millennium trust company rmd form can be filled in online without difficulty. Just open FormsPal PDF editing tool to do the job quickly. Our tool is constantly developing to present the best user experience possible, and that is because of our resolve for continuous enhancement and listening closely to comments from customers. All it takes is a few basic steps:

Step 1: First, access the tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: Once you launch the editor, you will notice the form all set to be filled in. In addition to filling in different blank fields, you can also perform various other things with the file, such as writing your own textual content, editing the initial text, adding graphics, signing the PDF, and more.

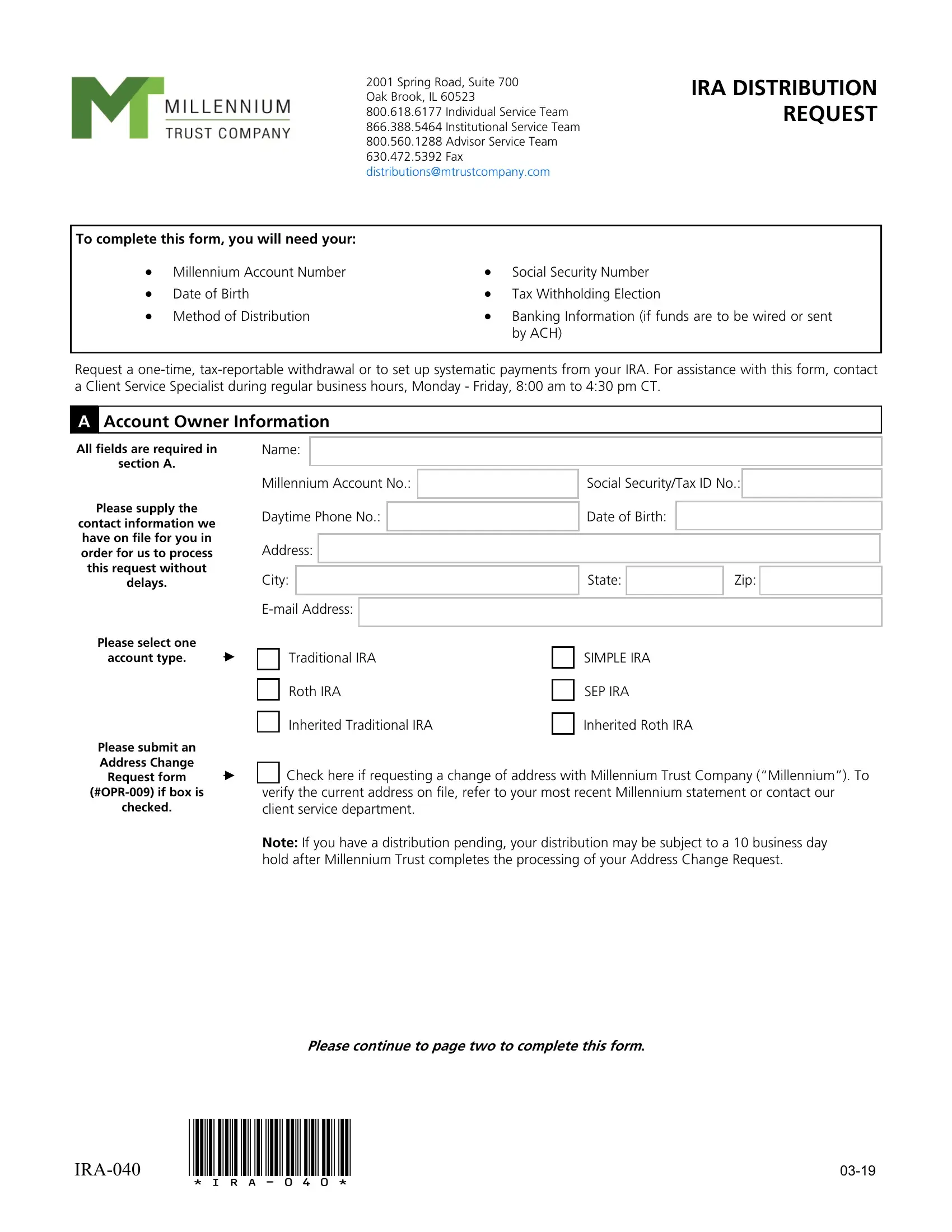

With regards to the blanks of this particular form, here's what you want to do:

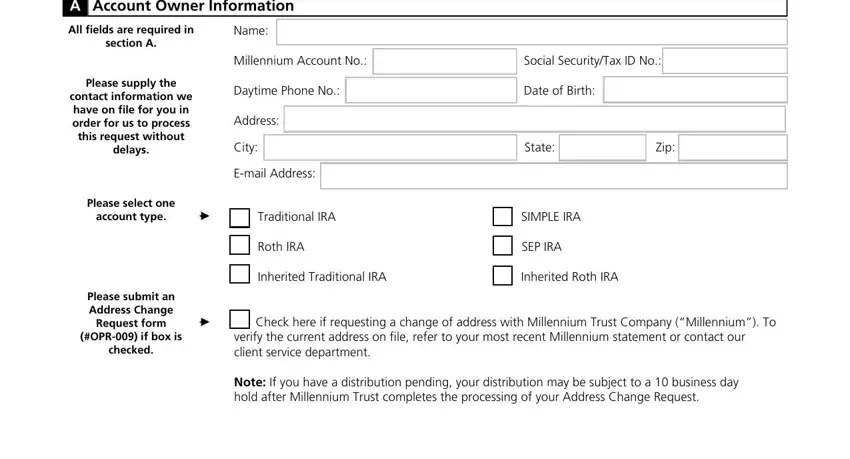

1. The millennium trust company rmd form will require specific information to be inserted. Be sure the subsequent blank fields are finalized:

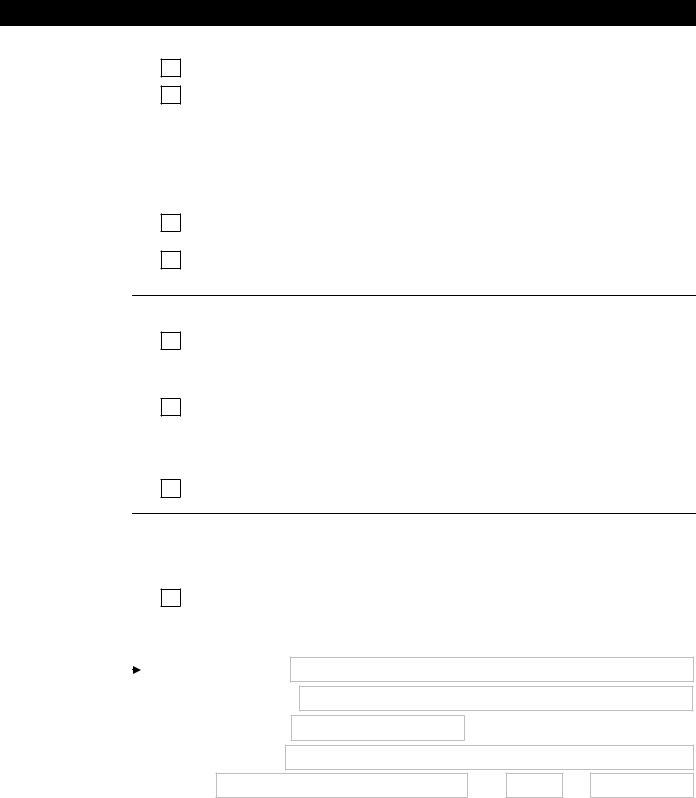

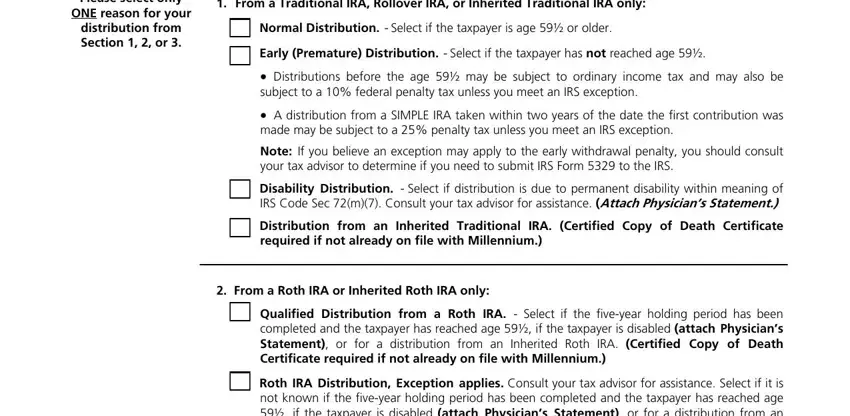

2. Once your current task is complete, take the next step – fill out all of these fields - Please select only, ONE reason for your, distribution from Section or, From a Traditional IRA Rollover, Normal Distribution Select if the, Early Premature Distribution, Distributions before the age may, Note If you believe an exception, Disability Distribution Select, Distribution from an Inherited, required if not already on file, From a Roth IRA or Inherited Roth, Qualified Distribution from a Roth, and Roth IRA Distribution Exception with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

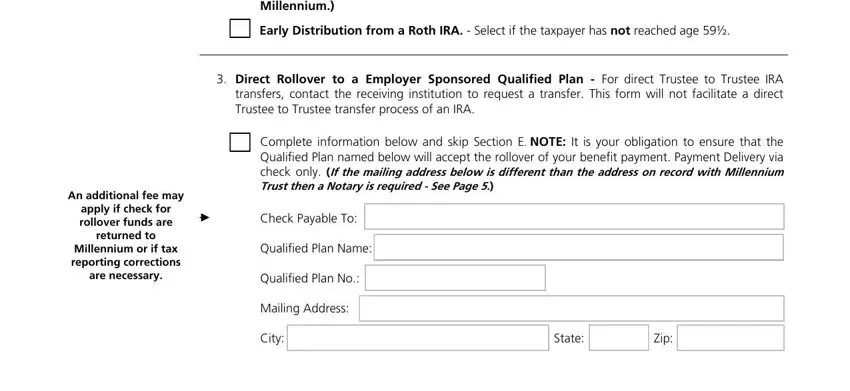

3. The following segment should also be relatively uncomplicated, An additional fee may, apply if check for rollover funds, returned to, Millennium or if tax reporting, are necessary, Roth IRA Distribution Exception, Early Distribution from a Roth, Direct Rollover to a Employer, Complete information below and, Check Payable To, Qualified Plan Name, Qualified Plan No, Mailing Address, City, and State - each one of these empty fields will have to be completed here.

It's simple to make errors when filling out your Direct Rollover to a Employer, therefore ensure that you take another look prior to deciding to send it in.

