Working with PDF documents online can be a piece of cake using our PDF editor. You can fill in w 4p michigan here effortlessly. Our editor is constantly developing to deliver the very best user experience achievable, and that's thanks to our commitment to constant development and listening closely to user feedback. By taking a couple of simple steps, it is possible to start your PDF journey:

Step 1: First of all, open the editor by pressing the "Get Form Button" above on this page.

Step 2: As you start the PDF editor, there'll be the form prepared to be filled in. Aside from filling out different blanks, you may also do other actions with the form, that is putting on your own text, editing the original textual content, adding illustrations or photos, placing your signature to the form, and more.

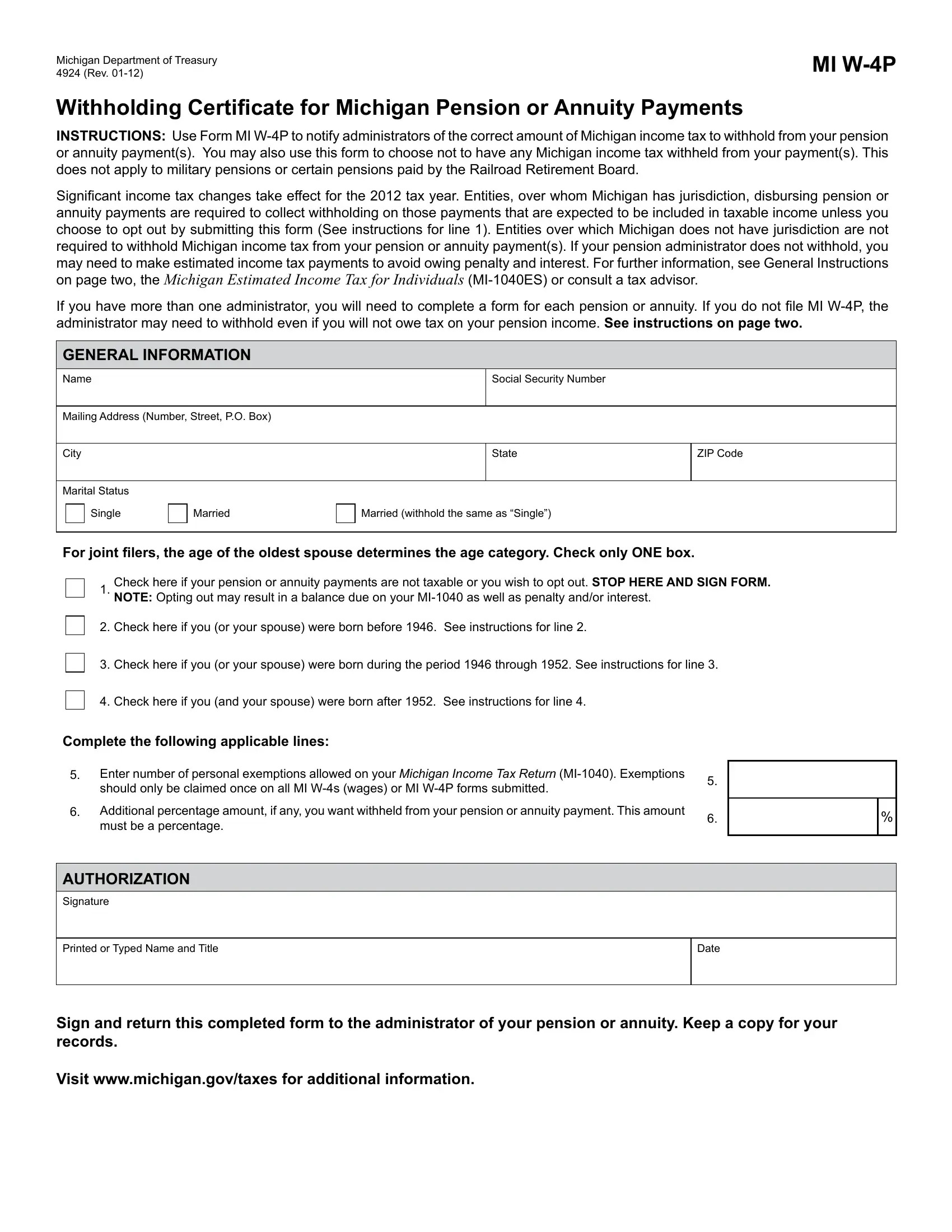

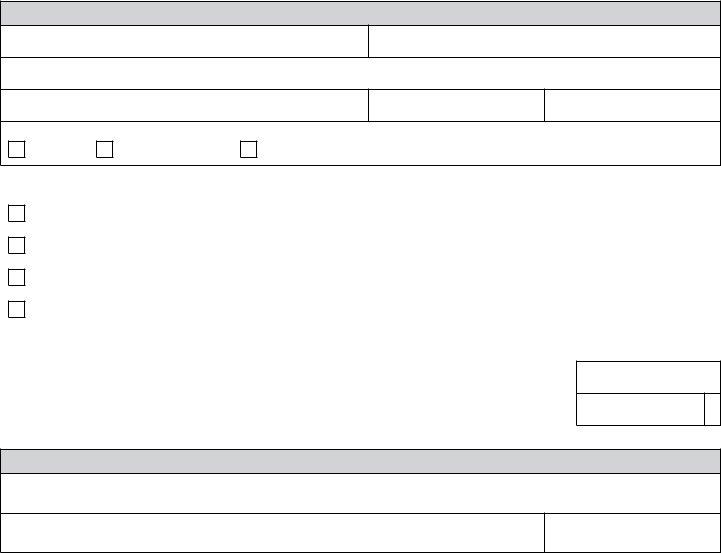

