Are you a Minnesota business owner and unsure how to properly manage your prorate accounts? With many regulations, rules, and forms to consider it can be challenging to stay organized. To help simplify the process, we've created a MN Prorate Account Checklist Form which outlines all required steps and information needed for successful prorate management in the state of Minnesota. This post will guide you through the process so that you can ensure that your prorate account complies with all applicable rules and regulations.

| Question | Answer |

|---|---|

| Form Name | MN Prorate Account Checklist Form |

| Form Length | 16 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min |

| Other names | New Prorate Account Checklist Form, Form PS2234-03 |

New Prorate Account Checklist

Full Name (print):

Business Name (if any):

Office Use Only

Prorate Acct. #:

Daytime phone #

This packet contains a Recordkeeping Fact Sheet, sample recordkeeping forms, and the forms needed to apply for an International Registration Plan (IRP) and/or International Fuel Tax Agreement (IFTA) prorate account in Minnesota. If you have questions about the application process or completing the forms, call our office at (651)

STEP 1 – Before you start the application process, make sure you have the following items (links to online resources are included for your information):

1.USDOT Number – obtain online at www.dot.gov

2.Federal Employer Identification Number (FEIN) – obtain online at www.irs.gov/businesses

3.Heavy Highway Vehicle Use Tax Return (HVUT) Form 2290 – www.irs.gov/formspubs

4.Proof of vehicle ownership (e.g., title)

5.Lease agreement, if applicable

STEP 2 – Complete these five forms:

1.IRP Minnesota Presence Affidavit, PS2230 and copies of supporting documents

2.New Prorate Applicant Questionnaire, PS2231

3.Estimated Mileage Worksheet, PS2232

4.Minnesota IRP Renewal/Supplement Application (Schedule A and B), PS2276

5.IFTA License and Decals Application, PS2261

Submit this checklist and forms by mail or in person to the address at the bottom of this checklist or fax to (651)

The forms and documents will be reviewed by our office. You will be contacted by phone with the results of the review (usually within four days).

STEP 3 – If you receive approval from our office:

You must apply in person at our office or a Prorate Deputy Registrar’s office. Bring originals of all required forms and supporting documents – including this checklist. You will receive license plates and decals at that time.

For a list of office locations and contact information, go to www.mndriveinfo.org.

Account Closing Process – If it becomes necessary to close the Prorate account, you must:

1.Complete Minnesota IRP Renewal/Supplement Application and/or IFTA quarterly report;

2.Ensure that there are no outstanding tax liabilities;

3.Turn in plates, stickers, cab cards, and/or IFTA license and unused IFTA decals; and

4.Retain operational records for four years after the account is closed.

I hereby affirm that I received the Recordkeeping Fact Sheet. I understand the recordkeeping and mileage recording requirements imposed by the International Registration Plan (IRP) and agree to abide by the IRP/IFTA regulations. The operational records and any other pertinent information required by the base jurisdiction (Minnesota) are available upon request and will remain available for four years after the account is closed. The registrant is in compliance with the laws requiring insurance while operating motor vehicles upon public roads and will maintain the required insurance coverage.

Registrant/Authorized Signature: ___________________________________________ Date: ________________

(Power of Attorney form required for authorized third party/service bureau)

Accepted by: ________________________________________ Dep. No.: __________ Date: ________________

(Prorate Unit/Deputy Registrar)

Minnesota Department of Public Safety Driver and Vehicle Services Division |

||

445 Minnesota Street Saint Paul, Minnesota |

Office: (651) |

|

IRP/IFTA Recordkeeping Requirements

JUST T HE FA C T S

The International Registration Plan (IRP) and International Fuel Tax Agreement (IFTA) are cooperative pro- grams to collect and distribute registration and fuel tax revenue between member states and Canadian prov- inces. The programs benefit carriers by consolidating licensing and reporting requirements through the base (home) state.

The maintenance of mileage and fuel records is a requirement of IRP and IFTA. Mileage and fuel records are needed to ensure proper tax distribution among jurisdictions. The carrier and driver are responsible for main- taining vehicle trip reports that record by state/province every mile driven and every gallon of fuel put into the licensed power unit.

This fact sheet outlines the IRP/IFTA recordkeeping and reporting requirements. Topics include:

•Trip Reports

•Fuel Records

•Recaps (Mileage and Fuel Summaries)

• Record Retention

•Audit

•Account Closing Process

Trip Reports |

Fuel Records |

A "Trip Report" (see sample form) is the source document completed by the driver that records in detail the vehicle miles traveled and fuel purchased. These reports are used when completing the annual IRP registration renewal and the quarterly IFTA fuel tax returns.

The IRP and IFTA programs require that the vehicle mileage and fuel trip report contain the following items:

1.Date of trip (start and end)

2.Trip origin and destination (destination is the further- most point from the trip origin)

3.Routes of travel and/or state line odometer readings

IFTA requires a record of the fuel purchased and used by each IFTA licensed vehicle. Evidence of

1.Date of purchase

2.Seller's name and address

3.Number of gallons/liters purchased

4. |

Beginning and ending odometer or hub odometer |

4. |

Fuel type |

|

|

|

readings. |

5. |

Price per gallon or liter or total amount of sale |

||

|

|

|

|||

5. |

Total trip miles |

6. |

Unit numbers |

|

|

|

|

|

|

||

6. |

Mileage by state/province (determined by state line |

7. |

Purchaser’s name (in case of a lessor/lessee agree- |

||

|

odometer reading or route of travel) |

||||

|

|

ment, receipts will be accepted in either name, pro- |

|||

|

|

|

|

||

7. |

Unit number or vehicle identification number (VIN) |

|

vided a legal connection can be made to reporting |

||

8. |

Vehicle fleet number |

|

party) |

|

|

|

|

|

|||

9. |

Registrant’s name |

Note: Altered receipts will not be accepted. |

|||

|

|

MINNESOTA DEPARTMENT OF PUBLIC SAFETY |

|

||

|

|

|

|||

|

|

DRIVER AND VEHICLE SERVICES DIVISION |

|||

Fuel Records (cont.)

