Using the online PDF editor by FormsPal, you are able to complete or change renew indian passport in riyadh here and now. The editor is consistently improved by us, receiving additional features and turning out to be greater. It merely requires a couple of simple steps:

Step 1: Simply click the "Get Form Button" in the top section of this site to get into our pdf form editor. Here you'll find everything that is needed to fill out your document.

Step 2: With this state-of-the-art PDF file editor, you're able to accomplish more than simply fill out blank form fields. Express yourself and make your forms seem perfect with customized text put in, or adjust the original input to perfection - all backed up by the capability to insert any type of images and sign it off.

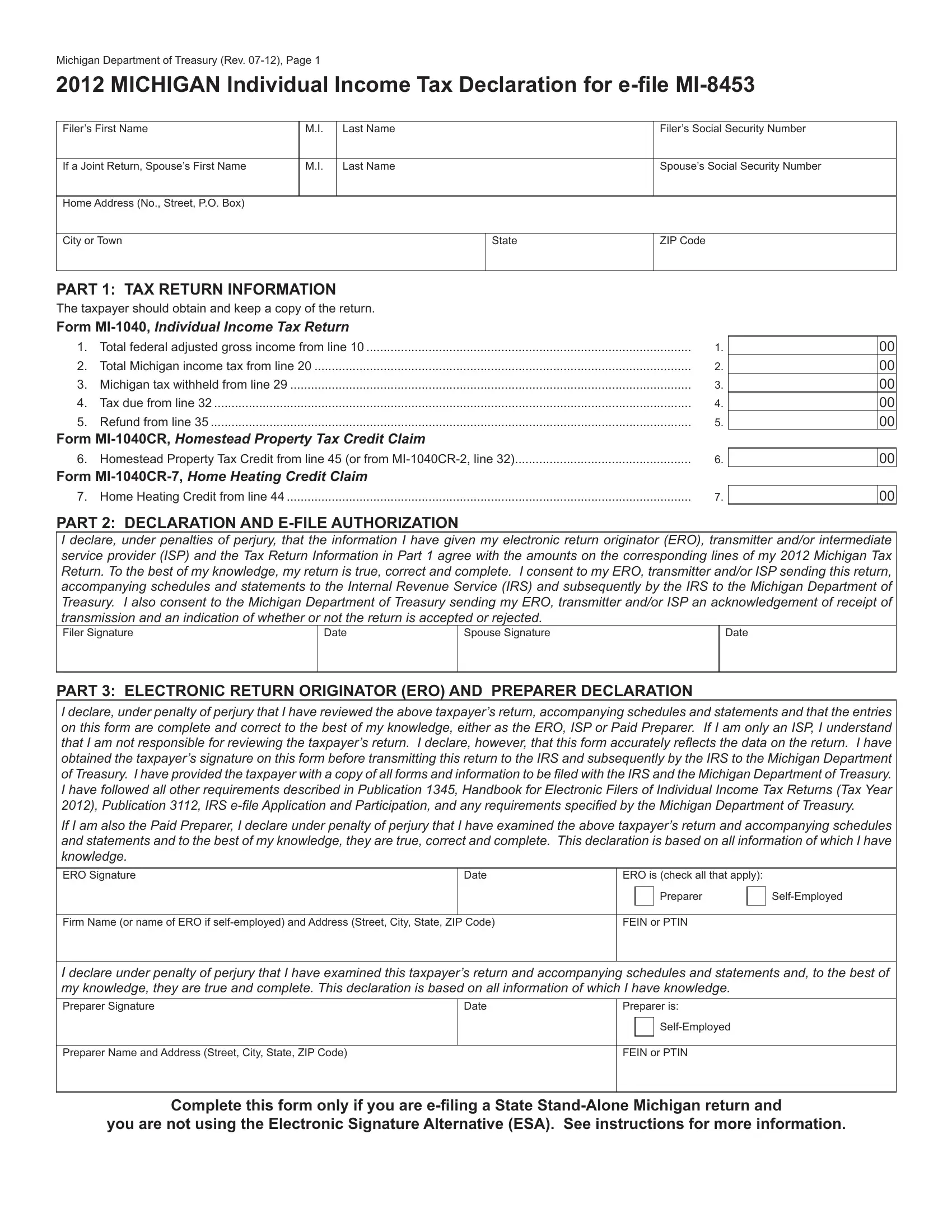

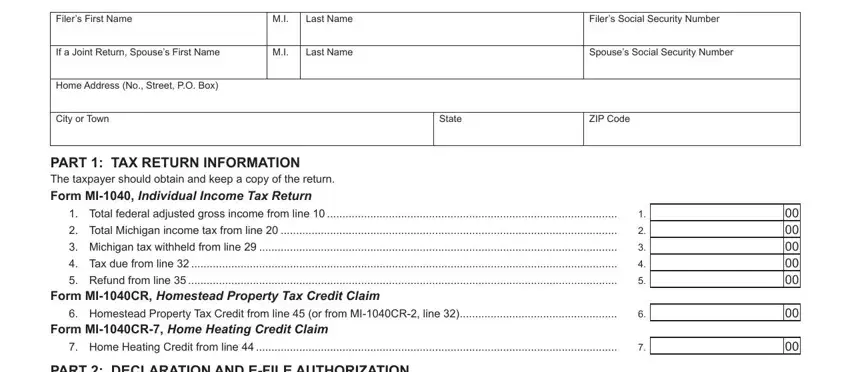

This PDF form will require specific information to be filled out, so you need to take your time to type in precisely what is required:

1. When filling in the renew indian passport in riyadh, be sure to incorporate all of the essential blanks within its corresponding form section. This will help facilitate the process, making it possible for your details to be processed without delay and appropriately.

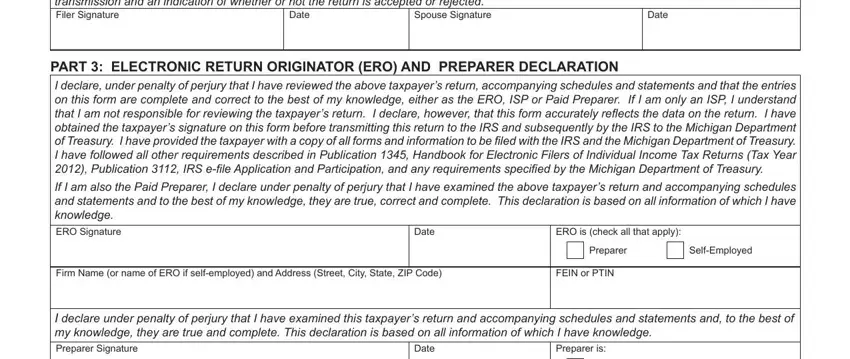

