Using PDF files online can be quite easy using our PDF editor. Anyone can fill in 5060 exemption here effortlessly. To make our editor better and easier to utilize, we consistently work on new features, with our users' suggestions in mind. To get the ball rolling, take these simple steps:

Step 1: Simply click the "Get Form Button" above on this page to start up our form editor. This way, you'll find all that is necessary to fill out your file.

Step 2: This tool enables you to work with almost all PDF files in a range of ways. Enhance it with customized text, correct original content, and include a signature - all when you need it!

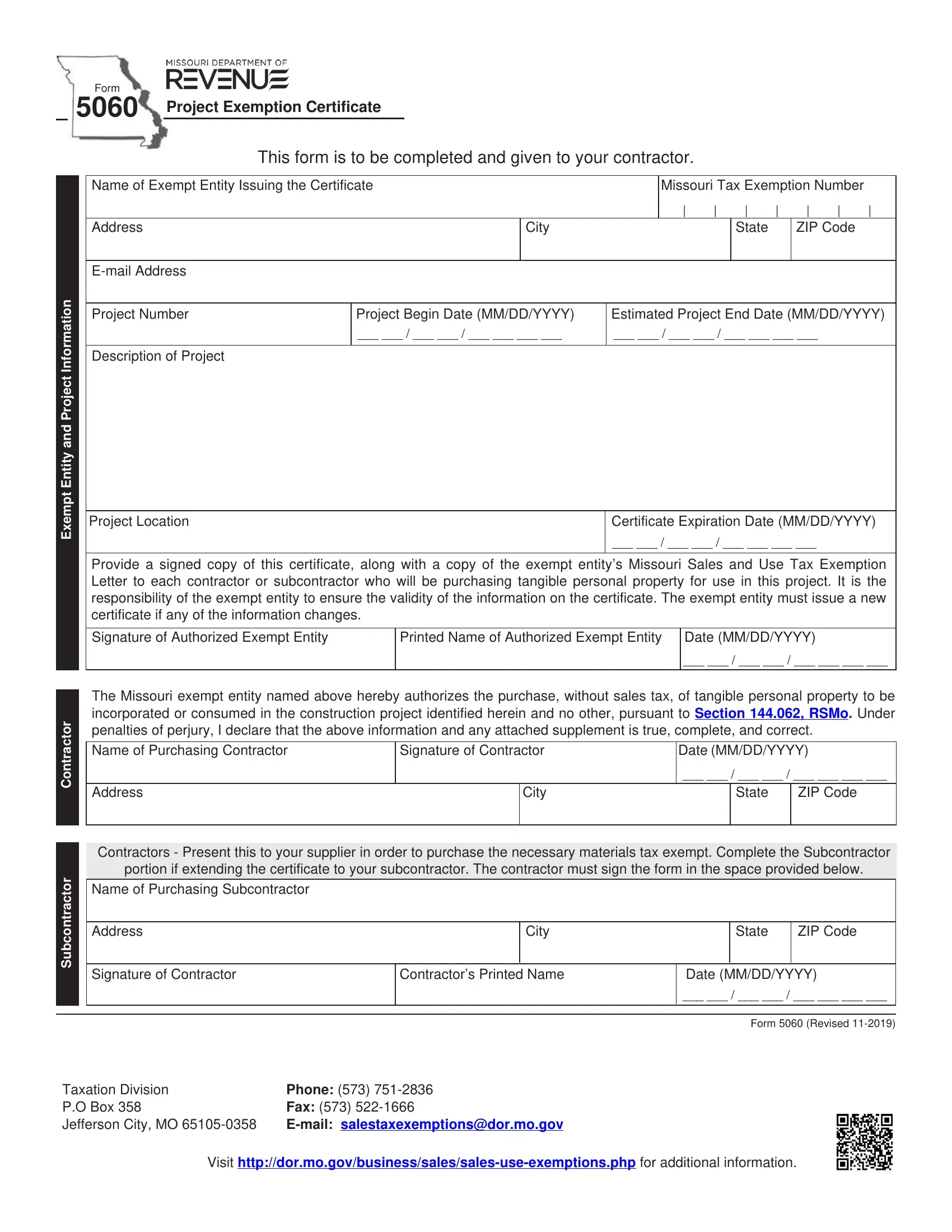

This form will need particular details to be typed in, so ensure that you take the time to enter what's requested:

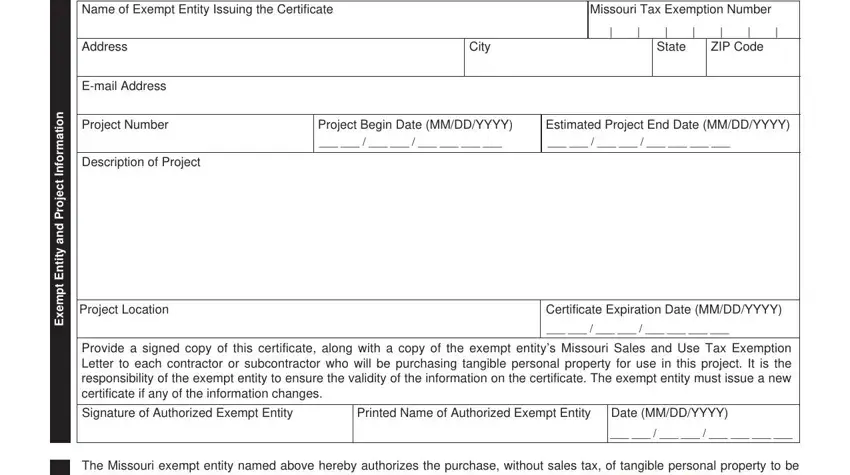

1. You will want to complete the 5060 exemption properly, so be mindful while working with the segments comprising these specific blank fields:

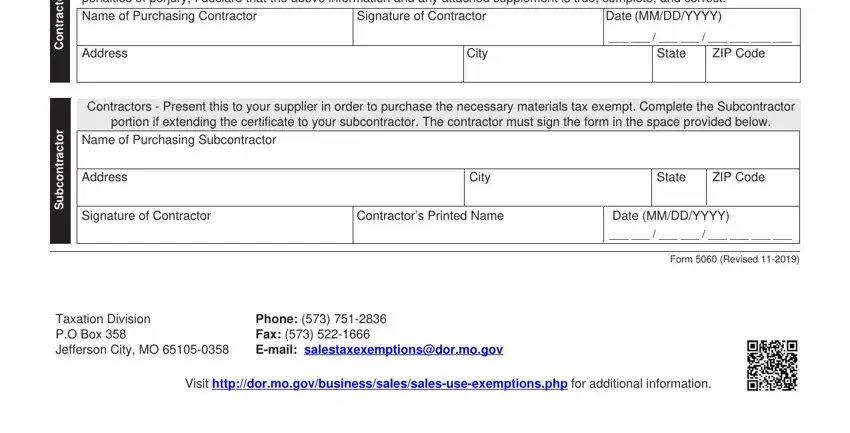

2. When this part is completed, go on to enter the applicable details in these - r o t c a r t n o C, r o t c a r t n o c b u S, The Missouri exempt entity named, Signature of Contractor, Address, City, State, ZIP Code, Contractors Present this to your, portion if extending the, Name of Purchasing Subcontractor, Address, City, State, and ZIP Code.

People who use this form often get some points wrong while filling out Contractors Present this to your in this area. Don't forget to go over everything you type in here.

Step 3: Proofread all the details you have typed into the form fields and click on the "Done" button. After creating afree trial account here, you will be able to download 5060 exemption or send it through email right away. The PDF will also be readily accessible from your personal cabinet with your each modification. FormsPal is dedicated to the confidentiality of all our users; we ensure that all information going through our editor is secure.