A bulk metered record can be used when

1.Date of withdrawal

2.Number of gallons

3.Fuel type

4. Unit number, license plate number, or VIN

5. Purchase and inventory records

to substantiate that tax was paid Helpful Hint! on all bulk fuel purchases

|

Print Trip Report |

|

form on an 8 ½ x 11” |

|

envelope and keep |

Recaps |

receipts inside. |

|

Mileage & Fuel Summaries

IRP and IFTA require carriers to maintain a monthly summary of miles traveled and fuel purchased for each vehicle (see sample form).

Monthly totals for the following items are required for all vehicles in the fleet:

•Miles driven by state/province.

•Fuel purchased by state/province.

•Total mileage driven.

•Total fuel purchased.

Record Retention

IFTA Retention Requirement – Records used to support the information reported on the fuel tax returns (miles and fuel purchases) must be retained for four years from the filing date of the return.

IRP Retention Requirement – Mileage records used to support the information reported on the annual renewal must be retained for three years after the close of the registration year.

MINNESOTA DEPARTMENT OF PUBLIC SAFETY

MINNESOTA DEPARTMENT OF PUBLIC SAFETY

RIVER AND VEHICLE SERVICES DIVISION

DRIVER AND VEHICLE SERVICES DIVISION

Prorate Office

445 Minnesota Street

Saint Paul, Minnesota

Phone:

Fax: 651.215.0027

TTY:

Web: www.dps.state.mn.us/

Audit

Carriers are audited periodically to ensure that accept- able records are maintained. If the carrier’s records are not located or made available in Minnesota, the auditor’s travel expenses and per diem will be billed to the license holder upon completion of the audit.

Failure to provide adequate mileage and fuel documen- tation may result in the following audit assessments:

IRP Registration Tax Penalty – An additional tax liabil- ity of 20% of the Minnesota base registration tax.

Fuel Tax Penalty – Use of four miles per gallon as the standard used to determine fuel tax liability for all au- dited quarters.

In addition, failure to maintain fuel receipts or invoices will result in denial of a fuel tax credit.

IFTA Filing Dates

IFTA tax reports are filed on a quarterly basis. Reports are due the last day of the month following the end of the quarter. If the last day of the month falls on a Saturday, Sunday, or legal holiday, the next business day is considered the filing due date.

All returns must be US postmarked by the deadline (bold date) to be considered timely:

April 30 – 1st Quarter

October 31 – 3rd Quarter

Note: Filing is required even when no miles were traveled during the quarter.

Penalties for failure to file a report, for filing a late report, or for underpayment of fuel taxes are:

•$50.00 or 10% of the net tax liability, whichever is greater; and

•Interest at a rate of 1% per month.

Account Closing Process

If it is necessary to close the Prorate account, you must:

1.Complete Minnesota IRP Renewal/Supplement Ap- plication and/or IFTA quarterly report;

2.Ensure that there are no outstanding tax liabilities;

3.Turn in plates, stickers, cab cards, and/or IFTA li- cense and unused IFTA decals; and

4.Retain operational records for four years after the account is closed.

Page 2

|

|

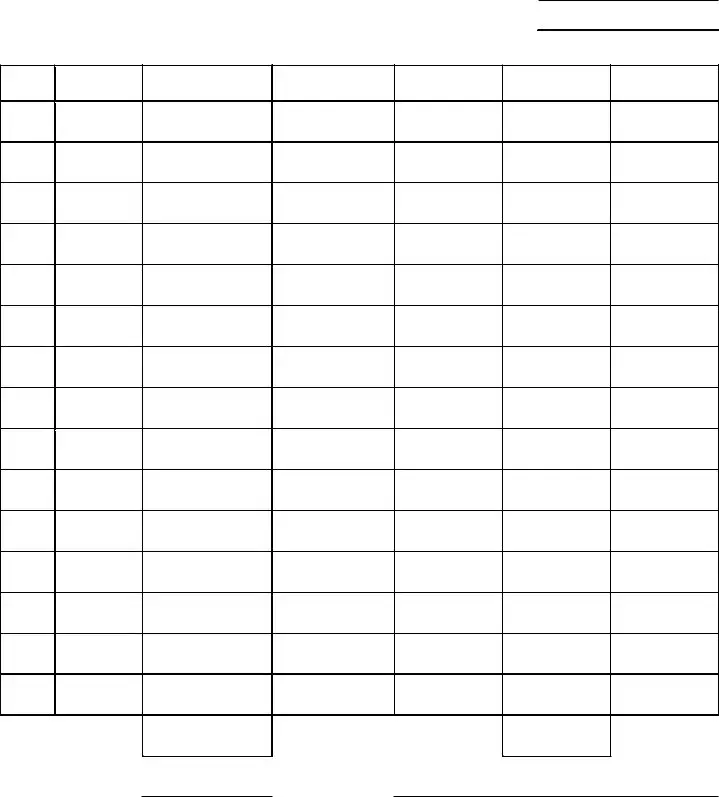

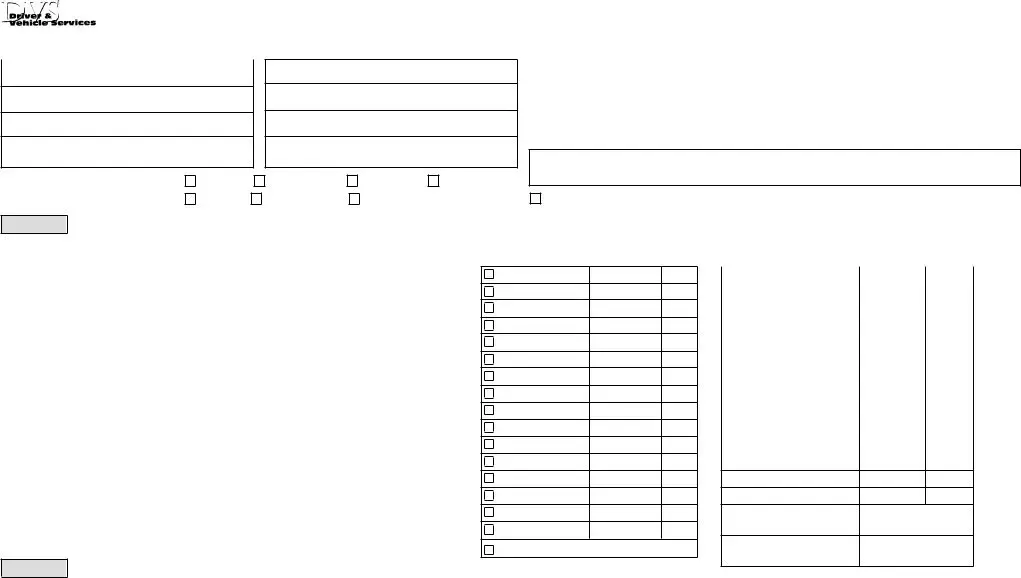

Trip Report |

|

Registrant/ |

|

Vehicle (Truck/Tractor) |

|

Carrier Name |

|

ID Number |

|

Trip Origin |

|

Fleet Number |

|

|

|||

|

|

|

|

Complete this report monthly or more frequently

Date State/ Province

Odometer

Daily beginning/state line

Highways Traveled

Destination/ Stops

Miles

Fuel Purchased (gallons)

