Handling PDF files online is always super easy with this PDF editor. You can fill in form 1353 online here in a matter of minutes. We at FormsPal are dedicated to giving you the perfect experience with our tool by consistently presenting new features and improvements. Our tool has become much more helpful thanks to the most recent updates! So now, editing PDF files is easier and faster than ever before. All it requires is a couple of basic steps:

Step 1: Click on the "Get Form" button above on this webpage to get into our tool.

Step 2: With our state-of-the-art PDF file editor, you are able to accomplish more than merely complete blank form fields. Try all the functions and make your forms appear sublime with custom text incorporated, or fine-tune the original content to perfection - all that comes along with the capability to insert your personal images and sign the document off.

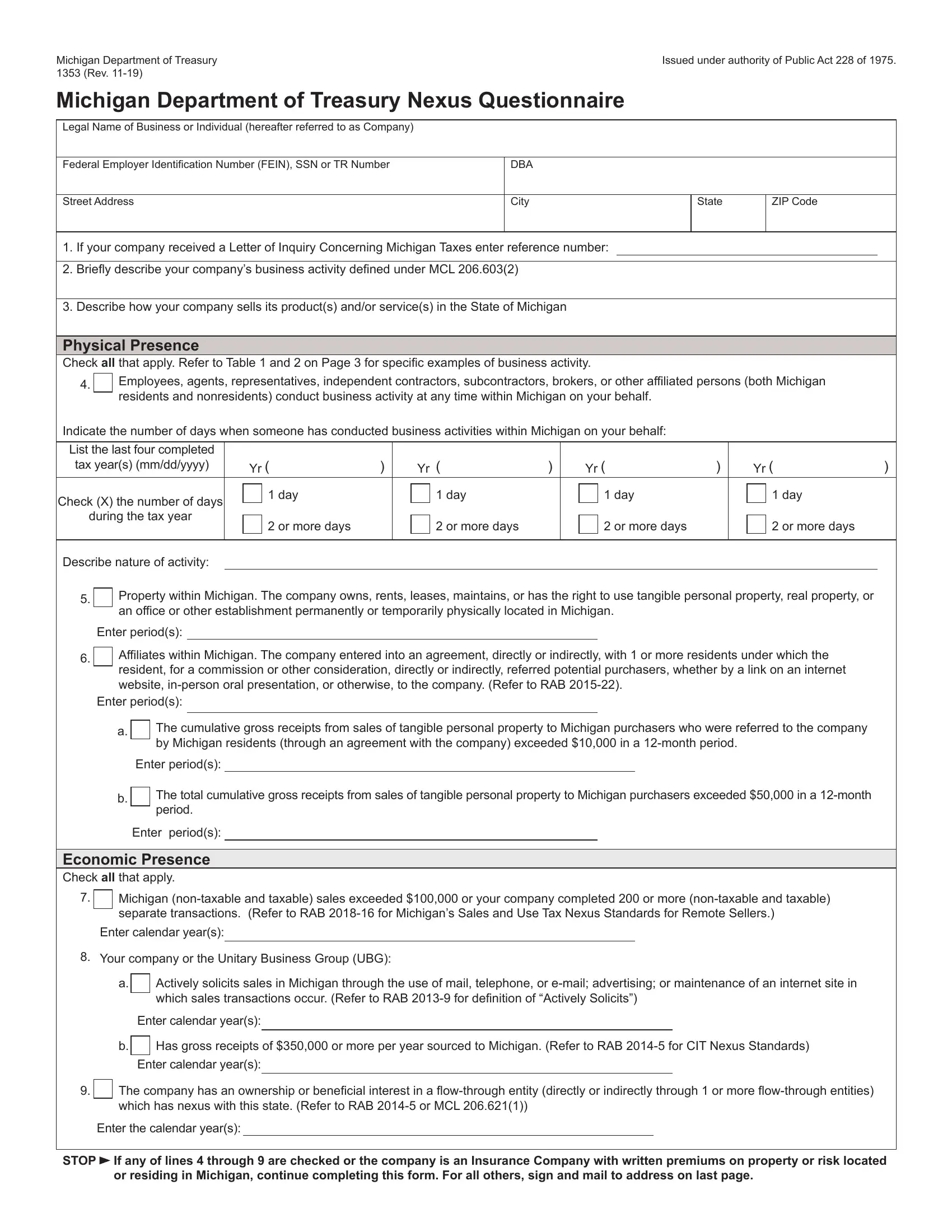

This PDF form requires specific data to be filled in, so be sure to take whatever time to fill in what's expected:

1. It's important to complete the form 1353 online correctly, therefore pay close attention when filling out the sections containing these specific blank fields:

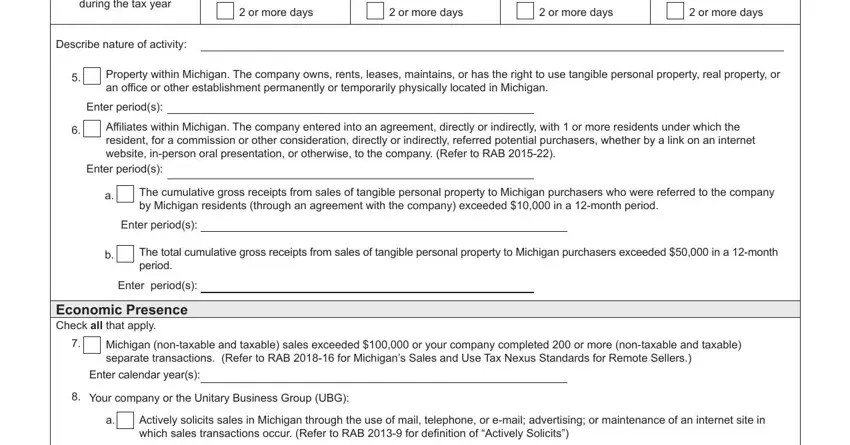

2. The next step is to fill out these fields: during the tax year, Describe nature of activity, or more days, or more days, or more days, or more days, Property within Michigan The, Enter periods, Affiliates within Michigan The, Enter periods, The cumulative gross receipts from, Enter periods, The total cumulative gross, Enter periods, and Economic Presence Check all that.

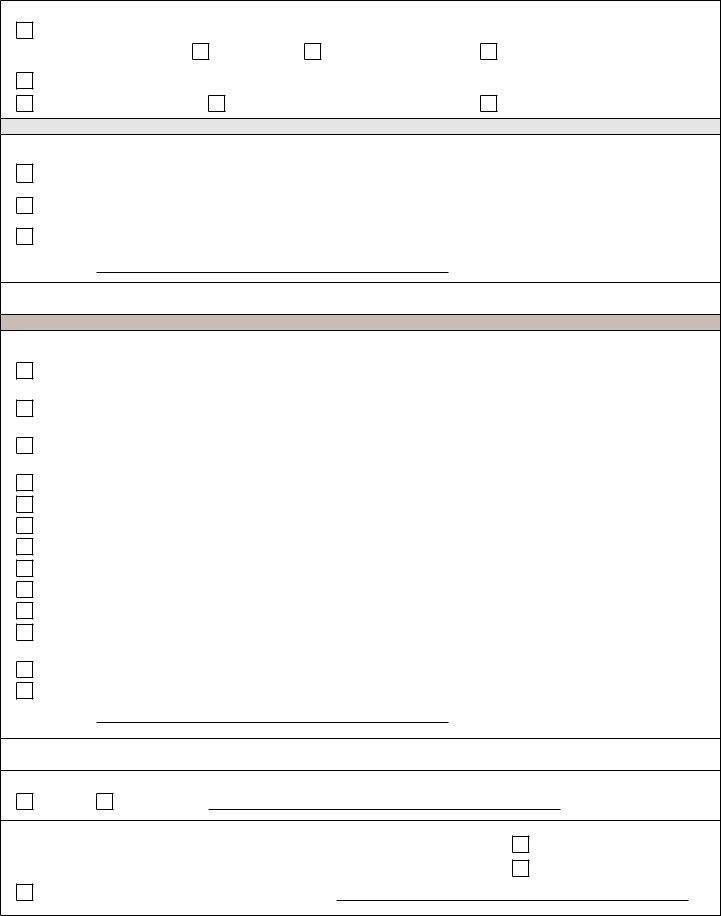

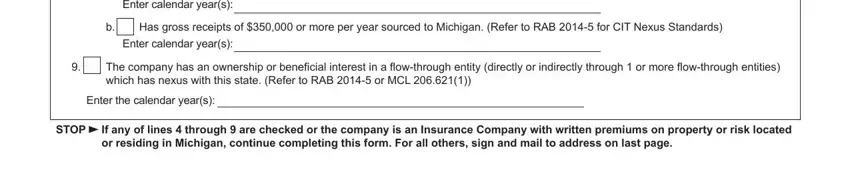

3. The following part is considered pretty easy, Enter calendar years, Has gross receipts of or more per, Enter calendar years, The company has an ownership or, Enter the calendar years, STOP, and If any of lines through are - every one of these form fields needs to be filled in here.

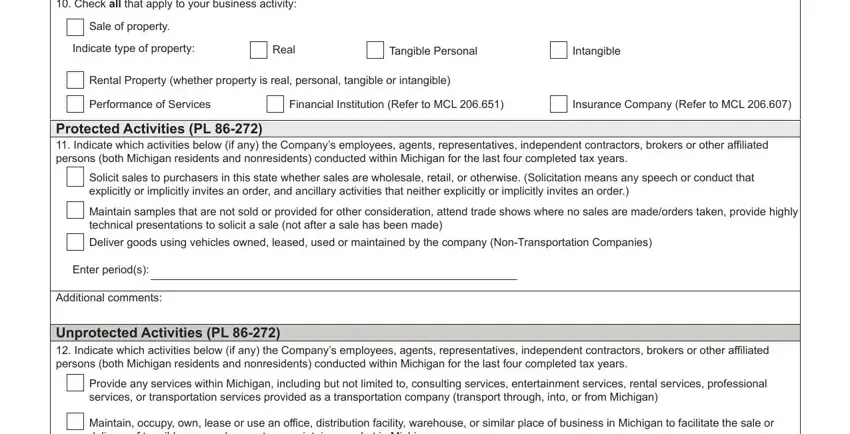

4. To go forward, your next section involves typing in a few blanks. Included in these are Page Check all that apply to, Sale of property, Indicate type of property, Real, Tangible Personal, Intangible, Rental Property whether property, Performance of Services, Financial Institution Refer to MCL, Insurance Company Refer to MCL, Protected Activities PL Indicate, Solicit sales to purchasers in, Enter periods, Additional comments, and Unprotected Activities PL, which you'll find essential to carrying on with this document.