This PDF doc will require specific details; to guarantee correctness, please be sure to adhere to the recommendations hereunder:

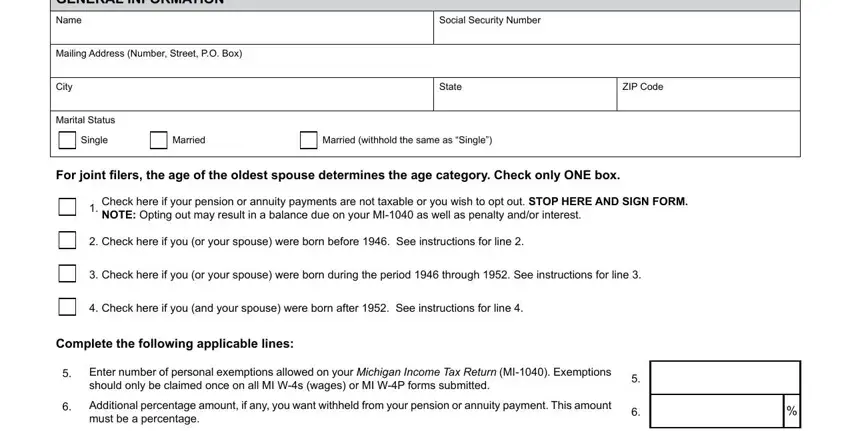

1. First of all, while filling out the w 4p michigan, start with the form section that has the next blanks:

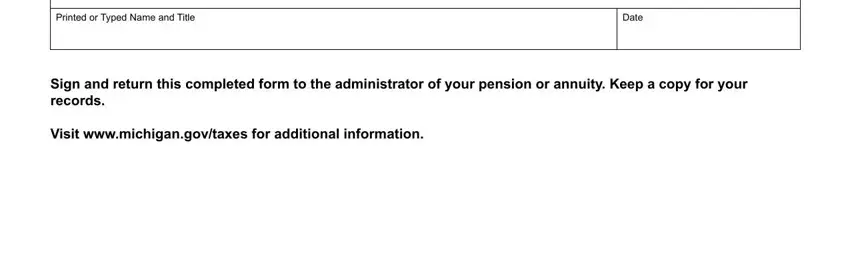

2. The next stage is to fill in the next few blank fields: Printed or Typed Name and Title, Date, Sign and return this completed, and Visit wwwmichigangovtaxes for.

Be very mindful while completing Visit wwwmichigangovtaxes for and Sign and return this completed, as this is the section in which most people make mistakes.

Step 3: After double-checking the fields and details, click "Done" and you're good to go! Go for a 7-day free trial subscription at FormsPal and acquire instant access to w 4p michigan - accessible inside your personal account. Here at FormsPal.com, we strive to be sure that all your information is stored protected.