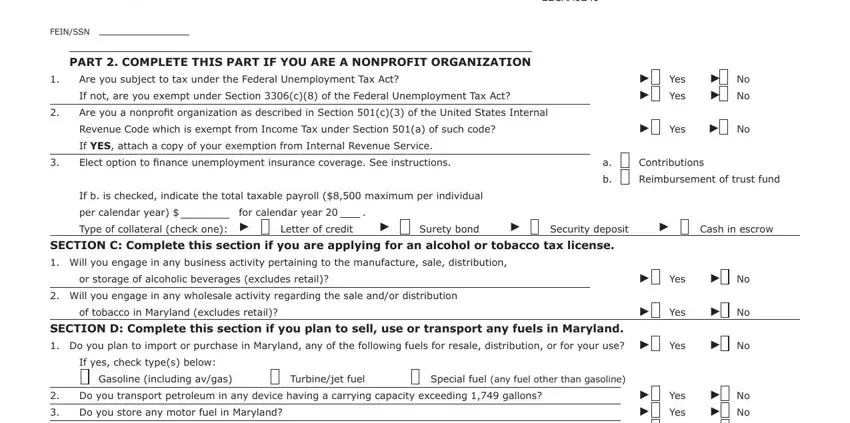

5. The very last notch to finalize this document is crucial. Ensure you fill in the appropriate blanks, which includes CRA, FEINSSN, PART COMPLETE THIS PART IF YOU, Are you subject to tax under the, for calendar year, Surety bond, Yes Yes, No No, Yes, a b, Contributions Reimbursement of, SECTION C Complete this section if, Letter of credit, Security deposit, and Cash in escrow, before submitting. If you don't, it may give you an unfinished and probably nonvalid paper!

Step 3: Make sure that your details are accurate and just click "Done" to progress further. Join FormsPal right now and instantly get maryland combined registration application form, all set for downloading. Each edit made is conveniently saved , so that you can edit the file at a later stage if required. FormsPal is committed to the confidentiality of our users; we make sure that all personal information used in our system is kept protected.