Handling PDF files online can be a piece of cake with this PDF editor. Anyone can fill in FEIN here without trouble. In order to make our editor better and simpler to work with, we continuously implement new features, considering suggestions from our users. This is what you'll need to do to begin:

Step 1: Just click on the "Get Form Button" at the top of this webpage to see our pdf editor. Here you'll find all that is required to fill out your document.

Step 2: With this state-of-the-art PDF tool, you're able to do more than simply fill out forms. Try each of the functions and make your forms seem high-quality with custom text put in, or adjust the file's original input to excellence - all that comes with the capability to incorporate your own photos and sign the file off.

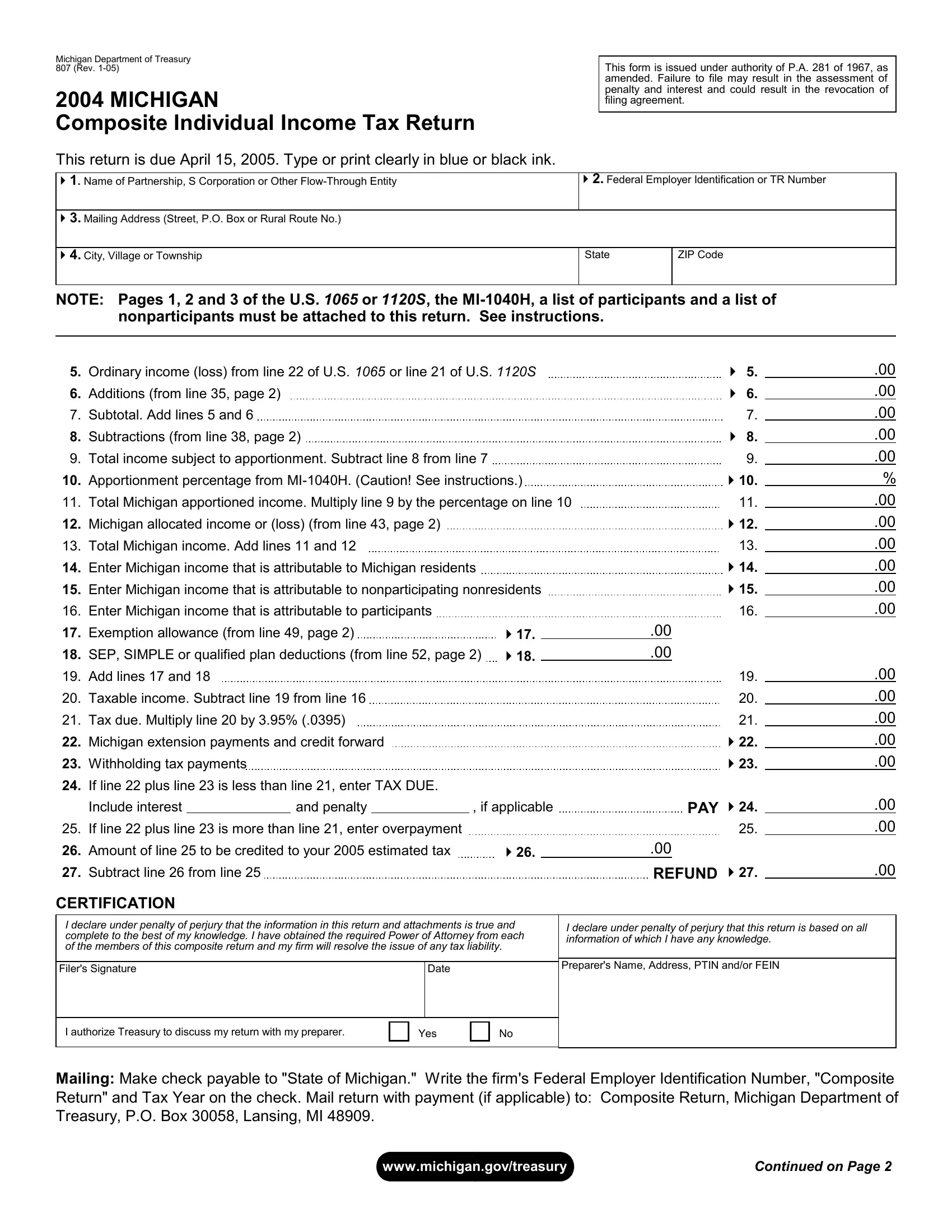