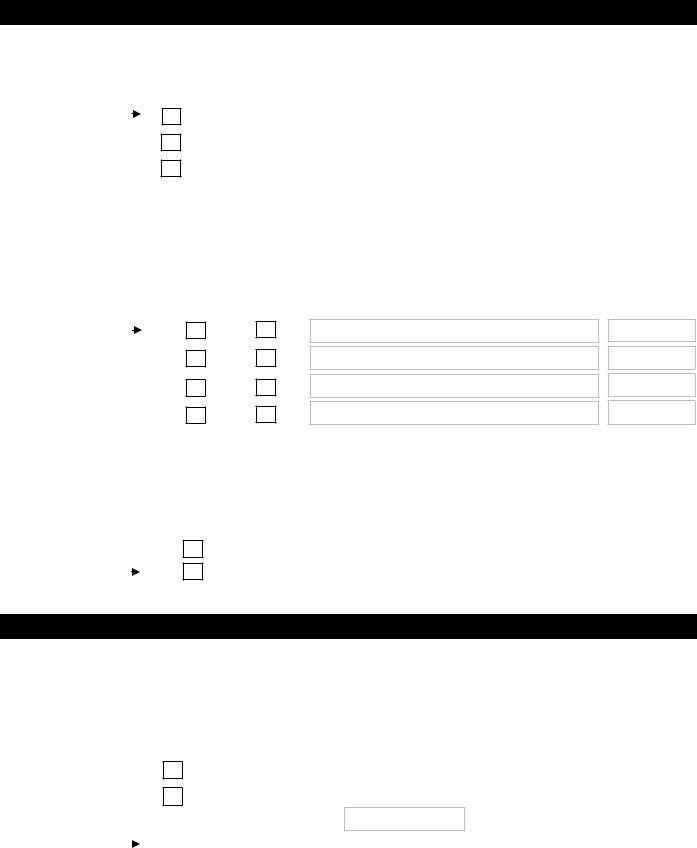

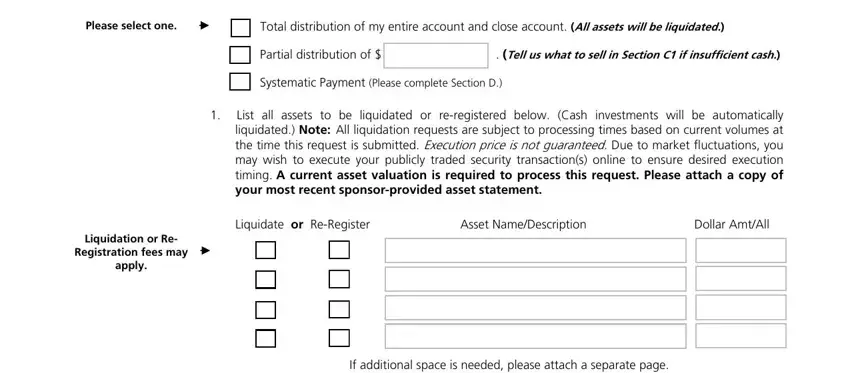

4. The next subsection comes with these fields to complete: If funds are invested in assets, Please select one, Total distribution of my entire, Partial distribution of, Tell us what to sell in Section C, Systematic Payment Please, List all assets to be liquidated, Liquidate or ReRegister Asset, Liquidation or Re, Registration fees may, apply, and If additional space is needed.

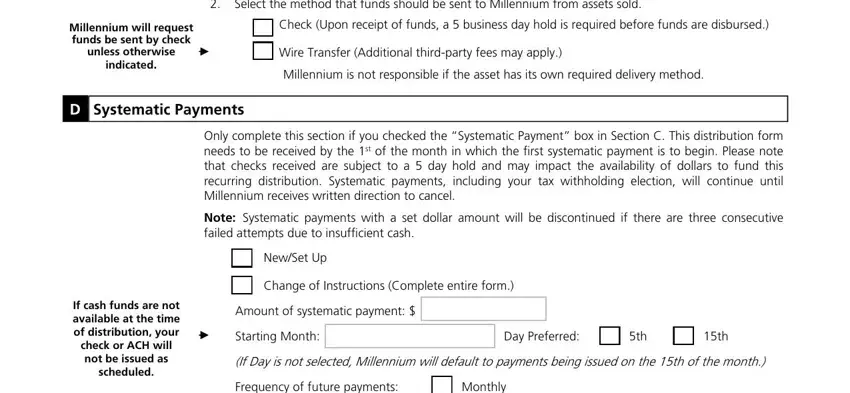

5. While you get close to the conclusion of the file, you will find just a few extra points to undertake. In particular, Select the method that funds, Millennium will request funds be, unless otherwise, indicated, D Systematic Payments, Check Upon receipt of funds a, Wire Transfer Additional, Millennium is not responsible if, Only complete this section if you, Note Systematic payments with a, NewSet Up, Change of Instructions Complete, If cash funds are not available at, scheduled, and Amount of systematic payment should be done.

Step 3: After you have looked over the details you filled in, press "Done" to complete your form. Try a 7-day free trial account at FormsPal and obtain immediate access to millennium trust company rmd form - available from your personal account. When using FormsPal, you'll be able to fill out forms without worrying about personal information leaks or entries getting distributed. Our protected system helps to ensure that your personal information is maintained safely.