Any time you would like to fill out MI-1040CR-5, you won't need to install any sort of applications - simply try using our online tool. The editor is constantly maintained by our team, acquiring new awesome functions and turning out to be greater. Starting is effortless! What you need to do is adhere to the next basic steps below:

Step 1: Press the "Get Form" button above. It will open our pdf editor so you can start completing your form.

Step 2: Once you launch the online editor, you'll see the document ready to be filled out. Apart from filling in various blank fields, you can also do other actions with the form, that is putting on your own words, changing the original text, inserting illustrations or photos, affixing your signature to the document, and much more.

This PDF doc will need specific details; in order to guarantee consistency, make sure you take heed of the recommendations below:

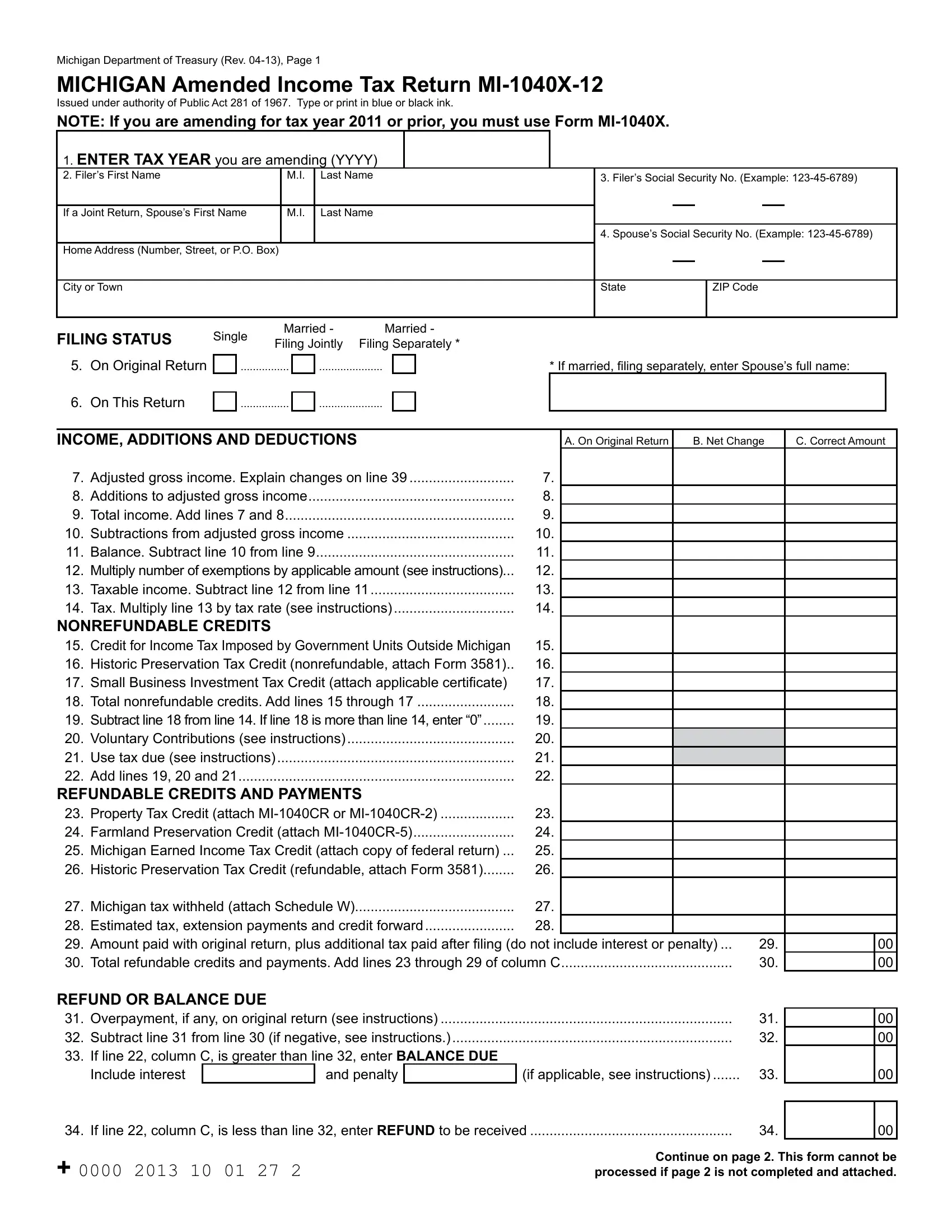

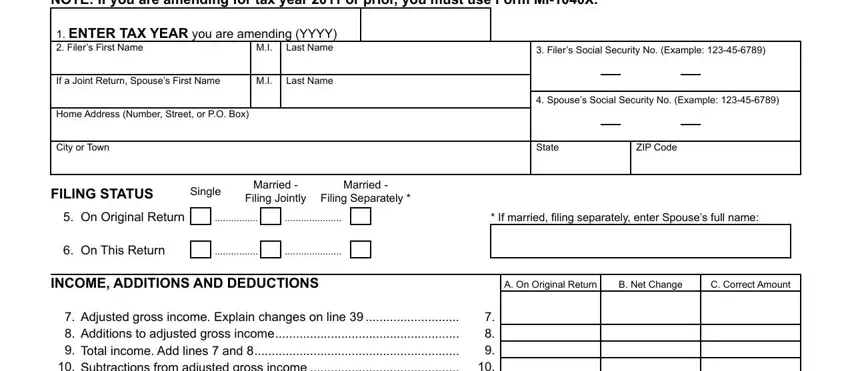

1. It's important to fill out the MI-1040CR-5 accurately, thus be mindful while filling out the segments comprising all these blank fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Adjusted gross income Explain, NONREFUNDABLE CREDITS, Credit for Income Tax Imposed by, REFUNDABLE CREDITS AND PAYMENTS, Property Tax Credit attach MICR, and Michigan tax withheld attach with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

