With the online tool for PDF editing by FormsPal, you're able to fill in or edit form missouri division here and now. Our editor is continually developing to deliver the best user experience attainable, and that's due to our resolve for continuous improvement and listening closely to comments from customers. To get the process started, consider these simple steps:

Step 1: Press the "Get Form" button above. It's going to open our pdf tool so you can start filling out your form.

Step 2: The tool helps you customize your PDF form in various ways. Improve it by writing your own text, correct original content, and put in a signature - all at your fingertips!

It is simple to complete the pdf using this detailed tutorial! Here is what you want to do:

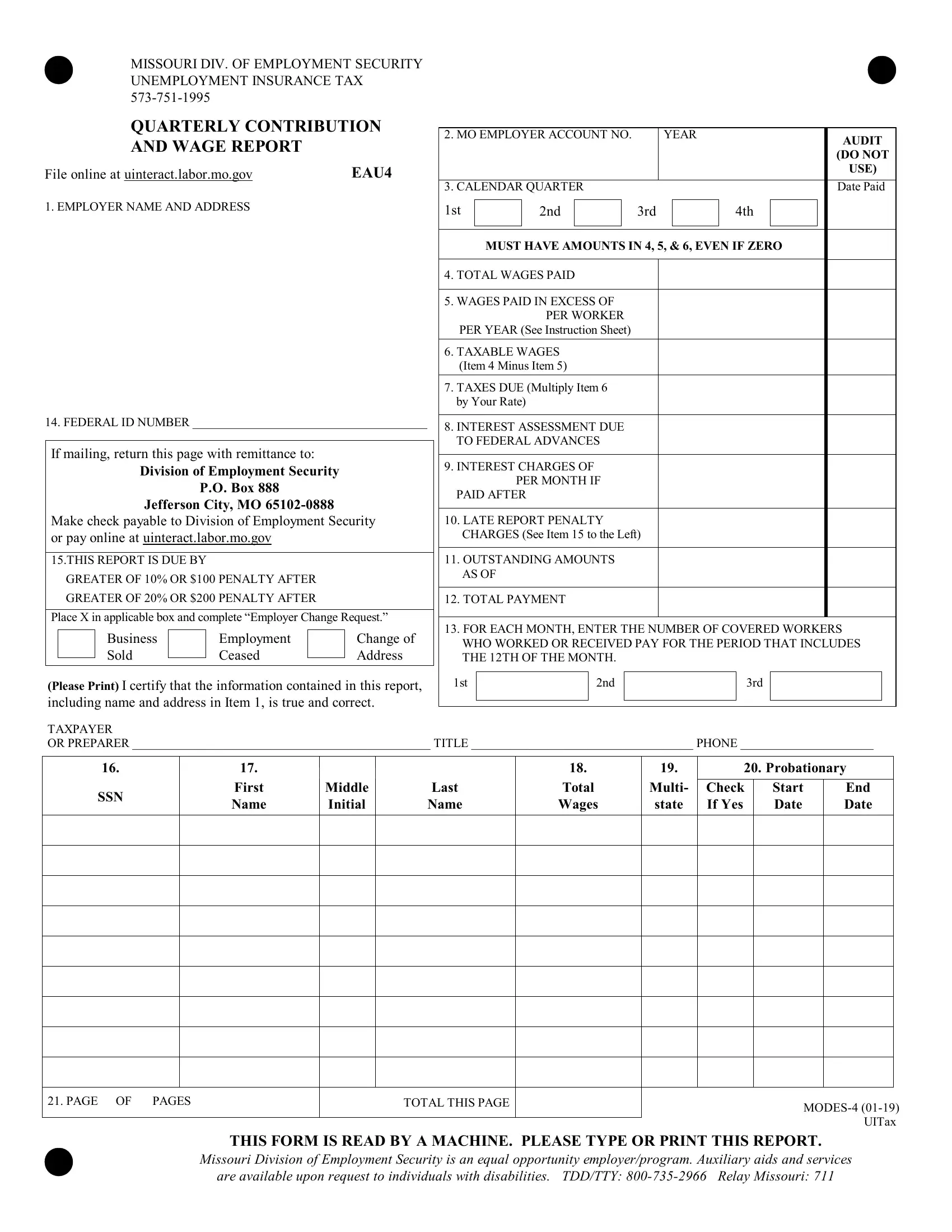

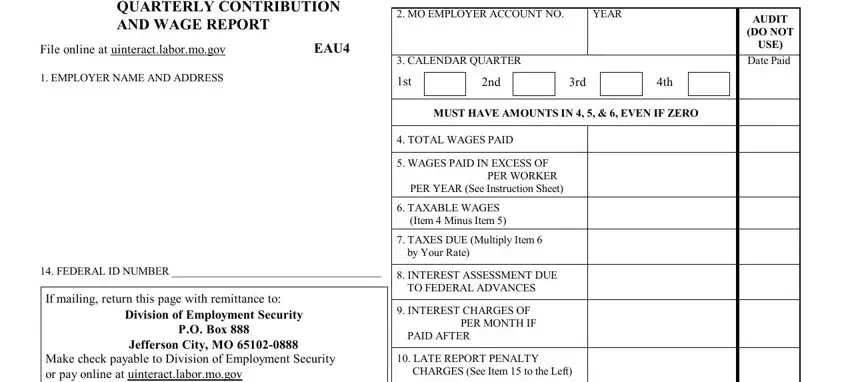

1. While completing the form missouri division, be sure to include all needed blank fields within its associated form section. It will help to hasten the process, which allows your information to be handled fast and accurately.

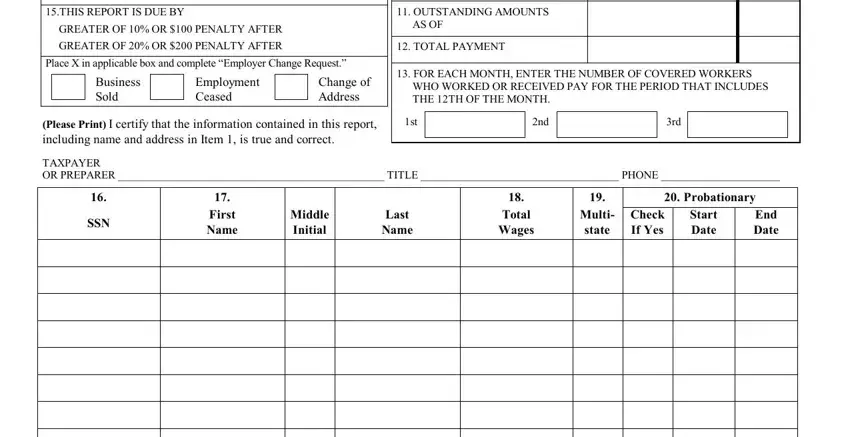

