Starting or managing a commercial fleet in Minnesota involves various steps, one of which includes navigating the MN Prorate Account Checklist form. This comprehensive form serves as a vital tool for operators looking to apply for an International Registration Plan (IRP) and/or International Fuel Tax Agreement (IFTA) prorate account. It not only aids in aligning with legal requirements but also ensures that all necessary recordkeeping and tax duties are met efficiently. The packet contains essential components like a Recordkeeping Fact Sheet, sample forms for ease of understanding, and detailed instructions on the application process. Applicants are guided through prerequisites such as obtaining a USDOT Number, FEIN, and completing specific forms including the IRP Minnesota Presence Affidavit and the IFTA License and Decals Application. Upon submission, the documents undergo review, and successful applicants are then required to apply in person, bringing all relevant forms and documents for final approval. Additionally, the checklist outlines the account closing process, emphasizing the importance of retaining operational records for a set period after closure and ensuring compliance with mileage recording and insurance laws. This introduction to the MN Prorate Account Checklist highlights its role not just as a formality but as a comprehensive guide for commercial operators to adhere to state and federal regulations, ensuring a smooth operation of their commercial fleet endeavors in Minnesota.

| Question | Answer |

|---|---|

| Form Name | MN Prorate Account Checklist Form |

| Form Length | 16 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min |

| Other names | New Prorate Account Checklist Form, Form PS2234-03 |

New Prorate Account Checklist

Full Name (print):

Business Name (if any):

Office Use Only

Prorate Acct. #:

Daytime phone #

This packet contains a Recordkeeping Fact Sheet, sample recordkeeping forms, and the forms needed to apply for an International Registration Plan (IRP) and/or International Fuel Tax Agreement (IFTA) prorate account in Minnesota. If you have questions about the application process or completing the forms, call our office at (651)

STEP 1 – Before you start the application process, make sure you have the following items (links to online resources are included for your information):

1.USDOT Number – obtain online at www.dot.gov

2.Federal Employer Identification Number (FEIN) – obtain online at www.irs.gov/businesses

3.Heavy Highway Vehicle Use Tax Return (HVUT) Form 2290 – www.irs.gov/formspubs

4.Proof of vehicle ownership (e.g., title)

5.Lease agreement, if applicable

STEP 2 – Complete these five forms:

1.IRP Minnesota Presence Affidavit, PS2230 and copies of supporting documents

2.New Prorate Applicant Questionnaire, PS2231

3.Estimated Mileage Worksheet, PS2232

4.Minnesota IRP Renewal/Supplement Application (Schedule A and B), PS2276

5.IFTA License and Decals Application, PS2261

Submit this checklist and forms by mail or in person to the address at the bottom of this checklist or fax to (651)

The forms and documents will be reviewed by our office. You will be contacted by phone with the results of the review (usually within four days).

STEP 3 – If you receive approval from our office:

You must apply in person at our office or a Prorate Deputy Registrar’s office. Bring originals of all required forms and supporting documents – including this checklist. You will receive license plates and decals at that time.

For a list of office locations and contact information, go to www.mndriveinfo.org.

Account Closing Process – If it becomes necessary to close the Prorate account, you must:

1.Complete Minnesota IRP Renewal/Supplement Application and/or IFTA quarterly report;

2.Ensure that there are no outstanding tax liabilities;

3.Turn in plates, stickers, cab cards, and/or IFTA license and unused IFTA decals; and

4.Retain operational records for four years after the account is closed.

I hereby affirm that I received the Recordkeeping Fact Sheet. I understand the recordkeeping and mileage recording requirements imposed by the International Registration Plan (IRP) and agree to abide by the IRP/IFTA regulations. The operational records and any other pertinent information required by the base jurisdiction (Minnesota) are available upon request and will remain available for four years after the account is closed. The registrant is in compliance with the laws requiring insurance while operating motor vehicles upon public roads and will maintain the required insurance coverage.