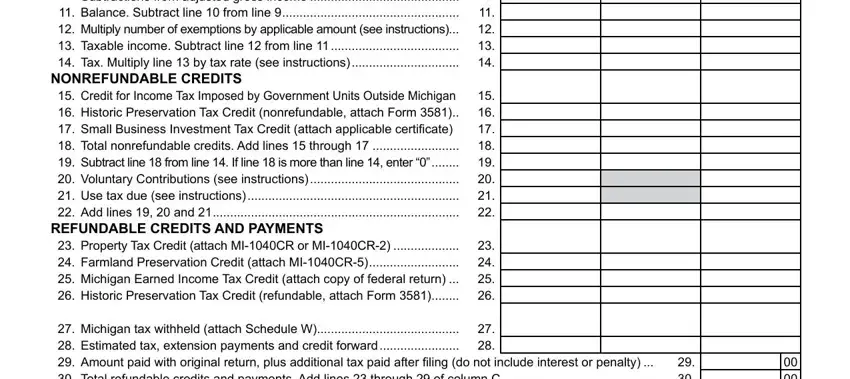

3. The next segment should be quite straightforward, REFUND OR BALANCE DUE, Overpayment if any on original, Include interest, and penalty, if applicable see instructions, If line column C is less than, and Continue on page This form cannot - every one of these fields will have to be filled in here.

Be really mindful when filling in Include interest and and penalty, as this is the section in which most users make errors.

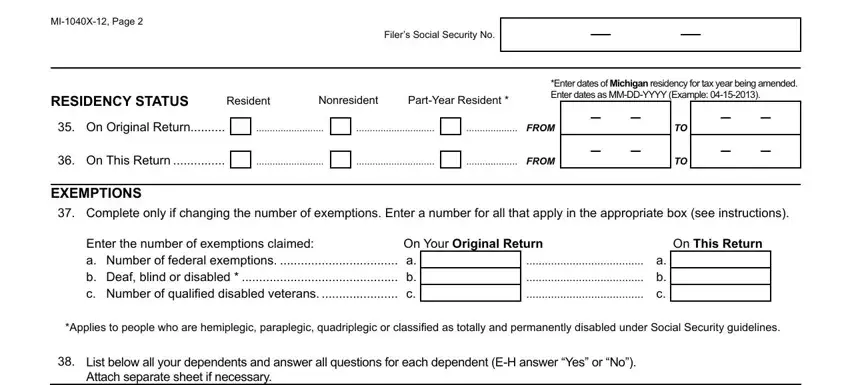

4. This next section requires some additional information. Ensure you complete all the necessary fields - MIX Page, Filers Social Security No, RESIDENCY STATUS, Resident, Nonresident, PartYear Resident, Enter dates of Michigan residency, On Original Return, FROM, On This Return, FROM, EXEMPTIONS, Complete only if changing the, Enter the number of exemptions, and a b c - to proceed further in your process!

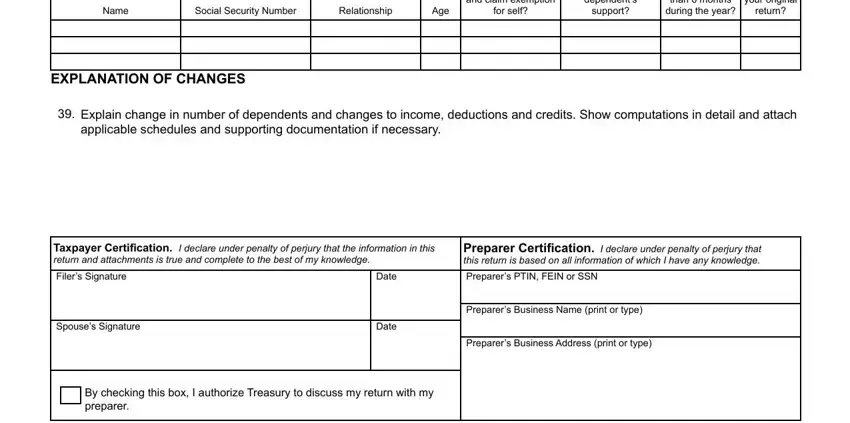

5. This form must be finalized by dealing with this area. Below there is a detailed listing of form fields that must be filled out with specific information in order for your form submission to be faultless: Name, Social Security Number, Relationship, Age, for self, Did the dependent ile a federal, dependents, support, dependent live with you more than, Was this dependent claimed on your, return, EXPLANATION OF CHANGES, Explain change in number of, applicable schedules and, and Taxpayer Certiication I declare.

Step 3: Check all the details you have entered into the form fields and hit the "Done" button. After registering afree trial account here, you'll be able to download MI-1040CR-5 or email it promptly. The form will also be readily accessible from your personal account with your every single change. FormsPal offers risk-free form editing with no data record-keeping or sharing. Feel safe knowing that your details are in good hands with us!