With the help of the online PDF editor by FormsPal, you may complete or change Md Form 1 here. To maintain our editor on the cutting edge of convenience, we work to integrate user-oriented features and improvements on a regular basis. We are always happy to get suggestions - join us in reshaping PDF editing. To begin your journey, consider these simple steps:

Step 1: Just press the "Get Form Button" above on this page to see our form editing tool. There you'll find everything that is needed to fill out your document.

Step 2: As soon as you open the tool, you will notice the document made ready to be filled in. In addition to filling in different blanks, you may as well do other actions with the PDF, including adding your own text, editing the initial text, inserting graphics, putting your signature on the PDF, and more.

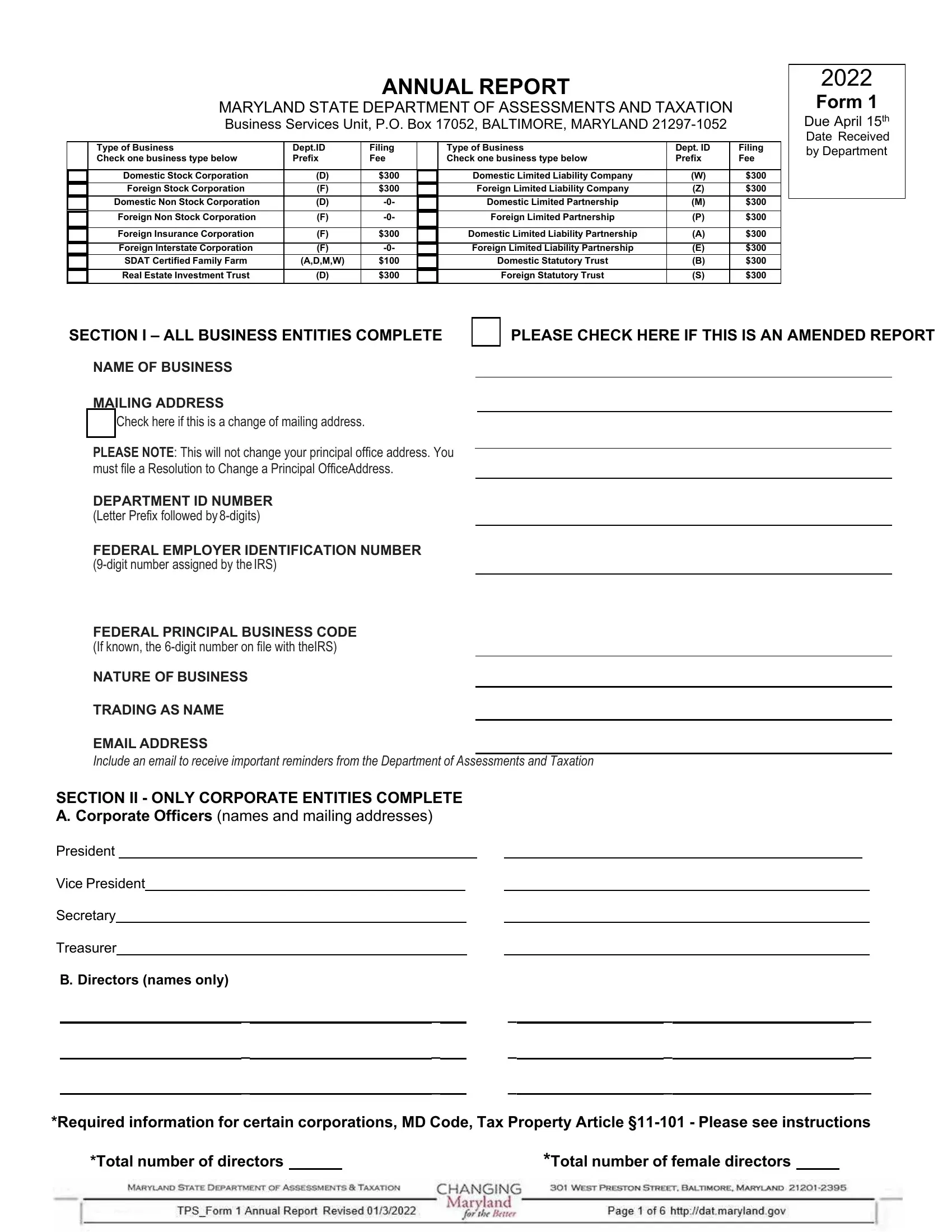

This PDF form will need specific data to be filled out, hence you need to take some time to provide exactly what is requested:

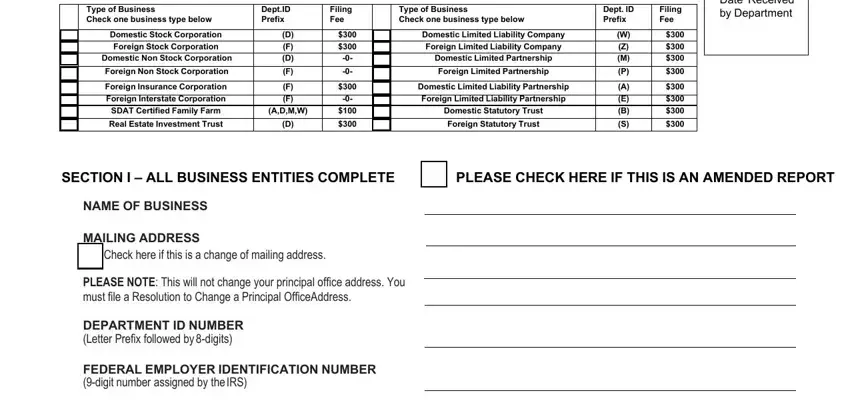

1. To get started, when completing the Md Form 1, start out with the part that features the following blanks:

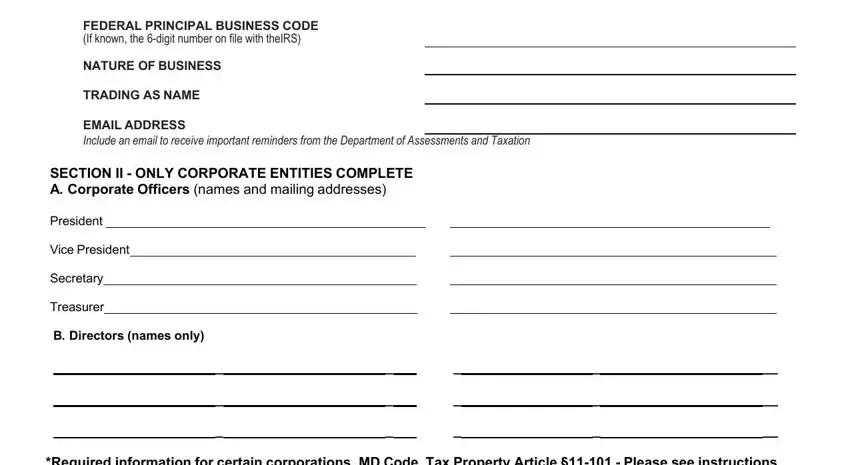

2. Soon after this selection of blank fields is done, go on to enter the suitable details in all these - FEDERAL PRINCIPAL BUSINESS CODE If, NATURE OF BUSINESS, TRADING AS NAME, EMAIL ADDRESS Include an email to, SECTION II ONLY CORPORATE, President, Vice President, Secretary, Treasurer, B Directors names only, and Required information for certain.

Always be really careful while filling out Treasurer and FEDERAL PRINCIPAL BUSINESS CODE If, as this is where a lot of people make a few mistakes.

3. In this part, look at Required information for certain, Total number of directors, TPSForm Annual Report, and Total number of female directors. All these will have to be filled out with highest precision.

