Working with PDF documents online is definitely a breeze with this PDF tool. You can fill in Minnesota Form M1X here painlessly. The tool is constantly updated by us, acquiring additional features and growing to be better. If you are looking to start, here is what it will require:

Step 1: Simply hit the "Get Form Button" above on this page to access our pdf file editor. This way, you will find all that is necessary to fill out your document.

Step 2: With the help of our online PDF file editor, you may accomplish more than just fill in blanks. Try all the functions and make your forms look high-quality with custom textual content added in, or optimize the file's original content to perfection - all accompanied by the capability to add any kind of graphics and sign the PDF off.

It really is simple to fill out the document with this detailed tutorial! This is what you must do:

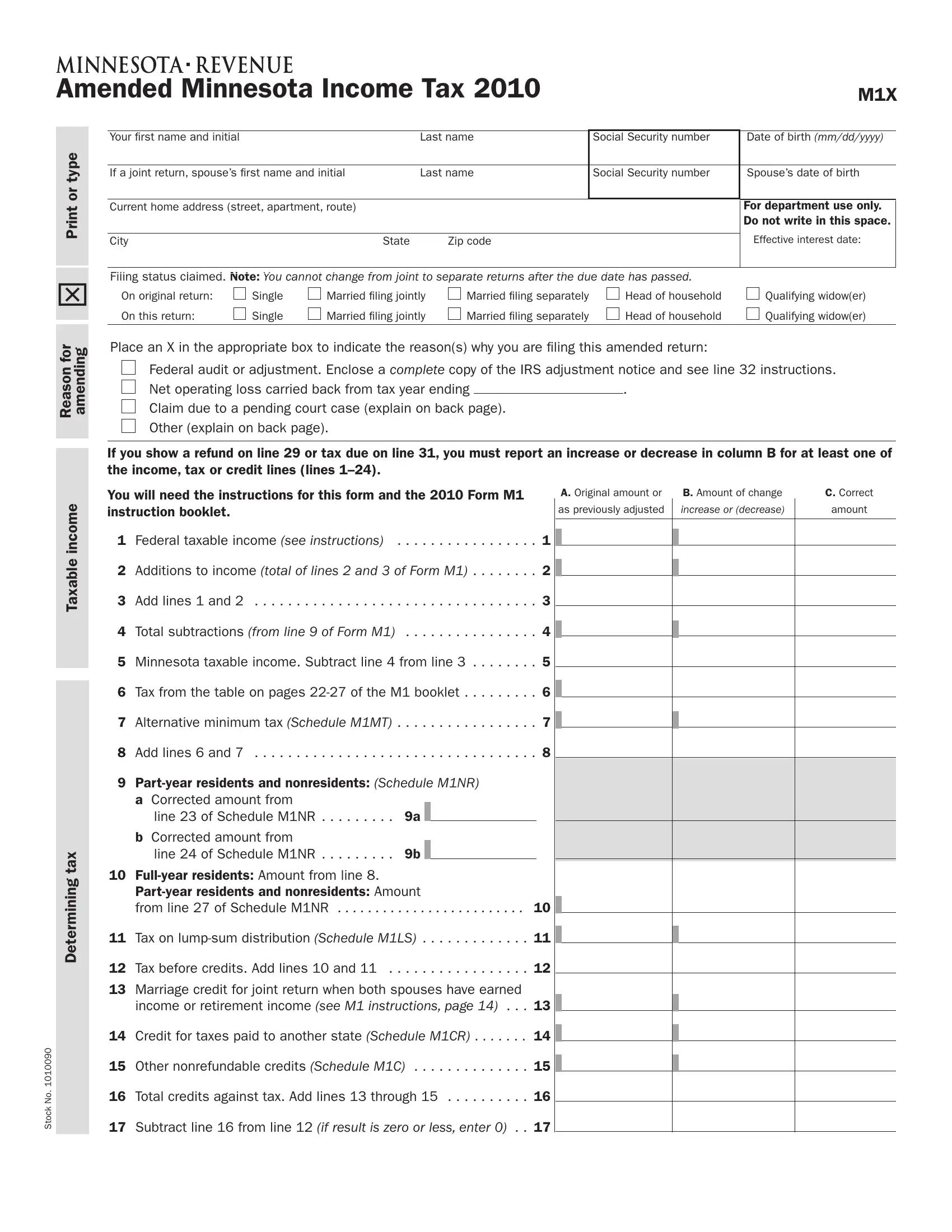

