In the rapidly-changing landscape of business taxation, the Michigan C 8000H form emerges as a pivotal document for enterprises striving to comply with the state's tax regulations. Crafted by the Michigan Department of Treasury and finding its roots in the authoritative Public Act 228 of 1975, this form serves as the Single Business Tax Apportionment Formula, designed to streamline the process of calculating the apportionment percentage for businesses. It meticulously breaks down the computation into different factors—property, payroll, and sales—each weighted differently, reflecting the nuanced approach Michigan takes towards taxation. Enterprises with all their property and payroll within Michigan are obligated to substantiate their nexus with another state, adding a layer of documentation and complexity. With segments devoted to specialized scenarios, such as transportation services, financial organizations, and scenarios necessitating a special formula, the form caters to a broad spectrum of business activities. Additionally, it addresses specific circumstances like the disposal of depreciable personal property acquired before a specified date, illustrating the form's attention to detail and providing a comprehensive toolkit for businesses navigating the tax landscape. For companies operating within Michigan's vibrant economy, understanding and accurately completing the C 8000H is not only a statutory requirement but a crucial step in ensuring compliance and optimizing tax obligations, emphasizing the significance of this document in the broader tapestry of state business taxation.

| Question | Answer |

|---|---|

| Form Name | Michigan Form C 8000H |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | c8000hf8_3540_7 c 8000h michigan form |

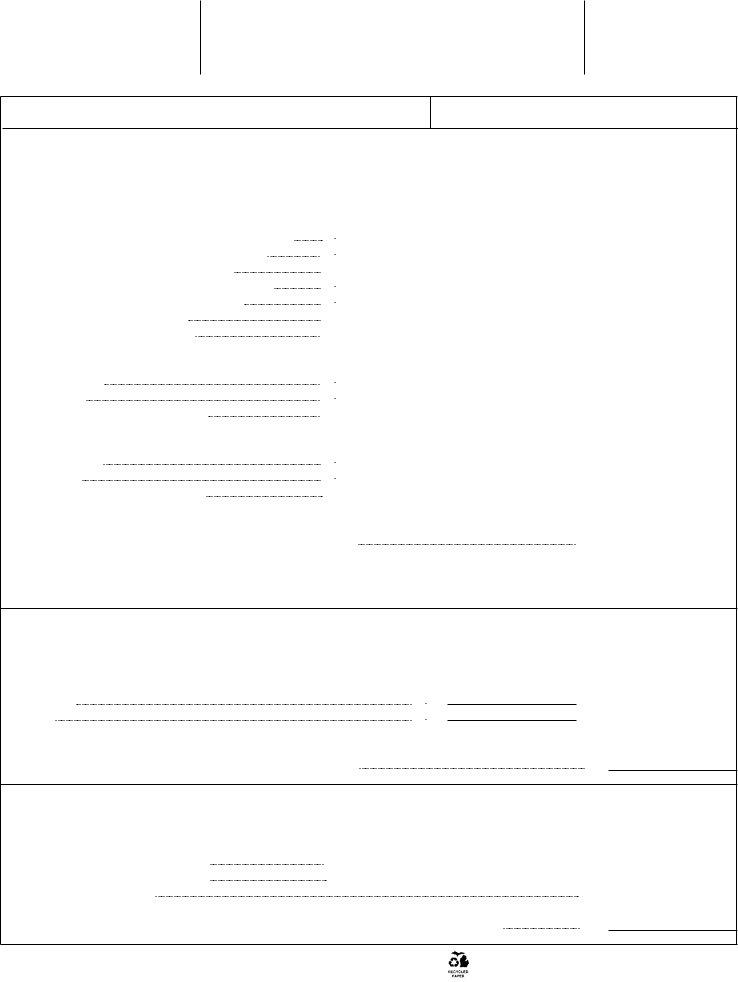

Michigan Department of Treasury (Rev.

SINGLE BUSINESS TAX APPORTIONMENT FORMULA

This form is issued under authority of P.A. 228 of 1975.

