I f you are a sole proprietor, t he Dist rict and the I RS prefer that you enter your social security number. The State of California Employment Development Department requires your SSN on the DE542 report.

I f you are a single-owner LLC that is disregarded as an ent ity separate from its owner (see Limited liability company ( LLC) in Part 1), enter your SSN. I f the LLC is a corporat ion, partnership, etc., ent er the entity’s EI N.

Note: See the chart on page 3 for further clarification of name and TI N combinat ions.

How to get a TI N. I f you do not have a TI N, apply for one immediately. To apply for an SSN, get Form SS- 5, Application for a Social Security Card, from your local Social Security Administ rat ion office or get t his form on-line at w w w .ssa.gov/ online/ sst.html. You may also get this form by calling 1-800-772-1213. Use Form W - 7 , Applicat ion for I RS

I ndividual Taxpayer I dent ification Number, to apply for an I TI N or Form SS- 4, Application for Employer I dentificat ion Number, t o apply for an EI N. Your can get Forms W-7 and SS-

4from the I RS by calling 1-800-TAX-FORM (1-800- 829-3676) or from the I RS’s internet Web Site at w w w .irs.gov.

I f you are asked t o complete Form W-9 but do not have a TI N, write “ Applied For” in the space for the TI N, sign and date t he form, and give it to the requester. For interest and dividend payments, and cert ain payments made with respect to readily tradable instruments, generally you will have 60 days to get a TI N and give it t o the request er before you are subject t o backup withholding on payments. The 60-day rule does not apply to other types of payments. You will be subject to backup wit hholding on all such payments unt il you provide your TI N t o the request er.

Note: Writ ing “ Applied For” means that you have already applied for a TI N o r that you intend t o apply for one soon.

Caution: A disregarded domestic entity t hat has a foreign owner must use the appropriate Form W-8.

PART 4—EXEMPT FROM BACKUP WI THHOLDI NG

I f you are exempt, enter your name as described above and check the appropriat e box for your st atus, then check t he “ Exempt from backup withholding” box in Part 4.

Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup wit hholding for certain payment s, such as int erest and dividends.

Note: I f you are exempt from backup wit hholding, you should still complet e this form to

avoid possible erroneous backup wit hholding.

Exempt payees. Backup withholding is not required on any payments made t o t he

following payees:

1. An organizat ion exempt from t ax under section 501(a), any I RA, or a custodial account under sect ion 403(b)(7) if the account satisfies the requirements of section 401(f)(2);

2. The United St ates or any of its agencies or instrumentalit ies;

3. A stat e, the Dist rict of Columbia, a possession of the United St ates, or any of their polit ical subdivisions or inst rument alities;

4. A foreign government or any of its polit ical subdivisions, agencies, or instrumentalit ies; or

5. An int ernational organizat ion or any of its agencies or instrumentalit ies;

6. A corporation;

7. A foreign cent ral bank of issue;

8. A dealer in securities or commodit ies required to regist er in the Unit ed St ates, the District of Columbia, or a possession of t he United St ates.

9. A futures commission merchant regist ered with the commodity Futures Trading Commission;

10. A real estate invest ment trust;

11. An ent ity registered at all times during t he tax year under the I nvestment Company Act of 1940;

12. A common t rust fund operated by a bank under sect ion 584(a);

13. A financial instit ution;

14. A middleman known in the investment community as a nominee or custodian; or

15. A trust exempt from tax under section 664 or described in section 4947.

The chart below shows types of payments that may be exempt from backup withholding. The chart applies t o the exempt recipients listed above, 1 through 15.

I f the payment is for… |

THEN the payment is exempt for… |

|

|

I nterest and dividend payments |

All exempt recipients except for 9 |

|

|

Broker transactions |

Exempt recipients 1 t hrough 13. Also, a |

|

person regist ered under the I nvest ment |

|

Advisers Act of 1940 who regularly acts |

|

as a broker |

|

|

Bart er exchange transactions and |

Exempt recipients 1 t hrough 5 |

patronage dividends |

|

|

|

Payments over $600 required to be |

Generally, exempt recipients 1 through 7 |

report ed and direct sales over $5,000 1 |

2 |

|

|

1See Form 1099-MI SC, Miscellaneous I ncome, and it s inst ruct ions.

2However, the following payments made t o a corporation (including gross proceeds paid to an att orney under section 6045(f), even if the att orney is a corporat ion) and report able on Form 1099-MI SC are not exempt from backup withholding: medical and health care payments, attorneys’ fees; and payments for services paid by a Federal executive agency.