*Ending Odometer

Reading

Total Odometer

Miles

Total Miles by State/Province

Total Trip Miles

Driver’s Name

MN: ________ _____ : __________ _____ : ___________ _____ : __________ _____ : __________

*Ending odometer reading should be the same as the next trip’s beginning odometer reading.

Sample Trip Report |

Page 3 |

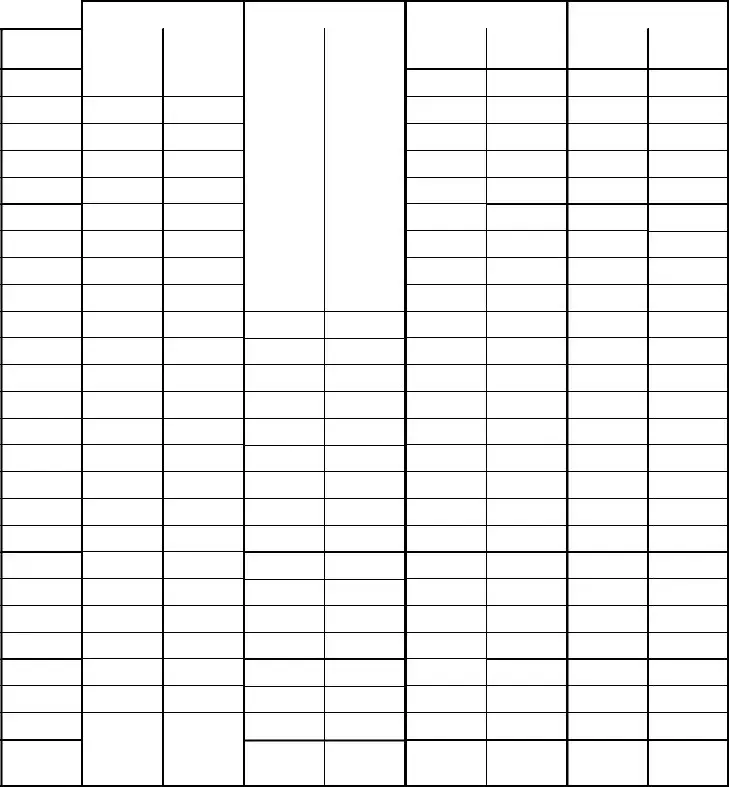

|

Monthly Mileage and Fuel Summary |

||

Registrant/ |

|

Vehicle (Truck/Tractor) |

|

Carrier Name |

|

ID Number |

|

|

|

|

|

Quarter/Year |

|

Fleet Number |

|

|

|

|

|

•Include only IRP and/or IFTA qualified vehicles (over 26,000 pounds GVW or three or more axles).

•Include all fuel pumped into the power unit.

State/ Province

Month |

|

Month |

|

Month |

|

|

|

|

|

|

|

Miles |

Fuel |

Miles |

Fuel |

Miles |

|

Traveled |

Purchased |

Traveled |

Purchased |

Traveled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Total |

|

|

|

|

Fuel |

Miles |

Fuel |

Purchased |

Traveled |

Purchased |

Monthly Totals

Sample Monthly Mileage and Fuel Summary |

Page 4 |

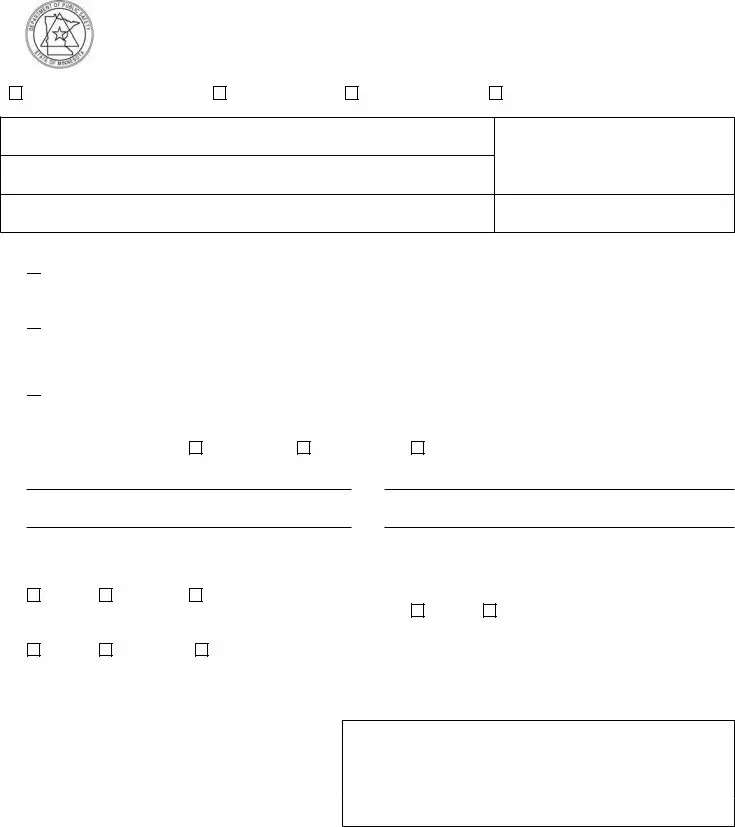

IRP Minnesota Presence Affidavit

IMPORTANT: READ BEFORE YOU COMPLETE THIS FORM

Why are you being asked to share this information and how will it be used?

An International Registration Plan (IRP) registrant who declares Minnesota as the base jurisdiction must provide evidence of a Minnesota presence (an established place of business or residence).

