In case you would like to fill out FHLMC, it's not necessary to install any kind of programs - simply make use of our PDF tool. The editor is consistently improved by our staff, acquiring awesome features and becoming a lot more convenient. Starting is simple! Everything you need to do is adhere to the following easy steps down below:

Step 1: Press the "Get Form" button above on this webpage to open our PDF tool.

Step 2: When you start the PDF editor, you'll see the form ready to be filled out. In addition to filling out different blank fields, you can also perform some other things with the file, that is putting on your own textual content, changing the initial textual content, adding graphics, placing your signature to the PDF, and a lot more.

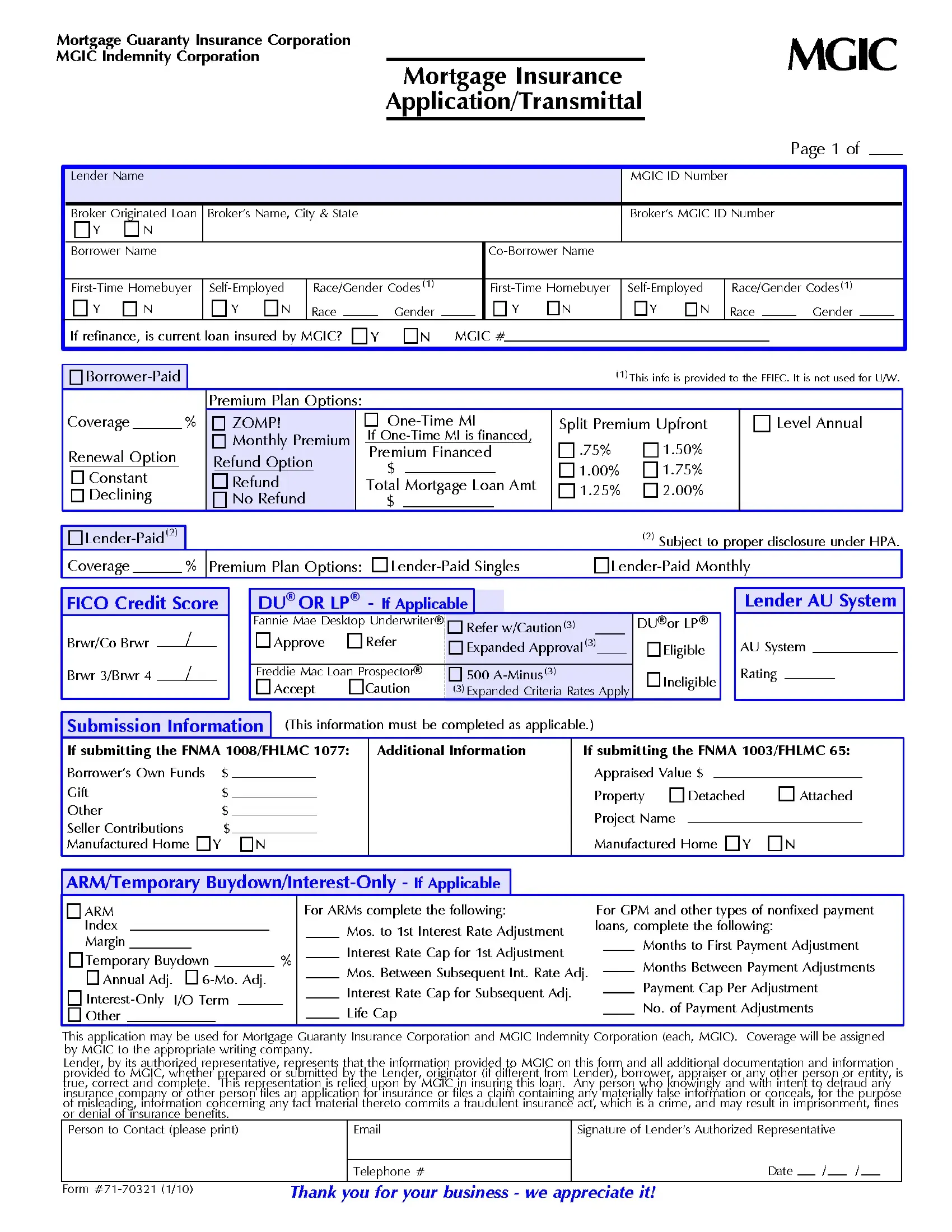

This PDF requires particular details to be typed in, thus you should take whatever time to enter what's required:

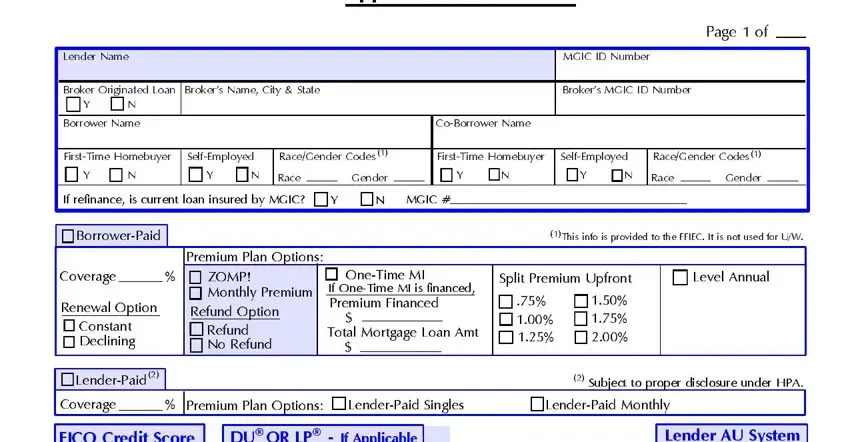

1. The FHLMC involves specific details to be inserted. Ensure that the following fields are complete:

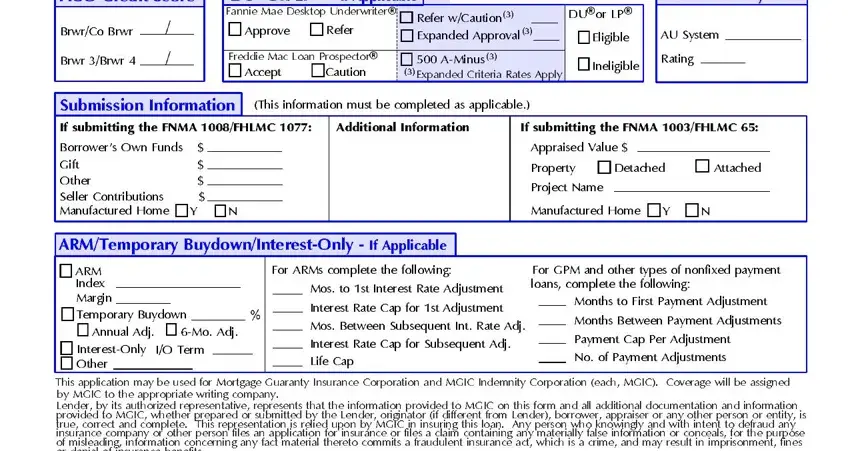

2. The subsequent part is usually to fill out the next few blank fields: FICO Credit Score, BrwrCo Brwr, Brwr Brwr, DU OR LP Fannie Mae Desktop, If Applicable, Approve, Refer, Refer wCaution Expanded Approval, Freddie Mac Loan Prospector Caution, Accept, AMinus Expanded Criteria Rates, Lender AU System, DU or LP, Eligible, and AU System.

You can potentially make an error when filling out your AU System, hence make sure to look again prior to when you finalize the form.

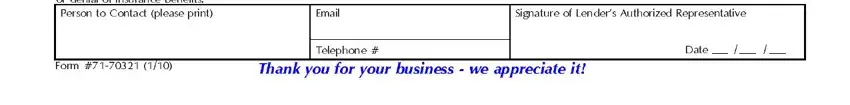

3. This next segment is all about This application may be used for, Signature of Lenders Authorized, Email, Form, Thank you for your business we, Telephone, and Date - fill out all of these blanks.

Step 3: Check all the information you have inserted in the blank fields and click the "Done" button. Try a 7-day free trial subscription with us and gain immediate access to FHLMC - readily available inside your personal account. With FormsPal, you can certainly fill out documents without having to worry about database breaches or records getting distributed. Our secure system makes sure that your private details are kept safely.