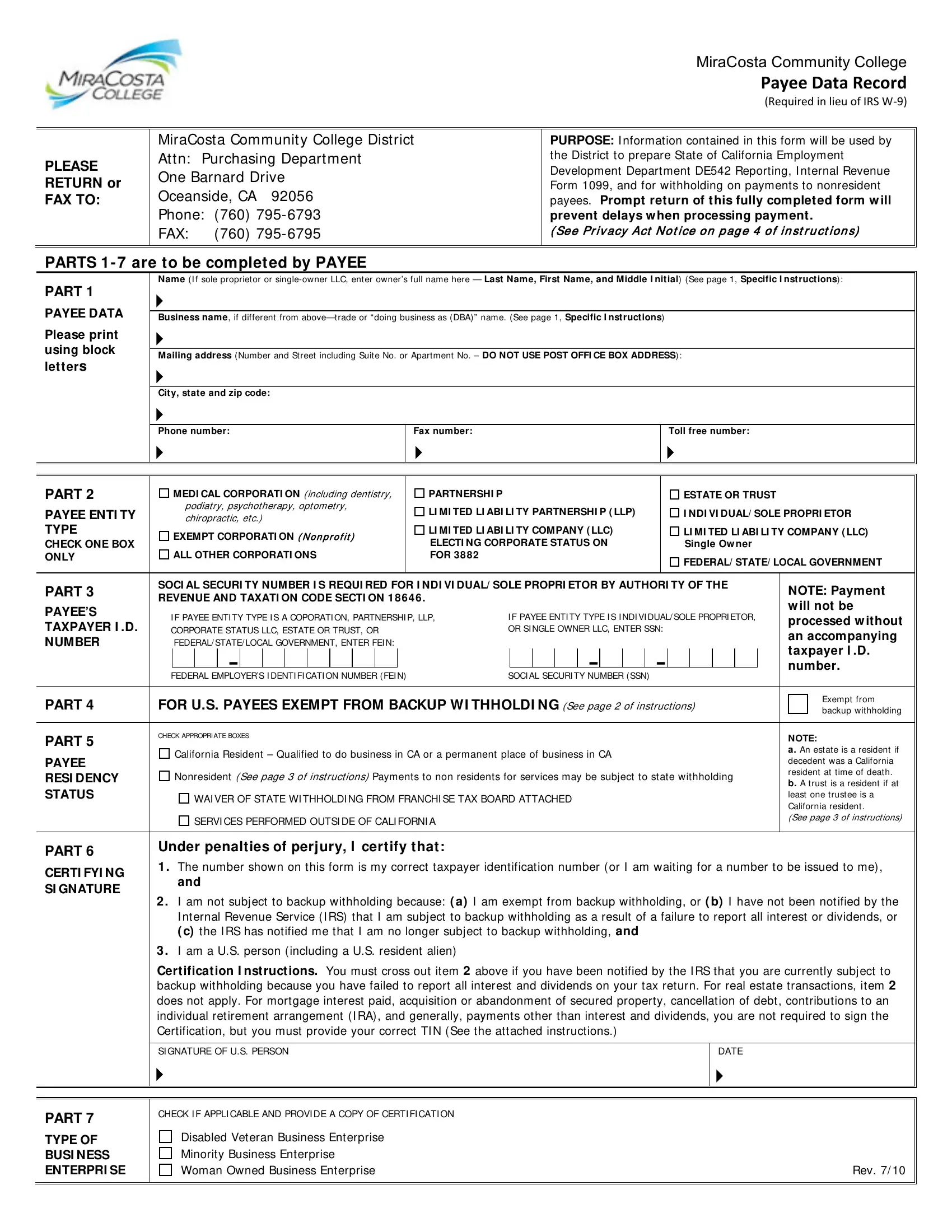

PART 5—RESI DENCY STATUS

Each corporat ion, individual, sole proprietor, partnership, estat e or trust doing business wit h the MiraCosta Community College Dist rict must indicate t heir residency status along with t heir t axpayer identificat ion number.

A corporation will be considered a “ resident” if it has a permanent place of business in California. The corporat ion has a permanent place of business in California if it is organized and existing under the laws of t his state or, if a foreign corporation, has qualified t o transact int rastat e business. A corporat ion t hat has not qualified to transact intrastat e business (e.g., a corporation engaged exclusively in int erstat e commerce) will be considered as having a permanent place of business in this state only if it maintains a permanent office in t his state that is permanent ly staffed by it s employees.

For individuals/ sole proprietors, the t erm “ resident” includes every individual who is in California for ot her than a t emporary or t ransitory purpose and any individual domiciled in California who is absent for a temporary or transitory purpose. Generally, an individual who comes t o California for a purpose, which will extend over a long or indefinit e period, will be considered a resident . However, an individual who comes t o perform a particular contract of short duration will be considered a nonresident .

For withholding purposes, a partnership is considered a resident partnership if it has a permanent place of business in California. An est ate is considered a California est ate if the decedent was a California resident at the time of death and a trust is considered a California t rust if at least one t rust ee is a California resident .

More information on residency stat us can be obtained by calling the Franchise Tax Board at the numbers list ed below:

From wit hin the Unit ed Stat es, call |

1-800-338- 0505 |

From out side t he Unit ed Sat es, call |

1-916-845- 6600 |

For hearing impaired wit h TDD, call |

1-800-822- 6268 |

Are You Subject To Nonresident Withholding?

Payments made t o nonresident payees, including corporat ions, individuals, partnerships, estat es and trusts, are subject to withholding. Nonresident payees performing services in