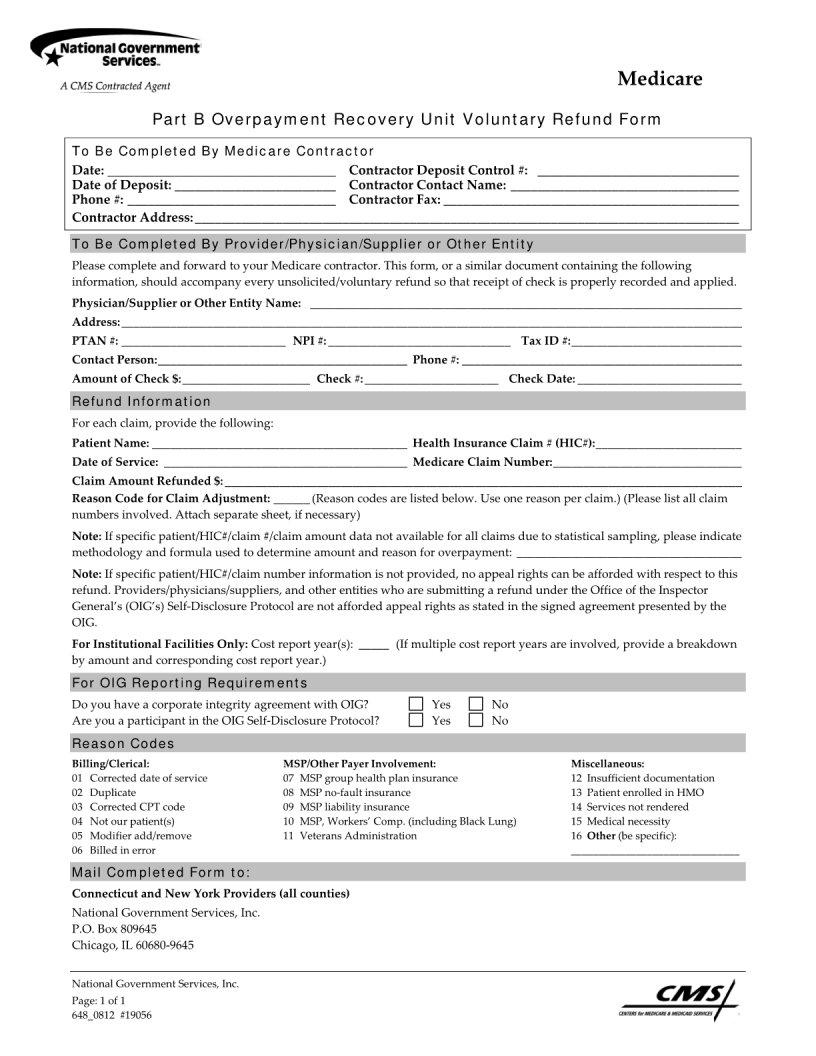

In the United States, health care providers who offer services to Medicare beneficiaries may occasionally receive overpayments for various reasons such as incorrect service codes or billing for services that were not provided. To address this, the Medicare Part B Voluntary Refund form serves as a crucial tool. It allows providers to rectify these discrepancies by voluntarily returning erroneous payments received from Medicare. This process not only facilitates compliance with federal healthcare laws but also helps in maintaining the integrity of the Medicare program. Through the completion and submission of this form, providers can detail the reason for the overpayment and the amount being returned, ensuring transparency and accountability in their billing practices. Additionally, timely submission of the refund can prevent potential penalties and interest charges that could arise from retaining the overpayment beyond the permissible period. The form represents an essential aspect of healthcare providers' obligations to the Medicare program, underscoring the importance of accuracy and honesty in medical billing.

| Question | Answer |

|---|---|

| Form Name | Medicare Part B Voluntary Refund Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | medicare voluntary refund form, refund form ngs, refund form for medicare part b, overpayment recovery unit voluntary refund |