Navigating the complexities of local tax obligations can be challenging for businesses, but the Mesa Transaction Privilege and Use Tax Return form provides a structured approach to fulfilling these duties. This document, integral for reporting and remitting taxes in Mesa, Arizona, breaks down the process into manageable steps. It starts with possible adjustments to the mailing address, then guides businesses through the process of potentially cancelling their license, before moving on to the core of tax reporting. The form requires businesses to delineate their gross income across different classifications—such as retail, construction, or rental—thereby ensuring that taxes are calculated on a basis that reflects the nature of the business and its revenue. Additionally, it allows for specific deductions that can be subtracted from the gross income to determine the net taxable amount, which is then multiplied by the city's tax rate to calculate the tax owed. Further sections of the form address the reporting and payment of use tax, any excess tax collected, and adjustments for penalties, interest, or credits, culminating in the final tax liability. With spaces for necessary signatures and detailed instructions for completing and submitting the form, it serves as a comprehensive tool for businesses to comply with local tax regulations.

| Question | Answer |

|---|---|

| Form Name | Mesa Tpt Return Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 000XXXXXXXXXXX20XX, form, how to fill out city of mesa form tpt 1 rev 06 2009, sales |

Revenue Collections Operations

TRANSACTION PRIVILEGE AND USE TAX RETURN

These instructions should be retained for future reference in completing your transaction privilege and use tax returns.

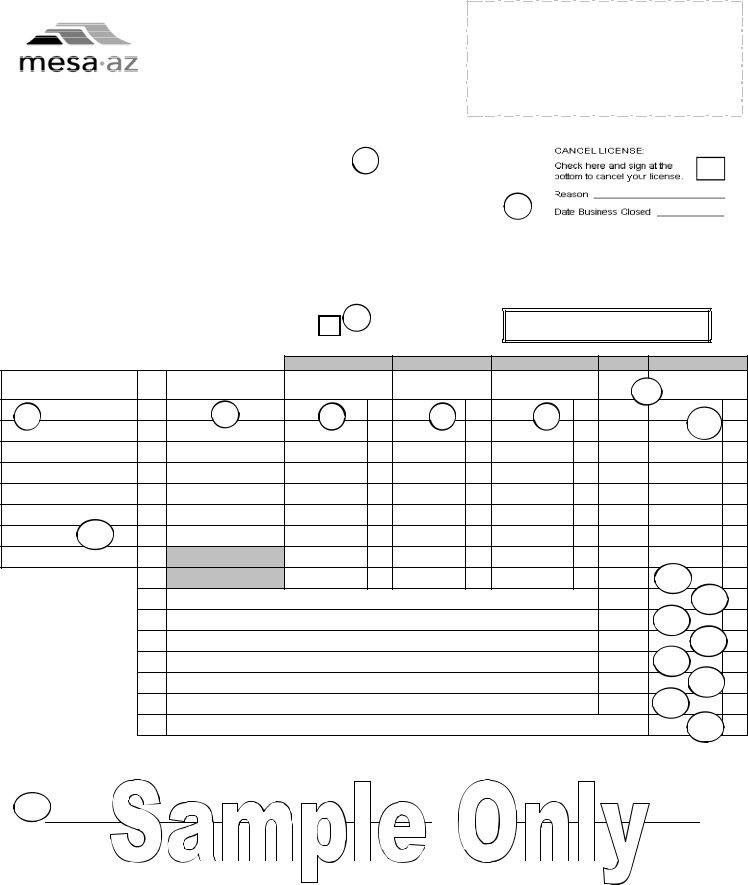

1)If applicable, make any mailing address corrections in this area.

2)If you want to cancel your license check this box and indicate reason.

3)Check this box if you have no taxes to report for the reporting period.

4)Business description: specify the type of business you are reporting taxes for (i.e. rental, retail, construction, etc.).

5)Business class: Find your classification codes by referring to the list of codes on the back of this page.

6)Gross Income (column 1): Enter the gross income, including tax collected, for each applicable business class. If you

report on the cash basis, enter the total amount received, including draws for construction contracting, in the reporting period. If you report on the accrual basis, enter the total amount billed per customer invoices, including progressive billings for construction contracting, in the reporting period.

7)Allowable Deductions (column 2): Enter the total deductions from the back of the return for each applicable business class.

8)Net Taxable (column 3): Subtract total deductions in column 2 from gross income in column 1 and enter here.

9)Tax Rate % (column 4): This is the City of Mesa tax rate which is preprinted on the report form.