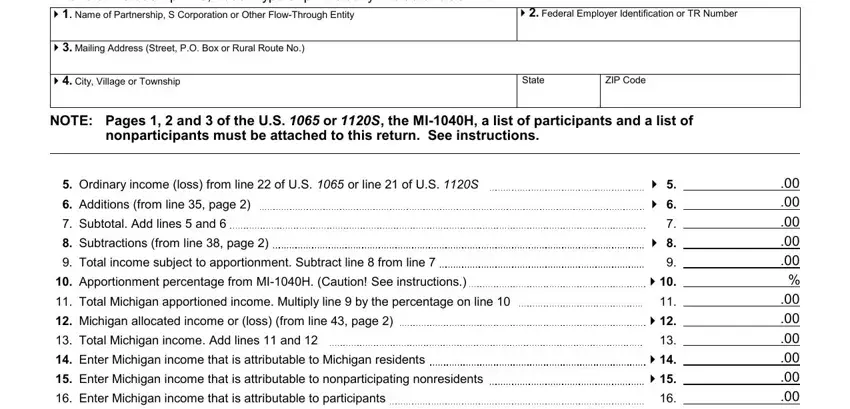

In an effort to complete this PDF document, be certain to enter the right information in every single field:

1. Whenever submitting the FEIN, ensure to include all important blank fields in the relevant area. It will help to expedite the process, which allows your information to be handled quickly and correctly.

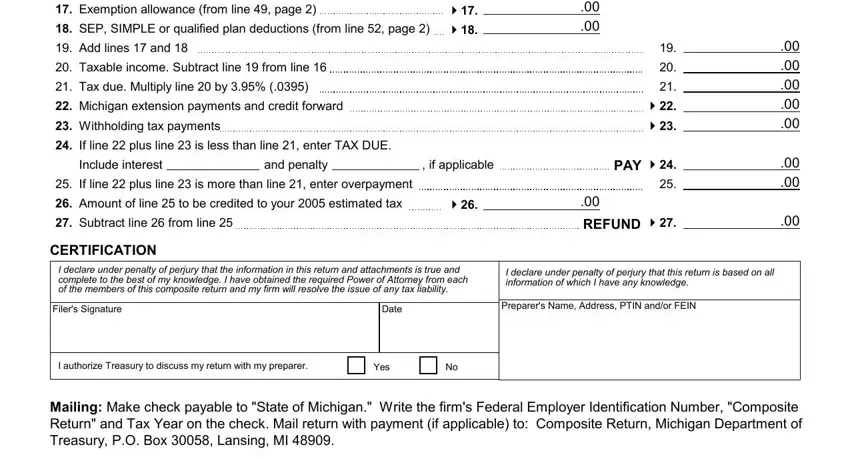

2. The third step would be to complete the following fields: Exemption allowance from line, SEP SIMPLE or qualified plan, Add lines and, Taxable income Subtract line from, Tax due Multiply line by, Michigan extension payments and, Withholding tax payments, If line plus line is less than, Include interest and penalty if, If line plus line is more than, Amount of line to be credited to, Subtract line from line, CERTIFICATION, PAY, and REFUND.

