Montana Form 2Ez can be filled out online without any problem. Simply open FormsPal PDF tool to finish the job promptly. Our tool is constantly developing to present the best user experience attainable, and that is because of our dedication to continual enhancement and listening closely to feedback from customers. Here's what you will want to do to start:

Step 1: Firstly, access the tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: Once you start the editor, you will find the document prepared to be filled in. Aside from filling out various blank fields, you can also perform some other things with the PDF, namely writing your own words, modifying the initial text, adding illustrations or photos, affixing your signature to the PDF, and more.

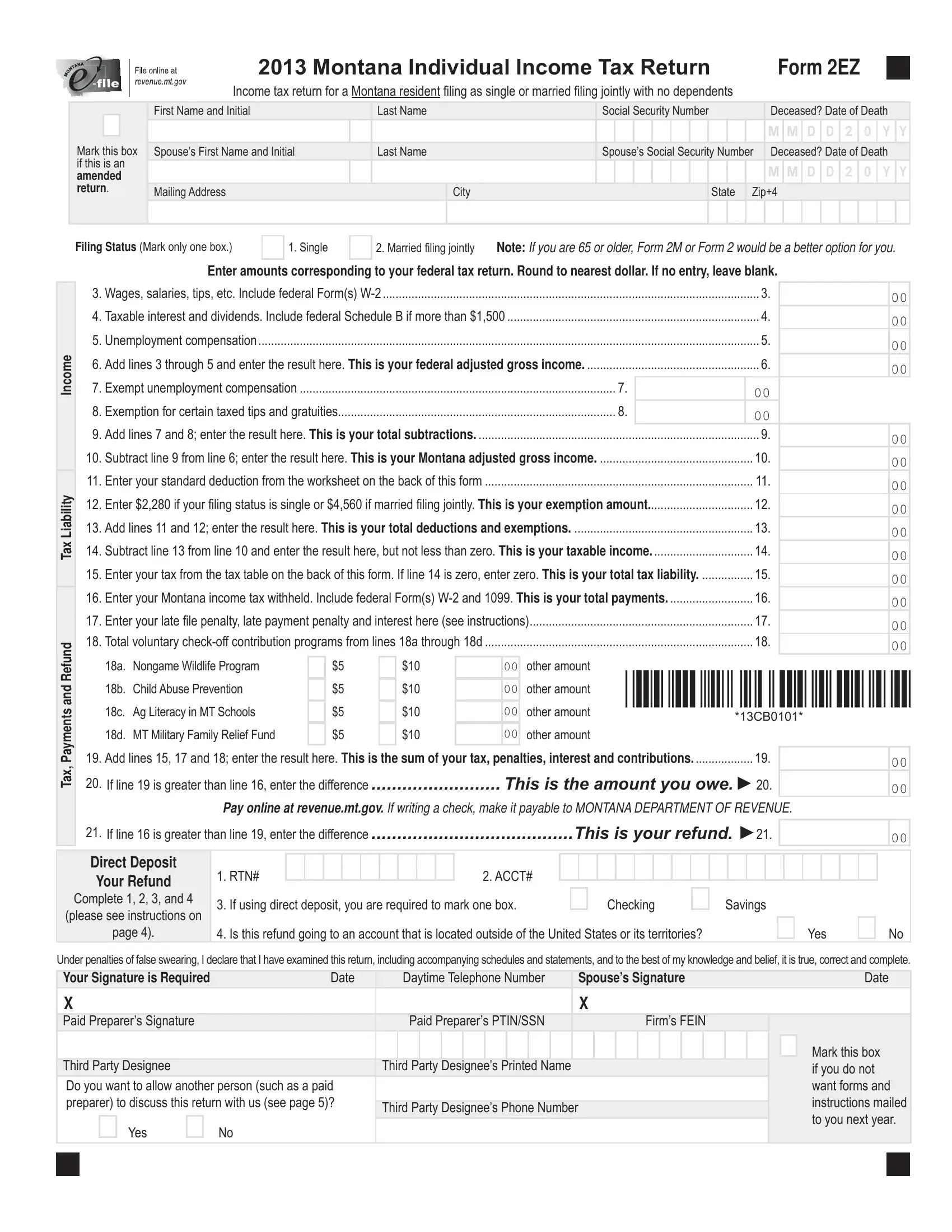

This PDF form will require specific information to be filled out, thus be certain to take the time to enter precisely what is required:

