Dealing with taxes can be complicated, but understanding and filing the Massachusetts Form 355U is an important part of financial planning for many individuals in the state. The purpose of this form is to report income earned from the sale or exchange of capital assets during any tax year, including real estate property and investments such as stocks and bonds. Whether you're a seasoned investor looking to update your portfolio or a first-time seller trying their hand at trading in the stock market, getting knowledgeable on this form will help ensure your finances are properly managed come tax time. In this blog post, we'll provide an overview of what’s required when it comes to completing Form 355U and highlight some tips that may make preparing it easier.

| Question | Answer |

|---|---|

| Form Name | Massachusetts Form 355U |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | taxable, Massachusetts, U-ST, form 355u |

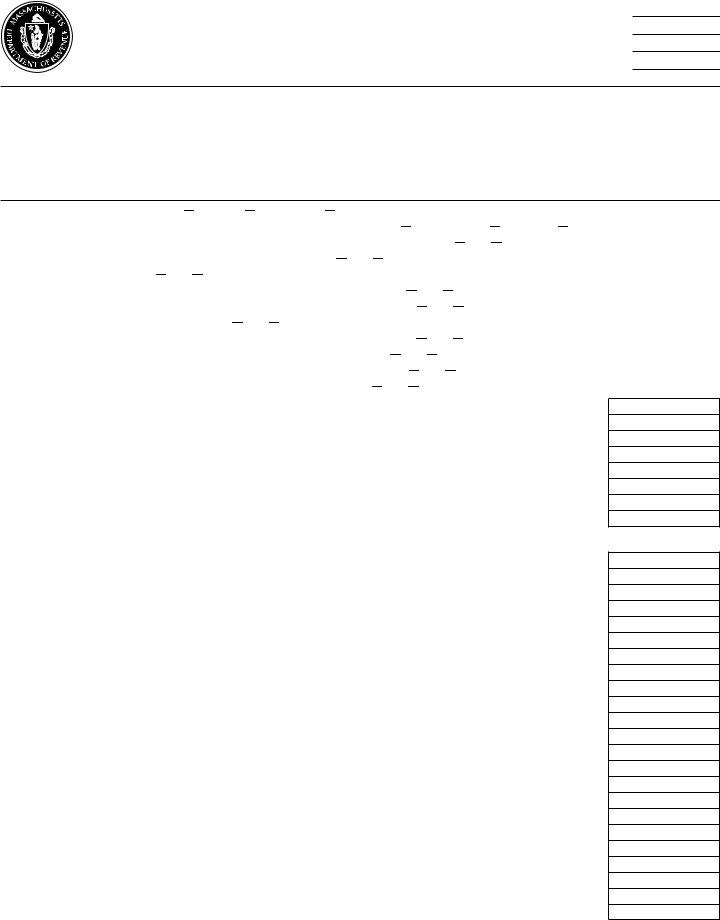

Form 355U

Excise for Taxpayers

Subject to Combined Reporting

2011

Massachusetts

Department of

Revenue

Forcalendaryear2011ortaxableperiodbeginning |

|

2011andending |

|

|

|

|

|

Name of principal reporting corporation |

Federal Identificationnumber |

|

|

3 |

3 |

|

|

|

|

|

|

Principal address |

City/Town |

State |

Zip |

|

|

|

|

Contact person |

Telephone number |

|

|

1Type of group (check one only): 3 Financial

2Are you making or are you subject to an affiliated group or worldwide election? 3 Affiliated group Worldwide Neither

3If an affiliated group or worldwide election applies, is it a new election for the current year? 3 Yes No

4Is any member of the group requesting alternate apportionment? 3 Yes No

5Is this an amended filing? 3 Yes No

6Is the group or any member deducting interest expense paid to a related entity? 3 Yes No

7Is the group or any member deducting intangible expense paid to a related entity? 3 Yes No

8Does the group have an excluded parent? 3 Yes No

9Has the group elected a Massachusetts adjusted basis for

10Is any member currently under audit by the Internal Revenue Service (IRS)? 3 Yes No

11Is any member taking a Massachusetts film credit against its income excise tax? 3 Yes No

12Is any member taking a life science credit against its income excise tax? 3 Yes No

13 Last year for which any member was audited by IRS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 Enter the number of federal disclosure statements filed by members for this tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Enter the number of Massachusetts taxpayer disclosure statements included with return . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Total number of taxable members included in the combined report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Number of members subject to

18 Number of

19 Number of U.S. Schedules

20 Number of members subject to fiscalization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

Excise Tax Calculation

21 |

Total financial institution excise due from members |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 21 |

22 |

Total utility corporation excise due from members |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 22 |

23 |

Total business corporation measure of excise due from members. . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 23 |

24 |

Total excise before credits and payments.Add lines 21 through 23. . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . 24 |

25 |

Credits taken by corporations using their own credits |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 25 |

26 |

Credits taken under sharing rules |

. . . . . . . . . 3 26 |

|

27 |

Excise due before voluntary contribution |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . 27 |

28 |

Voluntary contribution for endangered wildlife conservation |

. . . . . . . . . 3 28 |

|

29 |

Excise due plus voluntary contribution.Add lines 27 and 28 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . 29 |

30 |

2010 overpayment applied to 2011 tax (from Schedule CG, Part 1, line 2) |

. . . . . . . . . 3 30 |

|

31 |

Estimated tax payments (group) (from Schedule CG, Part 1, total of lines 3 through 6) |

. . . . . . . . . 3 31 |

|

32 |

Payment with extension (group) (from Schedule CG, Part 1, line 7) . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 32 |

33 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 33 |

|

34 |

Total refundable credits (total of all Schedules |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 34 |

35 |

Other payment or refund for this tax year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 35 |

36 |

Total payments for the combined group |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . 36 |

37 |

Amount overpaid. Subtract line 29 from line 36 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . 37 |

38 |

Amount overpaid to be credited to 2012 estimated tax |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . 3 38 |

39 |

Amount overpaid to be refunded |

. . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . |

. . . . . . . . . 3 39 |

40 |

Balance due. Subtract line 36 from line 29 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . 40 |

41 |

$ ______________________ |

Total penalty 41 |

|

42 |

Interest |

. . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . .3 42 |

43 |

Excise due plus statutory additions |

. . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . |

. . . . . . . . . 3 43 |