There isn't anything hard regarding working with the metlife life insurance claim using our PDF editor. By taking these simple steps, you're going to get the ready PDF file in the minimum time period possible.

Step 1: On the following website page, select the orange "Get form now" button.

Step 2: You can now change the metlife life insurance claim. You may use the multifunctional toolbar to add, eliminate, and change the content material of the file.

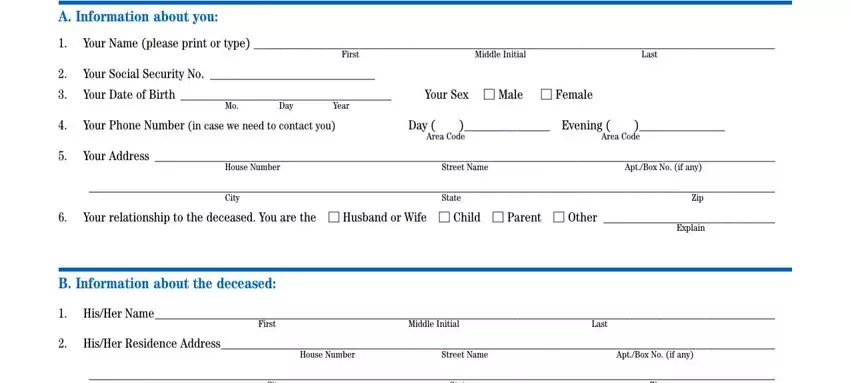

Provide the requested content in every single segment to fill out the PDF metlife life insurance claim

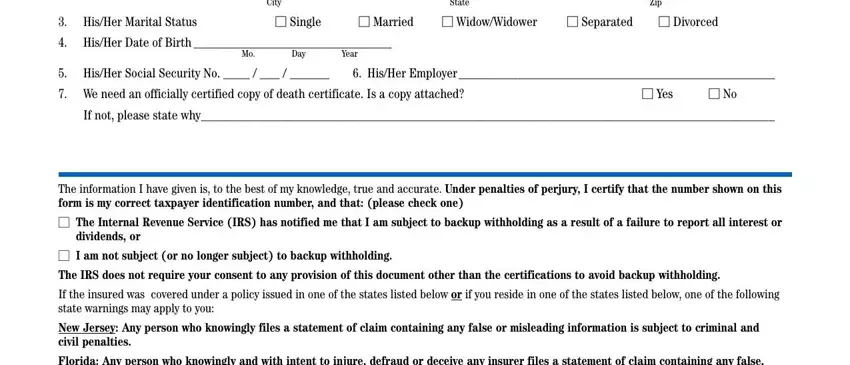

Write down the required particulars in City, State, Zip, His, Her, Marital, Status Single, Married, Widow, Widower Separated, Divorced, His, Her, DateofBirth Day, Year, His, Her, Social, Security, No His, Her, Employer and Yes section.

Type in any details you need in the space Beneficiary, Signature and Date.

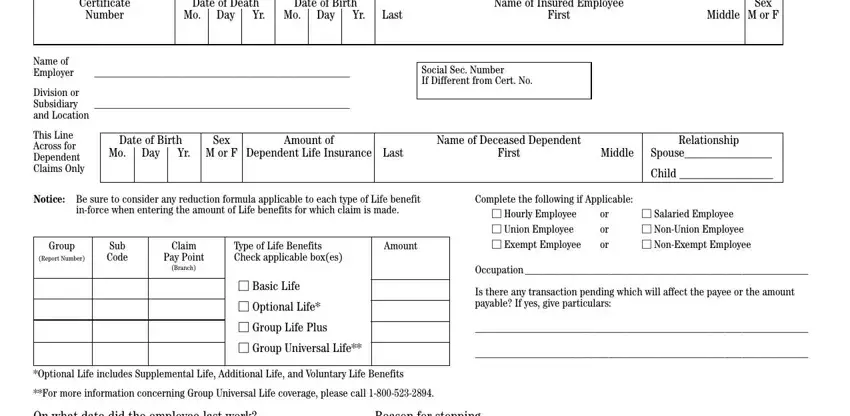

In the box Certificate, Number, Date, of, Death Day, DateofBirth, Day, Last, Name, of, Insured, Employee First, Sex, Middle, Mor, F Name, of, Employer Division, or, Subsidiary, and, Location DateofBirth, and Sex, record the rights and obligations of the sides.

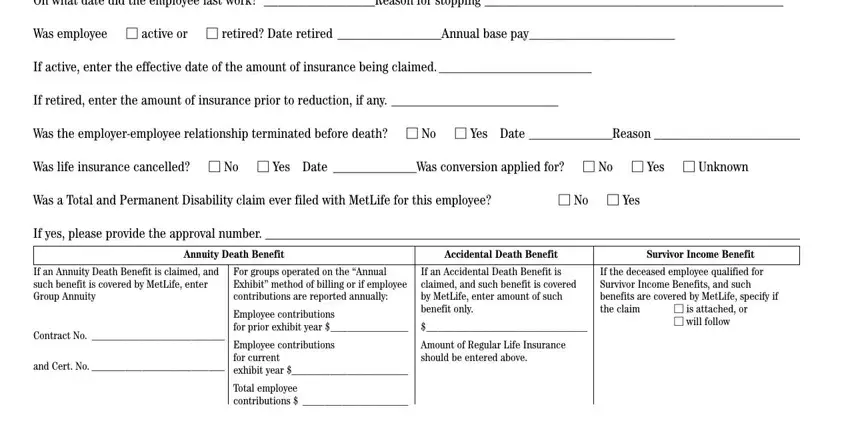

Look at the sections NoYes, If, yes, please, provide, the, approval, number Annuity, Death, Benefit Accidental, Death, Benefit Survivor, Income, Benefit Contract, No and, Cert, No Total, employee, contributions is, attached, or, will, follow Date, and Telephone, No and next fill them in.

Step 3: Click the "Done" button. Then, you may transfer the PDF file - upload it to your electronic device or deliver it by using electronic mail.

Step 4: It's going to be more convenient to keep copies of the file. You can rest assured that we won't display or check out your data.