There is nothing difficult regarding completing the ma form energy when using our PDF editor. By taking these basic steps, you will definitely get the prepared document in the minimum period you can.

Step 1: The following page includes an orange button that says "Get Form Now". Click it.

Step 2: You can now change the ma form energy. The multifunctional toolbar lets you add, remove, customize, and highlight content or perhaps carry out other commands.

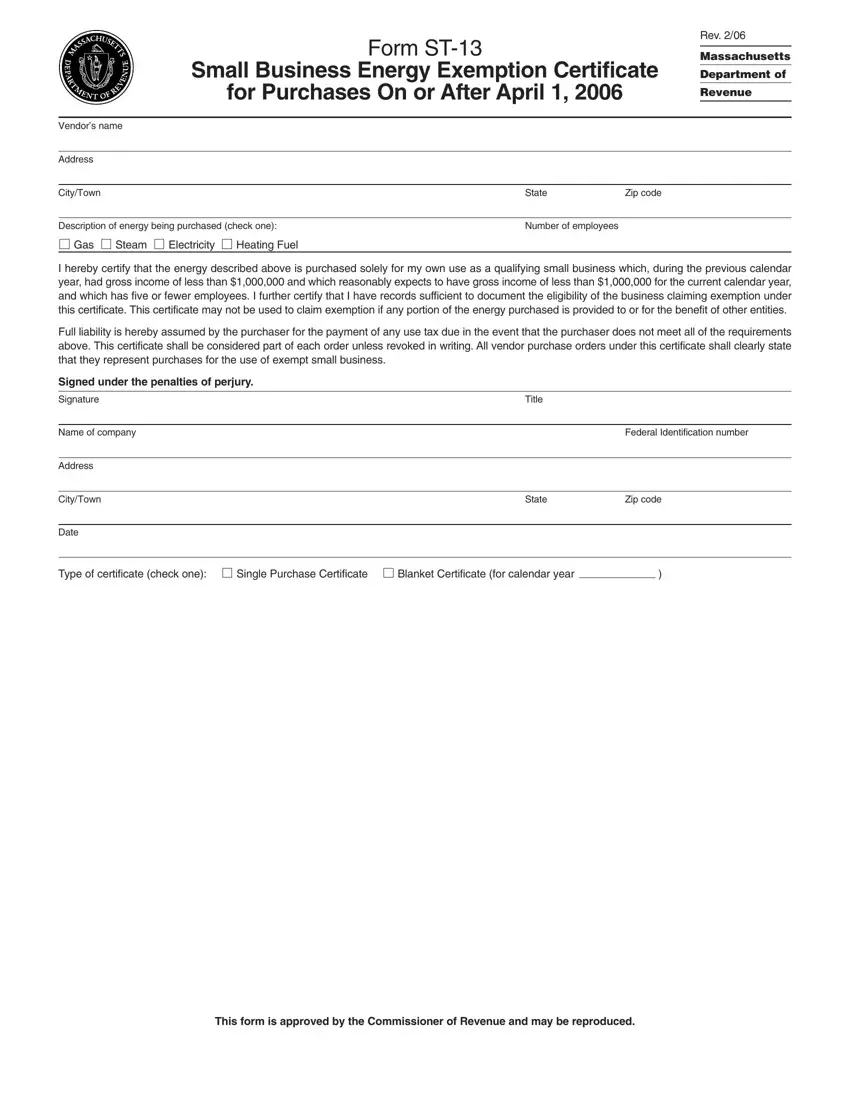

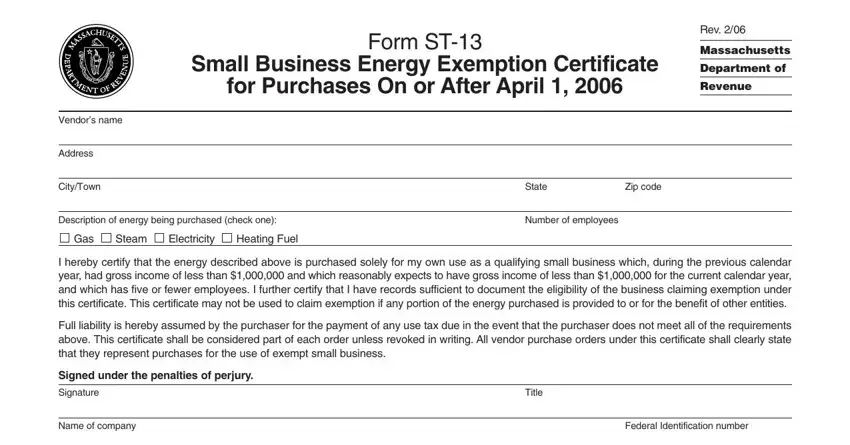

The next few sections are what you will have to fill out to obtain the ready PDF file.

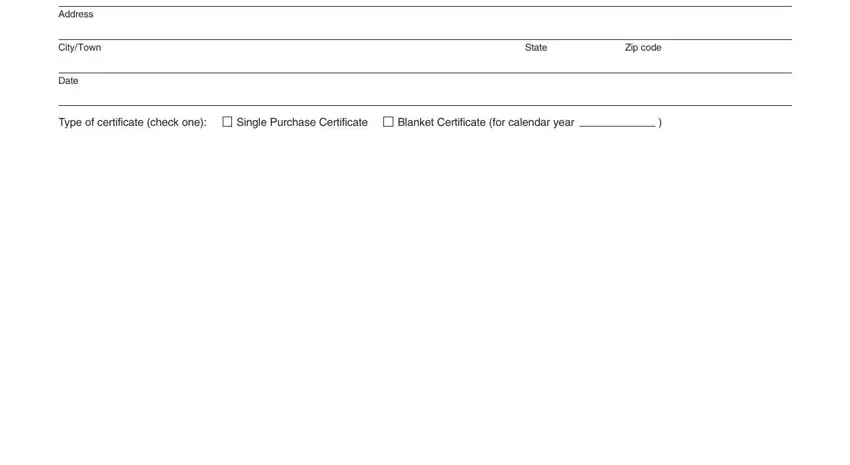

Put down the information in the Address, CityTown, Date, State, Zip code, Type of certificate check one, Single Purchase Certificate, and Blanket Certificate for calendar area.

Step 3: Choose the Done button to make sure that your finalized file is available to be transferred to every electronic device you end up picking or mailed to an email you specify.

Step 4: You could make duplicates of the file tokeep clear of different upcoming complications. You should not worry, we do not distribute or watch your information.