2. Immediately after this selection of fields is completed, go to enter the applicable details in these: PART DECLARATION AND EFILE, Date, Date, PART ELECTRONIC RETURN ORIGINATOR, ERO Signature, Date, ERO is check all that apply, Preparer, SelfEmployed, Firm Name or name of ERO if, FEIN or PTIN, I declare under penalty of perjury, Preparer is, and Date.

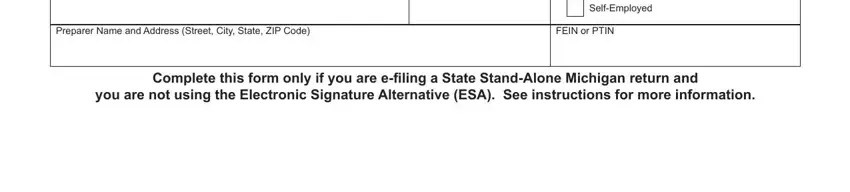

3. This next segment is all about Preparer Name and Address Street, SelfEmployed, FEIN or PTIN, Complete this form only if you are, and you are not using the Electronic - fill in each one of these blank fields.

When it comes to SelfEmployed and you are not using the Electronic, ensure you get them right in this section. Both these are certainly the key fields in the form.

Step 3: Before finalizing your document, double-check that all form fields have been filled in properly. Once you are satisfied with it, click on “Done." Right after getting a7-day free trial account here, you will be able to download renew indian passport in riyadh or email it immediately. The PDF file will also be readily accessible via your personal account menu with your every edit. FormsPal is devoted to the confidentiality of our users; we make sure all personal information coming through our editor is kept secure.