The Department of Public Safety (DPS) will use the information to identify you as a registrant or authorized agent of the registrant, to create or identify your Minnesota prorate account, to determine your eligibility for Minnesota prorate registration, to access your record for any future service transactions and/or inquiries, and to comply with state and federal laws.

State law authorizes collection of this information.

The International Registration Plan (IRP) entered into under the authority of Minnesota Statutes, section 168.187, subdivision 7, requires this information. Minnesota Rules, part 7410.0400, requires proof of identity for vehicle registration and title transactions.

Consequences of supplying or refusing to supply requested information.

If you supply the requested information, the DPS will be able to determine whether to issue you Minnesota title and prorate registration.

If you don’t provide the information requested, the DPS cannot issue you title or prorate registration and your eligibility for any current registration may be affected.

How is the requested information shared with other agencies?

The DPS releases this information to local, state, and federal government agencies only as authorized or required by state and federal law. This means that the information may be shared with the Federal Motor Carrier Safety Administration (FMCSA) and IRP member states. In addition, your personal information may also be disclosed as authorized in the United States Code, title 18, section 2721.

Permissible Uses of Motor Vehicle Data as provided in United States Code, title 18, section 2721

1.For use by any government agency, including court or law enforcement agency, in carrying out its functions, or any private person or entity acting on behalf of a federal, state or local agency in carrying out its functions.

2.For use in connection with matters of motor vehicle or driver safety and theft; motor vehicle emissions; motor vehicle product alterations, recalls or advisories; performance monitoring of motor vehicles, motor vehicle parts and dealers; motor vehicle market research activities, including survey research; and removal of

3.For use in the normal course of business by a legitimate business or its agents, employees, or contractors, but only:

(A)to verify the accuracy of personal information submitted by the individual to the business or its agencies, employees, or contractors; and

(B)if such information as so submitted is not correct or is no longer correct, to obtain correct information, but only for the purposes of preventing fraud by, pursuing legal remedies against, or recovering on a debt or security interest against the individual.

4.For use in connection with any civil, criminal, administrative, or arbitral proceeding in any federal, state or local court or agency or before any

5.For use in research activities, and for use in producing statistical reports, so long as the personal information is not published, re- disclosed, or used to contact individuals.

6.For use by any insurer or insurance support organization, or by

7.For use in providing notice to the owners of towed or impounded vehicles.

8.For use by any licensed private investigative agency or licensed security service for any purpose permitted under this subsection.

9.For use by an employer or its agent or insurer to obtain or verify information relating to a holder of a commercial driver’s license that is required under the Commercial Motor Vehicle Safety Act of 1986 (49 U.S.C. App. 2710 et seq.).

10.For use in connection with the operation of private toll transportation facilities.

11.For any other use in response to requests for individual motor vehicle records if the state has obtained the express consent of the person to whom such personal information pertains.

12.For bulk distribution for surveys, marketing, or solicitations if the state has obtained the express consent of the person to whom such personal information pertains.

13.For use by any requester, if the requester demonstrates it has obtained written consent of the individual to whom the information pertains.

14.For any other use specifically authorized under the law of the state that holds the record, if such use is related to the operation of a motor vehicle or public safety.

Minnesota Department of Public Safety Driver and Vehicle Services Division

445 Minnesota Street Saint Paul, Minnesota |

Office: (651) |

IRP Minnesota Presence Affidavit

_______________________________________________ |

____________________________________________ |

(Print Registrant/Company Name) |

(Print Authorized Signer’s Name and Title) |

I, the undersigned, declare Minnesota as the base jurisdiction of the International Registration Plan (IRP) registrant named above. Minnesota presence is based on item 1 or item 2 (mark only one box).

1. The registrant has an established place of business in Minnesota that meets all of the following conditions:

___ |

Physical structure located within Minnesota (building or office) owned or leased by the registrant |

___ |

Street address (not a post office box) ___________________________________________________________ |

___ |

Open for business. List business hours:_________________________________________________________ |

___ |

Vehicles will accrue miles in Minnesota |

|

* And located within the physical structure: |

___ |

Permanent employee(s) of the registrant conducting the registrant's |

___ |

The operational records of the fleet (or records will be made available to the state when requested) |

|

* Shall be presented with this affidavit: |

___ |

Articles of Business Incorporation (including certificate) issued by authorized state agency |

___ |

Minnesota Secretary of State Certificate of Authority (required for foreign state/province corporations) |

___ |

Ownership documents or Lease agreement records associated with the physical structure |

___ |

List of permanent Minnesota employees that are currently in employment by the registrant |

2. The registrant is a Minnesota resident and does not have an established place of business. Shall be presented with this affidavit (three items from Column A or B required):

___ Vehicles will accrue miles in Minnesota

___ The operational records of the fleet (or records will be made available to the state when requested)

All documents shall be current and list registrant name and Minnesota address

|

Column A: |

Individual |

___ |

Minnesota driver’s license card |

|

___ |

Federal income tax return (filed) |

|

___ |

Minnesota personal income tax records (paid) |

|

___ |

Minnesota property/estate tax records (paid) |

|

___ |

Utility billing statement; |

|

|

(i.e. phone, cable, gas, electric, water, etc.) |

|

___ |

Minnesota motor vehicle title or registration |

|

|

(in registrant’s name) |

|

|

Column B: |

Business Entity |

___ |

Minnesota driver’s license card |

|

|

(principle owner must be a MN resident) |

|

___ |

Minnesota Secretary of State |

|

|

Articles of Incorporation |

|

___ |

Federal income tax return (filed) |

|

___ |

Minnesota personal income tax records (paid) |

|

___ |

Minnesota property/estate tax records (paid) |

|

___ |

Utility billing statement; |

|

|

(i.e. phone, cable, gas, electric, water, etc.) |

|

___ Minnesota motor vehicle title or registration (in registrant’s name)

I hereby affirm that I received all privacy warnings required by state and federal law. The information I provided is true and correct. The registrant is familiar with the record keeping and mileage recording requirements imposed by the International Registration Plan (IRP). The operational records and any other pertinent information required by the base jurisdiction (Minnesota) are available upon request. The registrant is in compliance with the laws requiring insurance while operating motor vehicles upon public roads and will maintain the required insurance coverage. The Base Jurisdiction may accept information or use other evidential factors it deems pertinent to verify that an Applicant or Registrant has an Established Place of Business or residency within the Base Jurisdiction.