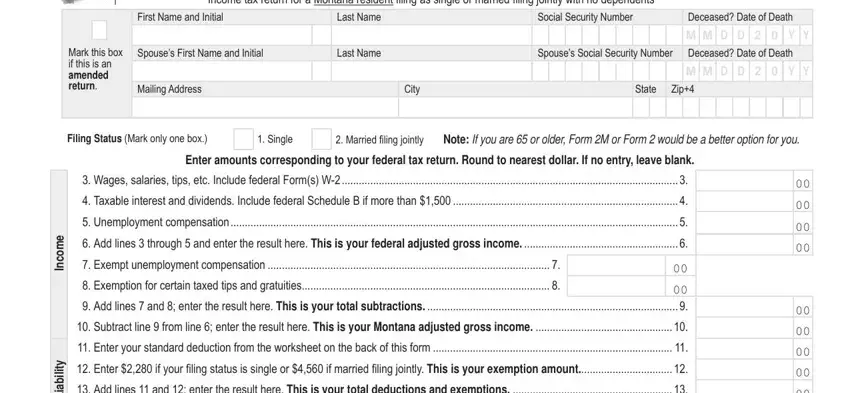

1. Start filling out the Montana Form 2Ez with a number of major blank fields. Get all of the important information and be sure absolutely nothing is left out!

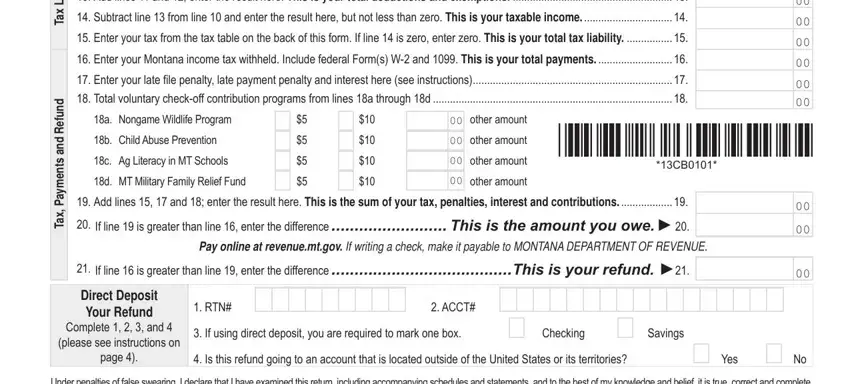

2. Just after the first array of blanks is completed, go to enter the relevant information in these: b a i L x a T, d n u f e R d n a s t n e m y a P, x a T, Add lines and enter the result, Subtract line from line and, Enter your tax from the tax table, Enter your Montana income tax, Enter your late fi le penalty late, a Nongame Wildlife Program, b Child Abuse Prevention, c Ag Literacy in MT Schools, d MT Military Family Relief Fund, other amount, other amount, and other amount.

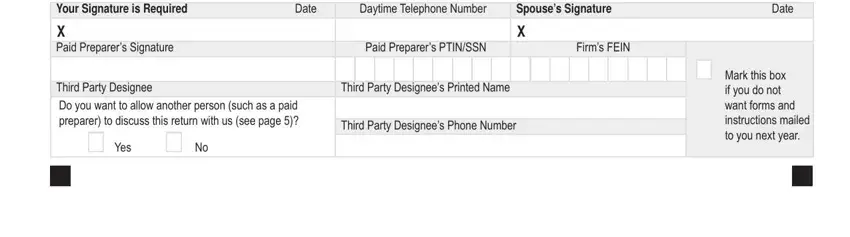

3. This next step is focused on Under penalties of false swearing, Daytime Telephone Number, Spouses Signature, Date, Date, X Paid Preparers Signature, Paid Preparers PTINSSN, Firms FEIN, Third Party Designee Do you want, Third Party Designees Printed Name, Third Party Designees Phone Number, Yes, and Mark this box if you do not want - fill out these blank fields.

