If you desire to fill out Minnesota Form M1, it's not necessary to download any kind of applications - just make use of our online PDF editor. Our development team is relentlessly endeavoring to develop the editor and enable it to be even better for users with its many features. Unlock an endlessly innovative experience now - check out and find out new opportunities along the way! For anyone who is seeking to start, this is what you will need to do:

Step 1: Click the "Get Form" button above on this webpage to access our PDF editor.

Step 2: As you start the file editor, you will get the document all set to be filled out. Apart from filling out various blanks, it's also possible to perform various other actions with the form, namely adding your own textual content, changing the initial textual content, inserting graphics, affixing your signature to the form, and much more.

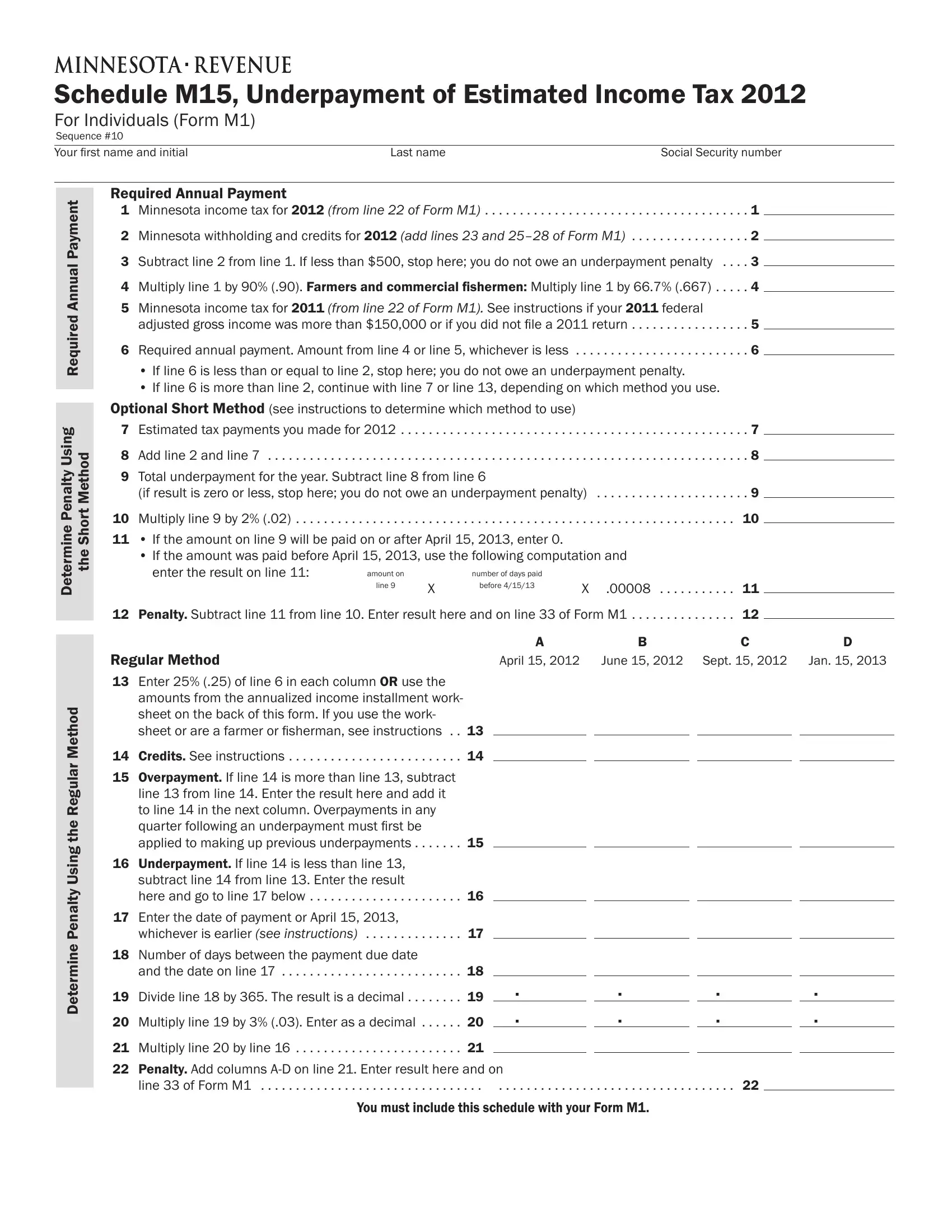

This PDF will require particular info to be filled out, therefore make sure to take whatever time to type in precisely what is expected:

1. When completing the Minnesota Form M1, be certain to incorporate all of the needed blank fields in their associated form section. It will help facilitate the process, allowing your information to be processed without delay and accurately.

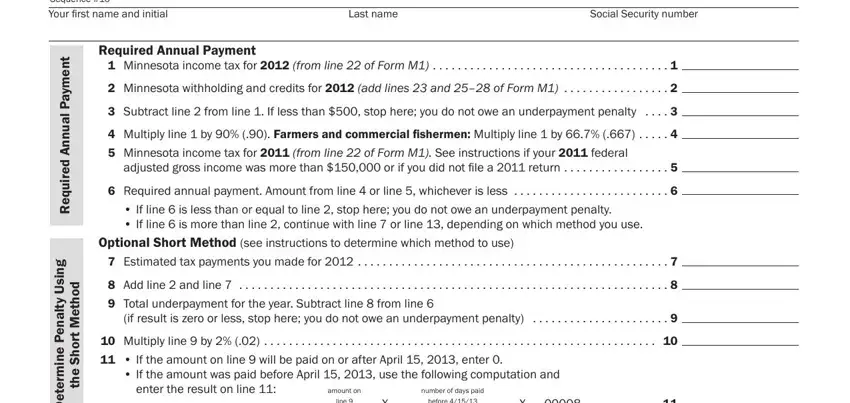

2. The third part would be to fill in all of the following blank fields: g n i s U y t l a n e P e n m r e, d o h t e M, r a u g e R e h t g n i s U y t l, Multiply line by, If the amount was paid before, number of days paid before, line, Penalty Subtract line from line, Regular Method, April, June, Sept, Jan, Enter of line in each column, and amounts from the annualized income.