10)Tax Amount (column 5): Multiply column 3 (net taxable) by column 4 (tax rate) for each business code and enter here.

11)Line 7: All use tax is to be entered on this line.

12)Line 9: Subtotal all columns here.

13)Line 10: If more tax was collected than is due, enter the city portion of the excess tax collected (from Schedule B).

14)Line 11: Enter the total of lines 9 and 10.

15)Line 12: This is for current late penalty & interest if applicable. Leave this line blank if you want the City to compute and bill you for the penalty and interest. If you want to pay the penalty & interest contact Tax Audit & Collections at

16)Line 13: Enter the total of lines 11 and 12.

17)Line 14: If you received notice from the City of a credit balance, enter the amount to be applied to the tax due. Do

not exceed the total tax due. Submit a copy of the City's credit notice with your return.

18)Line 15: Subtract line 14 from line 13 and enter that amount here.

19)Line 16: Enter the amount of the check.

Make your check payable to the City of Mesa and submit to the City of Mesa with the original tax return. Do not staple the check to the return. If no payment is being made, enter zero.

20) Signature/Date line. THIS IS REQUIRED.

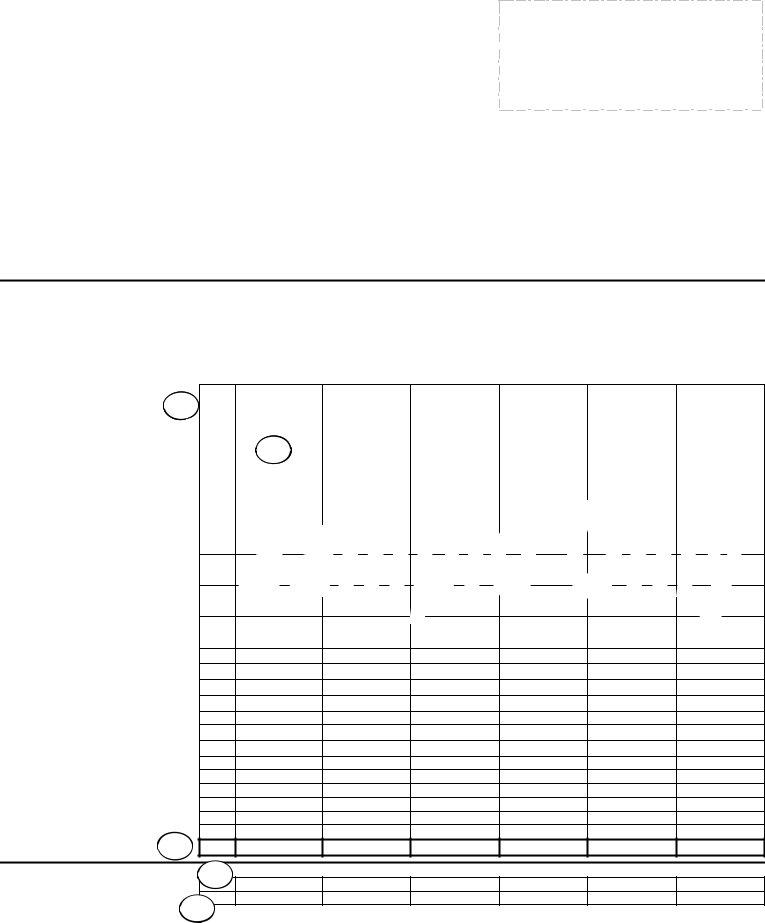

Instructions for back of return

Deduction Detail:

The six columns correspond to the six lines on the front of the return for the business class/description (see step 4, 5).

21)Enter the business class codes to match with the corresponding lines on the front of the return.

22)Enter the amount of each deduction on the appropriate deduction line for each business class.

To the left of the columns are the preprinted deductions. If a deduction, which you are allowed to claim is not listed, enter the name of the deduction on line 17 though 20 in the space provided and enter the amount in the column relating to the business class.

23)Total Deductions: Add each column and enter the sum at the bottom of the return for each column. Transfer the total of each column to the corresponding line in Column 2 on the front of the return.

Schedule B

24)Excess Tax Collected by Business Class: Enter any excess tax collected by business class. Enter this amount on line 10 on the front page of return.