Registrant/Authorized Signature: ___________________________________________ Date: ________________

(Power of Attorney form required for authorized third party/service bureau)

Accepted by: ________________________________________ Dep. No.: __________ Date: ________________

(Prorate Unit/Deputy Registrar)

Minnesota Department of Public Safety Driver and Vehicle Services Division |

||

445 Minnesota Street Saint Paul, Minnesota |

Office: (651) |

|

IRP/IFTA Recordkeeping Requirements

JUST T HE FA C T S

The International Registration Plan (IRP) and International Fuel Tax Agreement (IFTA) are cooperative pro- grams to collect and distribute registration and fuel tax revenue between member states and Canadian prov- inces. The programs benefit carriers by consolidating licensing and reporting requirements through the base (home) state.

The maintenance of mileage and fuel records is a requirement of IRP and IFTA. Mileage and fuel records are needed to ensure proper tax distribution among jurisdictions. The carrier and driver are responsible for main- taining vehicle trip reports that record by state/province every mile driven and every gallon of fuel put into the licensed power unit.

This fact sheet outlines the IRP/IFTA recordkeeping and reporting requirements. Topics include:

•Trip Reports

•Fuel Records

•Recaps (Mileage and Fuel Summaries)

• Record Retention

•Audit

•Account Closing Process

Trip Reports |

Fuel Records |

A "Trip Report" (see sample form) is the source document completed by the driver that records in detail the vehicle miles traveled and fuel purchased. These reports are used when completing the annual IRP registration renewal and the quarterly IFTA fuel tax returns.

The IRP and IFTA programs require that the vehicle mileage and fuel trip report contain the following items:

1.Date of trip (start and end)

2.Trip origin and destination (destination is the further- most point from the trip origin)

3.Routes of travel and/or state line odometer readings

IFTA requires a record of the fuel purchased and used by each IFTA licensed vehicle. Evidence of

1.Date of purchase

2.Seller's name and address

3.Number of gallons/liters purchased

4. |

Beginning and ending odometer or hub odometer |

4. |

Fuel type |

|

|

|

readings. |

5. |

Price per gallon or liter or total amount of sale |

||

|

|

|

|||

5. |

Total trip miles |

6. |

Unit numbers |

|

|

|

|

|

|

||

6. |

Mileage by state/province (determined by state line |

7. |

Purchaser’s name (in case of a lessor/lessee agree- |

||

|

odometer reading or route of travel) |

||||

|

|

ment, receipts will be accepted in either name, pro- |

|||

|

|

|

|

||

7. |

Unit number or vehicle identification number (VIN) |

|

vided a legal connection can be made to reporting |

||

8. |

Vehicle fleet number |

|

party) |

|

|

|

|

|

|||

9. |

Registrant’s name |

Note: Altered receipts will not be accepted. |

|||

|

|

MINNESOTA DEPARTMENT OF PUBLIC SAFETY |

|

||

|

|

|

|||

|

|

DRIVER AND VEHICLE SERVICES DIVISION |

|||

Fuel Records (cont.)

A bulk metered record can be used when

1.Date of withdrawal

2.Number of gallons

3.Fuel type

4. Unit number, license plate number, or VIN

5. Purchase and inventory records

to substantiate that tax was paid Helpful Hint! on all bulk fuel purchases

|

Print Trip Report |

|

form on an 8 ½ x 11” |

|

envelope and keep |

Recaps |

receipts inside. |

|

Mileage & Fuel Summaries

IRP and IFTA require carriers to maintain a monthly summary of miles traveled and fuel purchased for each vehicle (see sample form).

Monthly totals for the following items are required for all vehicles in the fleet:

•Miles driven by state/province.

•Fuel purchased by state/province.

•Total mileage driven.

•Total fuel purchased.

Record Retention

IFTA Retention Requirement – Records used to support the information reported on the fuel tax returns (miles and fuel purchases) must be retained for four years from the filing date of the return.

