By using the online PDF tool by FormsPal, you are able to complete or edit mony life insurance form 10481 here and now. We at FormsPal are focused on providing you the ideal experience with our editor by regularly presenting new functions and upgrades. With these improvements, working with our editor becomes easier than ever! This is what you'd want to do to get going:

Step 1: Open the PDF file inside our tool by hitting the "Get Form Button" in the top part of this webpage.

Step 2: With our state-of-the-art PDF editing tool, you may do more than merely fill out forms. Edit away and make your docs appear faultless with customized text put in, or optimize the original input to excellence - all that comes with an ability to incorporate your own graphics and sign the file off.

Filling out this document generally requires care for details. Make certain all required areas are done properly.

1. To start with, when filling out the mony life insurance form 10481, start in the form section containing following blank fields:

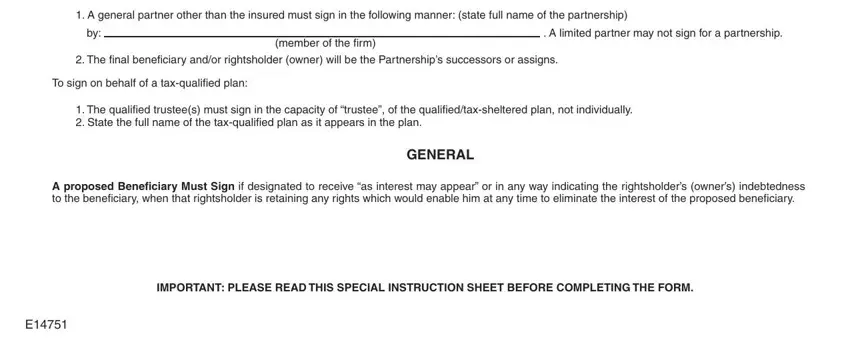

2. Now that this segment is completed, you have to insert the essential details in A general partner other than the, member of the firm, A limited partner may not sign, The final beneficiary andor, To sign on behalf of a taxqualified, The qualified trustees must sign, A proposed Beneficiary Must Sign if, GENERAL, and IMPORTANT PLEASE READ THIS SPECIAL allowing you to proceed further.

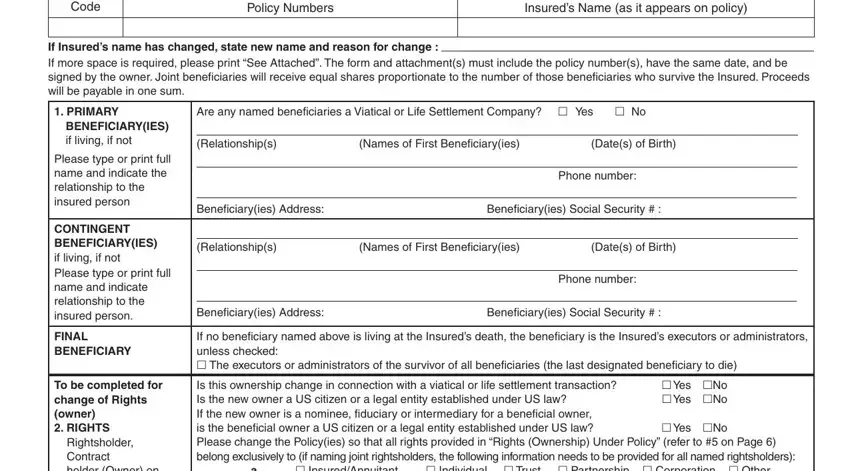

3. Through this part, take a look at Agency Code, Policy Numbers, Insureds Name as it appears on, If Insureds name has changed state, PRIMARY BENEFICIARYIES if living, Please type or print full name and, CONTINGENT BENEFICIARYIES if, FINAL BENEFICIARY, To be completed for change of, Rightsholder Contract holder Owner, Are any named beneficiaries a, Relationships, Names of First Beneficiaryies, Dates of Birth, and Phone number. All of these need to be completed with greatest accuracy.

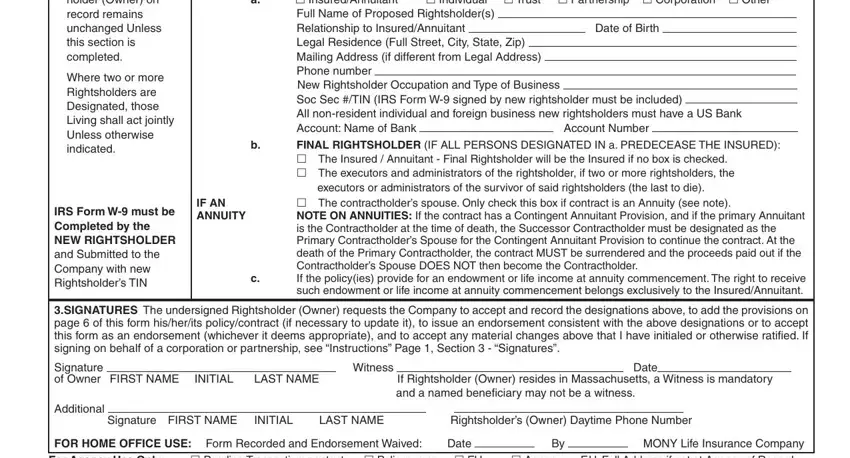

4. The next part comes with all of the following blanks to consider: Rightsholder Contract holder Owner, Where two or more Rightsholders, IRS Form W must be Completed by, InsuredAnnuitant, Is this ownership change in, Soc Sec TIN IRS Form W signed by, Full Name of Proposed, Individual Trust Partnership, Account Number, Date of Birth, FINAL RIGHTSHOLDER IF ALL PERSONS, IF AN ANNUITY, The Insured Annuitant Final, executors or administrators of the, and NOTE ON ANNUITIES If the contract.

5. To conclude your document, the last area includes some extra fields. Filling in For Agency Use Only Print FU or, Pending Transaction contact, By Agency Agency, and FU Full Address if not at Agency should conclude the process and you're going to be done before you know it!

It's easy to make errors while completing your By Agency Agency, hence make sure to reread it before you decide to submit it.

Step 3: Just after rereading the fields and details, hit "Done" and you're all set! Try a 7-day free trial option at FormsPal and get instant access to mony life insurance form 10481 - download, email, or edit from your personal account. FormsPal is focused on the confidentiality of our users; we make certain that all personal data coming through our tool remains protected.