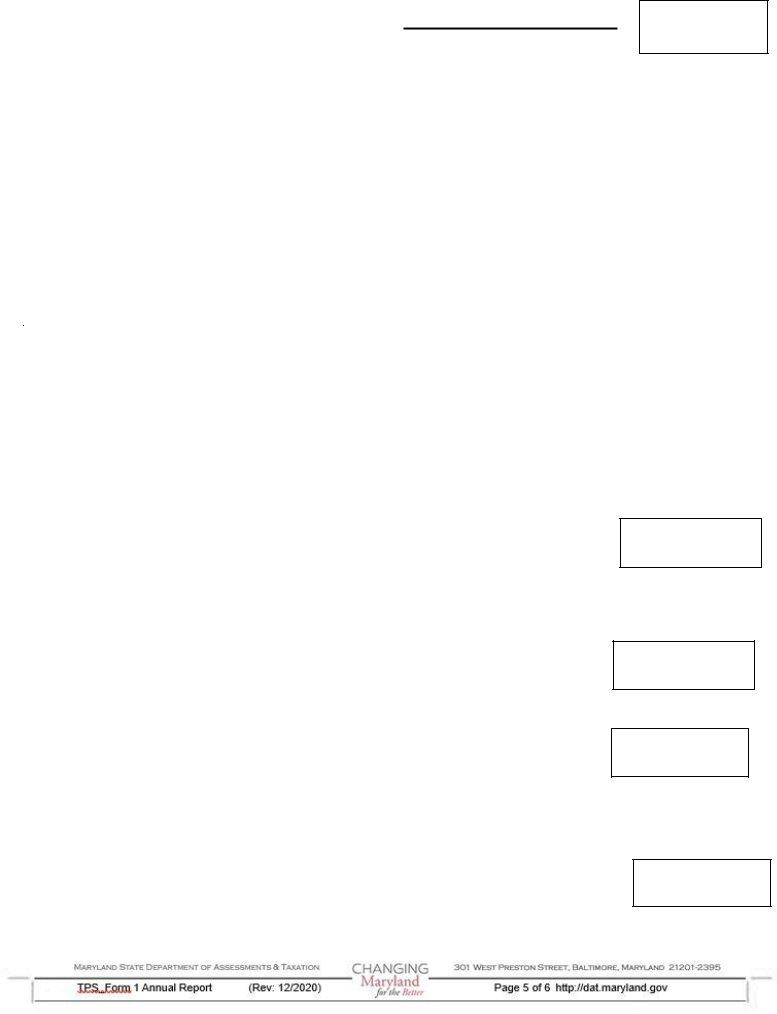

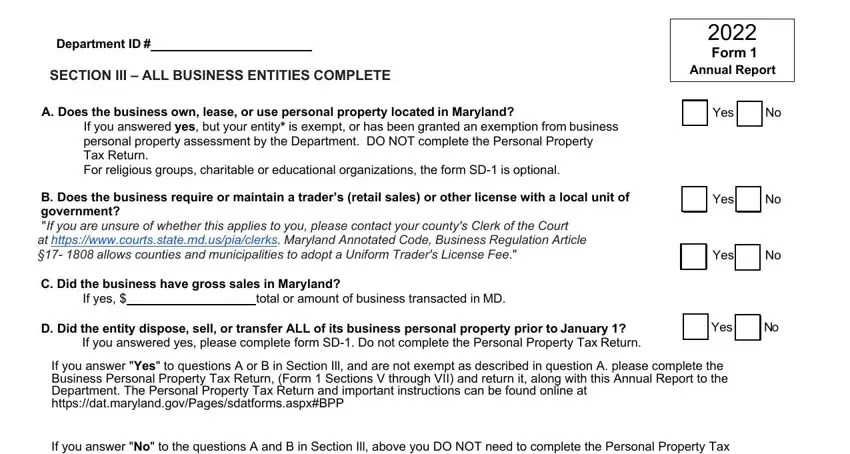

4. To move ahead, this part will require typing in a few blank fields. Examples of these are Department ID, SECTION III ALL BUSINESS ENTITIES, A Does the business own lease or, If you answered yes but your, B Does the business require or, C Did the business have gross, total or amount of business, If yes, D Did the entity dispose sell or, Form, Annual Report, Yes, Yes, Yes, and Yes, which you'll find crucial to going forward with this form.