IRP Retention Requirement – Mileage records used to support the information reported on the annual renewal must be retained for three years after the close of the registration year.

MINNESOTA DEPARTMENT OF PUBLIC SAFETY

MINNESOTA DEPARTMENT OF PUBLIC SAFETY

RIVER AND VEHICLE SERVICES DIVISION

DRIVER AND VEHICLE SERVICES DIVISION

Prorate Office

445 Minnesota Street

Saint Paul, Minnesota

Phone:

Fax: 651.215.0027

TTY:

Web: www.dps.state.mn.us/

Audit

Carriers are audited periodically to ensure that accept- able records are maintained. If the carrier’s records are not located or made available in Minnesota, the auditor’s travel expenses and per diem will be billed to the license holder upon completion of the audit.

Failure to provide adequate mileage and fuel documen- tation may result in the following audit assessments:

IRP Registration Tax Penalty – An additional tax liabil- ity of 20% of the Minnesota base registration tax.

Fuel Tax Penalty – Use of four miles per gallon as the standard used to determine fuel tax liability for all au- dited quarters.

In addition, failure to maintain fuel receipts or invoices will result in denial of a fuel tax credit.

IFTA Filing Dates

IFTA tax reports are filed on a quarterly basis. Reports are due the last day of the month following the end of the quarter. If the last day of the month falls on a Saturday, Sunday, or legal holiday, the next business day is considered the filing due date.

All returns must be US postmarked by the deadline (bold date) to be considered timely:

April 30 – 1st Quarter

October 31 – 3rd Quarter

Note: Filing is required even when no miles were traveled during the quarter.

Penalties for failure to file a report, for filing a late report, or for underpayment of fuel taxes are:

•$50.00 or 10% of the net tax liability, whichever is greater; and

•Interest at a rate of 1% per month.

Account Closing Process

If it is necessary to close the Prorate account, you must:

1.Complete Minnesota IRP Renewal/Supplement Ap- plication and/or IFTA quarterly report;

2.Ensure that there are no outstanding tax liabilities;

3.Turn in plates, stickers, cab cards, and/or IFTA li- cense and unused IFTA decals; and

4.Retain operational records for four years after the account is closed.

