If you desire to fill out pr 1 form, you won't have to download and install any applications - simply make use of our online PDF editor. In order to make our editor better and easier to utilize, we consistently come up with new features, with our users' feedback in mind. If you are looking to get started, this is what it will take:

Step 1: Just click on the "Get Form Button" above on this page to get into our pdf editing tool. There you'll find all that is needed to fill out your document.

Step 2: This tool will give you the opportunity to change PDF files in a range of ways. Improve it by writing any text, correct what's originally in the file, and put in a signature - all within the reach of several clicks!

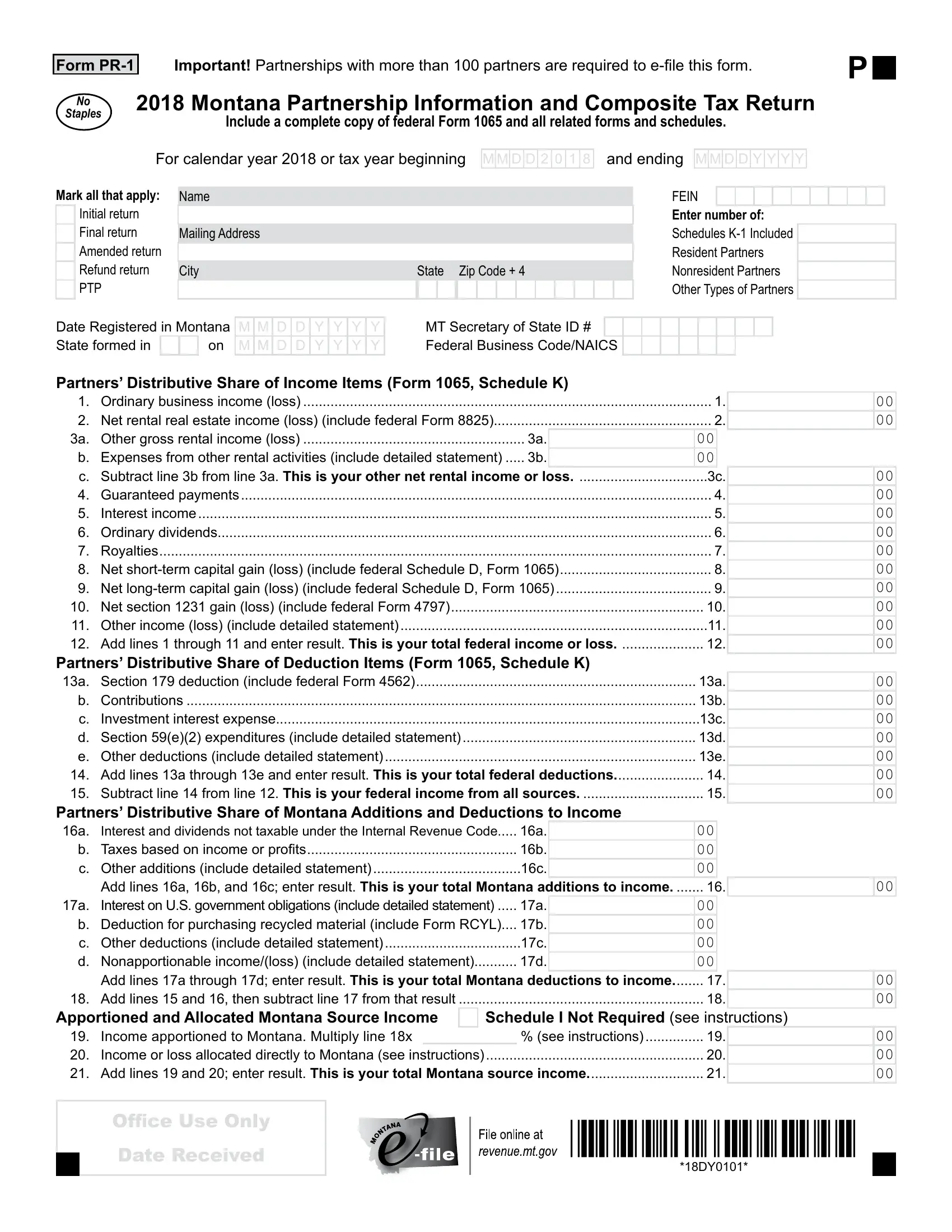

With regards to the blanks of this precise PDF, here is what you should know:

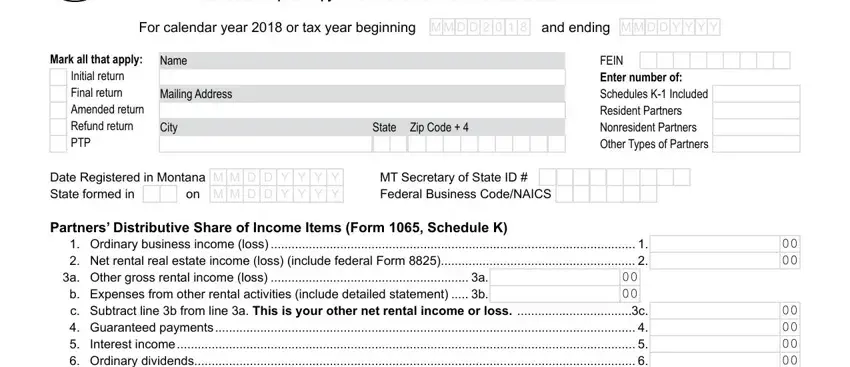

1. First, while filling in the pr 1 form, begin with the form section that features the following blank fields:

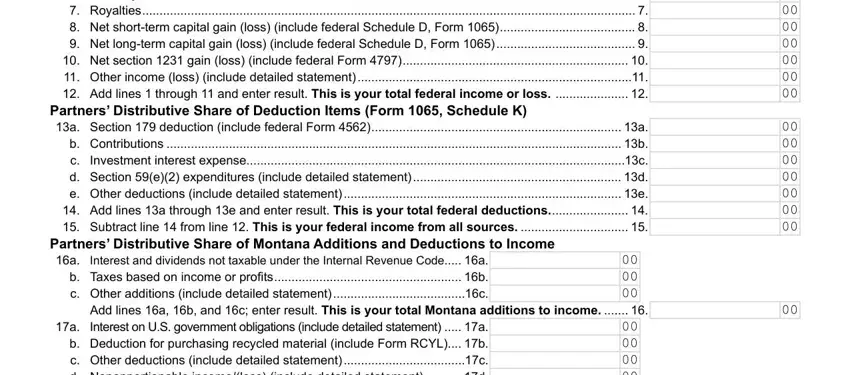

2. After this part is done, proceed to type in the relevant details in these: Ordinary business income loss, Partners Distributive Share of, Partners Distributive Share of, Interest and dividends not taxable, and Add lines a b and c enter result.

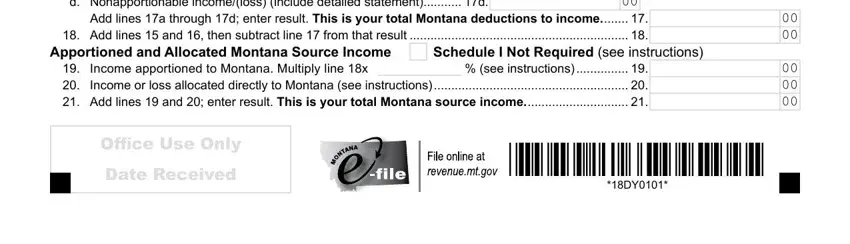

3. Completing Add lines a b and c enter result, Add lines a through d enter result, Apportioned and Allocated Montana, Schedule I Not Required see, Income apportioned to Montana, and Office Use Only Date Received is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