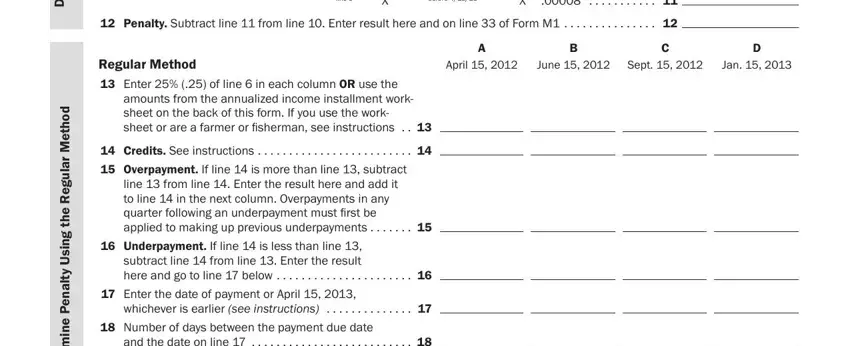

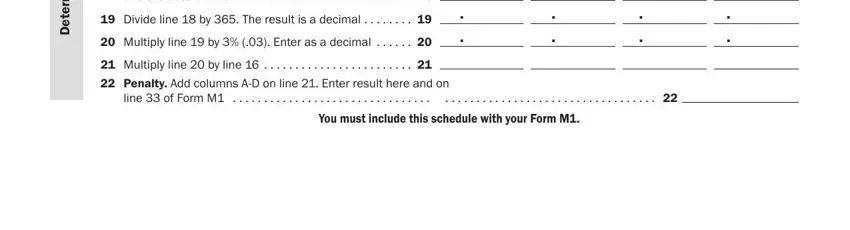

3. This subsequent section is typically pretty uncomplicated, r a u g e R e h t g n i s U y t l, Number of days between the, and the date on line, Divide line by The result is a, Multiply line by line, Penalty Add columns AD on line, line of Form M, and You must include this schedule - every one of these blanks has to be completed here.

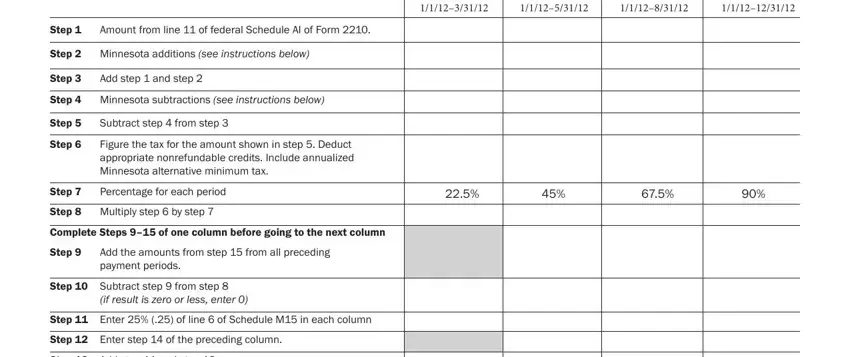

4. It's time to fill in this fourth segment! In this case you've got these Step, Amount from line of federal, Step Minnesota additions see, Step, Add step and step, Step Minnesota subtractions see, Step, Subtract step from step, Step, Figure the tax for the amount, Step, Percentage for each period, Step Multiply step by step, Complete Steps of one column, and Step blank fields to fill out.

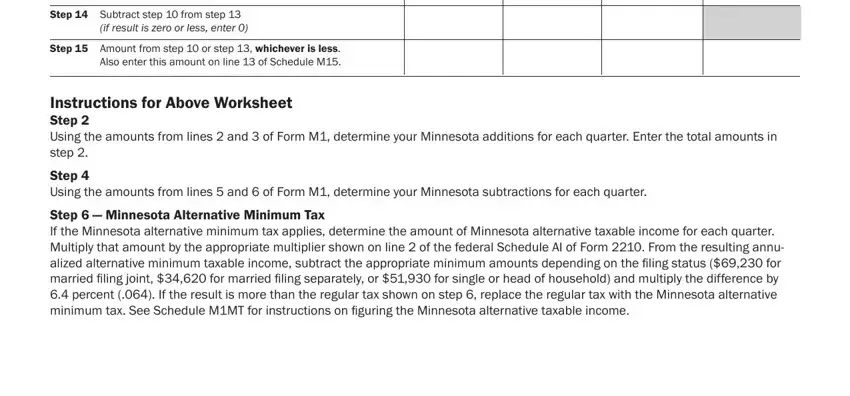

5. This document should be finalized with this section. Here you can find a full set of form fields that need appropriate information in order for your form submission to be faultless: Step Add step and step, Step Subtract step from step if, Step Amount from step or step, Instructions for Above Worksheet, Step Using the amounts from lines, and Step Minnesota Alternative.

Lots of people generally make mistakes when filling out Step Minnesota Alternative in this part. Remember to double-check everything you type in right here.

Step 3: Make sure that the information is accurate and then just click "Done" to progress further. Join FormsPal right now and immediately get Minnesota Form M1, set for download. All modifications you make are saved , which means you can modify the file at a later stage when required. FormsPal offers secure form editor with no personal information record-keeping or sharing. Be assured that your information is secure with us!