Page 2

|

|

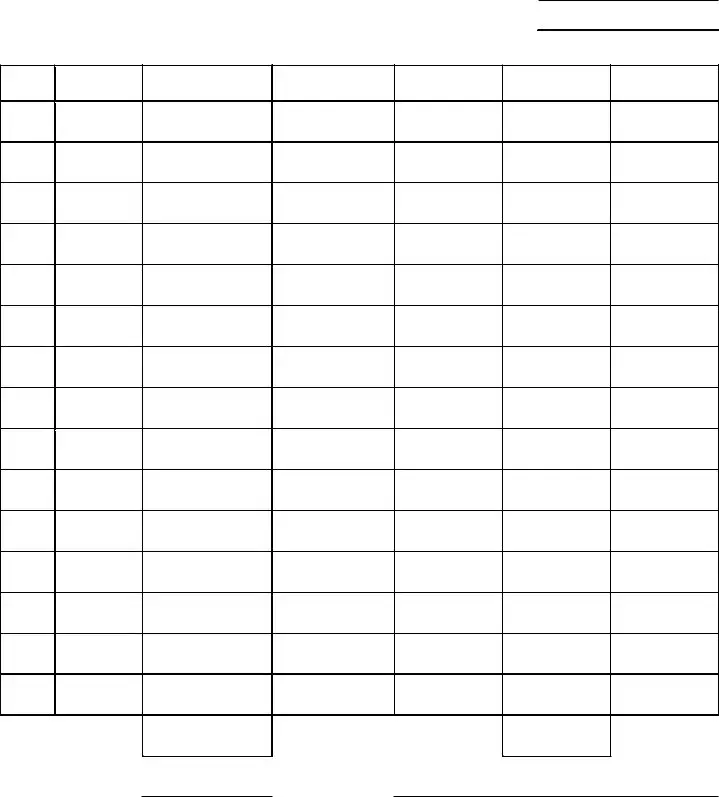

Trip Report |

|

Registrant/ |

|

Vehicle (Truck/Tractor) |

|

Carrier Name |

|

ID Number |

|

Trip Origin |

|

Fleet Number |

|

|

|||

|

|

|

|

Complete this report monthly or more frequently

Date State/ Province

Odometer

Daily beginning/state line

Highways Traveled

Destination/ Stops

Miles

Fuel Purchased (gallons)

*Ending Odometer

Reading

Total Odometer

Miles

Total Miles by State/Province

Total Trip Miles

Driver’s Name

MN: ________ _____ : __________ _____ : ___________ _____ : __________ _____ : __________

*Ending odometer reading should be the same as the next trip’s beginning odometer reading.

Sample Trip Report |

Page 3 |

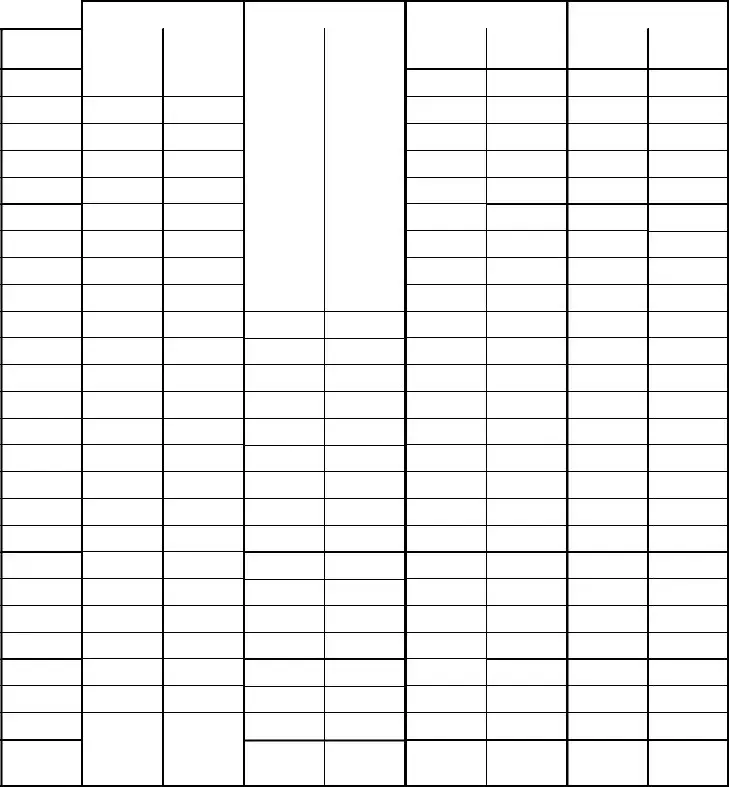

|

Monthly Mileage and Fuel Summary |

||

Registrant/ |

|

Vehicle (Truck/Tractor) |

|

Carrier Name |

|

ID Number |

|

|

|

|

|

Quarter/Year |

|

Fleet Number |

|

|

|

|

|

•Include only IRP and/or IFTA qualified vehicles (over 26,000 pounds GVW or three or more axles).

•Include all fuel pumped into the power unit.

State/ Province

Month |

|

Month |

|

Month |

|

|

|

|

|

|

|

Miles |

Fuel |

Miles |

Fuel |

Miles |

|

Traveled |

Purchased |

Traveled |

Purchased |

Traveled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Total |

|

|

|

|

Fuel |

Miles |

Fuel |

Purchased |

Traveled |

Purchased |

Monthly Totals

Sample Monthly Mileage and Fuel Summary |

Page 4 |