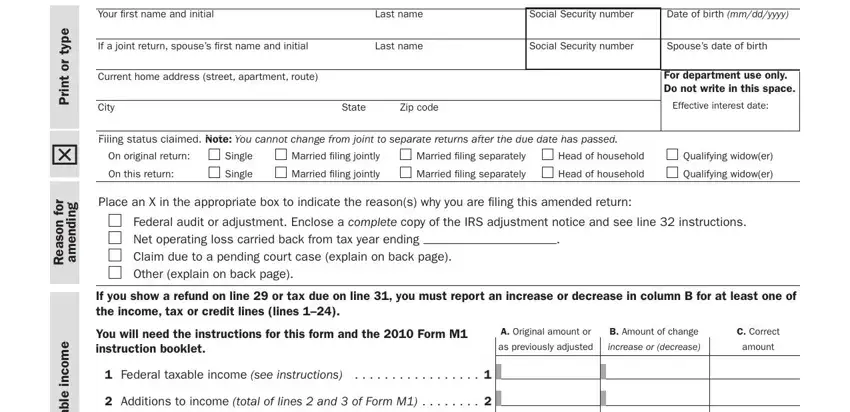

1. It's essential to fill out the Minnesota Form M1X accurately, so pay close attention when filling in the sections that contain these specific blanks:

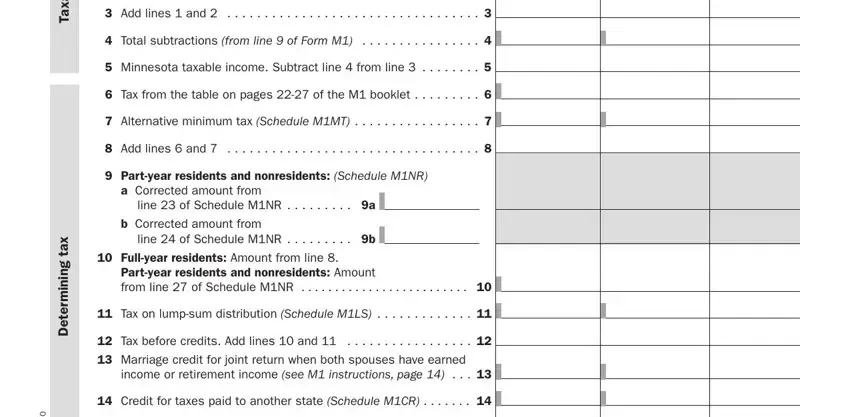

2. The subsequent part would be to submit the following fields: e m o c n i e b a x a T, Add lines and, Total subtractions from line of, Minnesota taxable income, Tax from the table on pages of, Alternative minimum tax Schedule, Add lines and, Partyear residents and, a Corrected amount from, line of Schedule MNR a, b Corrected amount from, line of Schedule MNR b, Fullyear residents Amount from, Partyear residents and, and Tax on lumpsum distribution.

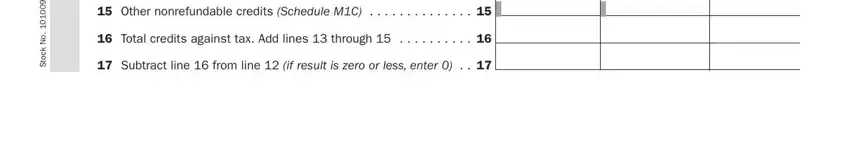

3. The next step is considered rather straightforward, Other nonrefundable credits, Total credits against tax Add, Subtract line from line if, and o N k c o t S - these fields will have to be filled out here.