Registrant/Authorized Signature: ____________________________________________ Date: ____________________

(Power of Attorney form required for authorized third party/service bureau)

Minnesota driver’s license number _____________________________________________________________________

(Required if one has been issued to the registrant/authorized signer)

Minnesota Department of Public Safety Driver and Vehicle Services Division

445 Minnesota Street Saint Paul, Minnesota |

Office: (651) |

New Prorate Applicant Questionnaire

Full Name (print):

Office Use Only

Prorate Acct. #:

Date:

Business Name (if any):

Contact Phone:

Why are you being asked to share this information and how will it be used?

The Department of Public Safety (DPS) will use the information to determine your eligibility for Minnesota prorate registration, to access your record for any future service transactions and/or inquiries, and to comply with state and federal laws.

State law authorizes collection of this information.

The International Registration Plan (IRP) entered into under the authority of Minnesota Statutes, section 168.187, subdivision 7, requires this information.

Consequences of supplying or refusing to supply requested information.

If you supply the requested information, the DPS will be able to determine whether to issue you Minnesota title and prorate registration. If you don’t provide the information requested, the DPS cannot issue you title or prorate registration and your eligibility for any current registration may be affected.

How is the requested information shared with other agencies?

The DPS releases this information to local, state, and federal government agencies only as authorized or required by state and federal law. This means that the information may be shared with the Federal Motor Carrier Safety Administration (FMCSA) and IRP member states. In addition, your personal information may also be disclosed as authorized in the United States Code, title 18, section 2721.

1.What do you haul (check all that apply)?

General Freight |

Mobil Homes |

Household Goods |

Machinery, Large |

Metal |

Beverages |

Coal, Coke |

Fresh Produce |

Motor Vehicles |

Intermodal Containers |

Drive Away, Tow |

Passengers |

Logs, Poles, Beams |

Oil Field Equipment |

Building Materials |

Livestock |

2. What type of operation is it? |

|

Authorized for hire |

Private; passengers |

Exempt for hire |

|

|

|

Private; property |

Rental |

|

|

Private; carrier |

Farm |

|

|

Private; passengers |

Migrant |

|

|

(buses) |

Bus |

Grain, Feed, Hay

Meat

Garbage, Refuse, Trash

US Postal Mail

Chemicals

Commodities: Dry, Bulk

Refrigerated Foods

Paper Products

Construction Moving Company US mail

Federal Government State Government Local Government

Utility

Farm Supplies

Construction

Water Well

Other: __________

_______________

_______________

Indian Tribe

Other: __________

_______________

_______________

_______________

3.How many vehicles are you prorating (include those you own that are leased to another company)? ______________

4.Where are these vehicles currently registered?

Minnesota |

Other jurisdiction: ___________________________________________________________ |

5.How are these vehicles currently registered?

Base plate (list plate number(s)): _______________________________________________________________

Base plate (list plate number(s)): _______________________________________________________________

__________________________________________________________________________________________

IRP plate (list plate number(s)): ________________________________________________________________

__________________________________________________________________________________________

New purchase from (seller’s name): _____________________________________________________________

Seller’s relationship to applicant (if any): _________________________________________________________

Other (explain in detail): ______________________________________________________________________

Minnesota Department of Public Safety Driver and Vehicle Services Division |

||

445 Minnesota Street Saint Paul, Minnesota |

Office: (651) |

|

New Prorate Applicant Questionnaire

Page 2

6. |

Do you have bulk fuel tanks? |

|

|

|

|

No |

Yes, used for prorated vehicles only |

Yes, used for prorated and |

|

7. |

If you have bulk fuel tanks, how is the fuel monitored and allocated (check all that apply)? |

|||

|

Individual fuel tickets |

Log sheets |

Meter readings |

|

8. |

Have you ever had IRP registration in Minnesota or any other jurisdiction? |

|||

|

No |

Yes (jurisdiction and registered name or account #): ______________________________________ |

||

9. |

In the last three years, have you been associated with a company or individual with a prorated account? |

|||

|

No |

Yes (jurisdiction and registered name or account #): ______________________________________ |

||

|

|

________________________________________________________________________________ |

||

10. |

Have you ever been denied registration? |

|

||

|

No |

Yes (explain in detail): ______________________________________________________________ |

||

11. |

Has your registration ever been suspended and/or revoked? |

|||

|

No |

Yes (explain in detail): ______________________________________________________________ |

||

12. |

Is(are) your vehicle(s) presently leased to an individual or company? |

|||

|

No |

Yes (lessee name, address, and phone number): _________________________________________ |

||

13.Under what authority (USDOT number displayed on vehicle) are you operating? _____________________________

Jurisdiction of issuance: _________________________________________________________________________

Authority holder (self or name, address, phone): ______________________________________________________

14.Have you ever been audited by Minnesota or another IRP member jurisdiction?

|

No |

Yes (approximate date, jurisdiction): ___________________________________________________ |

15. |

Has(have) your vehicle(s) accrued actual mileage (past mileage history)? |

|

|

No |

Yes (explain) _____________________________________________________________________ |

16. |

Have you been instructed on the importance of maintaining vehicle distance records? |

|

|

No |

Yes |

17. |

Address where records will be maintained for audit purposes: ____________________________________________ |

|

|

_____________________________________________________________________________________________ |

|

18.Who will be responsible for filing IRP returns? ________________________________________________________

19.Who will be responsible for filing IFTA returns? ________________________________________________________

20.Additional information/questions: ___________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

I hereby affirm that the information provided is true and correct. The registrant is familiar with the record keeping and mileage recording requirements imposed by the International Registration Plan (IRP) and International Fuel Tax Agreement (IFTA). The operational records and any other pertinent information required by the base jurisdiction (Minnesota) are available upon request. The registrant is in compliance with the laws requiring insurance while operating motor vehicles upon public roads and will maintain the required insurance coverage.

_____________________________________________________________ |

______________________ |

Signature, Title |

Date |

Minnesota Department of Public Safety Driver and Vehicle Services Division |

||

445 Minnesota Street Saint Paul, Minnesota |

Office: (651) |

|

Estimated Mileage Worksheet

(Submit with Minnesota IRP Renewal/Supplement Application)

Why are you being asked to share this information and how will it be used?