It's simple to make a mistake while filling out the X Paid Preparers Signature, and so make sure that you look again before you submit it.

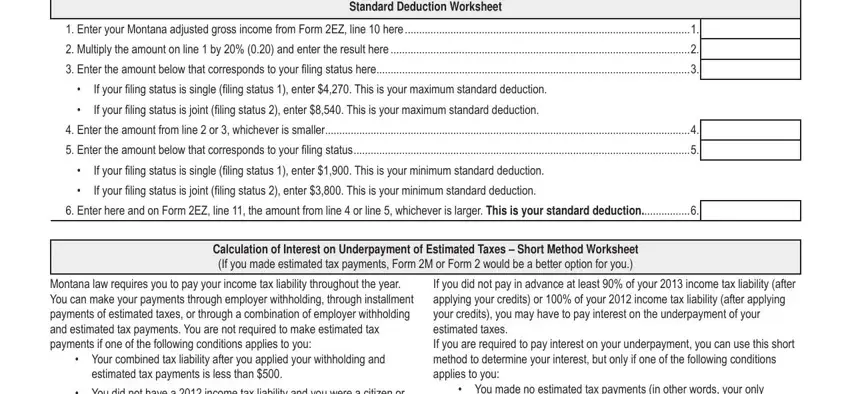

4. Filling out Standard Deduction Worksheet, Enter your Montana adjusted gross, Multiply the amount on line by, Enter the amount below that, cid, cid, If your fi ling status is single fi, If your fi ling status is joint fi, Enter the amount from line or, Enter the amount below that, cid, cid, If your fi ling status is single fi, If your fi ling status is joint fi, and Enter here and on Form EZ line is key in this step - don't forget to take the time and fill out every blank!

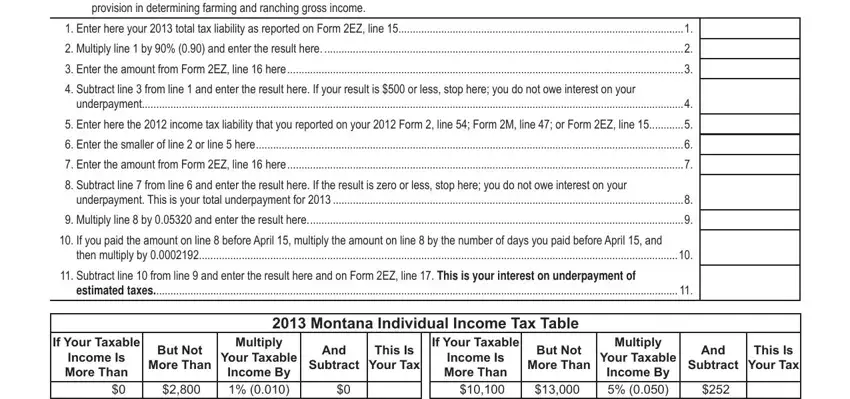

5. To conclude your form, the last area includes some additional blank fields. Filling in is derived from your farming and, Enter here your total tax, Multiply line by and enter the, Enter the amount from Form EZ, Subtract line from line and, underpayment, Enter here the income tax, Enter the smaller of line or, Enter the amount from Form EZ, Subtract line from line and, underpayment This is your total, Multiply line by and enter the, If you paid the amount on line, then multiply by, and Subtract line from line and should wrap up everything and you're going to be done in an instant!

Step 3: Soon after proofreading the fields and details, hit "Done" and you're all set! Download the Montana Form 2Ez once you sign up at FormsPal for a 7-day free trial. Easily use the form from your personal cabinet, together with any edits and adjustments being conveniently kept! We don't share or sell any information that you use when completing forms at our site.