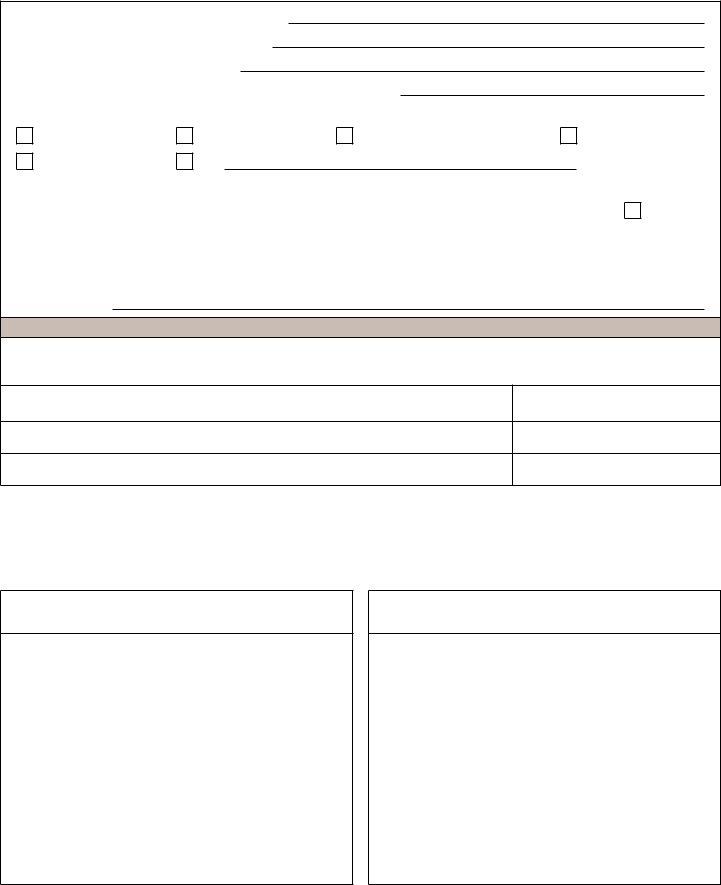

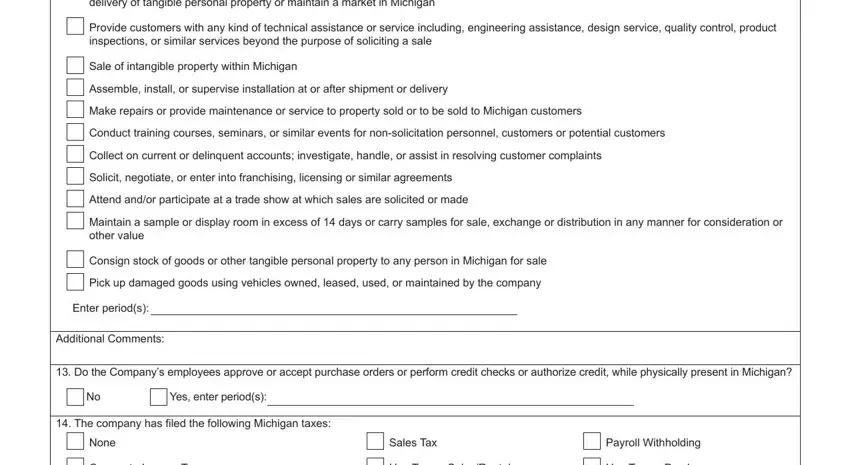

5. Since you come near to the completion of the file, there are several extra things to do. Notably, Maintain occupy own lease or use, Provide customers with any kind of, Sale of intangible property within, Make repairs or provide, Conduct training courses seminars, Attend andor participate at a, Maintain a sample or display room, Consign stock of goods or other, Pick up damaged goods using, Enter periods, Additional Comments, Do the Companys employees approve, Yes enter periods, The company has filed the, and None should all be filled out.

Regarding Maintain occupy own lease or use and The company has filed the, make certain you do everything right in this section. These are the key fields in this file.

Step 3: Before moving on, check that all form fields are filled in as intended. The moment you verify that it is good, press “Done." Try a 7-day free trial account at FormsPal and get immediate access to form 1353 online - download or edit in your personal account. Whenever you work with FormsPal, you can easily complete forms without needing to get worried about personal information leaks or records getting distributed. Our secure system helps to ensure that your personal information is kept safely.