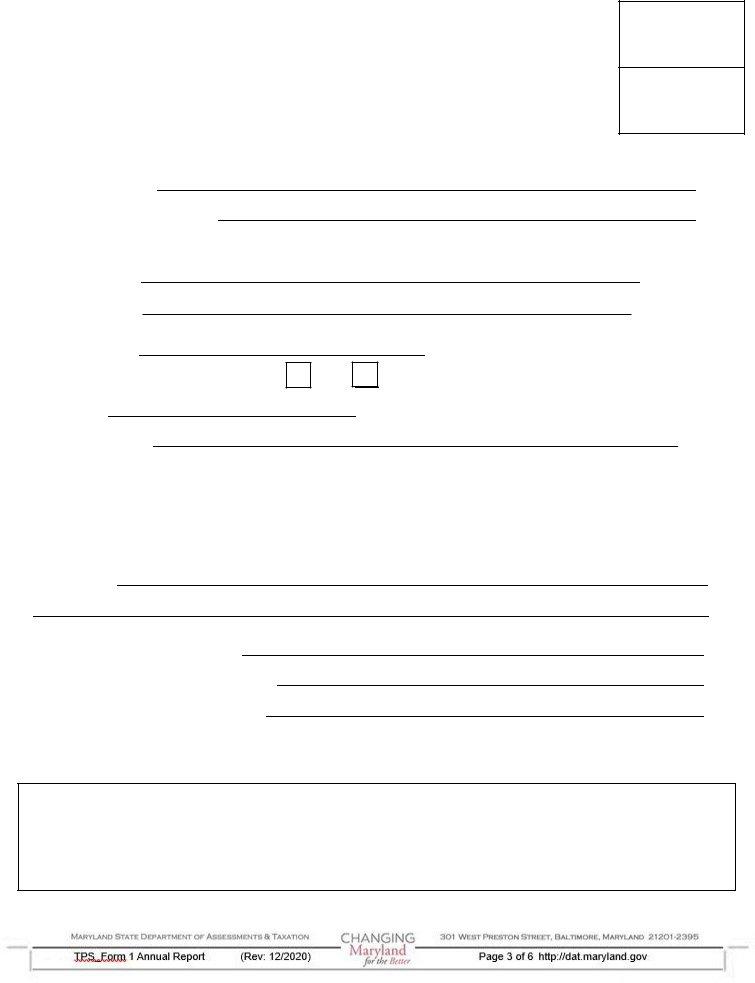

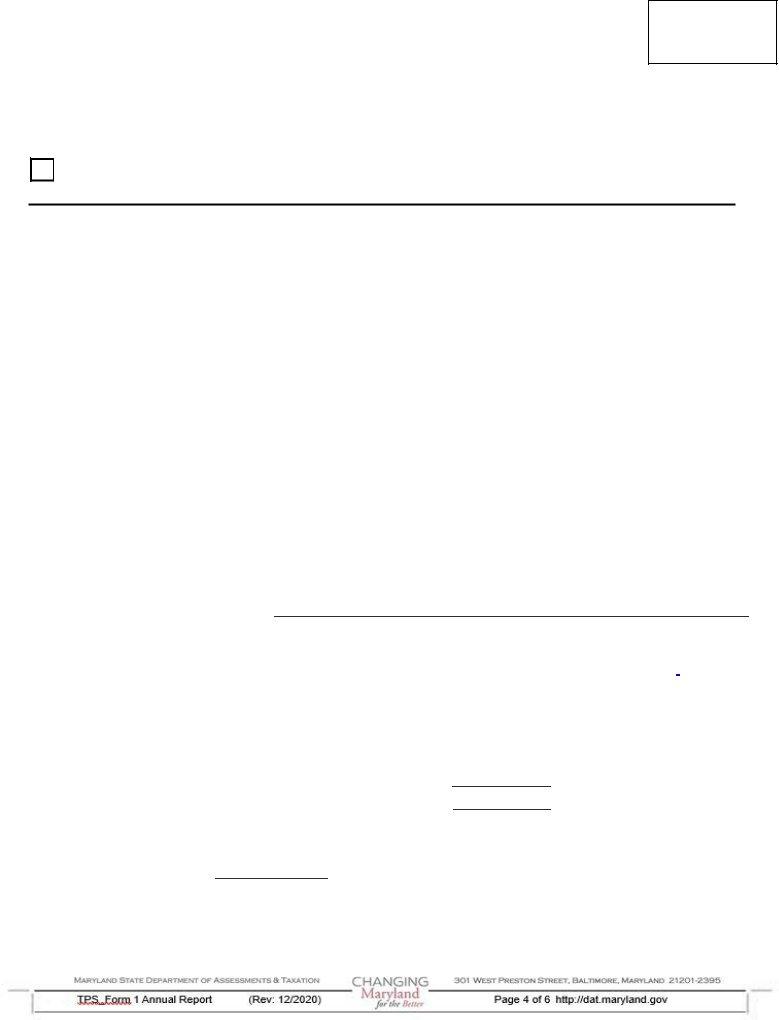

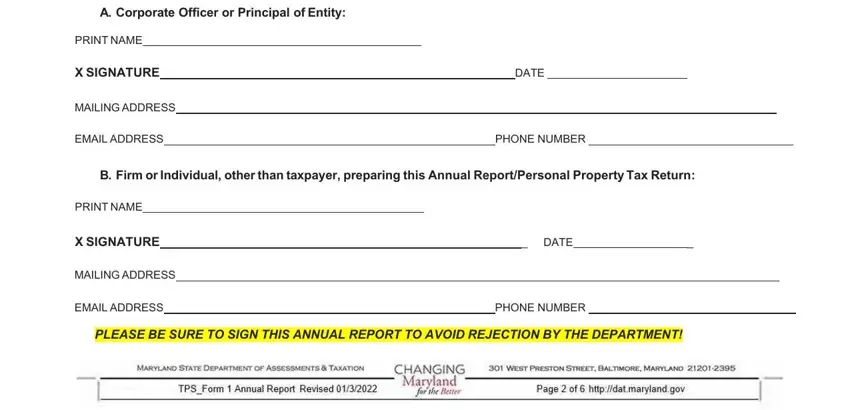

5. To wrap up your form, the last part incorporates a couple of additional fields. Entering A Corporate Officer or Principal, PRINT NAME, X SIGNATURE, MAILING ADDRESS, EMAIL ADDRESS, DATE, PHONE NUMBER, B Firm or Individual other than, PRINT NAME, X SIGNATURE, MAILING ADDRESS, EMAIL ADDRESS, DATE, PHONE NUMBER, and PLEASE BE SURE TO SIGN THIS ANNUAL will conclude the process and you'll definitely be done in a tick!

Step 3: Prior to finalizing your document, double-check that all blank fields were filled out as intended. Once you are satisfied with it, click “Done." After setting up a7-day free trial account with us, you'll be able to download Md Form 1 or send it via email right away. The file will also be available via your personal cabinet with your every modification. At FormsPal.com, we endeavor to be sure that all your details are stored private.