See instruction booklet for filing guidelines.

1998

1 Name

2 Federal Employer ID No. (FEIN) or TR No.

PART 1 COMPUTATION OF APPORTIONMENT PERCENTAGE

If 100% of your property and payroll is attributable |

|

|

|

|

A |

|

B |

|

C |

|

to Michigan, you must include documentation to |

|

|

|

|

|

|

||||

substantiate nexus with another state. |

|

|

|

|

|

|

Weighting |

|

Weighted |

|

|

|

|

|

|

|

|

|

|

||

|

PROPERTY FACTOR* |

|

|

|

|

|

|

Factors |

|

Percentage |

|

|

|

|

|

|

|

|

|

|

|

3 |

Average value of Michigan property held during the year |

▼ |

3 |

|

|

|

.00 |

|

|

|

4 |

Multiply Michigan rentals by 8 and enter the result |

▼ |

4 |

|

|

|

.00 |

|

|

|

5 |

Total Michigan property. Add lines 3 and 4 |

|

5 |

|

|

|

.00 |

|

|

|

6 |

Average value of total property held during the year |

▼ |

6 |

|

|

|

.00 |

|

|

|

7 |

Multiply total rentals by 8 and enter the result |

▼ |

7 |

|

|

|

.00 |

|

|

|

8 |

Total property. Add lines 6 and 7 |

|

8 |

|

|

|

.00 |

|

|

|

9 |

Percentage. Divide line 5 by line 8 |

|

9 |

|

|

|

% |

x 10% |

9 |

% |

|

PAYROLL FACTOR |

|

|

|

|

|

|

|

|

|

10 |

Michigan wages |

▼ |

10 |

|

|

|

.00 |

|

|

|

11 |

Total wages |

▼ |

11 |

|

|

|

.00 |

|

|

|

12 |

Percentage. Divide line 10 by line 11 |

|

12 |

|

|

|

% |

x 10% |

12 |

% |

|

SALES FACTOR |

|

|

|

|

|

|

|

|

|

13 |

Michigan sales |

▼ |

13 |

|

|

|

.00 |

|

|

|

14 |

Total sales |

▼ |

14 |

|

|

|

.00 |

|

|

|

15 |

Percentage. Divide line 13 by line 14 |

|

15 |

|

|

|

% |

x 80% |

15 |

% |

16 |

Apportionment percentage. Add column C, lines 9, 12 & 15**. |

|

|

|

|

|

|

|

|

|

|

Use this percentage to apportion your tax base on |

|

|

|

|

|||||

|

and to apportion the capital acquisition deduction on |

|

|

16 |

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

*The Commissioner of Revenue may require periodic averaging of property values during the tax year if this is reasonably required to reflect the average value of the filer's property.

**If you do not have three factors (if line 8, 11 or 14 is zero) see Formulas for Special Situations on page 35 of the instructions.

PART 2 TRANSPORTATION SERVICES, FINANCIAL ORGANIZATIONS, OR

TAXPAYERS AUTHORIZED TO USE A SPECIAL FORMULA, USE THE LINES PROVIDED BELOW.

(Attach explanation. )

17 Michigan

▼

17

.00

18Total

19Apportionment percentage. Divide line 17 by line 18.

Use this percentage to apportion your tax base on

▼

18

.00

19 |

% |

|

PART 3 CAPITAL ACQUISITION APPORTIONMENT

This part is only used for certain recaptures. Complete this part only if you disposed of depreciable personal property that you acquired in tax years beginning before Oct. 1, 1989.

20 |

Property factor (from line 9, column A) |

20 |

% |

|

|

|

21 |

Payroll factor (from line 12, column A) |

21 |

% |

|

|

|

22 |

Total. Add lines 20 and 21 |

|

|

|

22 |

% |

23 |

Average percentage. Divide line 22 by 2; if you have only one factor enter the amount from line 22. |

|

|

|||

|

Use this percentage to compute your recapture of capital acquisition deduction on |

23 |

% |

|||

www.treasury.state.mi.us