25)Jet Fuel: For jet fuel enter the amount of gallons sold and calculate this amount by .03. Enter this amount on line 10 on the front page of return.

|

|

|

CODE LEGEND |

|

ALLOWABLE DEDUCTION ITEMS |

|

CODE |

RATE |

ACTIVITY |

DEDUCTION ITEMS |

CODE |

EXPLANATION |

|

01 |

1.75% |

Advertising |

52,53,64 |

52 |

Discounts and Refunds (If Included in Gross) |

|

02 |

1.75% |

62,64,70,71 |

53 |

Bad Debts(If Included in Gross) |

|

|

|

|

Speculative |

|

54 |

Sales for Resale (Detail Records Must Be Kept) |

|

03 |

.1% |

*Mining |

52,53,64 |

55 |

Out of State Sales and Leases |

|

04 |

1.75% |

Job Printing |

52,53,54,64,65 |

58 |

Sales and Leases of Prosthetics and |

|

05 |

1.75% |

Publishing |

52,53,54,64 |

|

Prescription Drugs |

|

06 |

1.75% |

Transporting for Hire |

52,53,64 |

59 |

Sales of Motor Vehicle and Use Fuel |

|

07 |

1.75% |

Restaurants/Bars |

52,53,64,65 |

62 |

Out of City Contracting |

|

08 |

1.75% |

Leases and Rentals of |

52,55,58,64,65 |

63 |

Repair Service or Installation Labor |

|

|

|

Tangible Personal Property |

|

|

64 |

State, County and |

|

|

|

|

|

City Tax Collected or Factored (If |

|

|

|

Including Equipment Rentals |

|

|

|

Included in Gross) |

09 |

1.75% |

Rental of Real Property |

53,64 |

65 |

Sales to Qualified Health Care Organizations |

|

10 |

1.75% |

Retail Sales |

52 thru 59,63,64,65,75,76,77 |

70 |

35% Reduction of Gross Receipts |

|

12 |

1.75% |

Amusements |

53,64 |

71 |

Exempt |

|

13 |

1.75% |

Utilities |

53,64,65 |

75 |

50% of Sales to the United States Government |

|

14 |

1.75% |

Telecommunications (Cable |

53,64 |

76 |

Sales of Exempt Machinery and Equipment |

|

|

|

TV and Communications) |

|

77 |

Food For Home Consumption |

|

20 |

1.75% |

Use Tax |

|

Other Deductions Not Otherwise Classified Must Be Itemized |

||

|

|

|

|

(Explained). Use Item Numbers 78 Through 81. |

|

|

*See section |

|

|

|

|

||

TRANSACTION PRIVILEGE AND USE TAX RETURN Revenue Collections Operations

Licensing Office

55 North Center Street

Mesa Arizona 85201

000XXXXXXXXXXX20XX

License No. |

XXXXXXX |

Reporting Period |

month/year |

Due Date |

XX/20/XXXX |

Taxpayer Business Name |

Please indicate mailing address change here. |

|

Taxpayer C/O |

1 |

|

Taxpayer Address |

||

|

||

Taxpayer City/State/ZIP Code |

|

|

|

2 |

|

|

SPECIAL NOTICE |

|

|

|

|

|

Check here and sign at the bottom |

3 |

|

|

if you have no gross receipts to report. |

|

|

|

THIS RETURN IS DUE ON THE 20TH OF THE MONTH

|

|

|

|

Column 1 |

Column 2 |

Column 3 |

Column 4 |

Column 5 |

|

|

|

|

|

|

Allowable pg 2 |

|

x Tax |

|

|

Business Description |

Line |

Bus. Class |

Gross |

- Deductions |

= Net Taxable |

Rate |

9 |

= Tax Amount |

|

4 |

|

1 |

5 |

6 |

7 |

8 |

1.75% |

10 |

|

|

|

|

|

||||||

|

|

2 |

|

|

|

|

1.75% |

||

|

|

|

|

|

|

|

|||

|

|

3 |

|

|

|

|

1.75% |

|

|

|

|

4 |

|

|

|

|

1.75% |

|

|

|

|

5 |

|

|

|

|

1.75% |

|

|

|

|

6 |

|

|

|

|

1.75% |

|

|

USE TAX |

11 |

7 |

20 |

|

|

|

1.75% |

|

|

TOTAL FROM ADDTL PAGES |

8 |

|

|

|

|

1.75% |

|

||

|

|

9 |

SUBTOTAL |

|

|

|

1.75% |

12 |

|

|

|

10 |

(Total from Schedule B) EXCESS CITY TAX COLLECTED/JET FUEL |

Plus |

(+) |

13 |

|||

|

|

11 |

|

|

|

TOTAL TAX DUE |

Equals (=) |

14 |

|

|

|

12 |

|

(see instructions) PENALTY & INTEREST |

Plus |

(+) |

15 |

||

|

|

13 |

|

|

ENTER TOTAL LIABILITY |

Equals (=) |

16 |

||

|

|

14 |

|

(Total from Schedule B) CREDIT TO BE APPLIED |

Minus |

17 |

|||

|

|

15 |

|

|

ENTER NET AMOUNT DUE |

Equals (=) |

18 |

||

|

|

16 |

|

|

ENTER TOTAL AMOUNT PAID |

|

|

19 |

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