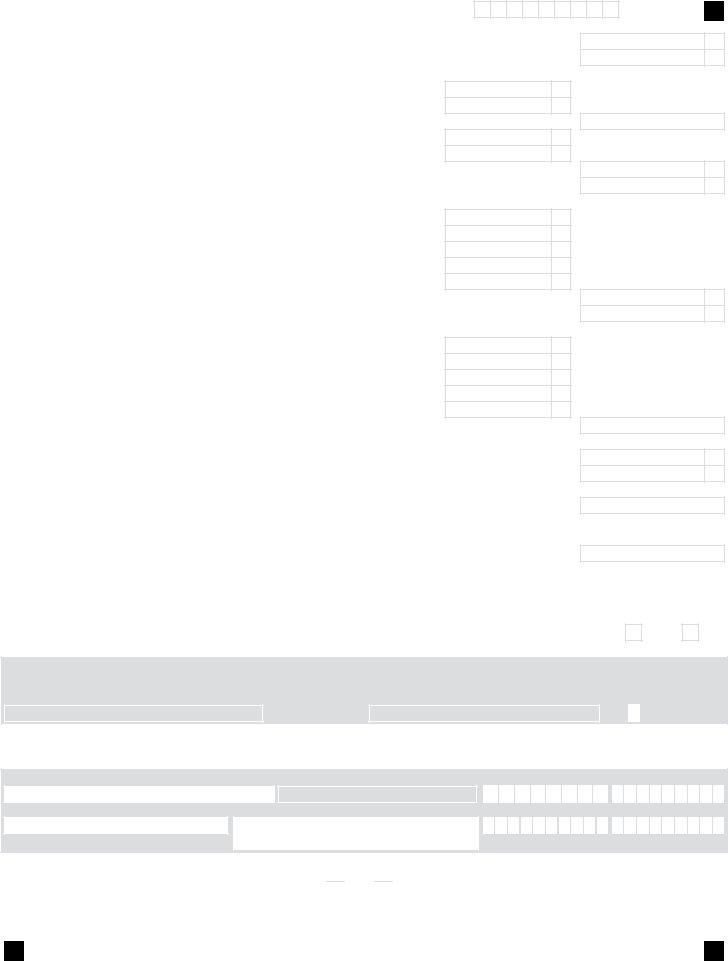

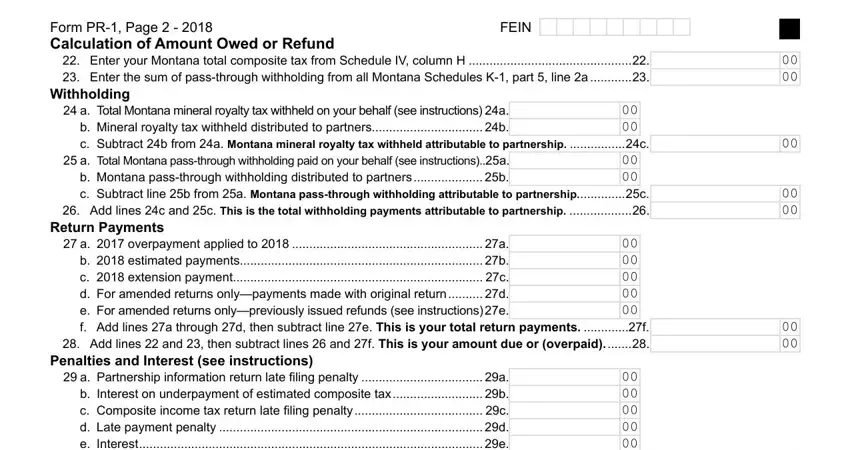

4. This next section requires some additional information. Ensure you complete all the necessary fields - Form PR Page Calculation of, FEIN, Enter your Montana total, Withholding, a Total Montana mineral royalty, a Total Montana passthrough, Return Payments, a overpayment applied to a b, Penalties and Interest see, and a Partnership information return - to proceed further in your process!

As to a Total Montana mineral royalty and Return Payments, be sure that you get them right in this current part. These are certainly the key ones in the form.

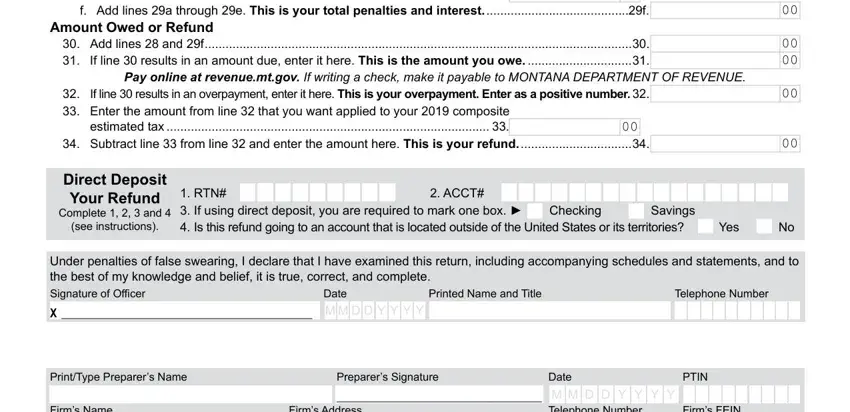

5. Last of all, this last segment is what you need to complete prior to closing the form. The blanks under consideration include the following: a Partnership information return, Amount Owed or Refund, Add lines and f If line, Pay online at revenuemtgov If, If line results in an overpayment, Enter the amount from line that, Subtract line from line and, Direct Deposit Your Refund, Complete and, see instructions, RTN If using direct deposit you, Checking, ACCT, Yes, and Under penalties of false swearing.

Step 3: Right after going through the entries, hit "Done" and you are all set! Make a 7-day free trial plan at FormsPal and obtain direct access to pr 1 form - with all changes kept and accessible in your FormsPal account page. FormsPal guarantees your information privacy by using a secure system that never saves or shares any kind of personal data typed in. Feel safe knowing your paperwork are kept protected each time you use our services!