You'll be able to fill in Michigan Form Uia 1015 C without difficulty by using our PDFinity® online tool. FormsPal development team is continuously working to expand the editor and help it become much better for users with its multiple functions. Take your experience to another level with constantly developing and interesting opportunities available today! Should you be looking to get started, here is what it will require:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" in the top section of this page.

Step 2: With our handy PDF tool, you're able to do more than just fill out blank form fields. Edit away and make your docs look faultless with custom text incorporated, or optimize the file's original content to perfection - all that comes with an ability to incorporate any photos and sign the PDF off.

When it comes to fields of this particular form, this is what you should consider:

1. Start completing the Michigan Form Uia 1015 C with a number of necessary blanks. Gather all of the necessary information and be sure not a single thing forgotten!

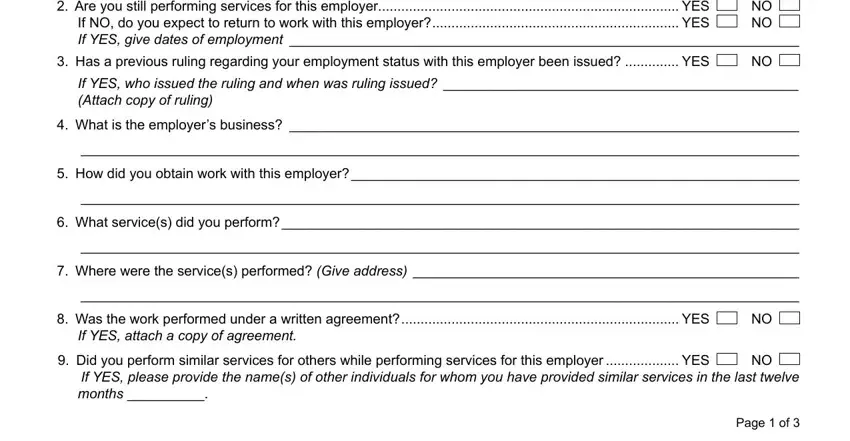

2. Soon after the last array of blank fields is completed, go on to enter the relevant information in all these - Are you still performing services, NO NO, Has a previous ruling regarding, If YES who issued the ruling and, What is the employers business, How did you obtain work with this, What services did you perform, Where were the services performed, Was the work performed under a, If YES attach a copy of agreement, Did you perform similar services, months, and Page of.

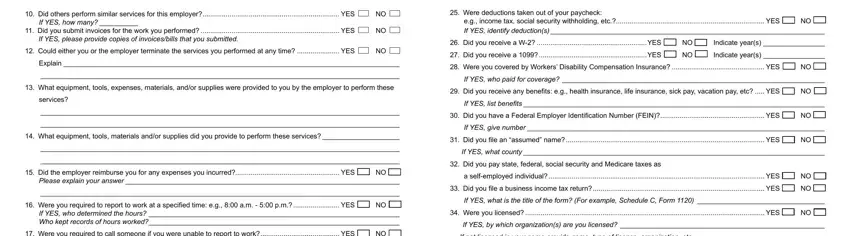

3. This next part is going to be hassle-free - fill out all the fields in Did others perform similar, Were deductions taken out of your, If YES how many, Did you submit invoices for the, Could either you or the employer, Explain, What equipment tools expenses, services, What equipment tools materials, Did the employer reimburse you, Please explain your answer, Were you required to report to, If YES who determined the hours, Were you required to call someone, and eg income tax social security to conclude this part.

Always be very careful when filling out Could either you or the employer and What equipment tools materials, because this is the section in which most users make some mistakes.

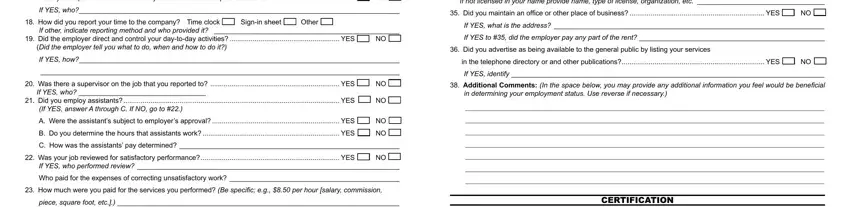

4. Your next section requires your attention in the following areas: Were you required to call someone, If YES who, How did you report your time to, Signin sheet, Other, If other indicate reporting method, Did the employer direct and, If YES how, Was there a supervisor on the job, If YES answer A through C If NO go, If not licensed in your name, If YES what is the address, If YES to did the employer pay, Did you advertise as being, and in the telephone directory or and. Always enter all of the requested info to move onward.

5. The final step to submit this document is pivotal. Make sure to fill in the necessary fields, such as How was the pay rate determined, I hereby certify that the answers, Signature, Date, Telephone Number Include Area Code, Page of, LARA is an equal opportunity, and Page of, before using the form. In any other case, it may generate an unfinished and probably unacceptable document!

Step 3: Look through what you've typed into the blanks and click the "Done" button. Acquire your Michigan Form Uia 1015 C as soon as you sign up at FormsPal for a free trial. Easily get access to the document inside your FormsPal account page, together with any edits and adjustments all kept! FormsPal guarantees your data privacy via a secure system that never records or distributes any type of personal information involved in the process. Be assured knowing your files are kept safe any time you use our tools!