Minnesota Form M4Np can be filled out easily. Just try FormsPal PDF tool to complete the task in a timely fashion. Our editor is continually evolving to grant the best user experience attainable, and that is due to our commitment to continuous enhancement and listening closely to customer feedback. If you're looking to get started, here's what it requires:

Step 1: Simply hit the "Get Form Button" in the top section of this site to start up our pdf file editor. Here you will find everything that is required to work with your file.

Step 2: After you access the PDF editor, there'll be the document prepared to be completed. Besides filling in various blank fields, you could also perform other things with the Document, namely putting on custom words, modifying the initial text, adding images, placing your signature to the form, and more.

This document will require specific information; to guarantee consistency, be sure to consider the tips listed below:

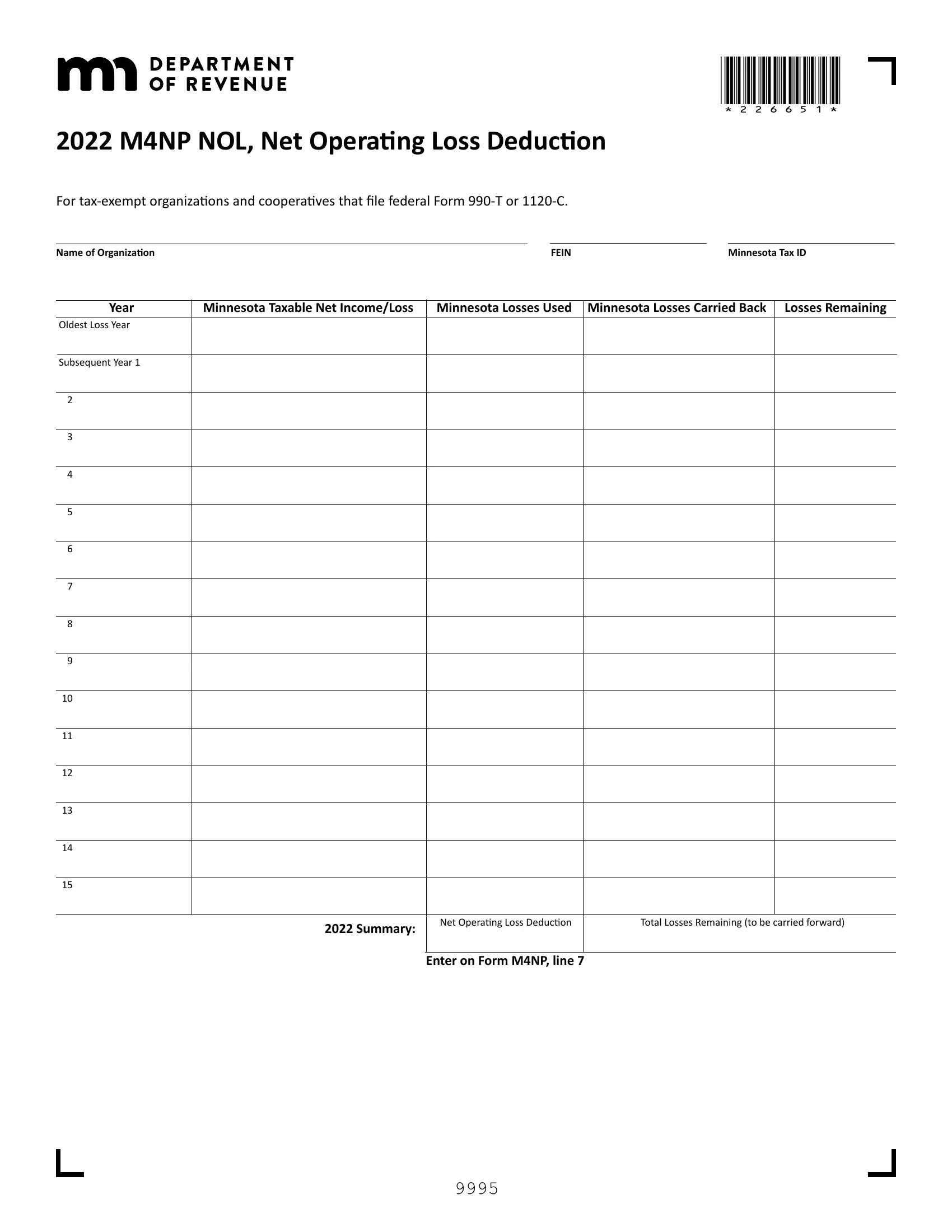

1. Fill out your Minnesota Form M4Np with a selection of essential blanks. Consider all the required information and be sure absolutely nothing is omitted!

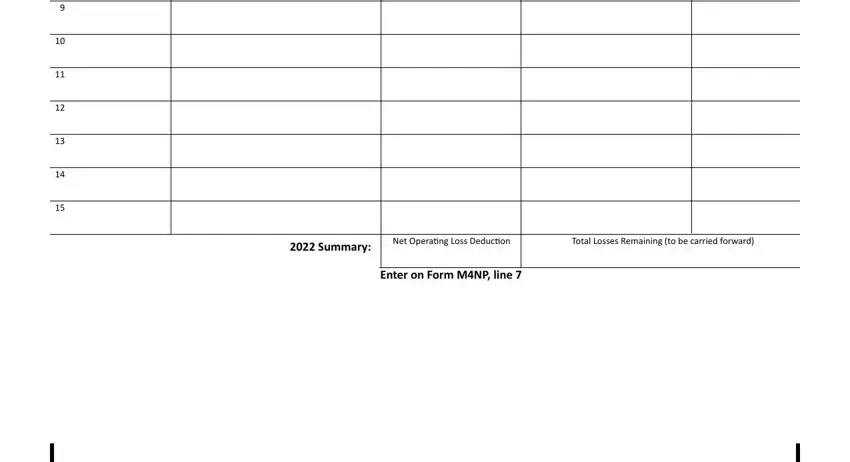

2. Now that the last section is completed, it is time to include the required details in Total Losses Remaining to be, Summary, Net Operating Loss Deduction, and Enter on Form MNP line so that you can move on to the 3rd part.

Concerning Net Operating Loss Deduction and Enter on Form MNP line, ensure that you double-check them here. These are thought to be the most significant fields in this file.

Step 3: Prior to moving on, check that blank fields are filled out the right way. Once you believe it is all fine, press “Done." Right after setting up a7-day free trial account at FormsPal, you'll be able to download Minnesota Form M4Np or email it right off. The document will also be easily accessible via your personal account page with your each change. At FormsPal.com, we do our utmost to make certain that all your information is stored private.