Michigan Form 3891 can be completed in no time. Just make use of FormsPal PDF editor to do the job fast. We at FormsPal are focused on providing you the absolute best experience with our tool by constantly introducing new features and enhancements. With all of these improvements, using our tool gets easier than ever! To get started on your journey, consider these easy steps:

Step 1: Firstly, open the editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This editor enables you to modify the majority of PDF forms in various ways. Transform it by adding your own text, adjust what's already in the file, and place in a signature - all when it's needed!

Pay attention when completing this pdf. Ensure that all necessary blanks are done accurately.

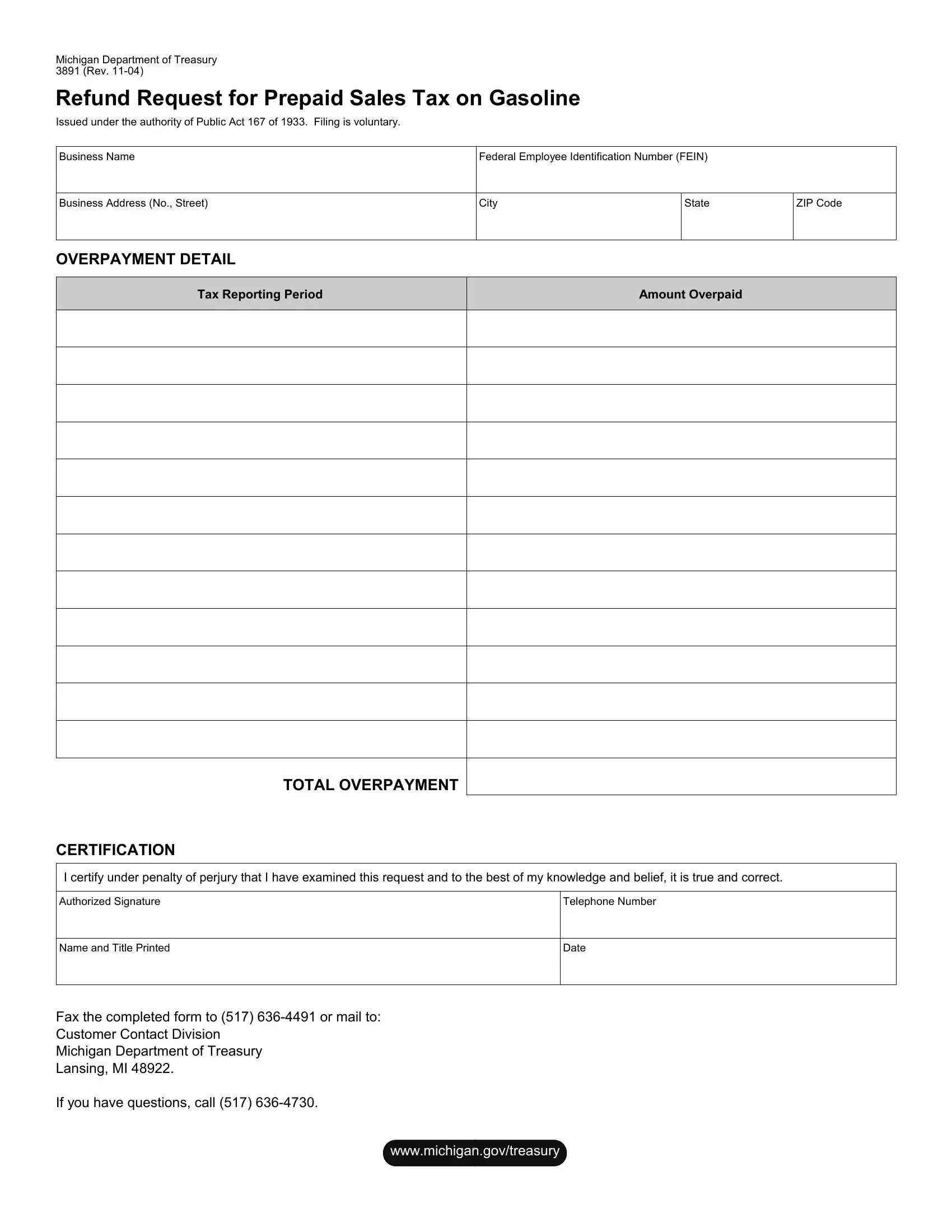

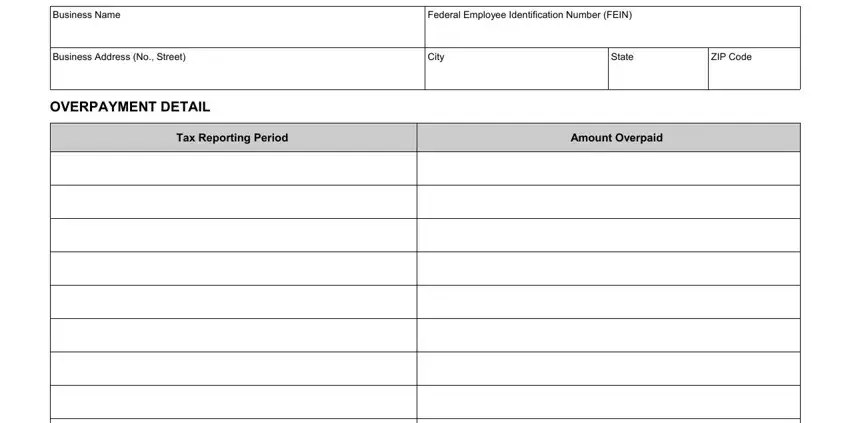

1. Complete your Michigan Form 3891 with a selection of major blank fields. Note all of the information you need and make sure absolutely nothing is omitted!

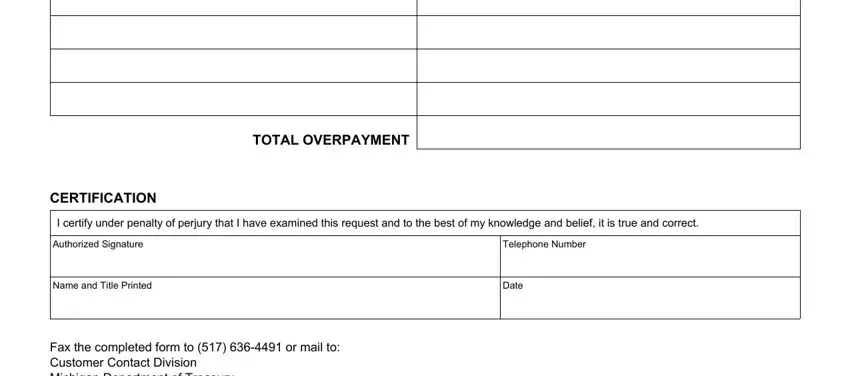

2. Once this section is completed, go on to type in the suitable information in all these: TOTAL OVERPAYMENT, CERTIFICATION, I certify under penalty of perjury, Authorized Signature, Telephone Number, Name and Title Printed, Date, and Fax the completed form to or.

Be very attentive while filling out Date and TOTAL OVERPAYMENT, because this is where many people make some mistakes.

Step 3: Ensure that your details are right and just click "Done" to complete the project. Obtain the Michigan Form 3891 once you sign up for a 7-day free trial. Easily get access to the pdf form from your FormsPal account page, together with any edits and adjustments being all saved! We don't share or sell the information that you type in whenever working with documents at our site.