An International Registration Plan (IRP) registrant must justify estimated mileage and show how the estimate was determined. The Department of Public Safety (DPS) will use the information to identify your Minnesota prorate account, to determine your eligibility for Minnesota prorate registration, to access your record for any future service transactions and/or inquiries, and to comply with state and federal laws.

Use the worksheet on the other side of this form to calculate estimated mileage for the registration year (12 months). If your estimates are not reasonable, the base jurisdiction (Minnesota) is required by the IRP agreement to make adjustments as necessary. If mileage is estimated and the fleet is found to have accrued actual mileage in the jurisdiction during the report year, applicable fees will be assessed, including penalty and interest.

State law authorizes collection of this information

The International Registration Plan (IRP) entered into under the authority of Minnesota Statutes, section 168.187, subdivision 7, requires this information.

Consequences of supplying or refusing to supply requested information

If you supply the requested information, the DPS will be able to determine whether to issue you Minnesota title and prorate registration. If you don’t provide the information requested, the DPS cannot issue you title or prorate

registration and your eligibility for any current registration may be affected.

How is the requested information shared with other agencies?

The DPS releases this information to local, state, and federal government agencies only as authorized or required by state and federal law. This means that the information may be shared with the Federal Motor Carrier Safety Administration (FMCSA) and IRP member states. In addition, your personal information may be disclosed as authorized in the United States Code, title 18, section 2721.

Instructions if route of travel is not known: Enter the miles, from column 2, times the number of vehicles registered in the fleet in column 7. When finished, transfer the Total Estimate to Section 3 of the IRP Renewal/Supplement Application.

Column 1: Circle the two letter designation (e.g., MN ) of each jurisdiction for which mileage is estimated.

At the bottom of the column, enter the total number of jurisdictions estimated.

Column 2: Estimated miles for the jurisdiction If the route of travel is not known, enter the miles from column 2 times the numbers of vehicles registered in the fleet in column 7.

Column 7: Column 2 times number of vehicles registered in the fleet in column 7.

Instructions if route of travel is known: Complete columns 3 through 7. When finished, transfer the Total Estimate to Section 3 of the IRP Renewal/Supplement Application.

Column 3: Entry location for the jurisdiction (used when route of travel is known)

Column 4: Exit or final destination within that jurisdiction (used when route of travel is known)

Column 5: Round trip distance between locations in column 3 and column 4

Column 6: Number of Trips per fleet for this route

Column 7: Multiply column 5 by column 6 and enter the result

At the bottom of the column, enter the total estimated mileage

Minnesota Department of Public Safety Driver and Vehicle Services Division

445 Minnesota Street Saint Paul, Minnesota

Email: dvs.prorate@state.mn.us

Estimated Mileage

Account Name: |

Account #: |

Fleet #: |

# of Vehicles: |

|

|

|

|

Supplement #:

Registration Year:

1. Jurisdiction: |

2. Miles |

3.City/Town of Entry Location with |

4.City/Town of Exit/Destination with |

5.Round Trip |

|

6. # Trips |

|

7. Total Estimate |

|

Routes of Travel |

Routes of Travel |

Mileage |

|

|

|||||

AL |

Alabama |

834 |

|

|

|

X |

|

= |

AL |

|

|

|

|

|

|

|

|

|

|

AR |

Arkansas |

933 |

|

|

|

X |

|

= |

AR |

|

|

|

|

|

|

|

|

|

|

AZ |

Arizona |

1,366 |

|

|

|

X |

|

= |

AZ |

|

|

|

|

|

|

|

|

|

|

CA |

California |

2,868 |

|

|

|

X |

|

= |

CA |

|

|

|

|

|

|

|

|

|

|

CO |

Colorado |

1,064 |

|

|

|

X |

|

= |

CO |

|

|

|

|

|

|

|

|

|

|

CT |

Connecticut |

315 |

|

|

|

X |

|

= |

CT |

|

|

|

|

|

|

|

|

|

|

DC |

D.C. |

5 |

|

|

|

X |

|

= |

DC |

|

|

|

|

|

|

|

|

|

|

DE |

Delaware |

72 |

|

|

|

X |

|

= |

DE |

FL |

Florida |

1,615 |

|

|

|

X |

|

= |

FL |

GA |

Georgia |

1,776 |

|

|

|

X |

|

= |

GA |

IA |

Iowa |

5,625 |

|

|

|

X |

|

= |

IA |

ID |

Idaho |

709 |

|

|

|

X |

|

= |

ID |

IL |

Illinois |

5,513 |

|

|

|

X |

|

= |

IL |

IN |

Indiana |

3,761 |

|

|

|

X |

|

= |

IN |

KS |

Kansas |

1,813 |

|

|

|

X |

|

= |

KS |

|

|

|

|

|

|

|

|

|

|

KY |

Kentucky |

1,423 |

|

|

|

X |

|

= |

KY |

LA |

Louisiana |

545 |

|

|

|

X |

|

= |

LA |

|

|

|

|

|

|

|

|

|

|

MA |

Massachusetts |

378 |

|

|

|

X |

|

= |

MA |

|

|

|

|

|

|

|

|

|

|

MD |

Maryland |

477 |

|

|

|

X |

|

= |

MD |

|

|

|

|

|

|

|

|

|

|

ME |

Maine |

154 |

|

|

|

X |

|

= |

ME |

MI |

Michigan |

1,147 |

|

|

|

X |

|

= |

MI |

MN |

Minnesota |

21,133 |

|

|

|

X |

|

= |

MN |

MO |

Missouri |

2,824 |

|

|

|

X |

|

= |

MO |

MS |

Mississippi |

602 |

|

|

|

X |

|

= |

MS |

MT |

Montana |

1,953 |

|

|

|

X |

|

= |

MT |

NC |

North Carolina |

974 |

|

|

|

X |

|

= |

NC |

ND |

North Dakota |

2,580 |

|

|

|

X |

|

= |

ND |

NE |

Nebraska |

1,942 |

|

|

|

X |

|

= |

NE |

NH |

New Hampshire |

94 |

|

|

|

X |

|

= |

NH |

NJ |

New Jersey |

586 |

|

|

|

X |

|

= |

NJ |

|

|

|

|

|

|

|

|

|

|

NM |

New Mexico |

1,223 |

|

|

|

X |

|

= |

NM |

|

|

|

|

|

|

|

|

|

|

NV |

Nevada |

1,095 |

|

|

|

X |

|

= |

NV |

|

|

|

|

|

|

|

|

|

|

NY |

New York |

1,142 |

|

|

|

X |

|

= |

NY |

|

|

|

|

|

|

|

|

|

|

OH |

Ohio |

3,784 |

|

|

|

X |

|

= |

OH |

|

|

|

|

|

|

|

|

|

|

OK |

Oklahoma |

1,537 |

|

|

|

X |

|

= |

OK |

|

|

|

|

|

|

|

|

|

|

OR |

Oregon |

730 |

|

|

|

X |

|

= |

OR |

PA |

Pennsylvania |

3,190 |

|

|

|

X |

|

= |

PA |

RI |

Rhode Island |

38 |

|

|

|

X |

|

= |

RI |

SC |

South Carolina |

623 |

|

|

|

X |

|

= |

SC |

SD |

South. Dakota |

2,350 |

|

|

|

X |

|

= |

SD |

TN |

Tennessee |

1,630 |

|

|

|

X |

|

= |

TN |

TX |

Texas |

3,683 |

|

|

|

X |

|

= |

TX |

UT |

Utah |

1,491 |

|

|

|

X |

|

= |

UT |

VA |

Virginia |

965 |

|

|

|

X |

|

= |

VA |

|

|

|

|

|

|

|

|

|

|

VT |

Vermont |

79 |

|

|

|

X |

|

= |

VT |

|

|

|

|

|

|

|

|

|

|

WA |

Washington |

1,084 |

|

|

|

X |

|

= |

WA |

|

|

|

|

|

|

|

|

|

|

WI |

Wisconsin |

8,028 |

|

|

|

X |

|

= |

WI |

|

|

|

|

|

|

|

|

|

|

WV |

West Virginia |

468 |

|

|

|

X |

|

= |

WV |

|

|

|

|

|

|

|

|

|

|

WY |

Wyoming |

1,942 |

|

|

|

X |

|

= |

WY |

|

|

|

|

|

|

|

|

|

|

AB |

Alberta |

202 |

|

|

|

X |

|

= |

AB |

BC |

British Columbia |

140 |

|

|

|

X |

|

= |

BC |

MB |

Manitoba |

581 |

|

|

|

X |

|

= |

MB |

NB |

New Brunswick |

39 |

|

|

|

X |

|

= |

NB |

NL |

Newfoundland |

16 |

|

|

|

X |

|

= |

NL |

NS |

Nova Scotia |

29 |

|

|

|

X |

|

= |

NS |

ON |

Ontario |

618 |

|

|

|

X |

|

= |

ON |

PE |

Prince Edward |

2 |

|

|

|

X |

|

= |

PE |

QC |

Quebec |

192 |

|

|

|

X |

|

= |

QC |

SK |

Saskatchewan |

356 |

|

|

|

X |

|

= |

SK |

|

|

Total Jurisdictions Estimated |

|

Total Estimated Mileage |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Minnesota Dept. of Public Safety |

|

445 Minnesota Street Ste 188 |

|

St. Paul, MN 55101 |

|

Phone: (651) |

|

Fax: (651) |

Section 1 |

TDD/TYY: (651) |

|

|

|

|

MN International Registration Plan Renewal/Supplement Application

Account Number: _______ Fleet: _____

Account Name: |

|

|

Physical Address 1 |

|

County of Residence |

Physical Address 2 |

|

|

City, State, Zip |

|

|

|

Ownership Type: |

Company |

Section 2 |

||

|

Type of Operation: |

For Hire |

|

DBA:

Mailing Address 1

Mailing Address 2

City, State, Zip

Corporation |

Partnership |

Sole Owner |

Private Carrier |

Rent vehicles less than 45 days |

|

Contact Person Name: |

|

|

Registration Year: |

|

|

|

|

Phone No. |

Fax No: |

|

Tax ID (FEIN or SSN:) |

|

|

|

|

Email Address: |

|

|

US DOT # |

|

|

|

|

All information collected on a motor vehicle application is required by law and is used to identify the vehicle. Failure to provide required information may result in denial of the requested action. Except for certain uses by federal and state laws, personal information may not be disclosed to anyone without your consent.

Rent vehicles 45 days and over

Section 3 |

Check the jurisdictions which you want to appear on your cab card for this registration period. Indicate the distance code for each selected jurisdiction as follows: |

|

|

|

A = Actual Miles Reported E = Estimate. For jurisdictions with a distance code of A, report the miles this fleet traveled for the period of________________________________________ |

|

|

|

|

Jurisdiction |

Miles |

A/E |

|

|

|

|

|

|

|

|

|

|

* |

|

|

Alaska |

|

|

|

|

|

|

|

Alabama |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arkansas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Connecticut |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dist of Columbia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Iowa |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Idaho |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Illinois |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kansas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kentucky |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4

|

|

|

|

Jurisdiction |

Miles |

A/E |

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michigan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Missouri |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Mississippi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Montana |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North Carolina |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North Dakota |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Hampshire |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Mexico |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jurisdiction Miles A/E

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Virginia

Vermont

Washington

Wisconsin

West Virginia

Wyoming

Wyoming Intrastate Authority

|

|

|

|

Jurisdiction |

Miles |

A/E |

|

|

|

|

|

|

|

|

|

|

|

Alberta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

British Columbia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manitoba |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Brunswick |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Newfoundland/Lab |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nova Scotia |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

* |

|

|

NW Territory |

|

|

|

|

|

|

|

|

|

|

* |

|

|

Nunavut |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ontario |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prince Edward Isl |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quebec |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Saskatchewan |

|

|

|

|

|

|

|

|

*Yukon

*Mexico

Total Miles

Total Vehicles Renewed

I attest that this vehicle is insured while operated upon the public roads as required by law; proof of insurance will be carried in the vehicle. For any estimated distance reported you are required to use the Estimated Distance Worksheet. I understand that the estimated miles designated reflect intended travel in each state for the current registration year and that mileage cannot be changed during the registration year. I

furthermore affirm that I am familiar with the responsibility imposed upon me by the International Registration Plan (IRP); pursuant to Article II, Section 234 of the IRP you are required to submit, upon request, lease information regarding the