20

Taxpayer's Signature |

|

Date |

Paid Preparer's Signature |

||

|

|

|

|

|

|

Print Name |

|

Phone # |

Print Paid Preparer's Name |

||

A SIGNATURE IS REQUIRED TO MAKE THIS RETURN VALID |

Mailing Address |

||||

Return original with remittance in envelope provided. |

PO Box 16350 |

||||

Please make check payable to: CITY OF MESA |

Mesa Arizona |

||||

Complete both sides of form.

DUE DATE: The due date for the city privilege tax is the 20th of the month following the reporting period. A return is considered timely if received by the last business day of the month. A business day is any day except Friday, Saturday, Sunday, or legal city holiday.

PENALTIES: 1. Failure to File - A penalty of 5% of the tax due will be assessed for each month, or fraction elapsing between the delinquency date of the return and the date on which it is filed. Filing your return on time, whether or not you pay the tax due, will avoid the late filing penatly.

2.Failure to Pay - A penalty of 10% of the unpaid tax will be assessed if the tax is not paid timely.

3.Total Penalty - Total penalties assessed will not exceed 25%.

INTEREST: Mesa's interest rate is the same as the State rate and continues to accrue until taxes are paid. This interest rate is subject to change on a quarterly basis as established by the I.R.S. CHECK YOUR RETURN: Check the amounts recorded by type of income for each line item as follows.

*Itemized deductions equal the total deductions recorded.

*Taxable income equals gross income less total deductions.

*Tax due is equal to the amount obtained by applying the preprinted tax rate to the taxable income amount.

*Total tax due equals tax due plus any excess tax collected.

FOR ASSISTANCE, CALL: City of

SCHEDULE A - DETAILS OF DEDUCTIONS: Enter below the deductions and exclusions you used in computing your city transaction privilege tax or use tax. You must keep a detailed record of all deductions and exclusions. Failure to maintain proper documentation and records required by city ordinance may result in their dissallowance. A separate detail of city records and documentation must be maintained only when the income, deductions or exemptions are different from state requirements.

Please note: Not all deductions are available to all business classifications.

NOTE: The line numbers at the top of each column below correspond with the line numbers of the business descriptions listed on the front page.

21

1.Total tax collected or factored (State, county and city)

2.Bad debts on which tax was paid

RETAIL & PERS. PROP. RENTALS

3.Sales for resale

4.Repair, service, or installation labor

5.Discounts and refunds

6.Sales to qualified health care org.

SALES TO U.S. GOVERNMENT

7.By retailer 50% deductible

8.By manufacturer and repairer (100% deductible)

9.

CONSTRUCTION CONTRACTING

10.35% reduction of gross receipts

11.Exempt

12.

OTHER DEDUCTIONS

13.Sales of motor vehicle and use fuel.

14.Sales of exempt machinery & equip.

15.Prescription drugs/prosthetics

16.Food for home consumption

17.Other (explain) _______________

18.Other (explain) _______________

19.Other (explain) _______________

20.Other (explain) _______________

|

Bus. Class |

Bus. Class |

Bus. Class |

Bus. Class |

Bus. Class |

Bus. Class |

Code |

|

|

|

|

|

|

|

LINE 1 |

LINE 2 |

LINE 3 |

LINE 4 |

LINE 5 |

LINE 6 |

64 |

22 |

|

|

|

|

|

53 |

|

|

|

|

|

|

54 |

|

|

|

|

|

|

63 |

|

|

|

|

|

|

52 |

|

|

|

|

|

|

65 |

|

|

|

|

|

|

75

75

55

70

71

62

59

76

58

77

78

79

80

81

Total Deductions |

23 |

SCHEDULE B |

24 |

|

Excess Tax Collected by Business Class |

||

|

||

Allowable Credits by Business Class |

|

|

Jet Fuel ________gals. X .03= |

25 >>> transfer this amount to line 10 on front page. |