2. Once your current task is complete, take the next step – fill out all of these fields - THIS REPORT IS DUE BY, GREATER OF OR PENALTY AFTER, GREATER OF OR PENALTY AFTER, Place X in applicable box and, OUTSTANDING AMOUNTS, AS OF, TOTAL PAYMENT, Business Sold, Employment Ceased, Change of Address, FOR EACH MONTH ENTER THE NUMBER, WHO WORKED OR RECEIVED PAY FOR THE, Please Print I certify that the, TAXPAYER OR PREPARER TITLE PHONE, and SSN with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning TAXPAYER OR PREPARER TITLE PHONE and Please Print I certify that the, be sure that you double-check them in this current part. Those two are certainly the most important fields in this PDF.

3. This third section is considered relatively easy, PAGE OF, PAGES, TOTAL THIS PAGE, MODES UITax, THIS FORM IS READ BY A MACHINE, Missouri Division of Employment, and are available upon request to - every one of these blanks must be completed here.

Step 3: Go through the information you have typed into the form fields and hit the "Done" button. Right after registering a7-day free trial account at FormsPal, you will be able to download form missouri division or email it without delay. The file will also be readily accessible via your personal account with your every change. If you use FormsPal, you can certainly complete forms without having to get worried about personal data leaks or entries being shared. Our secure platform helps to ensure that your private details are kept safely.