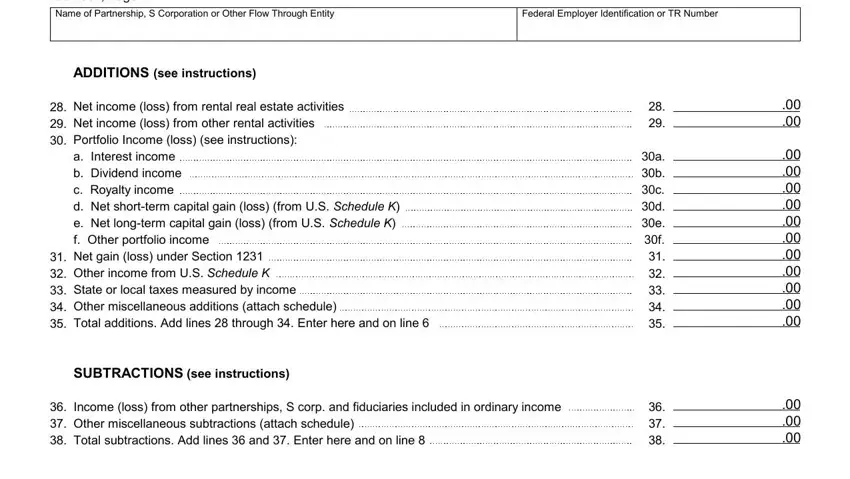

3. This next section is related to Page, Name of Partnership S Corporation, Federal Employer Identification or, ADDITIONS see instructions, Net income loss from rental real, SUBTRACTIONS see instructions, Income loss from other, and a b c d e f - type in all these blanks.

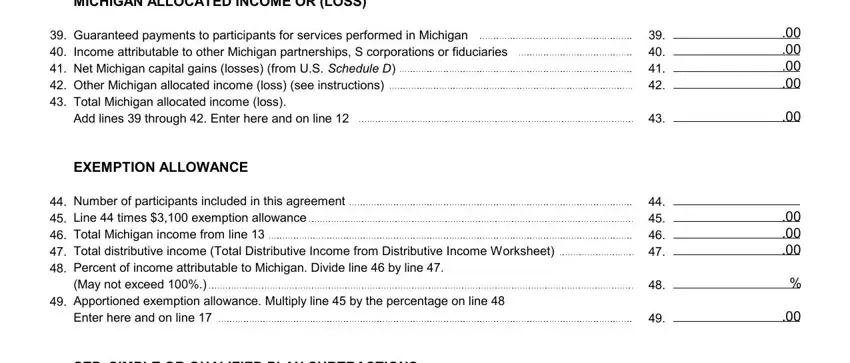

4. The fourth part comes with these form blanks to look at: MICHIGAN ALLOCATED INCOME OR LOSS, Guaranteed payments to, EXEMPTION ALLOWANCE, Number of participants included in, and SEP SIMPLE OR QUALIFIED PLAN.

People who work with this form generally make mistakes when completing EXEMPTION ALLOWANCE in this section. Be certain to read again whatever you enter here.

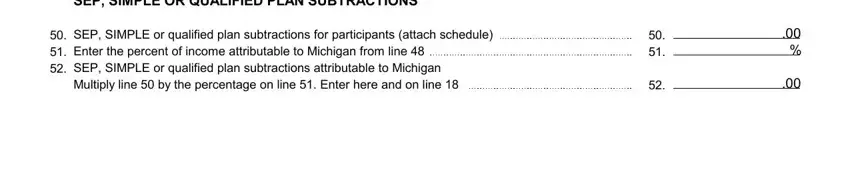

5. Last of all, the following last part is what you will have to finish prior to submitting the PDF. The blank fields in question include the following: SEP SIMPLE OR QUALIFIED PLAN, and SEP SIMPLE or qualified plan.

Step 3: After going through the completed blanks, press "Done" and you're done and dusted! Try a free trial option at FormsPal and acquire instant access to FEIN - with all adjustments saved and accessible inside your personal account. Here at FormsPal.com, we do everything we can to guarantee that all your details are kept secure.