Applicant Signature: ____________________________________________________ Title: ____________________________________ Date: _____________________________ |

or |

Authorized Agent Signature: ________________________________________________________________________________________ Date: ______________________________

|

|

Minnesota International Registration Plan Renewal/Supplement Application |

|

Section 5 |

|

||

Weight Group: #______ |

Account Number:___________________________ |

Fleet:____________________________________ |

|

|

|

Vehicle Type: ______________________________ |

Minnesota CGVW: _________________________ |

This Fleet Is Currently Apportioned With The Jurisdictions Indicated And At The Gross Weights Shown Below:

Jurisdiction |

|

Weight |

|

|

Jurisdiction |

|

Weight |

|

|

Jurisdiction |

|

|

Weight |

|

|

Jurisdiction |

|

Weight |

|

Jurisdiction |

|

Weight |

|

Jurisdiction |

Weight |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AL |

|

|

|

|

|

|

|

|

IA |

|

|

|

|

|

|

|

|

MI |

|

|

|

|

|

|

NM |

|

|

|

|

|

|

TN |

|

|

|

|

AB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AR |

|

|

|

|

|

|

|

|

ID |

|

|

|

|

|

|

|

|

MN |

|

|

|

|

|

NV |

|

|

|

|

|

|

TX |

|

|

|

|

BC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AZ |

|

|

|

|

|

|

|

|

IL |

|

|

|

|

|

|

|

|

MO |

|

|

|

|

|

NY |

|

|

|

|

|

|

UT |

|

|

|

|

MB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA |

|

|

|

|

|

|

|

|

IN |

|

|

|

|

|

|

|

|

MS |

|

|

|

|

|

OH |

|

|

|

|

|

|

VA |

|

|

|

|

NB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CO |

|

|

|

|

|

|

|

|

KS |

|

|

|

|

|

|

|

|

MT |

|

|

|

|

|

OK |

|

|

|

|

|

|

VT |

|

|

|

|

NL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CT |

|

|

|

|

|

|

|

|

KY |

|

|

|

|

|

|

|

|

NC |

|

|

|

|

|

|

OR |

|

|

|

|

|

|

WA |

|

|

|

|

NS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DC |

|

|

|

|

|

|

|

|

LA |

|

|

|

|

|

|

|

|

ND |

|

|

|

|

|

PA |

|

|

|

|

|

|

WI |

|

|

|

|

ON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE |

|

|

|

|

|

|

|

|

MA |

|

|

|

|

|

|

|

|

NE |

|

|

|

|

|

|

RI |

|

|

|

|

|

|

WV |

|

|

|

|

PE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FL |

|

|

|

|

|

|

|

|

MD |

|

|

|

|

|

|

|

|

NH |

|

|

|

|

|

SC |

|

|

|

|

|

|

WY |

|

|

|

|

QC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GA |

|

|

|

|

|

|

|

|

ME |

|

|

|

|

|

|

|

|

NJ |

|

|

|

|

|

|

SD |

|

|

|

|

|

|

|

|

|

|

|

SK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Section 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

** Place a "D" in |

the |

Action |

box if deleting the vehicle. |

Place a |

"C" in |

the |

Delete/Change |

box |

if changing any |

vehicle |

information. |

Please |

make |

all changes |

in red. |

|

||||||||||||||||||||||||

*1 |

Verify |

the US |

DOT number |

for the carrier |

responsible |

for |

safety |

fitness of |

the |

vehicle. |

This |

should be the US DOT number displayed on the cab of the vehicle. |

|

|||||||||||||||||||||||||||

*3 |

Please |

indicate |

if |

the carrier |

responsible |

for |

the |

safety |

fitness |

of |

the |

vehicle is |

expected to |

change during this registration year. |

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

*2 |

Verify |

|

the |

|

Tax |

Identification |

Number |

|

|

for |

the |

|

carrier |

responsible |

for |

the |

safety |

fitness |

of |

the |

vehicle. |

|

||||||||||||||||

*5 *4 VerifyIf thecountyunit |

keptis |

a |

whentype |

ofnot |

TK in withuse travelor |

operationin Colorado,(MS please163.051)indicate. |

if the |

truck |

pulls |

a |

trailer. |

|

|

|

|

|

|

|

||||||||||||||||||||||

*6 Please see renewal instructions regarding special use vehicles. Complete if applicable.

VEHICLE EQUIPMENT LIST FOR ACCOUNT _____ - FLEET _____ - WEIGHT GROUP _____

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.I.N. |

|

|

Owner Name |

Owner DOB |

*1 USDOT |

*2 FEIN |

|

*3 Yes/No |

*4 CO Trailer Y/N |

*5 County Kept When Not In Use |

*6 Special Use |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.I.N. |

|

|

Owner Name |

Owner DOB |

*1 USDOT |

*2 FEIN |

|

*3 Yes/No |

*4 CO Trailer Y/N |

*5 County Kept When Not In Use |

*6 Special Use |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.I.N. |

|

|

Owner Name |

Owner DOB |

*1 USDOT |

*2 FEIN |

|

*3 Yes/No |

*4 CO Trailer Y/N |

*5 County Kept When Not In Use |

*6 Special Use |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VEHICLE EQUIPMENT LIST FOR ACCOUNT _____- FLEET _____ - WEIGHT GROUP _____

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.I.N. |

|

|

Owner Name |

Owner DOB |

*1 USDOT |

*2 FEIN |

|

*3 Yes/No |

*4 CO Trailer Y/N |

*5 County Kept When Not In Use |

*6 Special Use |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.I.N. |

|

|

Owner Name |

Owner DOB |

*1 USDOT |

*2 FEIN |

|

*3 Yes/No |

*4 CO Trailer Y/N |

*5 County Kept When Not In Use |

*6 Special Use |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.I.N. |

|

|

Owner Name |

Owner DOB |

*1 USDOT |

*2 FEIN |

|

*3 Yes/No |

*4 CO Trailer Y/N |

*5 County Kept When Not In Use |

*6 Special Use |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Action |

Unit# |

Year |

Make |

Plate # |

|

Axles |

Combined |

Combined |

Seats |

|

Fuel |

Unladen Weight |

Gross Weight |

Purchase Price |

Factory Price |

Purchase Date |

|

|

|

|

|

|

|

MN Axles |

QC Axles |

|

|

|

|

|

|