When working in the online PDF tool by FormsPal, it is easy to fill out or modify ma form download right here and now. We at FormsPal are devoted to giving you the absolute best experience with our tool by constantly adding new functions and enhancements. Our tool is now much more intuitive with the newest updates! So now, working with PDF forms is a lot easier and faster than before. Starting is effortless! Everything you need to do is take these easy steps down below:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: The editor will let you modify PDF files in many different ways. Transform it by writing your own text, adjust what is already in the file, and place in a signature - all manageable within a few minutes!

When it comes to blank fields of this precise PDF, this is what you need to know:

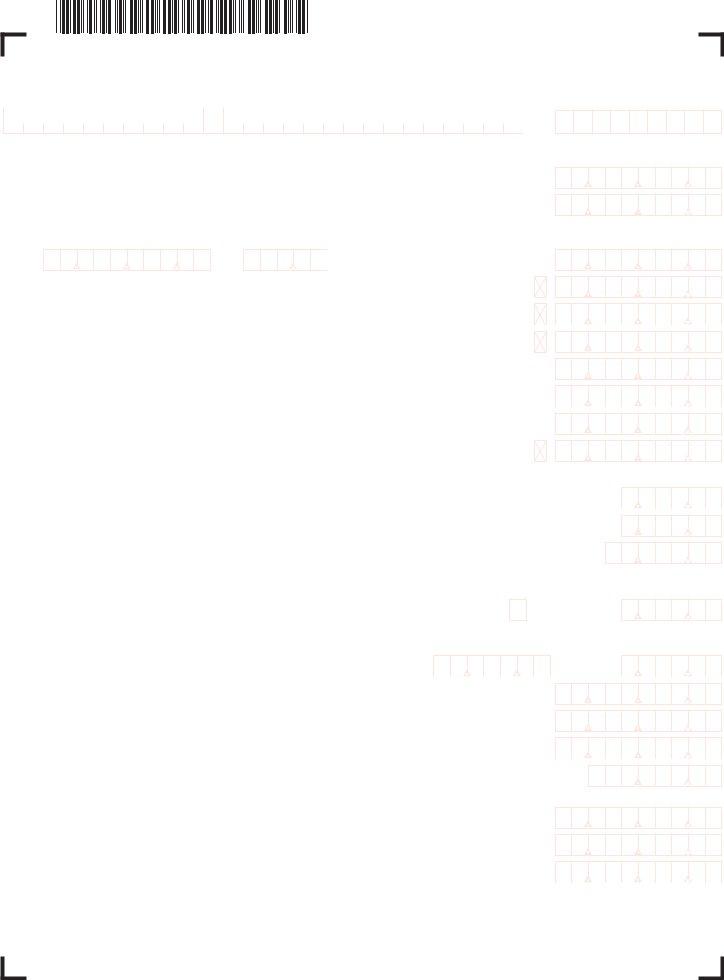

1. The ma form download usually requires certain details to be inserted. Be sure that the subsequent blanks are filled out:

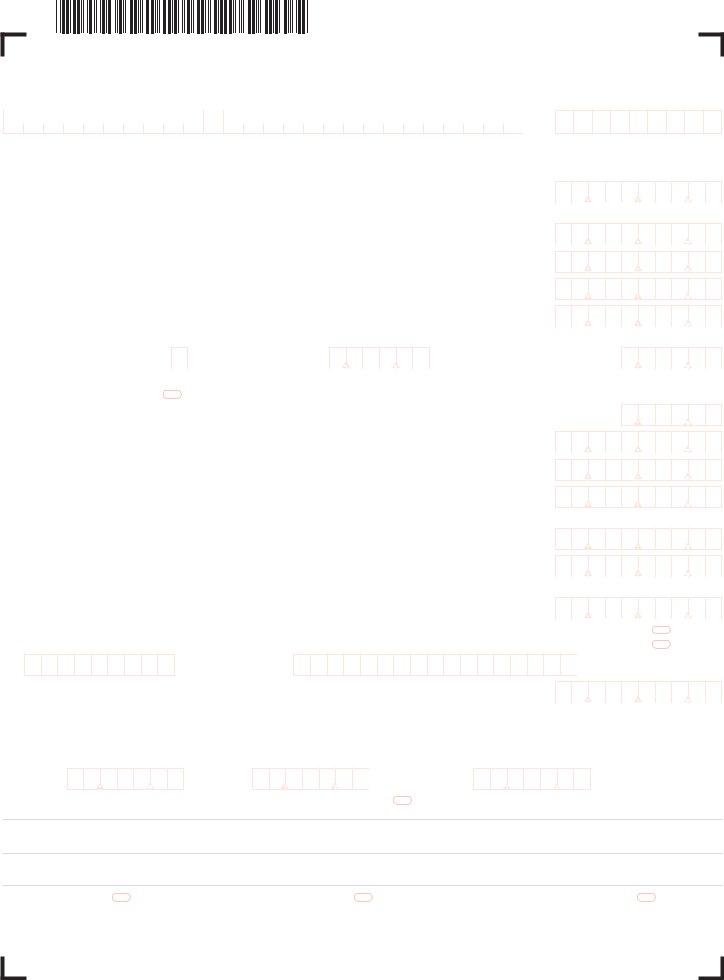

2. Once the last section is completed, go to type in the applicable details in these - Fill in if you received sold sent, b Total federal adjusted gross, from US Form line, from US Form line, IF A LOSS MARK AN X IN BOX, IF A LOSS MARK AN X IN BOX, FILING STATUS Fill in one only, Single Married filing joint return, Head of household see instructions, EXEMPTIONS, a Personal exemptions If single or, jointly enter, b Number of dependents do not, c Age or over before, and d Blindness.

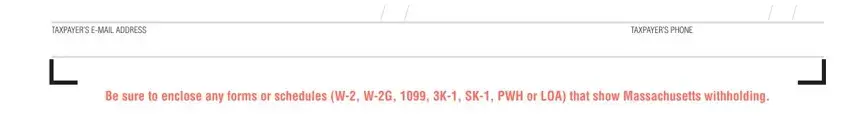

3. The following part is all about SIGN HERE Under penalties of, SPOUSES SIGNATURE, DATE, DATE, TAXPAYERS EMAIL ADDRESS, TAXPAYERS PHONE, and Be sure to enclose any forms or - fill in these empty form fields.

