Using PDF files online can be very simple with our PDF editor. You can fill out Montana Form Apls101F here effortlessly. FormsPal professional team is always working to develop the editor and help it become even faster for users with its handy functions. Make use of present-day revolutionary prospects, and find a heap of emerging experiences! To get the ball rolling, go through these easy steps:

Step 1: First, access the editor by clicking the "Get Form Button" above on this webpage.

Step 2: When you start the file editor, there'll be the document prepared to be filled out. Besides filling out different blanks, you can also do various other things with the Document, specifically adding your own textual content, editing the original textual content, inserting images, affixing your signature to the PDF, and much more.

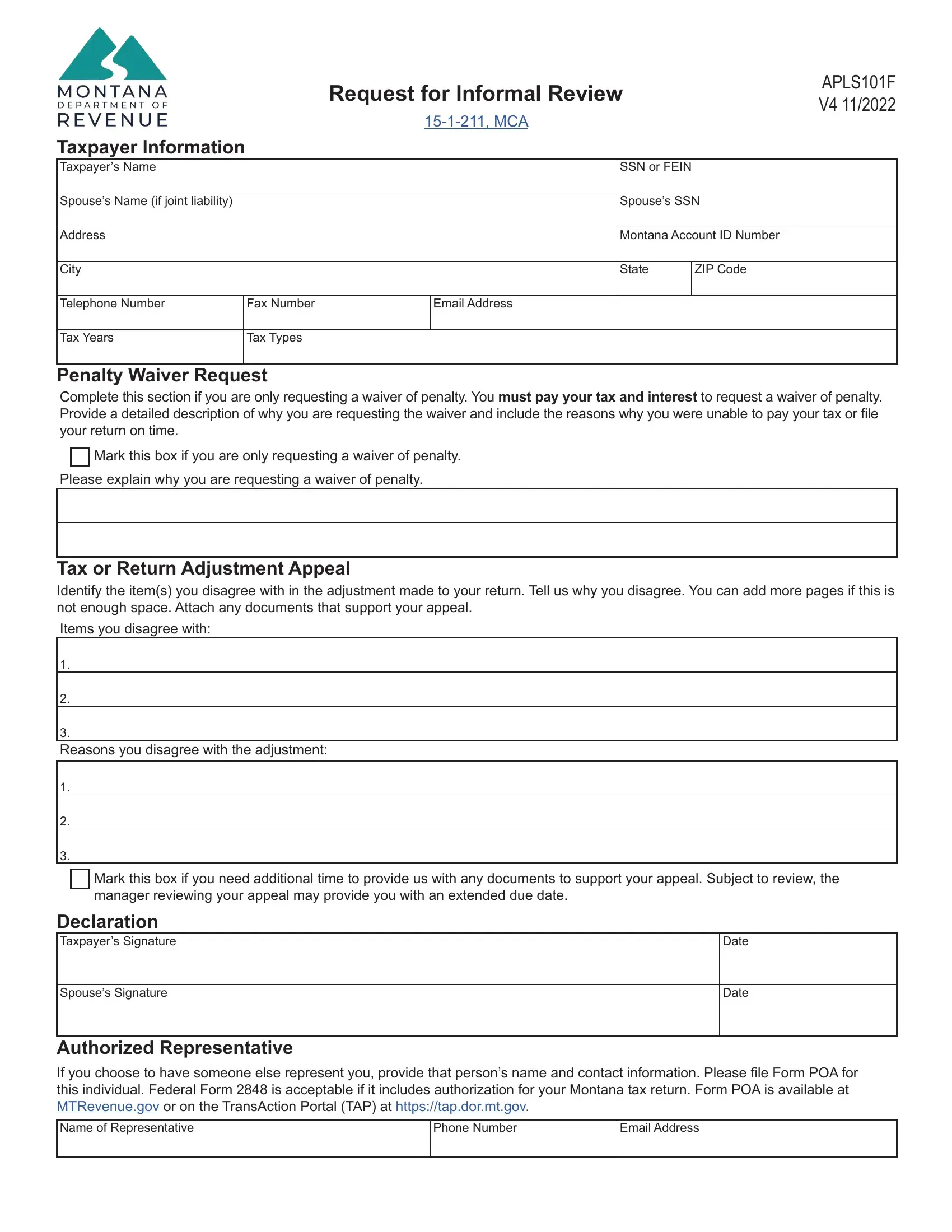

As for the blanks of this precise form, here is what you need to know:

1. When filling in the Montana Form Apls101F, be sure to include all of the needed fields in their relevant section. It will help expedite the process, enabling your information to be handled efficiently and properly.

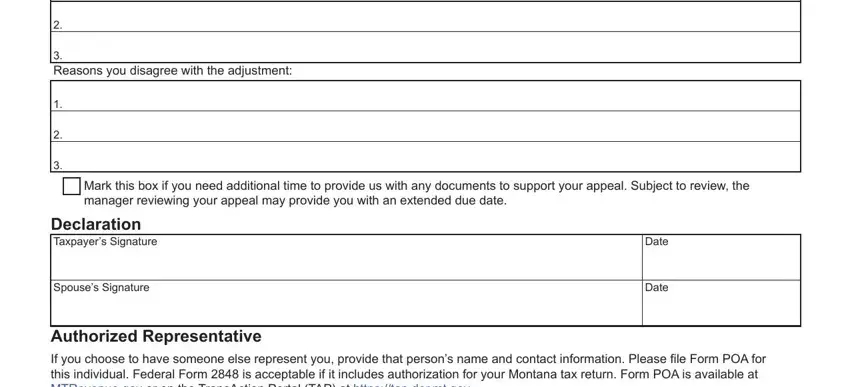

2. Right after performing the previous step, head on to the subsequent stage and fill out all required particulars in these fields - Reasons you disagree with the, Mark this box if you need, Declaration Taxpayers Signature, Spouses Signature, Date, Date, and Authorized Representative If you.

People often make errors when completing Date in this part. Ensure you revise what you type in right here.

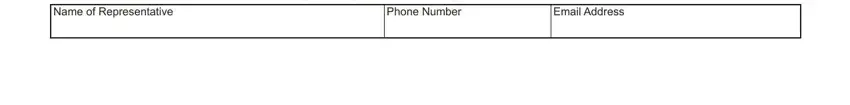

3. The following step is related to Authorized Representative If you, Name of Representative, Phone Number, and Email Address - complete these blanks.

Step 3: Proofread what you've inserted in the blank fields and click on the "Done" button. Create a 7-day free trial plan at FormsPal and gain direct access to Montana Form Apls101F - downloadable, emailable, and editable from your FormsPal account. With FormsPal, you can complete documents without being concerned about personal data breaches or entries getting shared. Our secure software helps to ensure that your private data is stored safe.