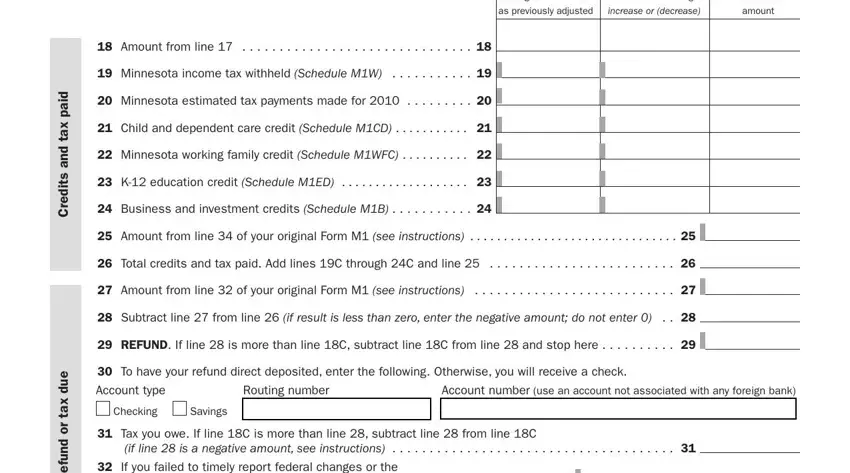

4. Now proceed to this fourth section! Here you have all of these A Original amount or, B Amount of change, C Correct, as previously adjusted, increase or decrease, amount, Amount from line, Minnesota income tax withheld, Minnesota estimated tax payments, Child and dependent care credit, Minnesota working family credit, K education credit Schedule MED, Business and investment credits, Amount from line of your, and Total credits and tax paid Add blank fields to fill in.

Regarding Minnesota income tax withheld and Amount from line of your, be sure that you get them right in this section. These two are the key ones in the file.

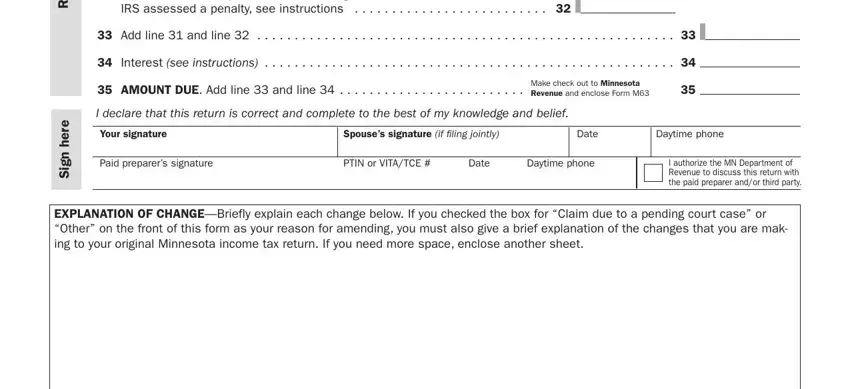

5. To finish your form, the last subsection requires a few additional blank fields. Completing If you failed to timely report, IRS assessed a penalty see, Add line and line, Interest see instructions, AMOUNT DUE Add line and line, Make check out to Minnesota, I declare that this return is, Your signature, Spouses signature if filing jointly, Date, Daytime phone, Paid preparers signature, PTIN or VITATCE, Date, and Daytime phone will certainly conclude the process and you're going to be done in a tick!

Step 3: Once you've looked again at the information in the blanks, press "Done" to complete your document creation. Grab the Minnesota Form M1X after you register at FormsPal for a 7-day free trial. Instantly gain access to the form inside your personal account page, together with any edits and changes being all preserved! We don't share any details that you enter when completing documents at our site.