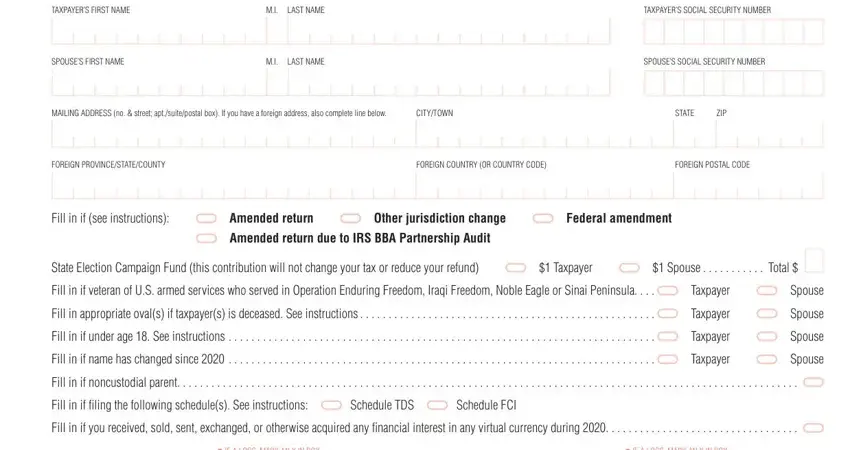

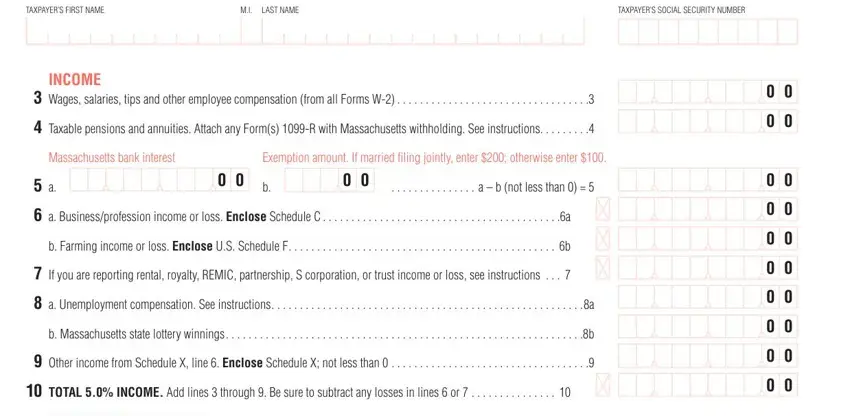

4. It's time to fill in the next section! Here you'll get all these TAXPAYERS FIRST NAME, LAST NAME, TAXPAYERS SOCIAL SECURITY NUMBER, INCOME, Wages salaries tips and other, Taxable pensions and annuities, Massachusetts bank interest, Exemption amount If married filing, a b not less than, a Businessprofession income or, b Farming income or loss Enclose, If you are reporting rental, a Unemployment compensation See, b Massachusetts state lottery, and Other income from Schedule X line empty form fields to do.

It's easy to make a mistake when filling out your INCOME, therefore be sure you reread it prior to deciding to finalize the form.

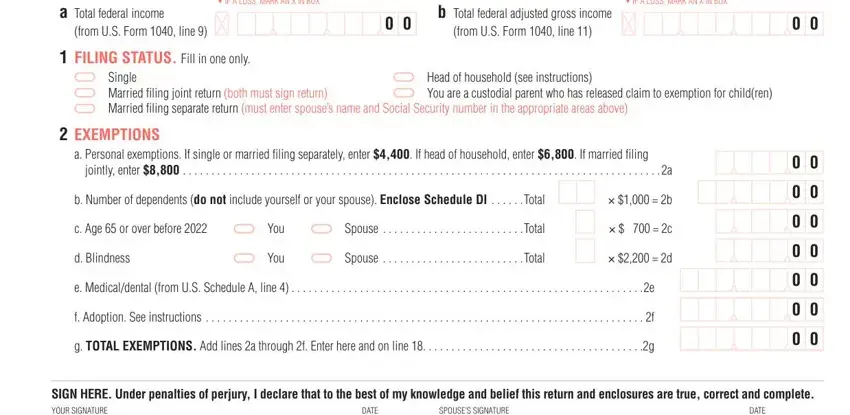

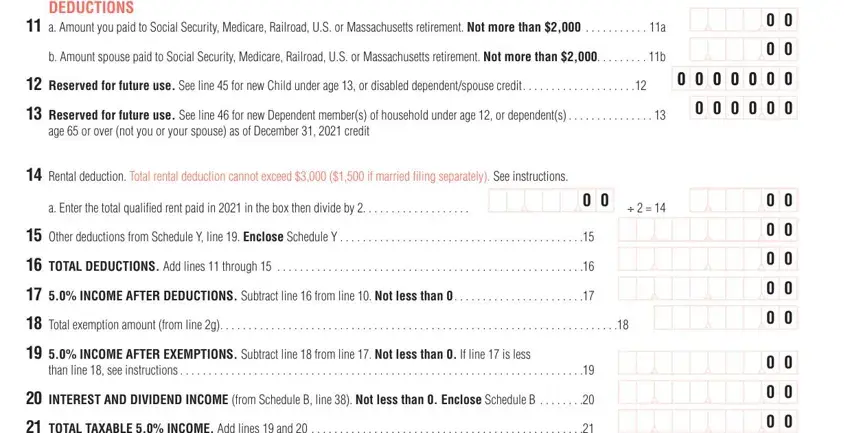

5. This document should be wrapped up with this particular area. Here you can see a comprehensive listing of blank fields that must be filled out with specific details in order for your document submission to be complete: DEDUCTIONS, a Amount you paid to Social, b Amount spouse paid to Social, Reserved for future use See line, Reserved for future use See line, age or over not you or your, Rental deduction Total rental, a Enter the total qualified rent, Other deductions from Schedule Y, TOTAL DEDUCTIONS Add lines, INCOME AFTER DEDUCTIONS Subtract, Total exemption amount from line, INCOME AFTER EXEMPTIONS Subtract, than line see instructions, and INTEREST AND DIVIDEND INCOME from.

Step 3: After going through the filled out blanks, press "Done" and you are good to go! Create a free trial plan with us and get direct access to ma form download - readily available inside your personal account. FormsPal guarantees your information privacy with a protected method that in no way records or shares any type of private data used in the PDF. Be assured knowing your documents are kept protected each time you work with our tools!